- Home

- »

- Biotechnology

- »

-

Fetal Bovine Serum Market Size, Industry Report, 2033GVR Report cover

![Fetal Bovine Serum Market Size, Share & Trends Report]()

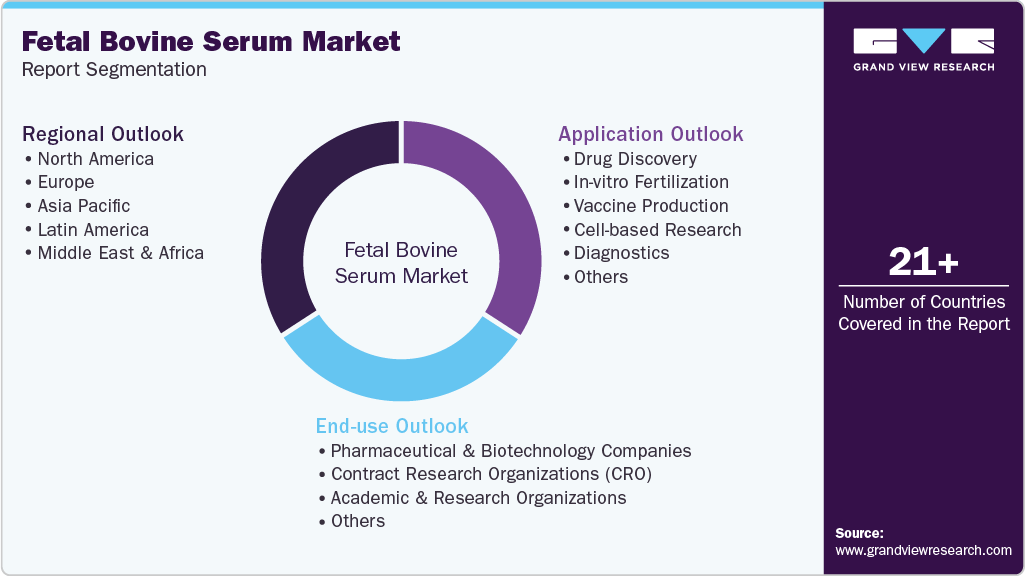

Fetal Bovine Serum Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Drug Discovery, Vaccine Production, Cell-based Research, Diagnostics), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-071-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fetal Bovine Serum Market Summary

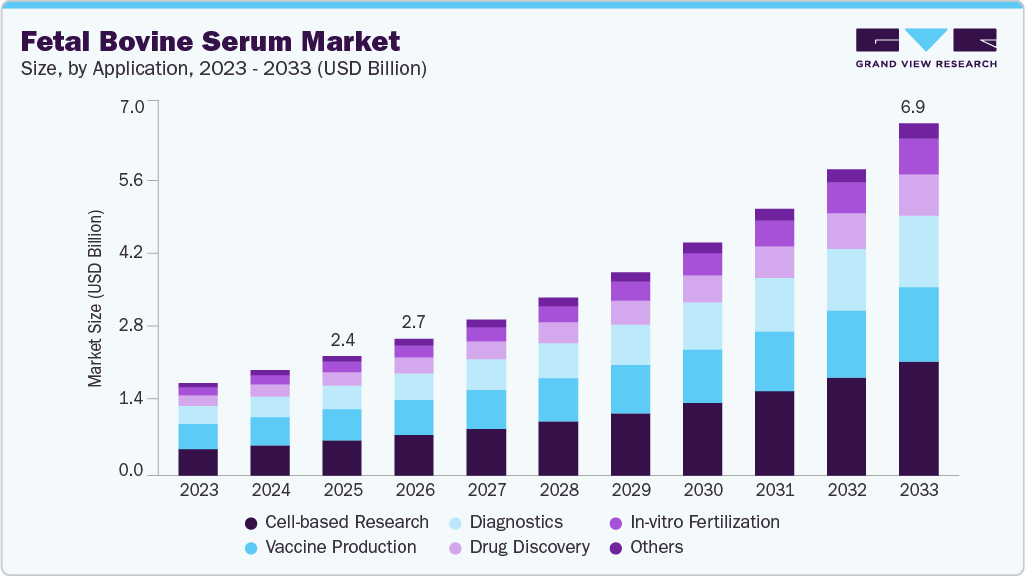

The global fetal bovine serum market size was estimated at USD 2.06 billion in 2024 and is projected to reach USD 6.91 billion by 2033, growing at a CAGR of 14.44% from 2025 to 2033. Factors such as the expansion of the biopharmaceutical industry in developing countries and established markets are expected to drive demand for fetal bovine serum (FBS) during the forecast period.

