- Home

- »

- Medical Devices

- »

-

Fertility Services Market Size, Share & Growth Report, 2030GVR Report cover

![Fertility Services Market Size, Share & Trends Report]()

Fertility Services Market Size, Share & Trends Analysis Report By Type (Diagnosis, Treatment, Preservation), By Provider, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-305-0

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Fertility Services Market Size & Trends

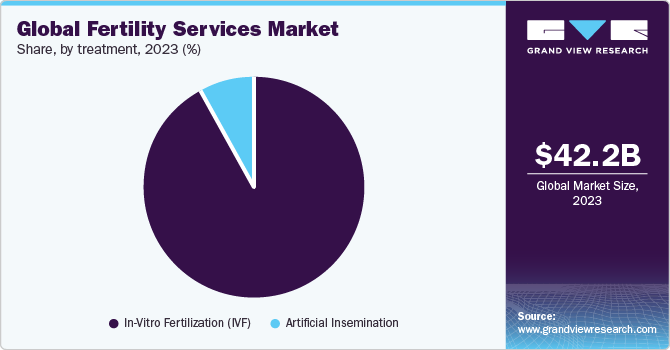

The global fertility services market size was estimated at USD 42.23 billion in 2023 and is projected to grow at a CAGR of 7.50% from 2024 to 2030. The increase in awareness regarding the use of IVF, the growing adoption of assisted reproductive technologies (ARTs), and rising infertility rates across the globe and are expected to drive the market growth in the coming years, and the availability of different types of treatments is likely to drive market growth during the forecast period.

The growing infertility rates globally are a significant driver behind the expansion of the market. Factors that are responsible for infertility includes lifestyle changes leading to obesity, stress, alcohol consumption, and various medical conditions such as polycystic ovarian syndrome (PCOS), endometrial tuberculosis, and sexually transmitted diseases (STDs). In addition, the decline in egg quality in older women due to delayed pregnancy is contributing to the rise in infertility rates.

According to the data published by WHO in April 2023, approximately 1 in 6 people globally experience infertility at some point in their lives. The prevalence of infertility is estimated to be around 17.8% in high-income countries and 16.5% in low- and middle-income countries. This data emphasizes the growing need for enhanced access to affordable and high-quality fertility care for those in need. Furthermore, infertility affects both men and women, with about 10% of women aged 15 to 44 in U.S. This is expected to boost demand for advanced fertility services during the forecast period.

Market Concentration & Characteristics

The market is highly fragmented, with the presence of many local and regional clinics. Furthermore, the degree of innovation is medium, and the level of M&A activities is high. The impact of regulations on the market is high, while geographic expansion is low. However, service expansion is moderate in the market.

The degree of innovations in the market is significant, driven by various factors like improvements in ART procedures, such as in vitro fertilization (IVF) and intracytoplasmic sperm injection (ICSI), which are expanding treatment options and enhancing success rates, driving demand for fertility services. Furthermore, there is a growing trend towards individualized care plans tailored to individual patient needs, and medical history, incorporating factors such as age, and genetic predispositions to optimize treatment.

The level of merger and acquisition activity in the market has seen a significant increase in recent years. Private equity-backed companies deploy capital to open new clinics and make selective acquisitions to gain market share during high growth years. In addition, international operators are entering new marketplaces through acquisitions. Several overseas players have established a presence in the UK by acquiring local clinics, such as FutureLife, IVF Life, and IVI.

The impact of regulations on the market is significant, with various factors influencing access to care and the practice of in vitro fertilization (IVF). State infertility insurance mandates are crucial in enhancing the accessibility of fertility treatments, yet they have limitations. These mandates vary widely among states, leading to disparities in coverage eligibility, services covered, and patient populations excluded. On a global scale, WHO emphasizes the importance of addressing challenges in infertility care, highlighting the need for policies that recognize infertility as a disease and promote prevention strategies to reduce the need for costly treatments.

Companies are focusing on developing advanced services such as the use of artificial intelligence, preimplantation genetic testing for blockchain-based fertility service apps, DNA fragmentation index (DFI), aneuploidy screening (PGT-A), and IoT (Internet of Things) in in-vitro fertilization services, are driving market growth. For instance, Alife, a US-based start-up, launched AI technology in October 2022 to advance IVF treatment outcomes and reduce costs, integrating artificial intelligence into fertility services.

