- Home

- »

- Agrochemicals & Fertilizers

- »

-

Fertilizer Catalyst Market Size & Share, Industry Report 2030GVR Report cover

![Fertilizer Catalyst Market Size, Share & Trends Report]()

Fertilizer Catalyst Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Iron Based, Nickel Based), By Process (Haber-Bosch Process, Urea Production, Nitric Acid Production), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-295-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertilizer Catalyst Market Size & Trends

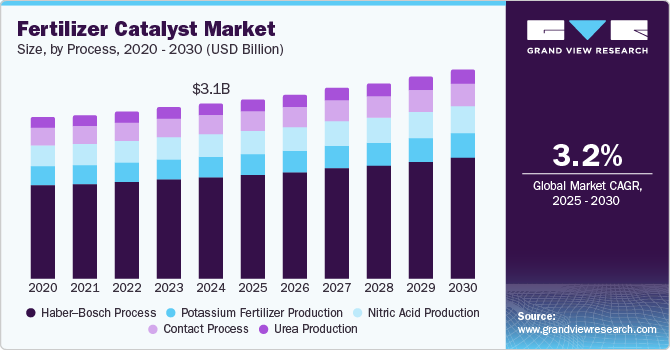

The global fertilizer catalyst market size was estimated at USD 3.05 billion in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2030. This growth is attributed to the product innovation aimed at reducing greenhouse gas emissions and enhancing process efficiency, which is crucial, alongside implementing stricter environmental regulations. In addition, the increasing demand for fertilizers due to rising populations and food security concerns further propels market growth. Furthermore, advancements in catalyst technologies that improve nutrient uptake efficiency contribute significantly to the sector's expansion, as do government subsidies promoting sustainable agricultural practices.

Fertilizer catalysts are specialized substances that enhance the efficiency of nutrient absorption in plants by accelerating chemical reactions between soil and fertilizers. The market is witnessing robust growth, largely driven by the escalating demand for food production due to a rapidly increasing global population.

In addition, as agricultural producers strive to meet these challenges, they increasingly rely on fertilizer catalysts to optimize production processes. These catalysts improve the conversion of raw materials into fertilizers, leading to higher yields and reduced waste. This operational efficiency is essential for making the best use of available resources while satisfying consumer demands. Furthermore, the emphasis on sustainability aligns with adopting these catalysts, as they support environmentally friendly agricultural practices. Advanced catalyst technologies facilitate the creation of slow-release and controlled-release fertilizers, ensuring sustainable crop production over time.

Technological advancements further influence the market by enhancing fertilizer production and performance. Innovations in catalyst development yield more efficient and durable options, enabling manufacturers to achieve better yields and lower costs amid fluctuating raw material prices. Moreover, increasing regulatory support for sustainable farming practices encourages the adoption of fertilizer catalysts that enhance nutrient use efficiency while minimizing environmental impacts, such as greenhouse gas emissions and water pollution. Therefore, the demand for effective and sustainable fertilizer solutions continues to drive market growth, solidifying the importance of fertilizer catalysts in contemporary agriculture.

Process Insights

The Haber-Bosch process dominated the market and accounted for the largest revenue share of 56.9% in 2024 attributed to the increasing demand for ammonia, a key ingredient in nitrogen-based fertilizers. As the global population rises, the need for enhanced food production intensifies, pushing agricultural practices to adopt efficient nitrogen sources. In addition, this process allows for the large-scale synthesis of ammonia from atmospheric nitrogen and hydrogen, utilizing catalysts to optimize reaction rates and yields. Furthermore, innovations aimed at reducing greenhouse gas emissions during ammonia production further support the expansion of this process, making it essential for sustainable agricultural practices.

The urea production process is expected to grow at a CAGR of 3.6% over the forecast period, owing to its critical role in producing urea, one of the most widely used nitrogen fertilizers. In addition, the rising global food demand necessitates efficient and effective fertilizer solutions, and urea production meets this need by providing a high-nitrogen content option that enhances crop yields. Furthermore, technological advancements in catalyst formulations have improved the efficiency and sustainability of urea production processes, allowing manufacturers to reduce costs and environmental impacts. Moreover, regulatory support for sustainable farming practices encourages the adoption of urea fertilizers, driving further growth in this market segment.