Key Market Trends & Insights

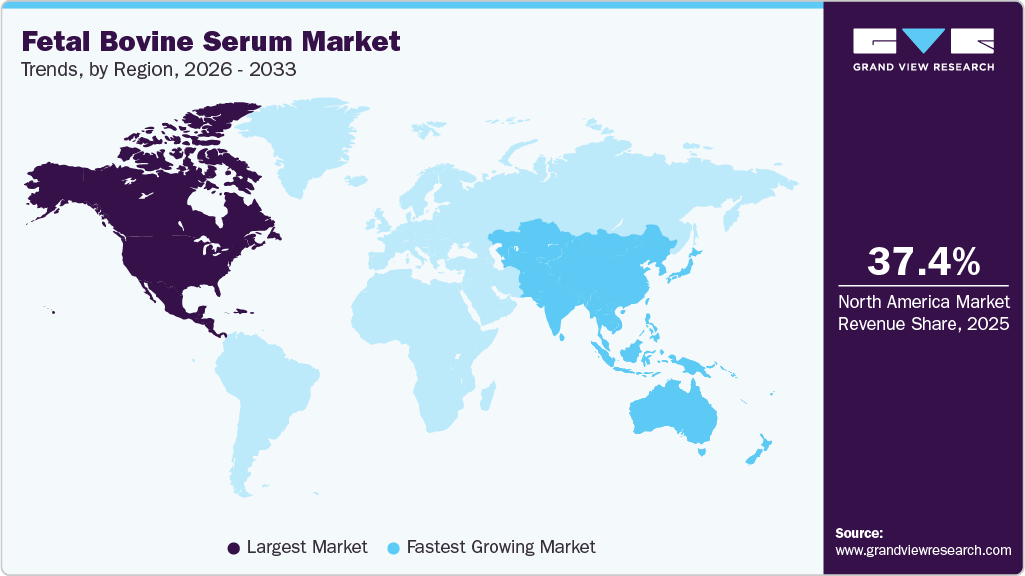

- North America fetal bovine serum market held the largest share of 37.60% of the global market in 2024.

- The fetal bovine serum industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the cell-based research segment held the highest market share of 28.73% in 2024.

- Based on end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.06 Billion

- 2033 Projected Market Size: USD 6.91 Billion

- CAGR (2025-2033): 14.44%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding Biopharmaceutical & Biotechnology Industry

The growth of the global biopharmaceutical and biotechnology industry is a significant driver of demand in the market. FBS remains the gold standard supplement for cell culture media, providing vital nutrients, hormones, and growth factors that support the survival and proliferation of mammalian cells. Its applications span the development and production of biologics, vaccines, monoclonal antibodies, and recombinant proteins. These therapeutic categories are witnessing rapid adoption due to the rising burden of chronic diseases, such as cancer, autoimmune disorders, and infectious diseases. As the biologics pipeline expands, the need for high-quality and consistent cell culture supplements is driving steady demand for FBS across research and commercial manufacturing settings.

Moreover, the increasing focus on advanced therapies such as cell therapy, gene therapy, and regenerative medicine has further heightened the importance of FBS in R&D and clinical-scale production. The surge in outsourcing to contract research and manufacturing organizations (CROs/CMOs) has also reinforced demand, as these entities rely on reliable and standardized inputs to support large-scale biologics production. These factors underscore how the expanding biopharmaceutical and biotechnology ecosystem acts as a central market driver for FBS, ensuring its sustained relevance despite the emergence of serum-free alternatives.

Rising Cell-Based Research

The increasing volume of cell-based research across life sciences is a key factor propelling the demand for Fetal Bovine Serum (FBS). Areas such as cell biology, genomics, proteomics, and metabolomics rely heavily on the availability of high-quality serum to sustain diverse cell lines under in vitro conditions. FBS offers an optimal combination of growth factors, hormones, carrier proteins, and lipids, which are essential for promoting cell viability, proliferation, and differentiation. As research becomes more complex and diverse, spanning basic biology to translational applications, FBS remains the most widely accepted and standardized supplement for maintaining reproducible laboratory results worldwide.

