- Home

- »

- Renewable Chemicals

- »

-

Fermenters Market Size And Share, Industry Report, 2030GVR Report cover

![Fermenters Market Size, Share & Trends Report]()

Fermenters Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Healthcare, & Cosmetics), By Mode of Operation, By Microorganisms (Bacteria, Fungi), By Process, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-343-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fermenters Market Summary

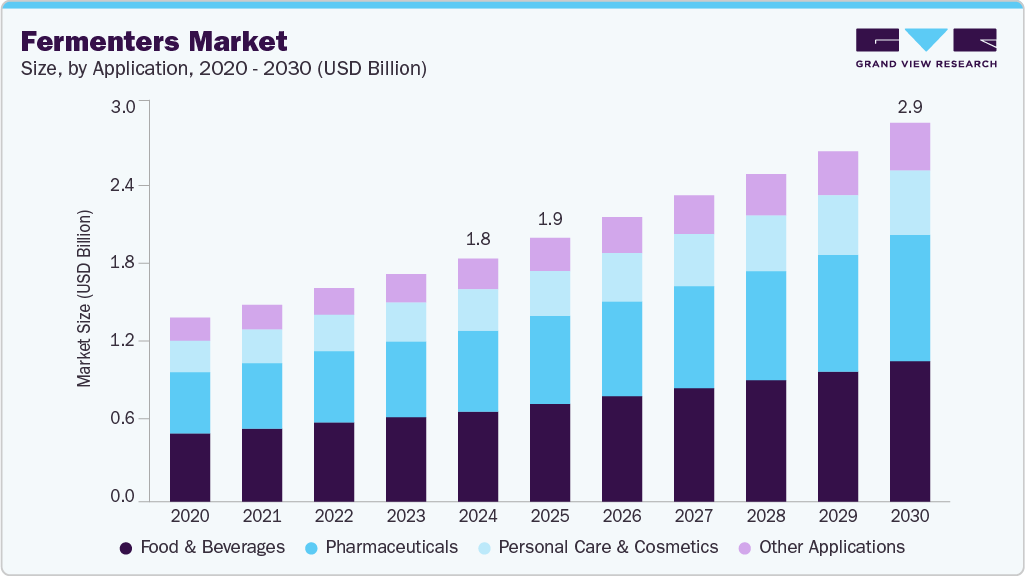

The global fermenters market size was estimated at USD 1.83 billion in 2024, and is projected to reach USD 2.97 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The rising prevalence of chronic diseases, such as cancer, cardiac disease, diabetes, and hypertension, has led to more focus on the development of innovative biological therapies.

Key Market Trends & Insights

- Europe dominated the market, is expected to grow with a significant rate during the forecast period.

- Germany contributed the highest revenue share within the regional market in 2024.

- By application, the food and beverage segment led the market with a significant revenue share in 2024.

- By mode of operation, automatic mode of operation segment dominated the market and accounted for a significant share in 2024.

- By microorganisms, the bacteria source segment dominated the market and accounted for a significant share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.83 Billion

- 2030 Projected Market Size: USD 2.97 Billion

- CAGR (2025-2030): 8.4%

- Europe: Largest market in 2024

Similarly, the demand for monoclonal antibodies and personalized medicines has increased bioproduction, accelerating the demand for fermenters. Furthermore, the rising usage of high-end technologies to simplify complex manufacturing is expected to boost the product demand during the forecast period. Besides, high investments in research and development activities by key biopharmaceutical companies are expected to drive industry growth. Fermenters are used for creating a proper environment for the growth of microorganisms or driving biochemically active substances derived from such organisms. They are basically utilized for the growth and maintenance of a population of bacterial or fungal cells in a controlled manner.

The expanding biopharmaceutical industry is a key growth driver for the fermenters market, as microbial fermentation is essential for producing vaccines, antibodies, and enzymes. According to the World Health Organization (WHO), biologics represent a significant portion of the pharmaceutical pipeline, indicating a growing reliance on fermentation processes in drug development. This rising demand has intensified the need for advanced fermentation systems that ensure scalability, sterility, and regulatory compliance.

