- Home

- »

- Next Generation Technologies

- »

-

Fiber Optic Fire And Heat Detectors Market Size Report 2030GVR Report cover

![Fiber Optic Fire And Heat Detectors Market Size, Share & Trends Report]()

Fiber Optic Fire And Heat Detectors Market Size, Share & Trends Analysis Report By Type, By Application (Tunnels & Bridges, Automotive, Railways, Building & Construction, Oil & Gas Pipelines), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-407-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

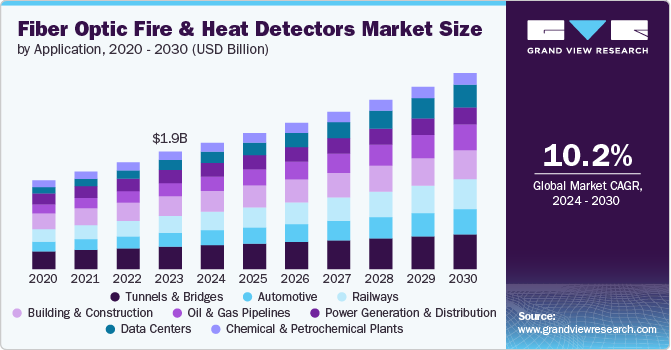

The global fiber optic fire and heat detectors market size was estimated at USD 1.93 billion in 2023 and is expected to grow at a CAGR of 7.6% from 2024 to 2030. The market growth is driven by advanced detection technology that uses optical fibers to sense temperature changes along their entire length, providing early warnings of fire hazards. This technology enhances safety and reliability in various industrial and commercial settings. The increasing demand for improved fire safety solutions, combined with ongoing technological advancements, further boosts market expansion.

With the growing demand for alternative and renewable energy sources, the wood pellet industry has become a significant player in the global energy market. Recently, fiber optic fire and heat detector technology has revolutionized the field by offering an advanced and reliable solution for detecting and preventing hotspots and fires. While fire protection may not be the primary concern with the wood pellets themselves, the users and operators of wood pellet-burning facilities and biomass plants must ensure the operational safety of their plants, including fire protection and early fire detection. The production and storage of wood pellets carry risks, such as the potential for fires. Fiber optic fire and heat detector technology can mitigate these risks by effectively monitoring temperature changes and detecting fires before they pose a significant hazard.

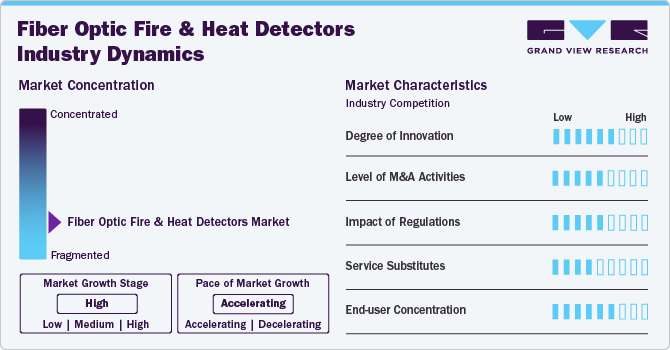

Market Concentration & Characteristics

Technological advancements in sensor networks and data analytics are driving innovation in zone-based systems, enabling smarter decision-making and proactive maintenance strategies. As organizations increasingly prioritize safety and compliance, the adoption of zone-based linear systems is expected to grow, supported by ongoing advancements and regulatory requirements aimed at enhancing fire safety standards globally.

The fiber optic fire and heat detectors industry is characterized by a high level of merger and acquisition (M&A) activity. For instance, in December 2023, Luna Innovations announced that it had acquired Silixa, a U.K.-based company specializing in distributed fiber optic sensing solutions. This acquisition would strengthen Luna Innovations' presence in the fiber optic sensing market by adding advanced capabilities to its portfolio, including Distributed Strain Sensing (DSS), Distributed Acoustic Sensing (DAS), and Distributed Temperature Sensing (DTS). These technologies help enhance the performance of applications in areas such as energy, mining, defense, and natural environments.

The impact of regulation in the fiber optic fire and heat detectors industry is significant, primarily driven by increasing safety standards and the need for compliance in various sectors. The fiber optic fire detection market is experiencing growth due to heightened awareness and stringent government regulations regarding fire safety. These regulations mandate the use of advanced fire detection systems in critical infrastructure, such as tunnels, warehouses, and industrial facilities, thereby driving demand for fiber optic solution. Moreover, Products like the Yokogawa DTSX1 Fiber Optic Heat Detector have gained renewed certification under European standards (EN 54-22), which enhances their marketability and trustworthiness. This certification ensures that the products meet rigorous safety and performance criteria, which is essential for adoption in high-risk environments

End-user concentration in the fiber optic fire and heat detectors industry is characterized by a diverse range of sectors that utilize these advanced detection systems, including oil and gas, petrochemical, and manufacturing industries. These sectors require robust fire detection systems due to the high value of assets and potential hazards associated with flammable materials.