The market is experiencing significant growth globally, with key regions showing promising expansion opportunities. Several companies are expanding their presence in different regions. For instance, in December 2022, Care Fertility Group, a leading IVF group in the UK, has partnered with Reach Fertility in the US and IVF-Life in Spain, facilitated by private equity investor Nordic Capital. These partnerships aim to leverage Care Fertility's expertise, innovation, and patient care across international markets, responding to the increasing demand for fertility treatments globally.

Type Insights

Based on type, the treatment segment held market with the largest revenue share of 65.33% in 2023. The treatment segment is further bifurcated into In-vitro fertilization (IVF) and artificial insemination. In 2023, IVF treatment dominated the market, owing to the increasing reproductive tourism and increasing cases of male & female infertility, leading to the growth of the segment. In addition, the incorporation of artificial intelligence in IVF processes, such as AI technology to advance IVF treatment outcomes and lower costs, is expected to drive the segment growth.

The preservation segment is expected to witness at a lucrative CAGR during the forecast period. The preservation segment is further bifurcated into egg & embryo freezing and sperm banking. Rising awareness and growing innovations in cryopreservation techniques, increasing demand from cancer patients, and the emergence of fertility tourism are the key factors driving the market growth. Furthermore, the increase in the risk of miscarriages is also a significant factor boosting the demand.

The market is experiencing significant growth, due to the increasing acceptance of same-sex marriage and single-parent in numerous societies. The rising acceptance of the Gay, Lesbian, Bisexual, and Transgender (LGBT) community is a key driver behind the surge in services such as IVF, sperm donation, surrogacy, and artificial insemination globally. Furthermore, the increase in demand for advanced services has led companies to implement various strategies, including launching new services, expanding facilities, and forming partnerships and collaborations, to enhance their presence and increase their market share. For instance, in June 2022, Perwyn, a European private equity firm, has acquired European Sperm Bank (ESB) from the Danish private equity firm Axcel.

Provider Insights

Based on provider, the fertility clinics segment led the market with the largest revenue share of 80.02% in 2023. This is attributed to growing demand of infertility treatments in developing countries due to safe and positive treatment outcomes. Comprehensive services offered at affordable prices by this specialty clinics such as preconception consultation, patient education, testing, and storage are gaining popularity in recent years. Established clinics are facing stiff competition from standalone clinics by leveraging competitive pricing strategies and improving pregnancy rates. With increasing competition among fertility clinics in each countries, regulatory bodies are taking measures to reduce cases of false advertising by the clinics. For example, the Human Fertilisation and Embryology Authority (HFEA) in the UK has set up a traffic light system for providing information on the state of additional services offered by the clinics.

The hospitals segment are expected to grow at a significant CAGR during the forecast period. Hospitals also offer reproductive health services as part of their broader range of medical services. These include prenatal care, obstetrics and gynecology services, and family planning. In addition, hospitals offer a comprehensive range of medical services to address various health needs. However, the scope of reproductive services in hospitals varies depending on the institution.

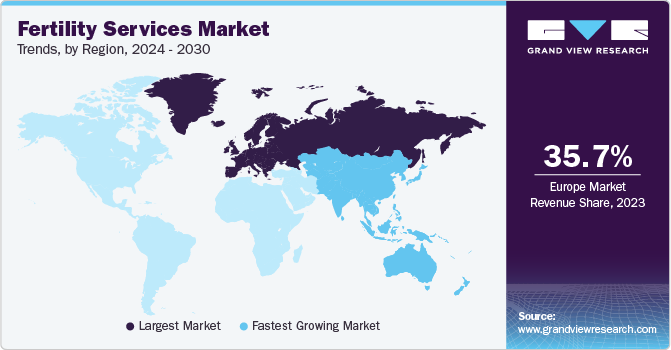

Regional Insights

The fertility services market in North America has a significant market share in 2023. North America is the second-largest region in the market, presenting abundant opportunities for key players due to factors like high population base, growth in awareness about fertility treatment, rise in popularity of IVF, increase in infertility rates, and delayed pregnancy trends. The region has also witnessed substantial investments and technological advancements in fertility services, contributing to market growth.