Moreover, the rise in functional genomics, disease modeling, and drug discovery studies has expanded the use of mammalian cell culture systems in academic, industrial, and clinical research environments. Universities, research institutes, and pharmaceutical companies increasingly depend on FBS to facilitate experiments ranging from gene expression studies to toxicity testing and biomarker discovery. With governments and private organizations investing heavily in life sciences research infrastructure, particularly in the Asia-Pacific region and emerging economies, the demand for reliable cell culture reagents, such as FBS, is expected to accelerate. This trend firmly positions rising cell-based research as a core driver for market growth.

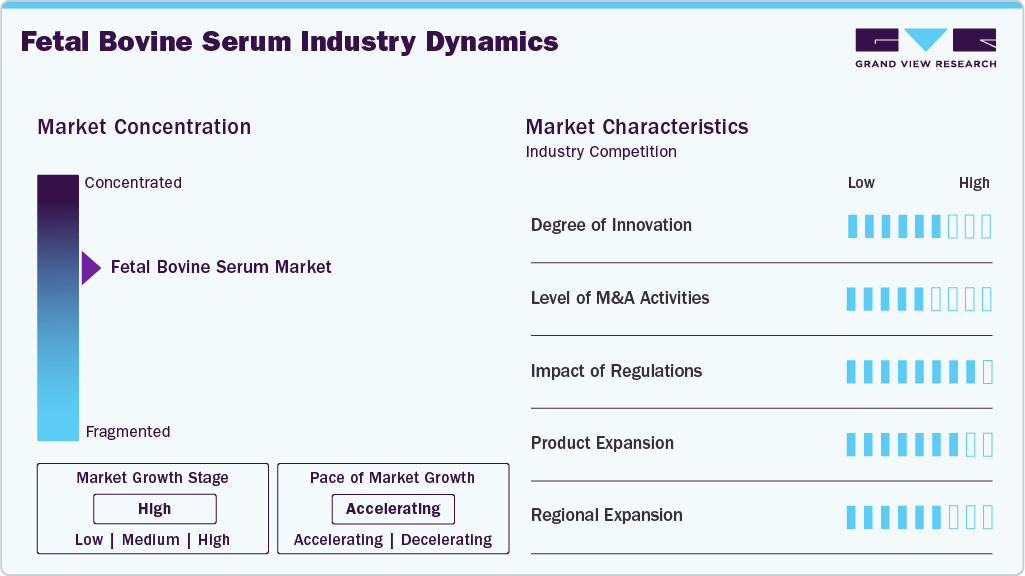

Market Concentration & Characteristics

The degree of innovation in the fetal bovine serum industry is moderate, as the core product has been long established, but suppliers are driving incremental advancements through improved processing methods, enhanced lot-to-lot consistency, and specialized variants such as heat-inactivated, dialyzed, or exosome-depleted serum. At the same time, innovation is emerging in the form of serum-free and chemically defined media that aim to address ethical concerns, batch variability, and supply chain limitations. However, adoption remains limited compared to FBS due to its unmatched biological richness and regulatory acceptance in cell culture applications.

The level of mergers and acquisitions (M&A) activity in the Fetal Bovine Serum industry has been moderate in recent years, with strategic acquisitions aimed at expanding product portfolios and enhancing supply chain capabilities. For instance, in December 2021, Thermo Fisher, Inc. acquired PPD, Inc., a U.S.-based provider of clinical research services to the pharmaceutical and biotechnology industries. These strategic moves reflect the industry's focus on strengthening capabilities in cell culture and regenerative medicine applications, areas where FBS remains a critical component.

Regulations have a significant impact on the FBS industry, as strict guidelines govern the sourcing, quality, and safety of animal-derived products. Authorities such as the FDA and EMA require that FBS be obtained from healthy bovine herds, tested for contaminants, and processed under stringent quality control standards to ensure consistency for research and biopharmaceutical applications. Compliance with these rules can increase production costs and limit supply while encouraging the development of serum-free or chemically defined alternatives, shaping both market dynamics and innovation in cell culture technologies.

