Fetal Monitoring Equipment Market Size, Share & Trends Analysis Report By Product, By Application (Antepartum, Intrapartum), By Portability, By Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-474-0

- Number of Report Pages: 170

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Fetal Monitoring Equipment Market Trends

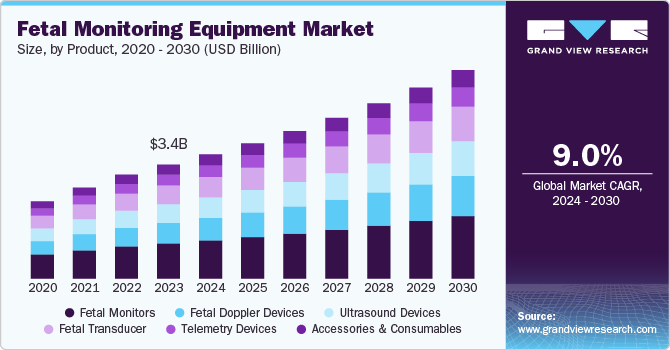

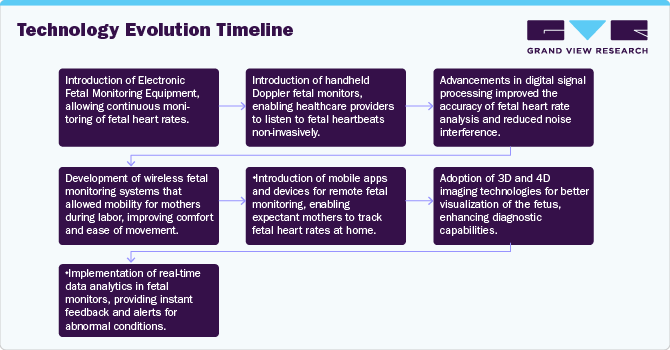

The global fetal monitoring equipment market size was estimated at USD 3.37 billion in 2023 and is expected to grow at a CAGR of 9.02% from 2024 to 2030. The market is driven by rapid technological advancements, increasing healthcare awareness, rising demand for early detection & prevention, and expanding healthcare infrastructure. Technological innovations in monitoring devices, such as advanced ultrasound systems and wireless technologies, have enhanced the accuracy and ease of monitoring.

The rise in the premature delivery rate led to the growing need for fetal monitoring equipment. This is expected to contribute to the growing demand for advanced fetal monitoring equipments globally. According to a study published in The Lancet, conducted by researchers from the WHO, the United Nations Children’s Fund (UNICEF), and the London School of Hygiene and Tropical Medicine, in 2020, approximately 13.4 million babies were born prematurely (before 37 weeks of gestation), which represents about 1 in 10 live births globally. With more premature babies being born, Neonatal Intensive Care Units (NICUs) require advanced monitoring equipment systems to manage the health of these vulnerable infants. This is expected to increase the demand for specialized fetal monitors designed for use in NICUs.

Furthermore, technological advancements have significantly modernized monitoring equipment, offering expectant mothers enhanced comfort and mobility through noninvasive, wireless devices. These innovations, including Fetal Electrocardiography and Electromyography, facilitate safer, continuous monitoring, moving away from traditional, restrictive methods. The introduction of systems such as the Novii Wireless Patch highlights this shift, providing real-time, comfortable monitoring. In addition, the integration of AI and machine learning into these systems enables remote monitoring, crucial for those in less accessible areas, but also improves data accuracy and predictive analysis for early detection of complications. This development, supported by seamless integration with electronic medical records, promises better outcomes for mothers and infants alike.

However, the availability of refurbished devices puts pressure on manufacturers, limiting their ability to sell new devices at premium prices. Companies like GE Healthcare and Philips face challenges in justifying the premium prices of their advanced devices when more affordable refurbished models are readily available in the market. This price competition is especially intense in emerging markets, where cost is a primary concern, leading to reduced profit margins for manufacturers. This downward pricing pressure, especially in price-sensitive markets, reduces potential profit margins and limits overall market growth for advanced fetal monitoring equipment. Therefore, the availability of low-cost alternatives impedes the growth of the fetal monitoring market, particularly in regions where cost & budget constraints are the main concerns for healthcare providers.