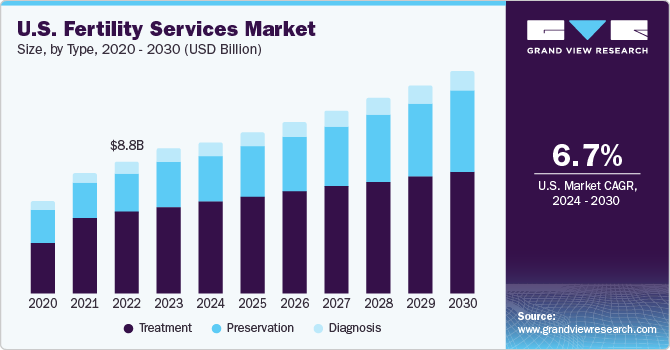

U.S. Fertility Services Market Trends

The fertility services market in U.S. held the largest share in 2023. According to the CDC's Fertility Clinic Success Rates Report in 2021, around 238,126 people had 413,776 ART cycles at 453 reporting clinics in U.S., resulting in 91,906 live births and 97,128 live birth infants. This is expected to drive the market growth during the forecast period.

Europe Fertility Services Market Trends

Europe dominated the fertility services market with a revenue share of 35.74% in 2023. Growth can be attributed to increasing infertility rates and supportive government initiatives. Furthermore, increasing success rates with IVF-ICSI in cases of poor sperm mobility and rising healthcare and research spending are the main factors driving the European market.

The fertility services market in Germany accounted for the largest market share in 2023, owing to the trend of delaying parenting due to financial stability and job goals. However, public health insurance in Germany covers only a restricted number of IVF cycles, with a low percentage of cycles refunded, highlighting the dependence on private funding and its impact on market dynamics.

The UK fertility services market is expected to witness at the fastest CAGR during the forecast period. The increase in the number of same-sex couples looking for parenthood through IVF treatment increases the market's growth. In addition, the commercialization of the three-parent IVF procedure in the UK has also contributed to growth of the fertility services in the country, providing further opportunities. In addition, supportive regulations in the UK, such as those by the Human Fertilization and Embryo Authority (HFEA), have further boosted the market growth.

Asia Pacific Fertility Services Market Trends

The fertility services market in Asia Pacific is experiencing significant growth and is expected to continue expanding. Most of the countries in the region have aging populations, with more women delaying pregnancy until later in life. As women age, fertility declines, increasing the need for assisted reproductive technologies. In addition, Asia Pacific is a popular destination for fertility tourism, with countries such India, Thailand and Malaysia offering affordable treatments and high-quality care. This is expected to drive the regional market.

The Japan fertility services market has dominated the Asia Pacific market in 2023 and is expected to grow at a substantial CAGR during the forecast period. The number of fertility clinics in Japan has been growing, making treatment more available and convenient for patients. This expansion is driven by increasing age of first-time mothers, rising awareness of infertility treatments, and advancements in assisted reproductive technology. Japan's fertility rate has been declining, reaching a record-tying low of 1.26 in 2022, marking the seventh consecutive year of decline. This rate is significantly lower than the global average of 2.4 reported by the World Bank. The number of newborns in Japan also reached a record low of 770,747 in 2022, down 40,875 from the previous year, with the first time the number of newborns fell below 800,000. This decrease in fertility rate is driving the demand for the fertility services in the region which is expected to further drive the market growth.

The fertility services market in India is expected to grow at the fastest CAGR during the forecast period. The market is primarily driven by rising infertility rates, developments in healthcare infrastructure, and reducing cultural and social stigmas surrounding infertility and ART. Further, India's competitive costs in IVF procedures attract international patients, contributing to the country's fertility tourism industry.

Latin America Fertility Services Market Trends

The fertility services market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. The growth is supported by increasing infertility rates, low-cost healthcare facilities, a large population facing infertility, and rising disposable income. In addition, the introduction of new and lenient laws allowing access to fertility services for single individuals and LGBTQ+ couples are expected to benefit the market.

The Brazil fertility services market is expected to grow at the substantial CAGR over the forecast period, due to increasing infertility rates and a higher number of clinics with advanced technologies. According to National Library of Medicine, the market in Brazil is dominated by private clinics, with 90.1% of services provided by the private sector. However, access to these services remains dependent on the financial resources of individuals, as public funding and insurance coverage are limited.