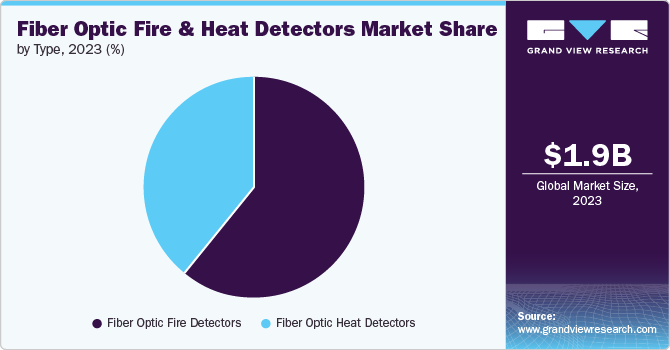

Type Insights

The fiber optic fire detectors segment led the market and accounted for a 60.6% share of the global revenue in 2023. Fiber optic fire detectors offer significant advantages over conventional detection systems in challenging environments, such as tunnels, pipelines, and industrial facilities. The need for improved safety measures in modern transportation and infrastructure projects is driving the demand for these detectors. Their ability to monitor extensive areas effectively, fast response times, and high precision make them well-suited for critical applications in large infrastructure projects. The demand for these detectors is growing as both government agencies and private organizations are investing aggressively in advanced fire detection systems to safeguard valuable assets and human lives. As a result, fiber optic detectors are becoming the preferred choice for new infrastructure developments.

The fiber optic heat detectors segment is estimated to grow significantly over the forecast period. The demand for fiber optic fire and heat detectors in tunnels and bridges is driven by the stringent safety requirements for transportation infrastructure. Tunnels and bridges are critical components of road and rail networks. Fire incidents occurring within tunnels and on bridges can have severe consequences on safety, traffic movement, and operational continuity. Fiber optic detectors offer advantages, such as early detection, precise location of fire or heat events, and reliability in challenging environments. Governments and transportation authorities are increasingly investing in advanced fire detection systems to enhance the safety and resilience of tunnels and bridges, a trend fostering the adoption of fiber optic technologies tailored for these specialized applications.

Application Insights

The adoption of fiber optic fire and heat detectors in the building & construction is experiencing strong growth due to heightened awareness about safety and the subsequent emphasis on regulatory compliance. These detectors leverage advanced fiber optic technology, providing significant advantages over conventional models. They excel in detecting temperature fluctuations and identifying smoke or fire with exceptional sensitivity and reliability. Their resistance to electromagnetic interference and the ability to cover expansive areas efficiently with minimal hardware installation are particularly valued attributes. With buildings becoming more intricate and safety standards becoming more rigorous, demand for these detectors is projected to rise. Furthermore, ongoing advancements in fiber optic sensing technology are expected to spur further innovation, fostering more sophisticated and seamlessly integrated fire safety solutions across the building & construction industry.

The data centers segment is projected to grow significantly over the forecast period. The demand for real-time and continuous monitoring solutions in data centers is driving the adoption of fiber optic fire and heat detectors to ensure constant surveillance of temperature and fire risks and offer instant alerts and actionable data when anomalies are detected. Continuous monitoring is critical for data centers, where even a minor fire incident can lead to significant data loss and operational disruption. The ability to continuously track environmental conditions and detect early signs of fire ensures that data centers can respond promptly to potential threats, reducing the risk of damage and maintaining uninterrupted service.

Regional Insights

North America fiber optic fire and heat detectors market held a significant market share of 32.0% in 2023. The North America regional market is witnessing a notable trend toward integrating fiber optic fire and heat detectors with advanced monitoring and control systems, which can be connected to centralized management systems and IoT networks to facilitate real-time data collection, remote monitoring, and automated responses. This integration enhances the ability to detect and swiftly respond to fire and heat-related incidents, mitigating the risk of damage and improving overall safety. Continued digital transformation and the move toward smart infrastructure are boosting the adoption of fiber optic detectors as part of the installation of comprehensive safety solutions.

U.S. Fiber Optic Fire And Heat Detectors Market Trends

The fiber optic fire and heat detectors market in the U.S. is experiencing significant growth as fiber optic heat detectors are increasingly being installed as part of the infrastructure development and modernization projects being undertaken across the U.S. As new infrastructure is built and existing facilities are upgraded, the emphasis on incorporating advanced fire detection technologies to ensure safety and resilience is growing. Fiber optic heat detectors are being deployed in tunnels, bridges, industrial facilities, and commercial buildings, among other infrastructures, to provide reliable fire and heat detection capabilities.

