- Home

- »

- Medical Devices

- »

-

Fertility Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Fertility Tourism Market Size, Share & Trends Report]()

Fertility Tourism Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Donor Egg Treatment, Surrogacy), By Age Group (18-24, 25-34, 34-44, 46-54), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-969-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertility Tourism Market Summary

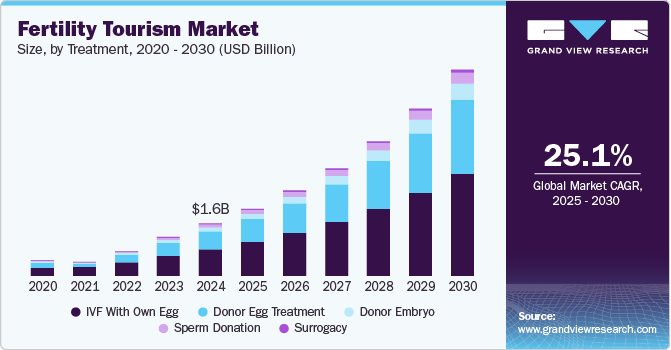

The global fertility tourism market size was estimated at USD 1.57 billion in 2024 and is projected to reach USD 6.18 billion by 2030, growing at a CAGR of 25.11% from 2025 to 2030. The market is expected to grow exponentially due to rising cases of infertility, an increasing trend of delayed pregnancy, and the rapid acceptance of fertility tourism.

Key Market Trends & Insights

- Turkey dominated the fertility tourism market with 2024.

- The Spain fertility tourism market is expected to grow at the fastest CAGR over the forecast period.

- Based on treatment, the IVF with own eggs segment led the market with the largest revenue share of 50.94% in 2024.

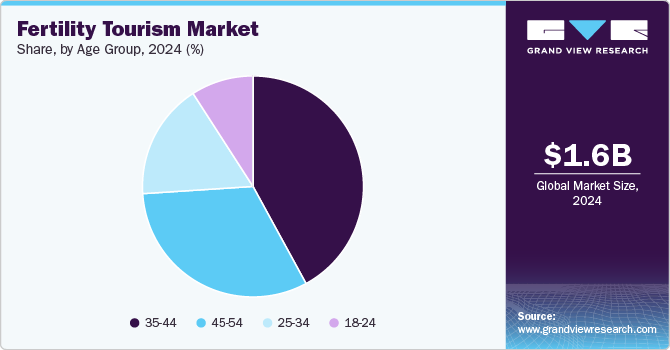

- Based on age group, the 35-44 age group segment led the market with the largest revenue share of 42.05% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.57 Billion

- 2030 Projected Market Size: USD 6.18 Billion

- CAGR (2025-2030): 25.11%

- Turkey: Largest market in 2024

In addition, advancements in assisted reproductive technologies coupled with cost savings and additional benefits to visitors such as improved healthcare, advanced devices, superior hospitality, and individualized care are propelling the market growth. Rising repro tourism and the increasing cases of male and female infertility are the key factors driving the market growth. Infertility is one of the major health concerns faced by individuals globally. As per the World Health Organization (WHO) report published in April 2023, 1 in 6 people globally are affected by infertility. This statistic highlights the prevalence of various demographics and regions, indicating that it is not only a personal or localized issue but rather a widespread public health issue. Moreover, as per the same source, 8%-10% of couples globally suffer from infertility, which is around 80 million couples globally.

According to the American Pregnancy Association, male infertility accounts for 30% of total cases and contributes to around one-fifth of infertility cases. The average age of women and men getting married and having their first child is increasing. This trend has surged the number of women seeking treatment abroad.

"Millions of people face catastrophic healthcare costs after seeking treatment for infertility, making this a major equity issue and, all too often, a medical poverty trap for those affected.”