Consistently growing investments in R&D for microbial fermentation processes have accelerated the adoption of fermenters in pharmaceuticals and industrial biotechnology. As industries prioritize efficiency, sustainability, and innovation, the fermenters industry is rapidly expanding globally. In addition, government-backed initiatives promoting domestic vaccine production are further accelerating fermenter adoption. These developments underscore the vital role of fermenters in meeting global healthcare challenges.

Innovation in fermenter technology, including the adoption of single-use systems and automation, enhances production efficiency and reduces contamination risks. The shift towards sustainable fermentation processes aligns with global environmental goals, encouraging the use of renewable feedstocks and waste valorization. Additionally, increasing investments in the developing regions of Asia Pacific, driven by expanding pharmaceutical and food industries, position the region as a key growth hub for fermenters. Such factors collectively shape the evolving dynamics of the fermenters market through 2030.

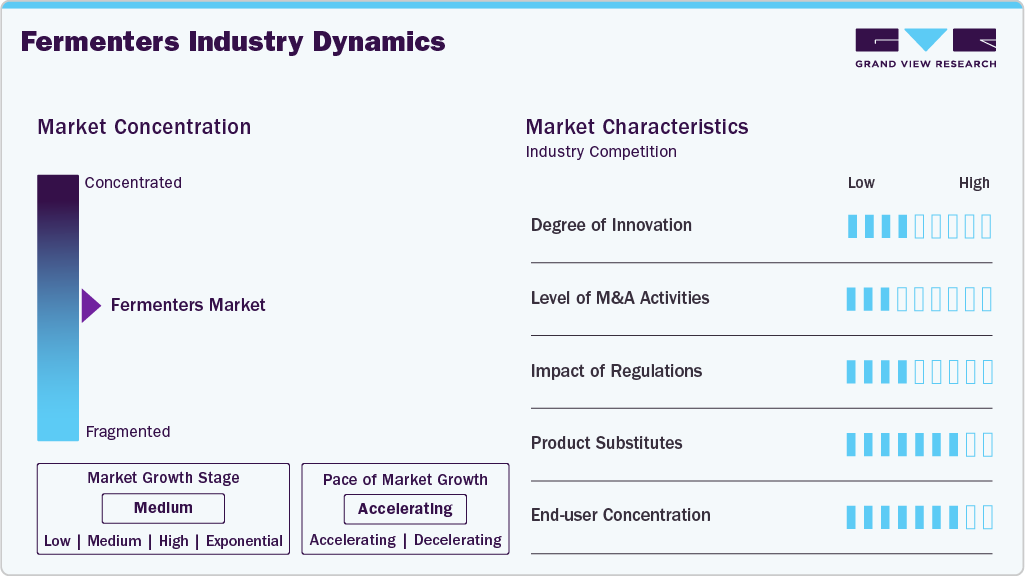

Market Concentration & Characteristics

The market can be characterized as moderately consolidated, with a mix of major players and smaller manufacturers. Several factors influence the competitive landscape, including the presence of key players, market share, and product offerings. Some key players in the global market are Eppendorf AG, Sartorius, Thermo Fisher Scientific, Pierre Guerin SAS, and Applikon Biotechnology BV, among others.

The global industry is competitive, with key players accounting for the majority of the market share in 2024. Companies are incorporating different strategies, including product innovation, new product launches, partnerships and collaborations, and mergers and acquisitions, to consolidate their industry presence. For instance, in June 2024, Danone, DMC Biotechnologies, Michelin, and Crédit Agricole Centre partnered together to create Biotech Open Platform in Clermont-Ferrand, France. The platform includes a demo-scale production line, including a fermenter and purification equipment, with the objective of scaling up and commercializing new products using transformative fermentation technology.

