- Home

- »

- Specialty Polymers

- »

-

Fiber Reinforced Polymer Composites Market Report, 2030GVR Report cover

![Fiber Reinforced Polymer Composites Market Size, Share & Trends Report]()

Fiber Reinforced Polymer Composites Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Automotive, Construction, Electronic, Defense), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-006-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Reinforced Polymer Composites Market Summary

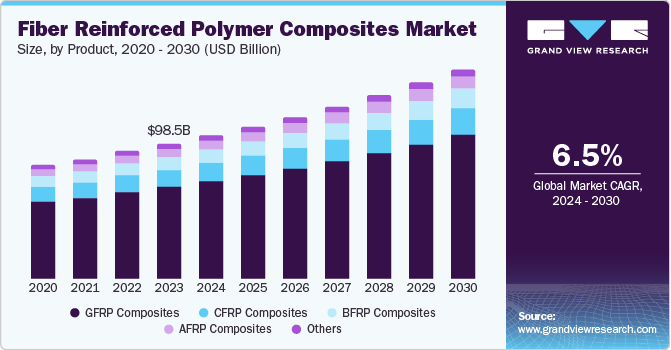

The global fiber reinforced polymer composites market size was estimated at USD 98.5 billion in 2023 and is projected to reach USD 152.0 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The market growth is due to the rising adoption of fiber reinforced polymer composites instead of ferrous and non-ferrous metals.

Key Market Trends & Insights

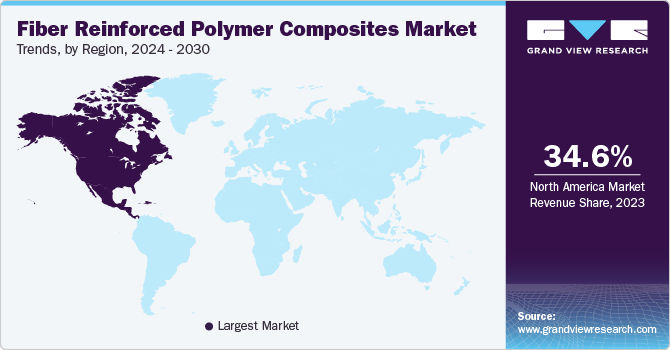

- North America fiber reinforced polymer composites market dominated the global market with a share of 34.6% in 2023, pertaining to the rising demand from automotive, construction, aerospace, and others.

- The U.S. fiber reinforced polymer composites market held a substantial market share in North America due to the presence of major automobile companies and the growing construction sector.

- Based on product, the glass fiber reinforced polymer (GFRP) composites segment dominated with a share of 67.7% in 2023.

- In terms of product, the carbon fiber reinforced polymer (CFRP) composites segment is expected to grow at a CAGR of 6.6% during the forecast period due to a rise in the usage of CFRP composites in aerospace, automotive, and construction.

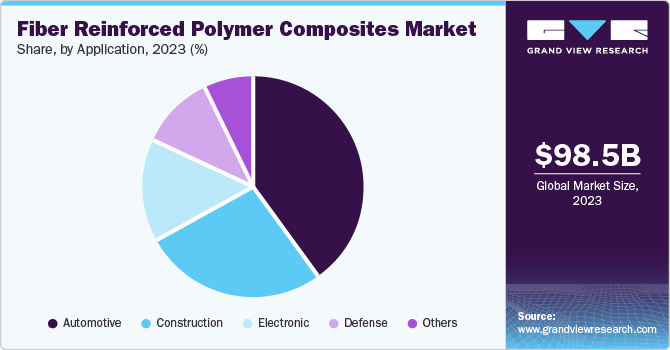

- On the basis of application, the automotive segment dominated the market in 2023 with a share of 40.2% attributed to the rising utilization of FRP composites for manufacturing automotive components.

Market Size & Forecast

- 2023 Market Size: USD 98.5 billion

- 2030 Projected Market Size: USD 152.0 billion

- CAGR (2024-2030): 6.5%

- North America: Largest market in 2023

There is an increased demand for fiber reinforced polymer composites in construction, automotive, aerospace, and other sectors.

