Fiberglass Fabric Market Size, Share & Trends Analysis Report By Application (Construction, Electrical & Electronics, Wind Energy, Aerospace), By Product (E-glass, S-glass), By Fabric Type (Nonwoven, Woven), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-730-8

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Advanced Materials

Report Overview

The global fiberglass fabric market size was estimated at USD 9.27 billion in 2017. It is expected to register a CAGR of 6.1% over the forecast period. Surging demand for the product in the construction of lightweight, long, and efficient rotor blades, with high corrosion resistance, and electrical and thermal insulation properties, for wind energy production, is likely to be a key trend stoking market growth.

Fiberglass fabrics possess superior properties such as perfect electrical resistance and electric insulation, which enables its use as a prime reinforcement material in high-pressure laminates for printed circuit boards (PCBs). These PCBs are majorly used in computers, modems, consumer electronics, automotive, and telecommunication products, thereby stirring up the demand for fiberglass fabrics in application industries.

Glass fiber, a primary raw material is sourced from a limited number of suppliers or a sole supplier to maintain consistency in the quality of fabrics. Growing demand for lightweight fiberglass with higher strength is leading manufacturers to constantly innovate, maintain standards for their products, and integrate across the supply chain to retain their customers.

Soaring demand for wide varieties of woven fibers including plain, twill, satin, basket, and leno, as per requirements of application industries in terms of flexibility and strength is poised to drive the market. Furthermore, modernization of technologies to meet technical requirements of industry-specific fiberglass fabric grades has also been boosting the market growth.

Rotor blades of length up to 80 meters for installation in different environments including offshore windmill stations are manufactured using the product. Furthermore, increasing government initiatives globally to promote renewable energy and wind energy power project are anticipated to fuel the demand for fiberglass fabric in the wind energy industry.

The product is highly capital-intensive with the high cost of the furnace and other machinery. Furthermore, manufacturing methods such as Vacuum Assisted Transfer Molding (VARTM) and autoclaving are both time consuming and labor-intensive. Handling of raw material and final product also require skilled labor, thereby increasing the cost of production.

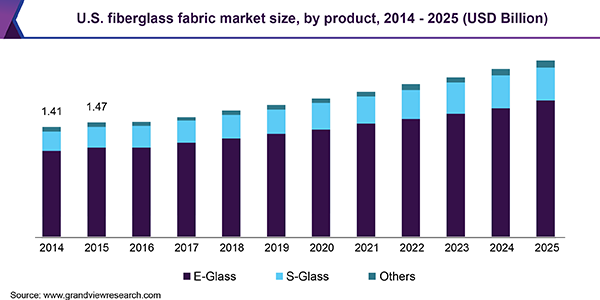

Product Insights

Glass fibers can be classified into premium special-purpose fibers and low-cost general-purpose fibers. General-purpose fibers include a wide range of boron-free E-glass fibers and boron-containing E-glass, whereas ECR-glass, A-glass, S-glass, hollow fibers, and silica fibers are some common types of special-purpose fibers.

On the basis of product, the market has been bifurcated into E-glass and S-glass. E-glass fibers offer high strength and corrosion and chemical and heat resistance in economical prices in comparison with special-purpose glass fabrics. However, special-purpose fibers play a vital role in the market owing to the excellent strength of R, S, and T glass, a low dielectric constant of D-glass, and various other physical and mechanical properties.

S-glass is projected to exhibit a CAGR of 6.4% in terms of revenue over the forecast period on account of its improved properties at elevated temperature as compared to E-glass fabrics. S-glass offers around 40.0% higher tensile and comprehensive strength, flexural modulus, and higher abrasion resistance as compared to E-glass, thereby escalating the demand for the product type in application industries.

Glass fibers such as C-glass, A-glass, D-glass, and M-glass are also used in the manufacturing of fiberglass fabrics, apart from S-glass and E-glass. These fibers are used in very specific applications where characteristics such as high chemical durability, high alkali resistance, low dielectric constant, or high modulus are required.

Fabric Type Insights

Fiberglass fabric is available in the form of woven and nonwoven formats with different finishes and coatings offering high strength, chemical and fire resistance, and durability. The fabric can be woven in various patterns including plain, basket, leno, satin, unidirectional, and twill weave; however, plain weaving is commonly used as it is simple and offers high strength to the woven fabric.

The woven segment dominated the fiberglass fabric market and accounted for just over 58.0% of the overall revenue in 2017. Woven glass fabric offers superior performance as compared to the nonwoven type. It is manufactured from chopped strand mats and can bring several structural advantages.

Nonwoven fiberglass fabric is a soft and durable nonwoven cloth that possesses high tear strength and is majorly used in construction applications such as wall coverings and ceiling for the prevention of cracks. It offers natural ventilation, high tensile strength, and is chemically inert and non-toxic. As a result, the demand for the fabric type is strong in the construction industry.

Nonwoven fiberglass material is a durable cloth offering several mechanical advantages over woven ones such as increased impact resistance and thermal insulation. Furthermore, these fabrics are highly effective in filtering various liquids and have a life 10 to 15 times longer than those made of metal and cotton. Their demand is projected to rise at a noteworthy rate during the forecast period.