Application Insights

The food and beverage segment led the market with a significant revenue share in 2024, primarily due to the growing use of fermenters in brewing, winemaking, and baking processes. Fermenters play a key role in breweries converting wort into beer, while wineries use fermenters to ferment grape juice into wine. Additionally, they are extensively used in commercial baking to ferment dough, improving baked goods' flavor, texture, and leavening. Common fermentation agents include yeast and sourdough cultures.

The pharmaceutical application is expected to grow at the fastest CAGR of 8.0% during the forecast period. Fermenters are widely utilized in the pharmaceutical and personal care industries to produce therapeutic compounds, vaccines, and bioactive ingredients. In pharmaceutical industries, fermenters enable large-scale manufacturing of antibiotics such as penicillin and erythromycin, as well as vaccines for viral and bacterial diseases. With consistently growing demand for drugs worldwide.

Mode of Operation Insights

Automatic mode of operation dominated the market and accounted for a significant share in 2024. This segment's dominant share is primarily due to its superior efficiency, precise control, and ability to maintain consistency throughout the fermentation process. It ensures stable operating conditions, resulting in uniform product quality across batches. Additionally, it enables real-time monitoring and adjustment of key parameters such as pH, agitation, and nutrient supply, significantly enhancing productivity and minimizing production time.

A semi-automatic mode of operation for fermenters is utilized in various scenarios where a balance between control and automation is preferred. It allows operations to intervene and adjust manually when needed. Furthermore, it may be more cost-effective to implement and maintain compared to fully automatic systems, especially in smaller-scale operations having limited access to advanced automation technologies.

Microorganisms Insights

The bacteria source dominated the market and accounted for a significant share in 2024. This segment's substantial share is driven by its capability to carry out targeted metabolic functions and synthesize a wide range of compounds, including enzymes, organic acids, vitamins, antibiotics, and biofuels. These outputs serve critical roles across multiple industries, including pharmaceuticals, food and beverage, bioenergy, and agriculture.

Certain fungi, such as molds, are used in fermenting foods like cheese and soy sauce, contributing to flavor development and preservation. Their versatility, efficiency, and ability to thrive through various environmental conditions positively impact the market growth of fungi for fermenters. Fermentation is used to produce antibiotics and other pharmaceutical compounds. It also makes multiple fermented foods and beverages such as bread, cheese, soy sauce, sake, and tempeh.