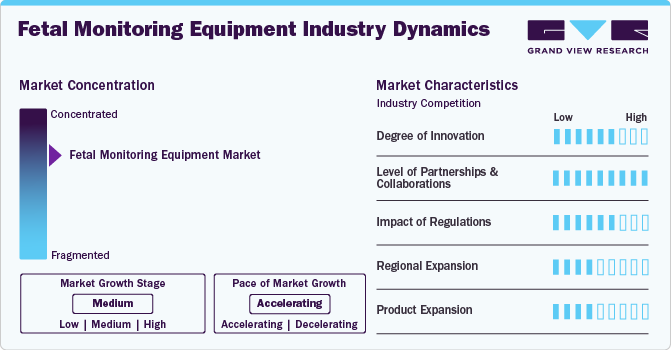

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, degree of innovation, impact of regulations, and regional expansion. The market is fragmented, with the presence of several emerging service providers dominating the market. The degree of innovation is high, and the level of partnerships & collaborations activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the industry is high. The growth in innovation is fueled by a growing demand for non-invasive and real-time monitoring solutions, combined with a competitive landscape that encourages companies to expand the boundaries of existing capabilities. In addition, technological advancements in AI and ML are being leveraged to enhance predictive analysis and diagnostic accuracy, further elevating the market's innovation profile. For instance, in April 2024, GE HealthCare introduced the AI-driven Voluson Signature 20 and 18 ultrasound systems to enhance imaging in women’s health. This launch benefits the industry by improving the accuracy and efficiency of ultrasound imaging through sophisticated artificial intelligence.

The industry's level of partnerships & collaborations is moderate. This is due to the collaboration’s aimed to leverage advanced technologies to enhance patient outcomes. These strategic alliances are driven by the aim of combining clinical expertise with innovative tech solutions, improving product offerings, and increasing market access. Furthermore, these partnerships enable the sharing of research and development costs, speeding up the introduction of advanced solutions. For instance, in March 2022, Koninklijke Philips NV partnered with Nuvo Group to enhance prenatal care services in rural Colorado.

The impact of regulations on the market is moderate due to the balance between fostering innovation and patient safety. One key regulation in the U.S. market is the FDA's guidance on fetal heart rate monitoring, which provides recommendations for designing, testing, and labeling fetal heart rate monitors. This guidance aims to ensure devices are accurate and reliable and provide healthcare professionals with the necessary information to make informed decisions during labor and delivery.

The level of regional expansion in the industry is moderate due to stringent regulatory barriers across different regions, a significant disparity in healthcare infrastructure between developed and developing countries, the high cost associated with advanced equipments, and a shortage of trained healthcare professionals in low—and middle-income countries.

Product Insights

Based on product, the fetal monitors segment held the largest revenue share of over 30.86% in 2023. The growth of this segment is attributed to the growing awareness about the importance of monitoring fetal health, along with an increase in preterm births and fetal issues, is boosting the demand for fetal monitors. Moreover, technological advancements that improve these devices' accuracy, portability, and user-friendliness are making them more widely available for use in diverse healthcare settings, including at home. For instance, in February 2024, GE Healthcare received FDA 510(k) clearance for its Novii+ Wireless Patch Solution. This advanced monitors noninvasively tracks fetal heart rate, maternal heart rate, and uterine activity. The belt-free, wireless design enhances maternal mobility, potentially improving labor comfort and reducing labor duration.

However, fetal doppler devices segment is anticipated to grow at the fastest CAGR over the forecast year due to their affordability and ease of use, which makes them accessible for both clinical settings and at-home monitoring. The growing emphasis on early detection of fetal distress and the increasing preference for home-based monitoring solutions further boost the demand for fetal doppler devices. Some of the players in the market offering fetal doppler devices are Medline Industries, Inc., Bionet Co., Ltd., Huntleigh Healthcare Limited, Promed Group Co., Ltd., ELCAT, Hadeco, Inc., Shenzhen Biocare Bio-Medical Equipment Co., Ltd., Advanced Instrumentations, and SonoScape Medical Corp.

Application Insights

Based on application, the antepartum segment held the largest revenue share of over 52.38% in 2023. The growth of this segment is attributed to the rising prevalence of chronic conditions among pregnant women, such as high blood pressure, diabetes, and obesity, has necessitated the need for enhanced monitoring solutions. These conditions elevate the risk of complications during pregnancy. Moreover, the growing governmental and non-governmental organizations' initiatives aimed at reducing infant mortality rates and improving prenatal care standards have significantly contributed to the expansion of the antepartum segment.

On the other hand, the intrapartum segment is anticipated to grow at a fastest growth rate over the forecast year. The growth of this segment is due to the increasing global awareness and demand for maternal and fetal safety during childbirth. In addition, healthcare providers are focusing on enhanced monitoring techniques to reduce the risks of intrapartum stillbirth and neonatal complications, propelling the need for advanced fetal monitoring equipment solutions. Furthermore, the surge in the prevalence of preterm births and the associated complications necessitate vigilant intrapartum monitoring to ensure the well-being of both the mother and the fetus, further fueling market growth.