Europe Fiber Optic Fire And Heat Detectors Market Trends

The fiber optic fire and heat detectors market in Europe is growing as the transportation industry is witnessing a surge in the adoption of fiber optic fire and heat detection systems, driven by the imperative for robust and efficient safety systems in critical infrastructure, such as railway tunnels, metro networks, and airports. These advanced systems are gaining prominence due to their ability to provide comprehensive coverage and rapid response times across large-scale, complex environments.

UK fiber optic fire and heat detectors market is rising due to adoption of specific wavelength detection systems for new construction projects and is gaining significant traction in the U.K. As new infrastructure development and urbanization projects are undertaken, there is an increasing demand for advanced fire detection technologies that can provide reliable and efficient monitoring. Specific wavelength detection systems are being deployed in new buildings, industrial facilities, and urban infrastructure to provide high-precision fire detection capabilities.

The fiber optic fire and heat detectors market in France is expected to grow significantly over the forecast period. In France, the application of fiber optic fire and heat detectors in tunnels and bridges extends to high-risk environments where conventional detection methods may be insufficient. These detectors offer robust performance in challenging conditions, such as confined spaces and high-traffic areas, where early detection of fire or heat anomalies is critical.

Germany fiber optic fire and heat detectors market held a significant share of the Europe market. The advances in electric and autonomous vehicle technologies present immense growth opportunities for fiber optic fire and heat detectors in Germany. The demand for advanced safety solutions, including fire detection systems, is expected to increase as automakers accelerate the development of electric and autonomous vehicles.

Asia Pacific Fiber Optic Fire And Heat Detectors Market Trends

The fiber optic fire and heat detectors market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific fiber optic fire and heat detectors market is witnessing significant growth, driven by rapid infrastructure development and continued urbanization. Countries, such as China and India, and Southeast Asian nations are investing heavily in new infrastructure projects, including smart cities, transportation networks, and industrial facilities. The need for advanced fire detection and temperature monitoring solutions for this infrastructure is fueling the demand for fiber optic systems to provide reliable and real-time monitoring, which is essential for ensuring safety and compliance with modern building and safety codes.

China fiber optic fire and heat detectors marketis expected to grow significantly over the forecast period. China is experiencing rapid growth in data center infrastructure, driven by increasing digitization and the growing demand for data storage and processing capabilities. As one of the world's largest markets for data centers, China is expanding its data center capacity to support the growing needs of various industries, including technology, finance, and e-commerce. The construction of new data centers and the expansion of existing facilities are fueling the demand for advanced fire and heat detection systems to ensure the safety and reliability of these critical facilities.

The fiber optic fire and heat detectors market in Indiais expected to grow substantially over the forecast period. India has a thriving startup ecosystem focused on robotics and automation, with many startups utilizing ROS as the foundation for their products and services. These startups are developing innovative ROS-based solutions for diverse applications, ranging from industrial automation to service robotics.

Japan fiber optic fire and heat detectors marketis expected to grow significantly over the forecast period. In India, railways are undergoing significant modernization to enhance safety, efficiency, and reliability, creating a robust market for fiber optic fire and heat detectors. Both government and private stakeholders are investing in upgrading railway infrastructure, including stations, tunnels, and bridges, with advanced safety systems. Fiber optic detectors are increasingly being deployed owing to their ability to provide continuous and real-time monitoring of temperature changes along railway tracks, tunnels, and other critical structures.

Middle East & Africa (MEA) Fiber Optic Fire And Heat Detectors Market Trends

The fiber optic fire and heat detectors market in the Middle East & Africa (MEA) is witnessing growing adoption of fiber optic fire and heat detectors in oil & gas pipelines to enhance safety and operational reliability. These detectors provide real-time monitoring and early detection of temperature anomalies and potential fire hazards along oil & gas pipelines, which is crucial to preventing leaks, explosions, and other catastrophic events. The ability of fiber optic systems to offer continuous and long-distance monitoring without the need for multiple discrete sensors makes them particularly suitable for the extensive and remote pipeline networks typically associated with the oil & gas industry.

The Kingdom of Saudi Arabia (KSA) fiber optic fire and heat detectors marketis expected to grow significantly over the forecast period. The pursuit of smart plant initiatives in Saudi Arabia’s chemical and petrochemical industries is driving the implementation of fiber optic fire and heat detection systems. Smart plants leverage advanced technologies, including IoT and real-time data analytics, to optimize safety and efficiency. Fiber optic detectors play a crucial role in these initiatives by providing continuous, real-time temperature data and early detection of fire hazards.