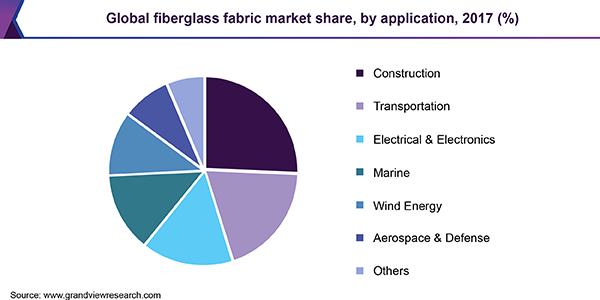

Application Insights

The construction segment represented over one-fourth of the total revenue in 2017 owing to spiraling demand for materials in structural reinforcements in construction and architectural projects. Increasing penetration of the product in the construction industry owing to its properties to withstand longitudinal and transverse load and chemical and corrosion resistance is further estimated to contribute to the growth of the segment.

The product has several dielectric applications and is used extensively in multilayer printed circuitry, offering a high degree of dimensional stability. Rising demand for PCBs across the globe with the expansion of the electronics industry along with high growth in the consumer electronics industry is expected to facilitate the growth of the overall market.

The wind energy sector is likely to post a CAGR of 7.3% in terms of value over the projected period, on account of the production of longer blades through mass reduction, leading to increased energy output. Growing focus on renewable energy generation is also escalating the demand for fiberglass fabrics in the sector.

Multiaxial fabrics are majorly used in the aerospace & defense sector on account of its flexibility and ability to handle extreme pressure without undergoing wear & tear. Lightweight fiberglass fibers provide structural integrity, high strength, and ballistic, environmental and thermal protection, which is poised to augment their demand in aerospace & defense applications over the forecast period.

Regional Insights

Asia Pacific was the leading regional market in the global arena in 2017, owing to high production of electrical & electronics, construction, aerospace & defense, wind energy products. China, being the largest consumer of fiberglass in Asia Pacific, commanded over 55.0% of the regional revenue in 2017.

Europe accounted for just over 25.0% of the global revenue in the same year owing to the availability of raw materials, manufacturing facilities, and the presence of major application industry players. Developed economies in the region including Germany, U.K., and France accounted for major revenue share owing to high penetration of the product in the construction and aerospace industries.

Central & South America is projected to witness a CAGR of 7.3% in terms of revenue over the forecast period on account of rapid development in the electrical & electronics, aerospace & defense, and wind power generation industries. Turbine manufacturing in Brazil and Argentina is gaining momentum owing to the rise in renewable energy production, which in turn is anticipated to supplement the growth of the regional market.

Key Companies & Market Share Insights

The market is highly fragmented and contains a significantly large number of manufacturers and service providers. Innovation, product development, and establishing strong distribution network of the product is a major factor in creating a competitive environment among players operating in the market.

Growing demand for high-quality fabrics with superior strength and lightweight characteristics impel manufacturers to innovate and maintain product quality standards. Major manufacturers have a long-term supply contract with distributors to ensure raw material availability as well as maintain consistency in product offerings.

Fiberglass Fabric Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2020 |

USD 11.86 billion |

|

Revenue forecast in 2025 |

USD 14.93 billion |

|

Growth Rate |

CAGR of 6.1% from 2018 to 2025 |

|

Base year for estimation |

2017 |

|

Historical data |

2014 - 2016 |

|

Forecast period |

2018 - 2025 |

|

Quantitative units |

Volume in million square meters, revenue in USD billion and CAGR from 2018 to 2025 |

|

Report coverage |

Volume, revenue forecast, company share, competitive landscape, growth factors and trends |

|

Segments covered |

Product, fabric type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa |

|

Key companies profiled |

Owens Corning; Jushi Group Co. Ltd; Gurit; Hexcel Corporation; BGF Industries, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global fiberglass fabric market report on the basis of product, fabric type, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

E-Glass

-

S-Glass

-

Others

-

-

Fabric Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

Woven

-

Nonwoven

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

Aerospace & Defense

-

Construction

-

Electrical & Electronics

-

Marine

-

Transportation

-

Wind Energy

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiberglass fabric market size was estimated at USD 11.26 billion in 2019 and is expected to reach USD 11.86 billion in 2020.

b. The global fiberglass fabric market is expected to grow at a compounded annual growth rate of 6.1% from 2018 to 2025 to reach USD 14.93 billion in 2025.

b. Asia Pacific dominated the fiberglass fabric market with a share of 52.3% in 2019. This can be attributed to owing to high production of electrical & electronics, construction, aerospace & defense, wind energy products.

b. Some key players operating in the fiberglass fabric market include Owens Corning, Jushi Group Co. Ltd, Gurit, Hexcel Corporation, and BGF Industries, Inc.

b. Key factors driving the fiberglass fabric market growth include surging demand for the product in construction of lightweight, long, and efficient rotor blades, with high corrosion resistance, and electrical and thermal insulation properties, for wind energy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."