-Dr Pascale Allotey, Director of Sexual and Reproductive Health and Research at WHO

The rising number and high success rates of IVF procedures are fueling market growth. Countries such as Spain, UK, Czech Republic, Turkey, and India have emerged as major destinations for IVF treatment. For instance, as per the Human Fertilization & Embryology Authority study published in July 2024, in the UK, a total of 52,500 patients underwent almost 77,000 fresh and frozen embryo transfer IVF cycles at licensed clinics in 2022. This indicates a robust engagement with assisted reproductive technologies among couples seeking to achieve. Notably, over 90% of these patients were treated alongside a partner, suggesting that IVF is often a collaborative effort between partners, which brings the total number of individuals involved in these cycles to approximately 100,000 people. Moreover, high IVF success rates are increasing preference for these countries in the international market. For instance, according to The National Association for Fertility Problems, Spain is a country where tourists prefer to have authentic procedures performed most frequently, accounting for almost 40% of fertility tourism in Europe.

In addition, rising government and private investment in new clinics and centers contribute to market expansion. For instance, in May 2023, a new satellite IVF center was launched in Vashi, Navi Mumbai, Maharashtra. This initiative aims to provide couples in the region with enhanced access to advanced treatment options. The establishment of this center is part of a broader trend in India towards improving reproductive health services and addressing the growing demand for effective treatments. Similarly, in April 2022, Seeds of Innocence launched a new facility in Lucknow, India. This facility aims to provide comprehensive services related to infertility treatment, including IVF, genetic testing, and fetal medicine. The establishment of this center is part of an ongoing effort to enhance the accessibility and quality of reproductive healthcare in the region.

The increasing awareness campaigns aim to educate people about Assisted Reproductive Techniques (ART) and to eliminate myths that lead to stigma by providing accurate information to empower individuals and couples facing sterility challenges. For instance, in July 2024, Oasis Fertility launched a campaign to address and break the stigma surrounding IVF. This campaign is significant in a society where misunderstandings and cultural taboos often prevent individuals from seeking fertility treatment. The initiative aims to inform the public about IVF, its processes, and its benefits to create a more supportive environment for those considering or undergoing treatments.

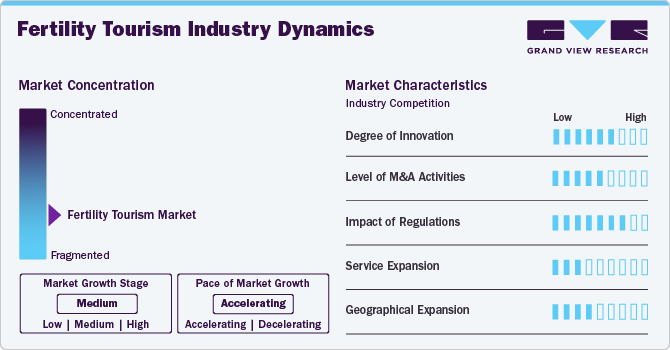

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including the degree of innovation, industry competition, service substitutes, and impact of regulations, level of partnerships & collaboration activities, and geographic expansion. For instance, the market is fragmented, with many small players entering the market and launching innovative treatments. The degree of innovation is medium, the level of partnerships & collaboration activities is medium, the impact of regulations on the market is high, and the regional expansion of the market is low.

The market is experiencing significant growth driven by various innovations and advancements in reproductive technologies. As couples increasingly seek fertility treatments abroad, several factors contribute to the market's expansion, including technological advancements, regulatory changes, and shifting societal attitudes toward infertility. The development of sophisticated ART methods, such as IVF, has improved success rates significantly. For instance, the success rate for IVF procedures is currently around 30-35%, which is a notable increase due to better embryo selection techniques and enhanced culture media. In addition, technologies such as Preimplantation Genetic Testing (PGT) and automation in embryo selection are also enhancing the efficacy of treatments, making them more appealing to prospective parents

The market saw notable expansion as larger operators sought to increase their reach and capabilities. For instance, in August 2024, Birla Fertility announced its acquisition of the in vitro fertilization chain BabyScience. This strategic move is part of Birla Fertility's ambitious plan to expand its presence in the reproductive health market by establishing a network of 100 clinics by the fiscal year 2028.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Each country has its regulatory framework that governs healthcare practices, patient safety standards, and the accreditation of medical facilities. For instance, in the U.S., the Joint Commission International (JCI) accredits hospitals that meet international healthcare quality standards. In addition, countries such as Turkey and Thailand have adopted more relaxed regulations to promote their medical tourism sectors. Turkey’s government actively supports health tourism through incentives for hospitals that cater to foreign patients. This approach is expected to lead to rapid growth in medical tourism but raises concerns about maintaining consistent quality across facilities.