The market growth is driven by the rise in the automotive sector and demand for passenger, commercial, and electric vehicles. Automotive companies are integrating fiber reinforced polymer composites in manufacturing various components as the material offers durability, low weight, and a high strength-to-weight ratio. Components such as door panels, roof panels, headrest panels, cooling ventilators, and more are manufactured from FRP composites.

The rising adoption of electric vehicles has increased demand for FRP composites. According to the International Energy Agency, around 14 million electric cars were registered in 2023. Electric cars have an ideal body weight that improves their on-road performance. Hence, automotive companies adopt FRP composites, which offer the same qualities as their metal counterparts with a reduced weight.

The increased application of FRP composites in the aerospace, sports, and construction sectors has helped market growth. Many companies use FRP composites to manufacture aircraft and helicopter components due to their lightweight and durable properties. Hence, these factors are responsible for developing the fiber-reinforced polymer (FRP) composites market.

Product Insights

The glass fiber reinforced polymer (GFRP) composites segment dominated with a share of 67.7% in 2023. Demand from automotive, construction, aerospace, and other industries drives the market growth. GFRP provides durability, high strength-to-weight ratio, corrosion resistance, and design flexibility. Hence, these factors are responsible for the segment growth.

The carbon fiber reinforced polymer (CFRP) composites segment is expected to grow at a CAGR of 6.6% during the forecast period due to a rise in the usage of CFRP composites in sectors such as aerospace, automotive, and construction. Properties offered by CFRP composites, such as high strength and low weight, have led to increased adoption of CFRP composites in place of materials such as aluminum and steel. Furthermore, the increasing use of CFRP composites in manufacturing automotive vehicles has also aided the market growth. Automotive components manufactured from CFRP composites result in weight reduction and improve the efficiency and performance of vehicles.

Application Insights

The automotive segment dominated the market in 2023 with a share of 40.2% attributed to the rising utilization of FRP composites for manufacturing automotive components such as door panels, vehicle interiors, seat panels, and more due to properties offered by FRP such as high strength, better finish, and design flexibility. Components made from FRP composites aid the vehicle's weight reduction without reducing its structural stability. Companies are shifting from metals such as steel and aluminum and adopting FRP composites for manufacturing components.

The construction segment is expected to grow at a CAGR of 6.6% during the forecast period due to the rising implementation of FRP composites in construction applications such as buildings, bridges, pipelines, and more. FRP composites' properties, such as high strength and low weight, aid in reducing structural weight and the cost of transportation and construction. Furthermore, corrosion resistance and longevity of FRP composites enable protection against harsh environments.

Regional Insights

North America fiber reinforced polymer composites market dominated the global market with a share of 34.6% in 2023 pertaining to the rising demand from automotive, construction, aerospace, and others. Rising shift from conventional materials such as steel and aluminum to FRP composites due to its properties such as weight reduction, improved strength, and corrosion resistance. Therefore, the regional market demand is poised to grow in the coming years.

U.S. Fiber Reinforced Polymer Composites Market Trends

The U.S. fiber reinforced polymer composites market held a substantial market share in North America due to the presence of major automobile companies and the growing construction sector. Vehicle manufacturers are adopting FRP composites to manufacture vehicle components as they aid in weight reduction and performance improvement. Furthermore, the presence of a developed aerospace industry has also led to market growth in the reinforced polymer composites market in the country.

Europe Fiber Reinforced Polymer Composites Market Trends

Europe fiber reinforced polymer composites market was identified as a lucrative region in this industry in 2023. The rising adoption of FRP composites in automotive, aerospace, construction, and other sectors powers the growth. Furthermore, aging infrastructure has led to a rise in regional redevelopment projects. It has led to an increase in the number of construction projects such as bridges, buildings, pipelines, and more. Hence, these factors aid in the market growth in this region.

Germany fiber reinforced polymer composites market is expected to grow rapidly due to the growing automotive and manufacturing sector and the rising adoption of FRP composites to manufacture automotive components. Furthermore, the increased population has resulted in the rise in demand for vehicles and commercial and private buildings. Therefore, these factors encourage market growth.

Asia Pacific Fiber Reinforced Polymer Composites Market Trends

Asia Pacific fiber reinforced polymer composites market is expected to grow significantly over the forecast period owing to rapid urbanization and industrialization based on increasing demand for commercial and passenger vehicles in the region. Furthermore, population growth in countries such as China, Japan, and India have increased in the construction sector. These factors contribute to developing the fiber-reinforced polymer composites market in the region.