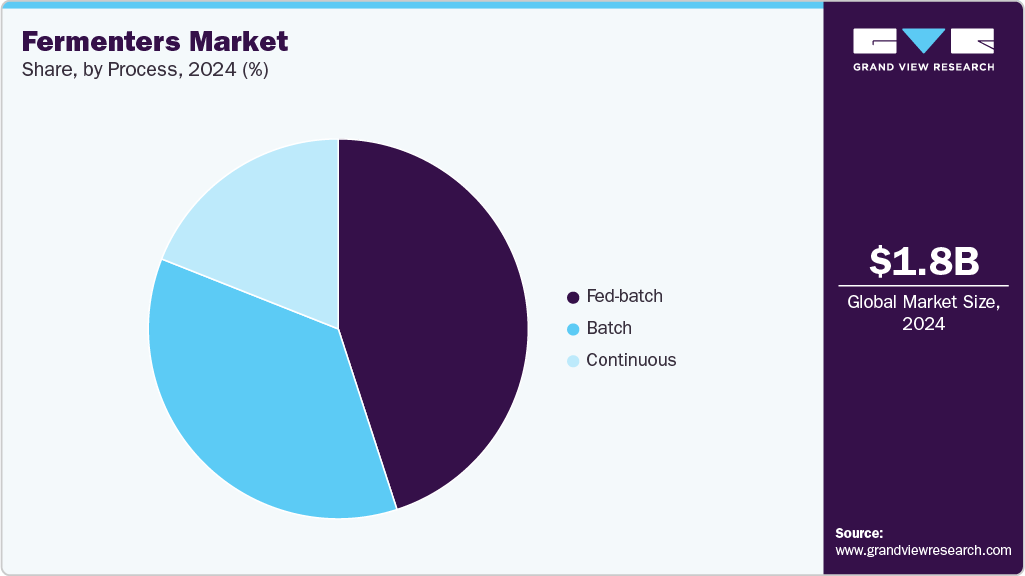

Process Insights

The fed-batch dominated the market and accounted for the largest share in 2024. This dominance is attributed to its enhanced control over nutrient supply and fermentation conditions, which helps maximize cell density and product yield. The fed-batch process is widely adopted in biopharmaceutical and industrial enzyme production due to its scalability and ability to reduce substrate inhibition. Its flexibility in adapting to different microbial systems further supports its broad application across various fermentation-based industries.

The continuous fermentation segment is expected to witness a robust CAGR over the forecast period. Its growth is driven by the ability to maintain steady-state conditions, allowing for uninterrupted production and higher volumetric productivity. This process is especially advantageous in large-scale operations where efficiency and cost-effectiveness are critical. Moreover, continuous systems are gaining traction in biofuel and biochemical manufacturing due to reduced downtime and lower operational costs than traditional batch processes.

Regional Insights

The fermenters market recorded strong demand across North America in 2024, driven by rising biopharmaceutical production and growing investments in sustainable manufacturing. The region’s robust healthcare infrastructure and increasing focus on personalized medicine have supported the adoption of advanced fermentation technologies. In addition, government funding for domestic vaccine and biologics production has further accelerated market expansion. Besides, the encouragement from the food and beverage sector for clean-label and functional ingredients continues to boost fermenter utilization. These factors collectively position North America as a critical contributor to regional market growth.

U.S. Fermenters Market Trends

The Fermenters market in the U.S. accounted for the largest share in the regional market. This growth is driven by significant investments in biopharmaceutical research and the increasing demand for biologic drugs. For instance, in May 2024, Lonza expanded its microbial capabilities in Visp with a new facility housing two 4,000L fermenters in the upstream suite and two separate downstream suites. This investment includes a state-of-the-art process development lab and a new 70L pilot lab, aimed at modernizing microbial manufacturing capabilities. Such advancements underscore the nation's commitment to enhancing fermentation technologies, positioning the U.S. as a pivotal player in the global fermenters market.

Europe Fermenters Market Trends

Europe dominated the market, is expected to grow with a significant rate during the forecast period. This strong position is driven by ongoing technological innovations in fermenter design and increasing advancements within the food and beverage sector, including the emergence of cultured and plant-based meat products. Additionally, growing consumer demand for fermented beverages, such as beer and kombucha, is further fueling market growth. These factors collectively support the sustained expansion of the fermenters market in the region over the forecast period.

Germany contributed the highest revenue share within the regional market in 2024. The country's strong industrial base, particularly in biopharmaceutical manufacturing and food and beverage production, has driven significant demand for advanced fermenters. Germany's focus on innovation, stringent quality standards, and investments in sustainable fermentation technologies have further strengthened its market position. Additionally, growing consumer interest in fermented foods and beverages continues to propel fermenter adoption nationwide.

Asia Pacific Fermenters Market Trends

Asia Pacific is expected to grow with a significant growth rate over the forecast period. Growing investments in biotechnology and increasing demand for fermented products such as traditional fermented foods, beverages, and biofuels are key growth factors. Additionally, government initiatives promoting domestic vaccine production and sustainable manufacturing practices are accelerating market adoption across countries like China, India, and Japan. These dynamics position Asia Pacific as a crucial region for the fermenters market growth over the forecast period.