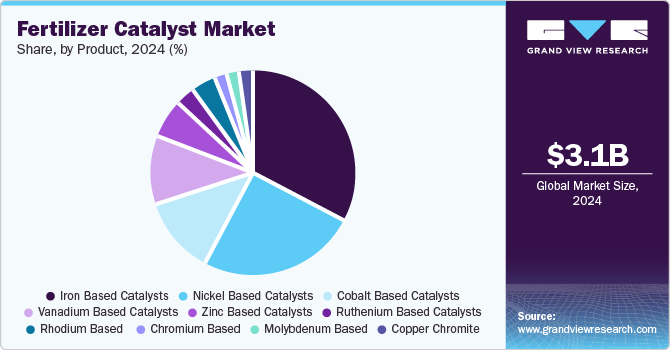

Product Insights

Iron-based catalysts led the market and accounted for the largest revenue share of 32.4% in 2024, driven by their cost-effectiveness, making them an attractive option for manufacturers, particularly in developing regions with significant budget constraints. In addition, iron catalysts are also known for their environmental benefits, as they contribute to reduced greenhouse gas emissions during fertilizer production processes. Furthermore, advancements in iron catalyst technology have improved their efficiency and durability, making them suitable for various applications in the agricultural sector. Moreover, the increasing focus on sustainable farming practices further propels the demand for iron-based catalysts, as they align well with eco-friendly agricultural initiatives.

Nickel-based catalysts are expected to grow at a CAGR of 3.7% over the forecast period, owing to their high catalytic efficiency and versatility across various industrial applications. Their critical role in hydrogenation and petrochemical production processes enhances their appeal to manufacturers aiming for improved yield and reduced operational costs. In addition, the rising demand for sustainable manufacturing practices also drives the adoption of nickel catalysts, which facilitate cleaner production methods. Furthermore, ongoing innovations in catalyst formulations and increased investments in research and development are expanding their applications, thereby boosting market growth.

Regional Insights

The fertilizer catalyst market in North America is expected to grow at a CAGR of 3.3% over the forecast period, owing to technological advancements and regulatory support for sustainable agricultural practices. In addition, increasing consumer awareness regarding sustainable farming methods drives demand for high-performance catalysts. Furthermore, the presence of established agricultural sectors and significant investments in research and development further bolster North America's position in the global fertilizer catalyst market.

U.S. Fertilizers Catalysts Market Trends

The U.S. fertilizer catalyst market dominated North America with the largest revenue share in 2024, attributed to advancements in agricultural practices and an emphasis on sustainability. As farmers seek to optimize crop yields while adhering to stringent environmental regulations, there is a growing demand for effective catalysts that enhance fertilizer production processes. Furthermore, government incentives to promote sustainable farming practices encourage investments in innovative catalyst technologies, driving market expansion as producers strive for greater efficiency and reduced emissions.

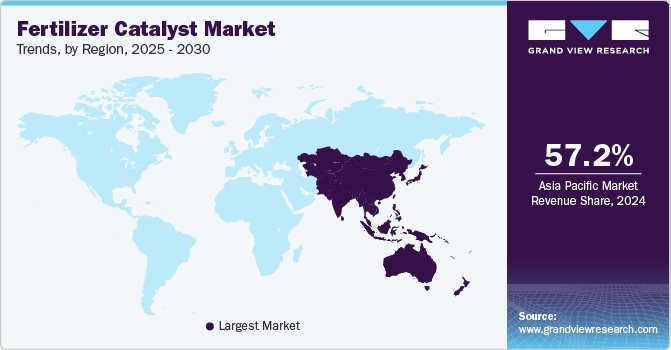

Asia Pacific Fertilizers Catalysts Market Trends

The Asia Pacific fertilizer catalyst market dominated the global market and accounted for the largest revenue share of 57.2% in 2024, attributed to the rising population changing dietary habits, increasing food demand, and higher agricultural output. In addition, economic development across countries in the region further contributes to this trend as consumers seek improved food quality. Furthermore, expanding fertilizer production facilities and adopting advanced catalyst technologies enhance operational efficiency. This combination of factors positions Asia Pacific as a key player in the global fertilizer catalyst market.

China fertilizer catalyst market led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its position as the largest consumer of fertilizers globally. In addition, the country's significant agricultural technology and infrastructure investments support the efficient production of nitrogenous fertilizers, particularly urea. Furthermore, government initiatives to improve food security and reduce environmental impacts drive the demand for innovative catalysts that enhance production efficiency.