In the FBS industry, product expansion is driven by the need to cater to diverse cell culture requirements and advanced research applications. Companies are introducing specialized FBS variants, such as heat-inactivated, charcoal-stripped, dialyzed, and exosome-depleted serum, to meet the specific needs of stem cell research, regenerative medicine, and vaccine production. Moreover, suppliers are expanding their portfolios with GMP-grade and serum-free compatible FBS to support clinical and industrial-scale applications. This product diversification enhances the usability of FBS across various cell types and research purposes, helping companies strengthen their market presence and address evolving customer demands in a highly competitive landscape.

Regional expansion in the FBS market is a key growth strategy for major suppliers aiming to tap into emerging life sciences hubs. Companies are expanding their presence in the Asia-Pacific, Latin America, and the Middle East regions that are witnessing rapid growth in biotechnology research, stem cell studies, and vaccine manufacturing. Establishing local distribution networks, production facilities, and partnerships with research institutions allows suppliers to ensure timely availability, regulatory compliance, and cost-effective supply of FBS. This geographic expansion broadens market reach and strengthens the company’s competitive positioning in regions with rising demand for cell culture products.

Application Insights

The cell-based research segment dominated the market in 2024, accounting for 28.73%. The rise in cell culture techniques in drug discovery, cancer research, stem cell research, and regenerative medicine, along with increased investments in biologics and cell therapy development, is expected to drive growth in this segment.

In vitro fertilization is expected to experience significant growth over the forecast period. FBS provides essential nutrients, hormones, and growth factors necessary for embryo growth and development. It is often combined with other supplements, such as human serum albumin, to optimize embryo culture conditions and improve embryo quality. With an increasing number of IVF cycles being done globally, the demand for FBS is expected to grow in the coming years.

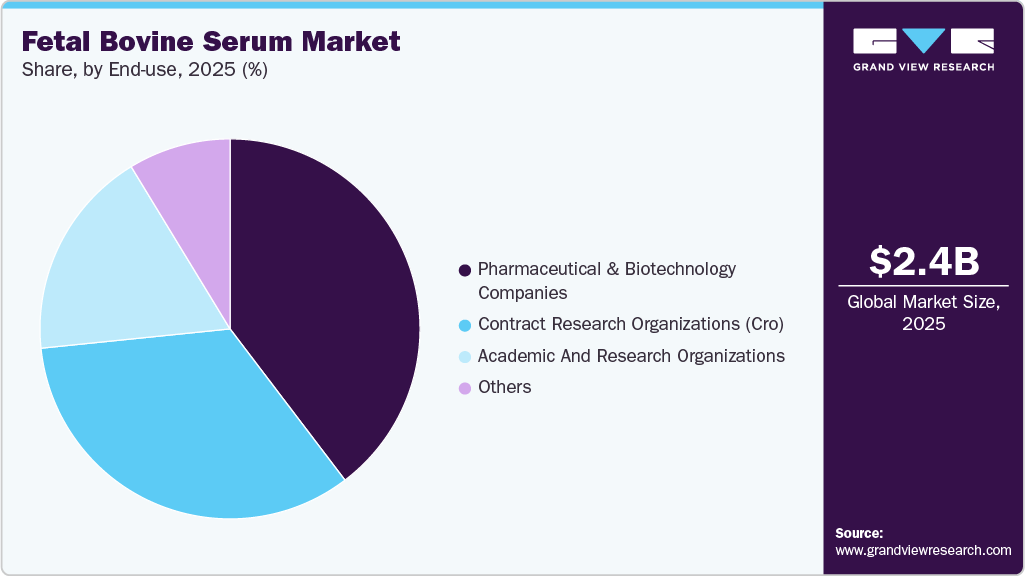

End Use Insights

The pharmaceutical and biotechnology companies segment held the highest market share of 33.33% in 2024 due to the increasing adoption of fetal bovine serum in drug development. Moreover, the growing prevalence of chronic diseases, such as cancer, demands increased research activities, and the rising adoption of fetal bovine serum for this purpose by pharmaceutical and biotechnology companies is driving the segment's growth.