Portability Insights

Based on portability, the non-portable segment held the largest revenue share of over 55.35% in 2023. The expansion of the non-portable segment in the market is driven by the growing demand for advanced, comprehensive fetal monitoring solutions in medical facilities globally. This surge is a direct response to the increased focus on maternal and fetal health, especially in scenarios requiring high-level, continuous monitoring that only non-portable units can provide. This expected to drive the growth of the segment during the forecast period.

The portable segment is anticipated to grow at the fastest growth rate over the forecast year. This growth is owing to the increasing prevalence of portable and wireless devices across healthcare settings. With the global increase in the number of pregnancies characterized by complications such as pre-eclampsia, diabetes, and preterm labor, there is an increased need for effective and continuous monitoring solutions. For instance, in October 2021, Meddist Company Limited (Jameel Health) partnered with Melody International to distribute the innovative cloud-based Melody i Mobile Fetal Monitor iCTG across selected markets in Asia, the Middle East, and Africa, covering over 1.9 billion people. This collaboration aims to improve fetal monitoring

Type Insights

Based on type, the non-invasive segment held the largest revenue share of over 67.79% in 2023 and is anticipated to grow at the fastest growth rate over the forecast year. Advancements in ultrasound technology significantly improved the resolution and accuracy of imaging, allowing detailed assessments of fetal health without the need for invasive procedures. Developing portable and user-friendly devices enhanced accessibility and convenience, enabling more frequent & widespread use in clinical and home settings. In addition, the focus on patient comfort and safety led to a preference for non-invasive methods, which minimize the risks of infection and other complications associated with invasive techniques. According to an article published by MDPI, pregnant women found the noninvasive Fetal Electrocardiogram (FECG) more comforting than the invasive version.

The invasive segment is anticipated to grow at a significant rate over the forecast year. Invasive equipment techniques, including the Fetal Scalp Electrode (FSE) and the Intrauterine Pressure Catheter (IUPC), are essential tools in managing high-risk pregnancies and complex labor situations. These methods provide precise and continuous measurements of fetal heart rate and uterine contractions, surpassing the accuracy of noninvasive methods, especially in cases where external factors such as maternal obesity or fetal positioning affect monitoring. In addition, fetal blood sampling and amnioinfusion are procedures utilized for assessing well-being and addressing complications such as umbilical cord compression. These factors are anticipated to create the demand for invasive equipment in the coming years.

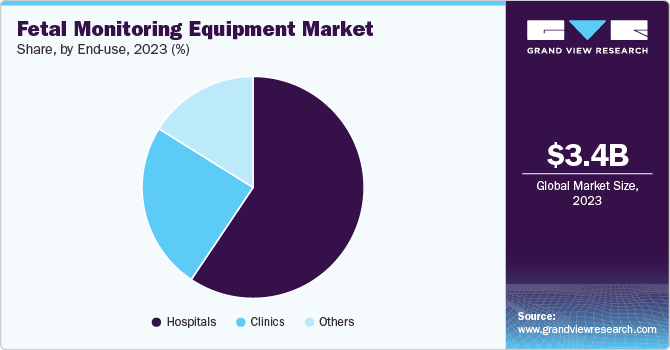

End-use Insights

Based on end use, the hospitals segment held the largest revenue share of 59.41% in 2023 and is anticipated to grow at a fastest growth rate over the forecast year. Several factors drive the growth of the hospital segment in the market, such as an increase in awareness regarding prenatal care led to a higher number of expectant mothers seeking hospital services for safe deliveries, technological advancements, such as wireless monitors and telemedicine solutions, improved hospital patient outcomes & operational efficiency. In addition, government initiatives promoting maternal health and investments in healthcare infrastructure further boost the segment growth.

The clinics segment is anticipated to grow significantly over the forecast year. The growth is attributed to the increasing number of prenatal visits and the rising awareness of maternal & fetal health. Furthermore, clinics with advanced ultrasound technology can detect anomalies earlier than traditional methods, allowing timely interventions. According to NCBI, clinics are adopting telehealth solutions that enable remote monitoring, expanding access to care for women in rural or underserved areas. This shift not only enhances patient engagement but also reinforces the role of clinics as vital players in ensuring safe pregnancies.