China Fiber Reinforced Polymer Composites Market Trends

China fiber reinforced polymer composites market is expected to grow due to a developed manufacturing industry and the rising adoption of FRP composites in sectors such as automotive, construction, and more. China is the largest producer of electric vehicles. Hence, there is an increased demand for FRP composites for manufacturing vehicle components. Furthermore, developed manufacturing sectors allow various companies to manufacture their products in the country and improve market expansion with the help of the country's developed supply chain.

Key Fiber Reinforced Polymer Composites Company Insights

Some major companies in the fiber reinforced polymer composites market are Avient Corporation, Hexcel Corporation, Mitsubishi Chemical Group Corporation, Plasan, and more. Companies focus on producing novel reinforced polymers to improve their market penetration and investing in research and development.

-

Hexcel is an industrial materials company specializing in producing and distributing composite materials. The company sells its services to military, automotive, aerospace, and more sectors. Its portfolio includes carbon fiber, fabrics, reinforcements, and resins.

-

Mitsubishi Chemical Group Corporation is a company that deals with specialty materials. It serves automotive, energy, information technology, electronics, electrical, medical, and other sectors.

Key Fiber Reinforced Polymer Composites Companies:

The following are the leading companies in the fiber reinforced polymer composites market. These companies collectively hold the largest market share and dictate industry trends.

- Avient Corporation

- Hexcel Corporation

- Mitsubishi Chemical Group Corporation.

- Plasan

- Röchling SE & Co. KG

- SABIC

- SGL Carbon

- Solvay

- TORAY INDUSTRIES, INC.

- TPI Composites Inc.

Recent Developments

-

In May 2024, emphasizing sustainability, Hexcel Corporation announced 10-year agreement with Fairmat to recycle carbon fiber composite materials. Fairmat is an international carbon fiber composite recycler. It recently opened a vast recycling facility near Hexcel Salt Lake City. The duo companies are dedicated to sustainable solutions in the long-term.

-

In October 2023, Mitsubishi Chemical Group Corporation announced the acquisition of CPC, an Italian Carbon Fiber Composite Components manufacturer. CPC specializes in manufacturing automobile components made from carbon fiber reinforced plastic (CFRP). The acquisition helps Mitsubishi Chemical Group Corporation expand its carbon fiber supply chain.

Fiber Reinforced Polymer Composites Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 104.3 billion

Revenue forecast in 2030

USD 152.0 billion

Growth Rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, Volume in Tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

Avient Corporation; Hexcel Corporation; Mitsubishi Chemical Group Corporation.; Plasan; Röchling SE & Co. KG; SABIC; SGL Carbon; Solvay; TORAY INDUSTRIES, INC.; TPI Composites Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Reinforced Polymer Composites Market Report Segmentation

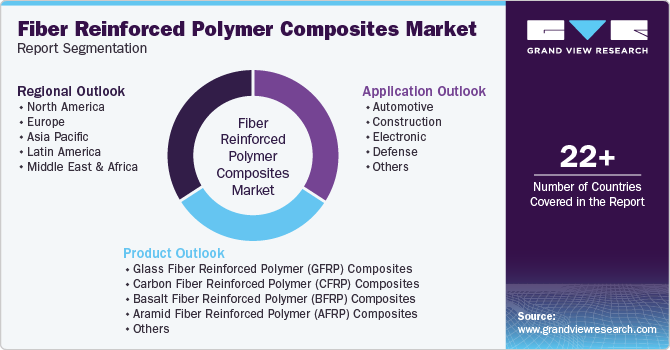

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fiber reinforced polymer composites market report based on product, application, and region.

-

Product Material Outlook (Revenue, USD Billion; Volume in Tons, 2018 - 2030)

-

Glass Fiber Reinforced Polymer (GFRP) Composites

-

Carbon Fiber Reinforced Polymer (CFRP) Composites

-

Basalt Fiber Reinforced Polymer (BFRP) Composites

-

Aramid Fiber Reinforced Polymer (AFRP) Composites

-

-

Application Material Outlook (Revenue, USD Billion; Volume in Tons, 2018 - 2030)

-

Automotive

-

Construction

-

Electronic

-

Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume in Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.