The contract research organizations (CRO's) segment is anticipated to register the fastest CAGR from 2025 to 2033. The adoption of CRO offers various benefits that will help manufacturers conduct successful clinical development programs, representing lucrative growth opportunities for this segment over the forecast period. Factors such as a better global reach, the presence of necessary resources, and the ease of delegating duties and functions to the CRO drive the segment's growth. Due to these advantages, an increasing number of manufacturers are opting to hand over research programs to CRO's rather than doing it in-house, which is helping the segment gain significant growth and sustain a relatively stronger position in the market.

Regional Insights

North America dominated the global fetal bovine serum (FBS) market in 2024, with a share of 37.60%, owing to the region’s well-established biotechnology and biopharmaceutical industries. The presence of major research institutions, pharmaceutical companies, and advanced cell culture manufacturing facilities drives strong demand for high-quality FBS. Moreover, supportive government funding for life sciences research, widespread adoption of cell-based therapeutics, and a robust regulatory framework for biologics contribute to North America’s leading position in the global FBS market.

U.S Fetal Bovine Serum Market Trends

The U.S. FBS industry is experiencing robust growth, driven by substantial investments in biopharmaceutical R&D, particularly in cell-based therapies and vaccine development. The presence of leading research institutions and pharmaceutical companies bolsters the demand for high-quality FBS. Moreover, the U.S. is witnessing a surge in in-vitro fertilization (IVF) procedures, further fueling the need for specialized FBS products tailored to clinical applications.

Europe Fetal Bovine Serum Market Trends

The fetal bovine serum market in Europe is expanding steadily, with a notable emphasis on vaccine production and regenerative medicine. Countries like Germany and Italy are at the forefront of investing in advanced cell culture technologies. The region is also witnessing increased adoption of serum-free media alternatives, driven by ethical considerations and regulatory pressures. Moreover, the UK focuses on stem cell research, contributing to the growing demand for specialized FBS products.

The UK fetal bovine serum market is characterized by a strong emphasis on regenerative medicine and stem cell research. The country's commitment to advancing cell-based therapies is evident through increased funding and collaboration between academic institutions and biotech firms. This focus drives the demand for high-quality FBS to support complex cell culture processes.

The fetal bovine serum market in Germany is experiencing growth, primarily due to its strong biotechnology sector and emphasis on vaccine development. The country's regulatory environment supports the use of FBS in research and clinical applications, ensuring high standards and quality control. Moreover, Germany is exploring alternatives to traditional FBS, such as serum-free media, to align with its ethical and sustainability goals.

Asia Pacific Fetal Bovine Serum Market Trends

The fetal bovine serum market in the Asia-Pacific region is expected to grow at the fastest CAGR of 15.92% over the forecast period, driven by increasing investments in biotechnology and pharmaceutical R&D. Countries such as China, India, and Japan are expanding their research capabilities, leading to a higher demand for FBS in cell culture applications. Other factors include the rising number of academic institutes and clinical research organizations within the region.

China fetal bovine serum market is expanding rapidly, driven by increasing biopharmaceutical research and vaccine production. Growing clinical research activities and cell-based therapy development drive the need for a reliable FBS supply.

The fetal bovine serum market in Japan is heavily focused on regenerative medicine and stem cell research. Advanced research infrastructure and government support for innovative therapies fuel demand for high-quality FBS across academic and industrial research.

MEA Fetal Bovine Serum Market Trends

The fetal bovine serum market in the MEA is gradually expanding, driven by investments in biotechnology and pharmaceutical research. Countries like the UAE and South Africa are developing research capabilities, boosting the demand for FBS in cell culture and related applications.

Kuwait fetal bovine serum market is in the early stages of development, with growing interest in biotechnology research and the establishment of local research institutions. Collaborations with international partners also support the increased demand for FBS.