Regional Insights

North America region held the largest share of 28.36% in 2023. This is due to the growing technological advancements and an increasing emphasis on maternal health. The region is expected to witness surge in development of advanced monitoring equipment, including non-invasive and wearable devices that offer enhanced accuracy and real-time data analysis. Innovations such as AI and machine learning are being integrated into monitors to provide predictive analytics and early detection of potential complications, thereby improving clinical outcomes and patient care. This is expected to boost the growth of the region during the forecast period. Some of the key companies operating in North America are GE Healthcare; The Cooper Companies Inc.; Koninklijke Philips NV; and MEDGYN PRODUCTS Inc.

U.S. Fetal Monitoring Equipment Market held the largest share in 2023, owing to the favorable regulatory environments, increasing healthcare expenditure, and a strong focus on maternal and child health. The combination of technological innovation, increased awareness of prenatal care, and government initiatives is expected to drive the adoption of fetal monitoring solutions, ultimately leading to improved health outcomes for mothers and their babies.

Europe Fetal Monitoring Equipment Market Trends

Europe fetal monitoring equipment marketis driven by increased prenatal awareness, government initiatives, and technological innovation. The growing awareness among expectant parents about early and accurate monitoring is a key driver. European healthcare systems emphasize preventive care and early detection of potential complications, leading to higher adoption rates of advanced monitoring technologies. For instance, in May 2021, the Irish government awarded Raydiants Oximetry a USD 3 million grant to create advanced monitors that enhance the health outcomes of mothers and infants during childbirth.

UK fetal monitoring equipment market held the largest market share in 2023 owing to the increasing prenatal awareness, the prevalence of high-risk pregnancies, and government initiatives aimed at improving maternal & child health. The rising number of births across the continent contributed to the demand for effective fetal monitoring equipment solutions. For instance, the Office for National Statistics data indicates 625,008 live births in the UK in 2021, a 1.5% increase from the previous year. This trend is expected to continue, prompting healthcare providers to adopt advanced monitoring technologies to ensure mothers' and infants' health and safety. The increased awareness of prenatal care among expectant parents and healthcare professionals is expected to drive demand for reliable monitoring solutions to detect potential complications.

Germany fetal monitoring equipment market held a significant market share in 2023. As awareness of prenatal care continues to rise among expectant parents, there is an increased focus on the importance of continuous monitoring during pregnancy and labor to ensure the health and safety of both mothers and infants. This trend is further supported by government programs that promote regular prenatal check-ups and screenings.

Asia Pacific Fetal Monitoring Equipment Market Trends

Asia Pacific fetal monitoring equipment market is expected to witness a significant growth over the forecast period owing to the growing integration of advanced technologies, such as AI and telemonitoring devices, which enhance the accuracy and convenience of fetal monitoring equipment. For instance, in October 2021, Abdul Latif Jameel Health and Melody International collaborated to distribute Melody’s advanced iCTG remote fetal monitor, a cloud-based and mobile wireless platform designed for fetal monitoring equipment. Developed countries such as Japan, South Korea, and Australia are at the forefront of implementing advanced fetal monitoring equipment technologies.

China fetal monitoring equipment market held a significant share in 2023. The government of China implemented various policies to improve maternal health outcomes, including promoting regular prenatal check-ups and using modern monitoring technologies. For instance, the introduction of the two-child policy led to an increase in birth rates, resulting in a greater demand for effective fetal monitoring devices to ensure the health & safety of mothers and infants. This focus on prenatal care contributed to the adoption of advanced fetal monitoring technologies, enhancing the overall quality of maternal care.

India fetal monitoring equipment market held the largest share in 2023.The fetal monitoring market in India is experiencing significant growth due to increasing awareness about maternal and fetal health, rising birth rates, and advancements in medical technology. With a large population, there is an increasing demand for quality healthcare services, including prenatal care. Companies such as GE Healthcare and Philips are actively competing in this space by offering innovative fetal monitoring solutions that cater to the needs of healthcare providers. For instance, GE Healthcare’s “Corometrics” line provides advanced fetal monitors that help clinicians track the health of both mother and baby during labor.

Latin America Fetal Monitoring Equipment Market Trends

LatinAmerica fetal monitoring equipment market is experiencing growth as manufacturers are increasingly focusing on developing devices that integrate advanced features such as Bluetooth connectivity for seamless data transmission and improved clinical workflows. This trend is driven by the need for efficient monitoring solutions considering rising birth rates and complications during childbirth.

Brazil fetal monitoring equipment market is anticipated to grow significantly due to the technological advancements. Innovations such as wireless fetal monitors and mobile health applications have made it easier for healthcare providers to monitor fetal health remotely. For instance, Bluetooth technology allows expectant mothers to track their child’s heart rate and movements from the comfort of their homes, reducing the need for frequent hospital visits. This shift enhances patient convenience and improves access to care in rural areas where specialized medical facilities may be limited.