China held a significant share in the Asia Pacific fermenters market in 2024, driven by its expanding biopharmaceutical industry and growing food and beverage sector. The country’s government support for biotechnology innovation, including investments in vaccine production and bio-manufacturing infrastructure, is fueling demand for advanced fermenters. Additionally, rising consumer interest in fermented foods and beverages and increased exports of fermented products are further boosting market growth. China’s strategic focus on sustainable and high-efficiency fermentation processes positions it as a key growth market in the region.

Key Fermenters Company Insights

The fermenters market remains highly fragmented, characterized by continuous innovation and expansion driven by sustainability goals, advanced materials, and enhanced process efficiencies. Industry leaders are focusing on developing technologically advanced fermenters that optimize production cycles, reduce energy consumption, and meet stringent regulatory standards.

-

Eppendorf AG is at the forefront of innovation with its focus on scalable bioprocessing solutions, including automated single-use fermenters that improve operational efficiency and reduce contamination risks. The company emphasizes sustainability by integrating energy-efficient components and promoting circular economy principles within its product lines.

-

Sartorius AG has made significant strides in expanding its portfolio of bioreactors and fermenters, particularly through recent acquisitions that enhanced its capabilities in single-use technologies and process analytics. Sartorius’s commitment to delivering flexible, customizable systems supports the growing demand across the pharmaceutical, biotech, and food industries, reinforcing its leadership in sustainable and high-performance fermentation solutions.

Key Fermenters Companies:

The following are the leading companies in the fermenters market. These companies collectively hold the largest market share and dictate industry trends.

- Eppendorf AG

- Sartorius AG

- Pierre Guerin SAS

- Applikon Biotechnology BV.

- GEA Group

- Cercell APS

- ElectroLab Biotech Ltd.

- Zeta Holding GmbH

- Thermo Fisher Scientific Inc.

- New Brunswick Scientific Co., Inc.

Recent Developments

-

In May 2025, GEA showcased its latest innovations at IFFA 2025 in Frankfurt, Germany. The company presented state-of-the-art technologies in food processing, slicing, and packaging, emphasizing efficiency and sustainability in food production.

-

In September 2024, GEA celebrated its 150th anniversary in Kitzingen, Germany, highlighting its long-standing legacy in brewing innovations. The company unveiled a new brewhouse kettle, which will be part of the world’s first CO₂-neutral large-scale brewery, symbolizing GEA’s commitment to sustainability and innovation in the brewing industry.

-

In August 2023, Sartorius announced a collaboration with Emerson to integrate its Biostat STR Generation 3 bioreactor with Emerson’s DeltaV distributed control system. This integration aims to simplify automation in biopharmaceutical manufacturing, enhancing scalability and reducing complexity.

Fermenters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.98 billion

Revenue forecast in 2030

USD 2.97 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, Company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, mode of operation, process, microorganisms, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Eppendorf AG; Sartorius, Pierre Guerin SAS; Applikon Biotechnology BV.; GEA Group; Cercell APS; ElectroLab Biotech Ltd.; Zeta Holding GmbH; Thermo Fisher Scientific Inc.; New Brunswick Scientific Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fermenters Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global fermenters market report based on mode of operation, process, microorganisms, application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Other Applications

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-automatic

-

Automatic

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Batch

-

Fed-batch

-

Continuous

-

-

Microorganisms Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacteria

-

Fungi

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global fermenters market size was estimated at USD 1.69 billion in 2023 and is expected to reach USD 1.83 billion in 2024.

b. The global fermenters market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 2.96 billion by 2030.

b. Europe dominated the fermenters market, with a share of 36% in 2024. This is attributable to the new technological innovations in fermenter design, coupled with rising advancements in the food & beverage industry, such as the advent of cultural and plant based meat

b. Some key players operating in the fermenters market include Eppendorf AG, Sartorius, Thermo Fisher Scientific, Pierre Guerin SAS, and Applikon Biotechnology BV among others.

b. Key factors driving market growth include the rapidly growing fermented beverage industry, which is owing to the growing popularity of a variety of beers and wines in emerging economies worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.