Middle East & Africa Fertility Services Market Trends

The fertility services market in Middle East & Africa is expected to witness at the fastest CAGR during the forecast period, due to rising healthcare expenditure, research activities, and advancements in healthcare technology, providing new opportunities for market expansion. Furthermore, advances in ART, increased public awareness of infertility treatments, and a rise in IVF clinics are all predicted to lead to the growth of fertility services.

The South Africa fertility services market is expected to grow at the fastest CAGR over the forecast period. According to the South African case study published by National Library of Medicine in 2021, Infertility is common in South Africa, with an estimated prevalence of 8-12.5% worldwide and up to 23% in sub-Saharan Africa. The projected demand for ART in the country is 76,500 cycles per year. However, only 6.4% of this need is currently met due to low access to ART services. Most services are provided in the private sector and at a few public university hospitals. Thus, while market in South Africa is growing, it remains small and inaccessible to many due to high costs and limited availability, especially in the public sector. Increasing access to affordable fertility services could help address unmet need.

Key Fertility Services Company Insights

The market is highly fragmented, with the presence of multiple local and regional players. The market is experiencing significant growth, with major companies like Vitrolife, Merck KGaA, Progyny Inc., Monash IVF Group, and Virtus Health leading the industry. These companies, along with others such as Olympus Corporation, The Cooper Companies Inc., and Instituto Bernabeu, play a crucial role in providing a wide range of services and technologies to address fertility challenges.

Key Fertility Services Companies:

The following are the leading companies in the fertility services market. These companies collectively hold the largest market share and dictate industry trends.

- PFCLA

- Mayo Foundation for Medical Education and Research (MFMER)

- Cleveland Clinic

- Apricity Fertility UK Limited

- King’s Fertility Limited

- Dallas IVF

- Midwest Fertility Specialists

- Europe IVF

- Care Fertility

- Aspire Fertility

- Virtus Health

- Monash IVF Group

Recent Developments

-

In June 2023, Quantum Health partnered with Progyny, Inc. to introduce Quantum Health’s Comprehensive Care Solutions platform for family building and fertility solutions

-

In April 2023, Cryoport, Inc. signed 3 years supply chain agreement with the Boston IVF to support the reproductive material shipment across the U.S.

Fertility Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 45.52 billion

Revenue forecast in 2030

USD 70.27 billion

Growth rate

CAGR of 7.50% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, provider, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PFCLA; Mayo Foundation for Medical Education and Research (MFMER); Cleveland Clinic; Apricity Fertility UK Limited; King’s Fertility Limited; Dallas IVF; Midwest Fertility Specialists; Europe IVF; Care Fertility; Aspire Fertility; Virtus Health; Monash IVF Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

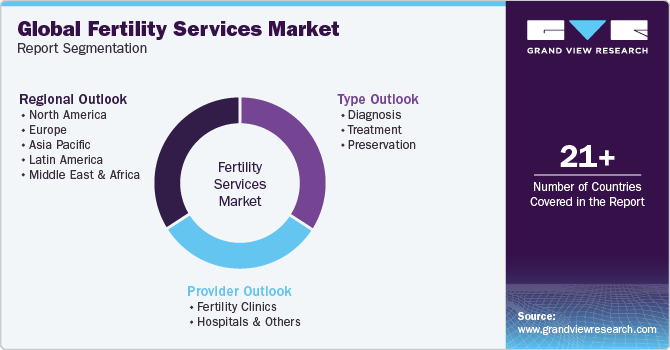

Global Fertility Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fertility services market report based on type, provider and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Male Infertility

-

DNA Fragmentation Technique

-

Oxidative Stress Analysis

-

Microscopic Examination

-

Sperm Agglutination

-

Computer Assisted Semen Analysis

-

Sperm Penetration Assay

- Others

-

-

Female Infertility

-

Ovarian reserve testing

-

Hysterosalpingography

-

Hormone testing

-

Other Tests

-

-

-

Treatment

-

In-Vitro Fertilization (IVF)

-

Artificial Insemination

-

-

Preservation

-

Egg & Embryo Freezing

-

Sperm Banking

-

-

-

Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Fertility Clinics

-

Hospitals and Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."