Europe Fertilizers Catalysts Market Trends

The fertilizer catalyst market in Europe is expected to witness significant growth over the forecast period, owing to stringent environmental regulations and a strong focus on sustainability. In addition, the European Union's commitment to reducing greenhouse gas emissions has led to increased investments in cleaner production technologies, including advanced catalysts for fertilizer manufacturing. Furthermore, changing consumer preferences towards organic and sustainably produced food contributes to the demand for efficient fertilizers that minimize environmental impacts. As European countries continue to prioritize sustainability in agriculture, the need for effective fertilizer catalysts becomes increasingly critical.

The growth of the France fertilizer catalyst market is driven by government policies promoting sustainable agriculture and environmental protection. In addition, the French agricultural sector is adapting to changing consumer demands for eco-friendly products, which drives the need for innovative catalysts that enhance fertilizer efficiency. Furthermore, France's commitment to reducing carbon emissions aligns with adopting advanced catalytic technologies in fertilizer production. This emphasis on sustainability supports local agricultural practices and positions France as a key player in the European fertilizer catalyst market.

Key Fertilizer Catalyst Company Insights

Some of the key players in the market include Clariant AG, Johnson Matthey, Unicat Catalyst Technologies, and others. These companies are adopting various strategies to enhance their competitive edge. Strategies such as partnerships enable firms to leverage complementary strengths and expand their market reach. In addition, new product launches focus on innovative catalyst formulations that meet evolving agricultural needs. Furthermore, mergers and acquisitions facilitate access to advanced technologies and broaden product portfolios. The market players are investing in research and development to create sustainable solutions, ensuring compliance with environmental regulations while addressing the growing demand for efficient fertilizers.

-

Clariant AG manufactures innovative products, including AmoMax and ReforMax, which enhance the efficiency of ammonia production while reducing energy consumption.

-

Unicat Catalyst Technologies specializes in developing innovative catalysts that enhance the efficiency of various chemical reactions involved in fertilizer manufacturing. The company’s offerings cater to diverse applications, focusing on improving yield and reducing operational costs.

Key Fertilizers Catalyst Companies:

The following are the leading companies in the fertilizers catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- Clariant AG

- Johnson Matthey

- Unicat Catalyst Technologies

- Albemarle Corporation

- LKAB Minerals AB

- Quality Magnetite

- Oham Industries

- Axens

- Agricen

- Thyssenkrupp AG

Fertilizer Catalysts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.13 billion

Revenue forecast in 2030

USD 3.67 billion

Growth Rate

CAGR of 3.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, process, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Clariant AG; Johnson Matthey; Unicat Catalyst Technologies; Albemarle Corporation; LKAB Minerals AB; Quality Magnetite; Oham Industries; Axens; Agricen; Thyssenkrupp AG

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

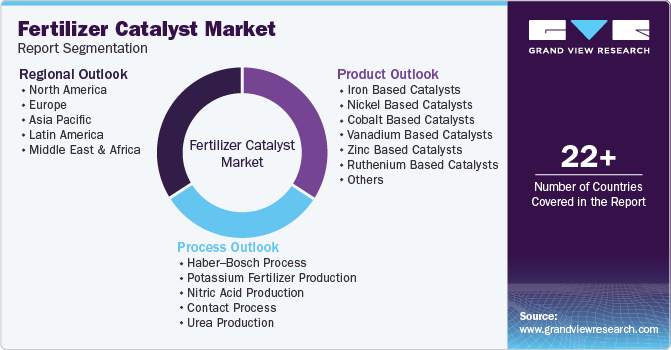

Global Fertilizer Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global fertilizer catalysts market report based on product, process, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Iron Based Catalysts

-

Nickel Based Catalysts

-

Cobalt Based Catalysts

-

Vanadium Based Catalysts

-

Zinc Based Catalysts

-

Ruthenium Based Catalysts

-

Rhodium Based Catalysts

-

Chromium Based Catalysts

-

Molybdenum Based Catalysts

-

Copper Chromite Catalyst

-

Platinum Based Catalysts

-

Palladium Based Catalysts

-

-

Process Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Haber-Bosch Process

-

Potassium Fertilizer Production

-

Nitric Acid Production

-

Contact Process

-

Urea Production

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.