Middle East & Africa Fetal Monitoring Equipment Market Trends

Middle East & Africa fetal monitoring equipment market is expected to grow significantly due to the increasing prenatal awareness and government initiatives are critical in driving market growth. Numerous countries in the region have launched public health campaigns to educate expectant mothers about the importance of regular prenatal check-ups and advanced monitoring. In Saudi Arabia, the government has been proactive in enhancing maternal healthcare services through initiatives such as the National Health Information Center, which supports integrating advanced technologies into prenatal care.

South Africa fetal monitoring equipment market is anticipated to grow significantly over the forecast period. The ongoing enhancement of South Africa’s healthcare infrastructure is the key driver for the growth of the market. The country has been investing in upgrading its medical facilities and expanding access to advanced healthcare technologies. Initiatives to improve prenatal care include integrating modern fetal monitoring systems in public and private hospitals. For instance, the South African government’s commitment to strengthening healthcare services through projects such as the National Health Insurance (NHI) aims to improve access to quality care, including innovative fetal monitoring technologies, across various healthcare settings.

Key Fetal Monitoring Equipment Company Insights

The market is moderately fragmented, with several large players and emerging players operating in this space adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices. Some emerging market players in the fetal monitoring equipment market include Nemo Healthcare, Mindchild Medical, Inc., MedGyn Products, Inc., and Neoventa Medical AB

Key Fetal Monitoring Equipment Companies:

The following are the leading companies in the fetal monitoring equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Avante Health Solutions

- Bionet America, Inc.

- CooperSurgical Inc. (THE COOPER COMPANIES, INC.)

- EDAN Instruments, Inc.

- FUJIFILM India Private Limited

- GE Healthcare

- Koninklijke Philips NV

- MEDGYN PRODUCTS INC.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers

- TRISMED Co., Ltd.

Recent Developments

-

In April 2024, GE Healthcare introduced the AI-driven Voluson Signature 20 and 18 ultrasound systems to enhance imaging in women’s health. This launch benefits the fetal monitoring equipment sector by improving the accuracy and efficiency of ultrasound imaging through sophisticated artificial intelligence.

-

In February 2024, GE Healthcare announced that its Novii+ Wireless Maternal and Fetal Monitoring Equipment System received FDA clearance to monitor nearly 95% of all eligible births in the U.S.

-

In November 2022, The Cooper Companies Inc. acquired Cook Medical’s Reproductive Health division, which specializes in producing minimally invasive medical devices for the fertility, obstetrics, and gynecology sectors.

-

In February 2021, CooperSurgical initiated a multi-year strategic partnership with Virtus Health, a leading global provider of assisted reproductive services. This collaboration, which begins this month, aims to foster innovation, enhance digitalization, and improve fertility treatment advancements.

Fetal Monitoring Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.67 billion |

|

Revenue forecast in 2030 |

USD 6.16 billion |

|

Growth rate |

CAGR of 9.02% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, portability, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Koninklijke Philips NV; GE Healthcare; Siemens Healthineers; CooperSurgical Inc. (THE COOPER COMPANIES, INC.); MEDGYN PRODUCTS INC.; EDAN Instruments, Inc.; Bionet America, Inc.; TRISMED Co., Ltd.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; FUJIFILM India Private Limited; Avante Health Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fetal Monitoring Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fetal monitoring equipment market report based on product, application, portability, type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fetal Monitors

-

Fetal Doppler Devices

-

Ultrasound Devices

-

Fetal Transducer

-

Telemetry Devices

-

Accessories and Consumables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antepartum

-

Intrapartum

-

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Portable

-

Portable

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Invasive

-

Invasive

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fetal monitoring equipment market size was estimated at USD 3.37 billion in 2023 and is expected to reach USD 3.67 billion in 2024.

b. The global fetal monitoring equipment market is expected to grow at a compound annual growth rate of 9.02% from 2024 to 2030 to reach USD 6.16 billion by 2030.

b. The fetal monitors segment dominated the global fetal monitoring equipment market with a share of 30.86% in 2023.

b. Some key players operating in the fetal monitoring equipment market include Koninklijke Philips NV, GE Healthcare, Siemens Healthineers, CooperSurgical Inc. (THE COOPER COMPANIES, INC.), MEDGYN PRODUCTS INC., EDAN Instruments, Inc., Bionet America, Inc., TRISMED Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., FUJIFILM India Private Limited, Avante Health Solutions.

b. Key factors that are driving the fetal monitoring equipment market growth include the growth in the premature delivery rate, technological advancements, and growing initiatives to reduce infant mortality rates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."