The geographical expansion of the market is significantly influenced by various factors, including the rising incidence of infertility, advancements in ART, and the increasing acceptance of medical tourism. Companies are entering into strategic moves with the aim of expanding their recognition and market reach. For instance, in August 2024, Birla Fertility & IVF announced its plans to expand its operations significantly in the southern and western regions of India by the fiscal year 2025. This strategic move is part of their broader goal to enhance accessibility to fertility treatments across the country. The company aims to establish new centers in key cities, which is likely to allow them to cater to a larger demographic seeking assisted reproductive technologies.

Treatment Insights

Based on treatment, the IVF with own eggs segment led the market with the largest revenue share of 50.94% in 2024. The preference for using one’s own eggs in fertility treatments is largely due to the increasing success rates associated with this method. Many individuals and couples are opting for this approach, as studies show that utilizing a woman’s own eggs significantly enhances the chances of achieving a successful pregnancy, especially for women aged over 35. According to an update from Babies & Us Fertility IVF & ICSI Center published in May 2024, it is indeed possible for women aged 42 and 49 to undergo IVF treatment using their own eggs. Advances in reproductive medicine have made it feasible for women over 40 to consider this option as a realistic possibility. Moreover, using one’s own eggs allows for a more tailored approach to fertility treatment, enabling women to participate actively in the selection of embryos based on their genetic material.

The donor egg treatment segment is expected to grow at the fastest CAGR over the forecast period. Its growth is attributed to the offering of feasible solution for older women or those with diminished ovarian reserve who wish to have biological children. Moreover, the primary advantage of using donor eggs is the significantly higher success rates associated with IVF cycles compared to traditional methods using the recipient’s own eggs. As per Sunflower Infertility & IVF Center updates published in August 2024, donor egg IVF can yield success rates exceeding 50% per cycle, which is substantially higher than the average success rates for women over 35 years old using their own eggs, which can drop below 20%. This increased likelihood of achieving a successful pregnancy is largely because donor eggs are typically sourced from younger women who have been screened for genetic and health issues, thus enhancing embryo quality.

Age Group Insights

Based on age group, the 35-44 age group segment led the market with the largest revenue share of 42.05% in 2024. The high incidence of infertility in this age group is a key factor in the growth of the segment. This demographic often experiences a combination of biological and socio-economic factors that influence their reproductive choices. Biologically, women in this age range are typically more aware of their declining fertility potential, which can prompt them to seek ART sooner rather than later. According to data updated by the Centers for Disease Control (CDC) in April 2023, women’s fertility experiences a gradual decline as they age. Specifically, women who are 35 years old or older often seek treatment for infertility issues, with their chances of achieving pregnancy falling between 54% and 56%. Moreover, this age group is also more likely to be informed about global healthcare options through digital platforms and social media, making them more inclined to explore international clinics that specialize in fertility treatments.

The 45-54 age group segment is expected to grow at the fastest CAGR over the forecast period. Its growth is attributed to the high spending capacity and world-class treatment facilities in developed countries. Moreover, the stigma surrounding older parents has diminished over time, with increasing acceptance of late parenthood. This cultural shift encourages individuals aged 45-54 to explore their options for having children through assisted reproductive technologies. The globalization of healthcare has also played a crucial role; many countries offer competitive pricing and high-quality medical services that attract international patients seeking fertility treatments. Furthermore, individuals in the 45-54 age group often possess greater financial stability compared to their younger counterparts, enabling them to invest in fertility treatments abroad where costs may be lower or where they can access advanced medical facilities that may not be available in their home countries.