The fiber optic fire and heat detectors market in the United Arab Emirates (UAE) is expected to grow substantially over the forecast period. Fiber optic fire and heat detectors are increasingly being used for high-voltage and underground cable monitoring in the UAE’s power distribution networks. These systems are essential for detecting temperature changes and potential fire risks in critical components, such as transformers, substations, and underground cables. Their ability to monitor longer distances and operate effectively in challenging environments makes them ideal for ensuring the safety and reliability of power distribution systems.

Key Fiber Optic Fire And Heat Detectors Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2023, AP Sensing introduced its next-generation Linear Heat Detection (LHD) system, the N45-Series. This innovative system boasts the industry's longest certified distance range of up to 16 km and offers four channels for enhanced versatility. The N45-Series ensures easy accessibility with a fully integrated web server that allows for simple browser-based administration, one-click compliance verification, and comprehensive customization options, including 2000 programmable alarm zones per channel and up to 98 integrated relay contacts. Moreover, the N45-Series offers simple installation, minimal maintenance requirements, immunity to Electromagnetic Interference (EMI), and high precision in fire event location and monitoring.

Key Fiber Optic Fire And Heat Detectors Companies:

The following are the leading companies in the fiber optic fire and heat detectors market. These companies collectively hold the largest market share and dictate industry trends.

- AP Sensing

- Bandweaver

- LIOS Technology (Luna Innovations)

- Mirion Technologies, Inc

- NKT Photonics A/S

- Optromix

- Patol Limited

- The Protectowire Co., Inc.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.

- Sensornet

- Weitan Technology

- Yokogawa Electric Corporation

Recent Developments

-

In July 2024, AP Sensing was appointed for a Singaporean Linear Heat Detection (LHD) project to upgrade a conventional heat detection system in old substations to a new and more robust Linear Heat Detection (LHD) system. This upgrade aimed at modernizing fire safety systems in substations. The project also entailed transforming several conventional fire alarm systems into addressable detection systems, enhancing overall fire safety and enabling better fire location identification.

-

In August 2022, Prysmian Group launched a new monitoring system for overhead transmission lines. The system employed the optical fibers of Optical Ground Wire (OPGW) and the grounding cable of the High Voltage (HV) transmission line to detect a range of events that can impact the performance of the transmission line. The system is designed to detect lightning strikes; short circuits; aeolian vibrations caused by wind; the corona effect, a discharge of electricity in the air around the transmission line; and fires.

Fiber Optic Fire And Heat Detectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.07 billion

Revenue forecast in 2030

USD 3.22 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

AP Sensing, Bandweaver, LIOS Technology (Luna, Innovations), Mirion Technologies, Inc, NKT Photonics A/S Optromix, Patol Limited, The Protectowire Co., Inc., Prysmian Group, Sumitomo Electric Industries, Ltd., Sensornet, Weitan Technology, Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Optic Fire And Heat Detectors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber optic fire and heat detectors market report based on robot type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Fiber Optic Fire Detectors

-

Distributed Temperature Sensing (DTS) Systems

-

Fiber Bragg Grating (FBG) Based Systems

-

Raman Scattering Systems

-

-

Fiber Optic Heat Detectors

-

Continuous Linear Systems

-

Zone-based Linear Systems

-

Specific Wavelength Detection

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Tunnels & Bridges

-

Automotive

-

Railways

-

Building & Construction

-

Oil & Gas Pipelines

-

Power Generation & Distribution

-

Data Centres

-

Chemical & Petrochemical Plants

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber optic fire and heat detectors market size was estimated at 1.93 billion in 2023 and is expected to reach USD 2.07 billion in 2024.

b. The global fiber optic fire and heat detectors market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 3.22 billion by 2030.

b. North America dominated the fiber optic fire and heat detectors market with a share of 32.0% in 2023. The growth of the fiber optic fire and heat detectors market is driven by advanced detection technology that uses optical fibers to sense temperature changes along their entire length, providing early warnings of fire hazards.

b. Some key players operating in the fiber optic fire and heat detectors market include, AP Sensing, Bandweaver, LIOS Technology (Luna Innovations), Mirion Technologies, Inc, NKT Photonics A/S, Optromix, Patol Limited, The Protectowire Co., Inc., Prysmian Group, Sumitomo Electric Industries, Ltd., Sensornet, Weitan Technology, Yokogawa Electric Corporation

b. Key factors that are driving the market growth include technological advancements in sensor networks and data analytics are driving innovation in zone-based systems, enabling smarter decision-making and proactive maintenance strategies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."