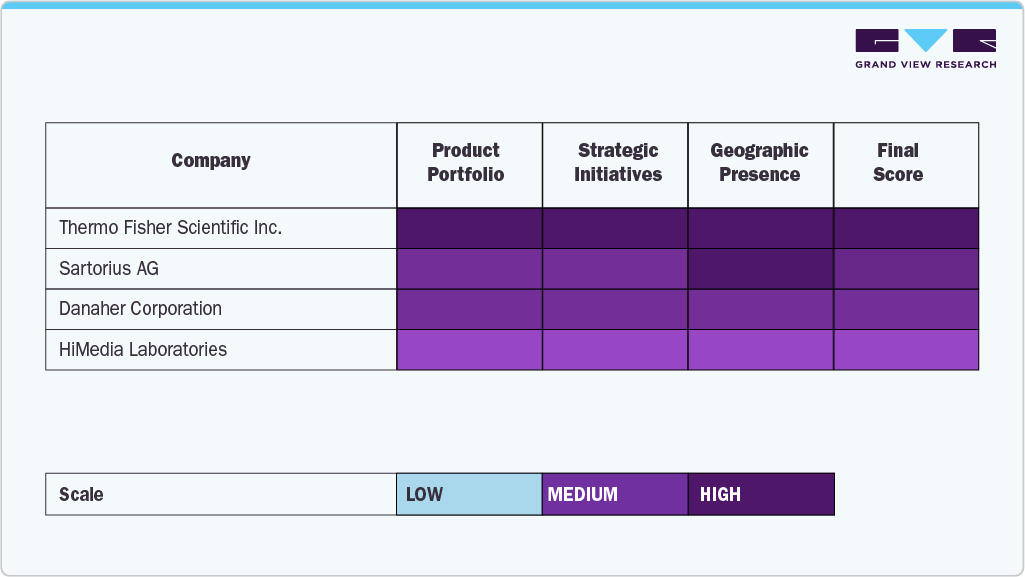

Key Fetal Bovine Serum Company Insights

The fetal bovine serum (FBS) industry is characterized by several well-established players who maintain their dominance through extensive product portfolios, strategic collaborations, and ongoing investments in research and quality assurance. Leading companies, such as Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, and Merck KGaA, have secured a significant market share by offering high-quality serum products, robust global distribution networks, and tailored solutions for diverse applications in cell culture, vaccine production, and regenerative medicine.

Companies such as HiMedia Laboratories, Bio-Techne, PAN-Biotech, Atlas Biologicals, Inc., Rocky Mountain Biologicals, and Biowest are expanding their presence through innovative product lines, customized serum solutions, and enhanced customer support, meeting the growing needs of research institutions, pharmaceutical manufacturers, and biopharmaceutical developers.

The market remains shaped by the convergence of established expertise and emerging innovation, with a focus on lot-to-lot consistency, contamination control, and compliance with stringent regulatory standards. Strategic partnerships, acquisitions, and advancements in serum processing technologies fuel competition, while companies that integrate high-quality products with customer-centric solutions are best positioned to sustain growth. As demand for vaccines, cell-based therapies, and advanced research applications continues to rise, the FBS market will increasingly be influenced by commitments to safety, reliability, and ethical sourcing, defining the future trajectory of the industry on a global scale.

Key Fetal Bovine Serum Companies:

The following are the leading companies in the fetal bovine serum market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- HiMedia Laboratories

- Bio-Techne

- PAN-Biotech

- Atlas Biologicals, Inc.

- Rocky Mountain Biologicals

- Biowest

Recent Developments

-

In June 2025, Cytiva, a subsidiary of Danaher, allocated USD 1.6 billion through 2028 to expand bioprocessing manufacturing capacity across North America, Europe, and Asia, reinforcing its region-by-region strategy.

-

In November 2024, Gemini Bioproducts, LLC in the U.S., acquired Bio-Techne’s R&D Systems FBS product rights and inventory, securing Optima, Premium Select, and Premium brands to ensure continued customer supply.

-

In November 2024, Lonza announced the successful completion of its first GMP batch at the next-generation mammalian manufacturing facility in Portsmouth, USA. This milestone underscores Lonza's commitment to advancing cell and gene therapy manufacturing capabilities. The state-of-the-art facility is equipped with cutting-edge technology to support the production of complex biologics, enhancing Lonza's position in the contract development and manufacturing organization (CDMO) sector. The completion of the first GMP batch marks a significant step in meeting the growing demand for high-quality biologic therapies.

Fetal Bovine Serum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.35 billion

Revenue forecast in 2033

USD 6.91 billion

Growth rate

CAGR of 14.44% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; HiMedia Laboratories; Bio-Techne; PAN-Biotech; Atlas Biologicals, Inc.; Rocky Mountain Biologicals; Biowest

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Fetal Bovine Serum Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global fetal bovine serum market based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery

-

In-vitro Fertilization

-

Vaccine Production

-

Cell-based Research

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations (CRO)

-

Academic And Research Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.