Country Insights

Turkey Fertility Tourism Market Trends

The fertility tourism market in Turkey held a significant revenue share of in 2024, due to the availability of world-class in vitro fertilization treatment services offered at competitive prices and the establishment of advanced fertility clinics that adhere to international standards. For instance, many Turkish clinics are accredited by organizations such as the Joint Commission International (JCI), ensuring high-quality medical care and safety for patients. These clinics often offer a range of services, including in vitro fertilization (IVF), egg donation, and surrogacy, which are appealing to couples facing infertility challenges. Moreover, Turkey has implemented competitive pricing strategies that make fertility treatments more affordable compared to countries including the U.S. or Western Europe. According to World Fertility Services updates 2023, the cost of IVF cycles in Turkey ranges from USD 5,000 to USD 6,000 while still providing high success rates. This price typically includes basic procedures such as egg retrieval, fertilization, and embryo transfer. This affordability is coupled with attractive package deals that may include accommodation and transportation services for international patients, further enhancing Turkey’s appeal as a destination for fertility tourism.

Spain Fertility Tourism Market Trends

The Spain fertility tourism market is expected to grow at the fastest CAGR over the forecast period, due to the increasing number of patients from other European countries, rapid developments in fertility tourism, and the rising number of international fertility clinics. In recent years, Spain has emerged as a leader in the field of ART, particularly IVF. According to the Instituto Bernabeu, Spain performs 15% of all IVF treatments conducted in Europe, outpacing both France and Germany in this regard. Moreover, in Spain, there are over 165,000 IVF cycles performed annually, and babies conceived through reproductive medicine techniques now make up 12% of all births nationwide. This prominence can be attributed to several factors, including advanced medical technologies, a high level of expertise among fertility specialists, and favorable legal frameworks that support reproductive health.

The rise in IVF treatments directly correlates with the growth of medical tourism. Many couples from other countries and beyond are seeking fertility treatments abroad due to various reasons such as cost-effectiveness, shorter waiting times, and access to advanced reproductive technologies. Countries’ reputation for high-quality healthcare services attracts international patients who are looking for reliable and successful IVF options. The influx of international patients seeking IVF contributes significantly to the country’s economy. These patients not only pay for medical services but also spend on accommodation, food, transportation, and leisure activities during their stay. This creates a ripple effect that benefits local businesses and boosts overall economic activity in regions known for fertility clinics.

Key Fertility Tourism Company Insights

Some of the major companies in the market are Bea Fertility, Freya Biosciences, Overture Life, Levy Health, Gaia, Hertility, and others. The strategies of key players to strengthen their market presence include new launches, partnerships & collaborations, mergers & acquisitions, awareness campaigns, and geographical expansion. For instance, in July 2024, Indira IVF, one of India’s leading fertility service providers, launched a campaign titled #IVFkiPehel. This initiative aims to raise awareness about infertility and promote in vitro fertilization (IVF) as a viable option for couples facing challenges in conceiving. The campaign is particularly significant in a country where discussions around infertility are often stigmatized or considered taboo.

Key Fertility Tourism Companies:

he following are the leading companies in the fertility tourism market. These companies collectively hold the largest market share and dictate industry trends.

- San Diego Fertility Center

- IVF-Life

- Barcelona IVF

- Eva Fertility Clinics

- The Surrey Park Clinic

- Bumrungrad International Hospital

- Assisted Reproduction and Gynecology Centre

- Sincere IVF Center

- Alpha IVF & Women’s Specialists

- Genesis IVF

- Manchester Fertility Services Ltd

- Apollo Fertility

Recent Developments

-

In June 2024, Sabine Hospitals successfully raised USD 50 million in a recent funding round. This financial boost was primarily led by CX Partners, a prominent investment firm known for its focus on healthcare and technology sectors. The infusion of capital is expected to enhance the hospital’s capabilities, expand its services, and improve patient care.

-

In March 2024, TMRW Life Sciences (TMRW), a company focused on advancing fertility technology and improving IVF laboratory standards, launched CryoLink. This workstation is designed to enhance the digital management of frozen specimen inventories in fertility clinics. With the introduction of CryoLink, users can operate TMRW’s Digital Specimen Management system either independently or alongside TMRW’s automated storage solutions.

-

In September 2023 , Sion Hospital, Mumbai, started offering free infertility treatment, including various diagnostic procedures, ART, and counseling services designed to support couples throughout their journey. The primary objective of this program is to make treatments more accessible, especially for those who may not have the financial means to afford such services. The initiative also seeks to raise awareness about reproductive health issues in the community.

-

In September 2023, Merck introduced a comprehensive Fertility Benefit program in to provide financial assistance for treatments to employees across eight markets: Germany, the UK, Switzerland, China, India, Taiwan, Brazil, and Mexico. Currently, Merck offers similar benefits to its workforce in the U.S., Canada, and Japan.

-

In August 2023 , the CK Birla Group’s Birla Fertility & IVF announced its plans to invest USD 59.4 million over the next 2-3 years to increase its market share within the domestic sector. Birla Fertility & IVF aims to expand its footprint in southern India by opening 10-12 new centers across Karnataka, Tamil Nadu, Kerala, Telangana, and Andhra Pradesh within the next 12-24 months.

Fertility Tourism Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.01 billion

Revenue forecast in 2030

USD 6.18 billion

Growth rate

CAGR of 25.11% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, age-group, country

Country scope

U.S.; UK; Spain; Czech Republic; Portugal; Thailand; Malaysia; India; South Korea; Turkey

San Diego Fertility Center; IVF-Life; Barcelona IVF; Eva Fertility Clinics; The Surrey Park Clinic; Bumrungrad International Hospital; Assisted Reproduction and Gynecology Centre; Sincere IVF Center; Alpha IVF & Women’s Specialists; Genesis IVF; Manchester Fertility Services Ltd; Apollo Fertility

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertility Tourism Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fertility tourism market report based on treatment, age group, and country.

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Donor Egg Treatment

-

IVF With Own Egg

-

Surrogacy

-

Donor Embryo

-

Sperm Donation

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18-24

-

25-34

-

35-44

-

45-54

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

UK

-

Spain

-

Czech Republic

-

Portugal

-

Thailand

-

Malaysia

-

India

-

South Korea

-

Turkey

-

Frequently Asked Questions About This Report

b. The fertility tourism market size was estimated at USD 1.57 billion in 2024 and is expected to reach USD 2.02 billion in 2025.

b. The fertility tourism market is expected to grow at a compound annual growth rate of 25.11% from 2025 to 2030 to reach USD 6.18 billion by 2030.

b. Turkey dominated the fertility tourism market with 2024. The availability of world-class IVF treatment services at a lower cost than in the U.S. and other European countries is responsible for the growth of the market in Turkey.

b. Some prominent players in the fertility tourism market include San Diego Fertility Center; IVF-Life; Barcelona IVF; Eva Fertility Clinics; The Surrey Park Clinic; Bumrungrad International Hospital; Assisted Reproduction and Gynecology Centre; Sincere IVF Center; Alpha IVF & Women’s Specialists; Genesis IVF; Manchester Fertility Services Ltd; Apollo Fertility

b. The market is expected to grow due to rising cases of infertility, an increasing trend of delayed pregnancy, and the rapid acceptance of fertility tourism. In addition, advancements in assisted reproductive technologies coupled with cost savings and additional benefits to visitors such as improved healthcare, advanced devices, superior hospitality, and individualized care are propelling the market growth.

b. The 35-44 segment dominated the market with a share of 42.05% in 2024. The high incidence of infertility in this age group is a key factor in the growth of the segment. The cost and anonymity of ART-assisted treatments are the main reasons for travel. Additionally, the availability of more donors offered by international clinics, as well as the success rates advertised contribute to the segment growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.