- Home

- »

- Medical Devices

- »

-

Female Infertility Diagnosis Market Size & Share Report 2030GVR Report cover

![Female Infertility Diagnosis Market Size, Share & Trends Report]()

Female Infertility Diagnosis Market Size, Share & Trends Analysis Report By Test (Ovarian Reserve Testing, Hormone Testing, Hysterosalpingography, Other Tests), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-369-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Female Infertility Diagnosis Market Trends

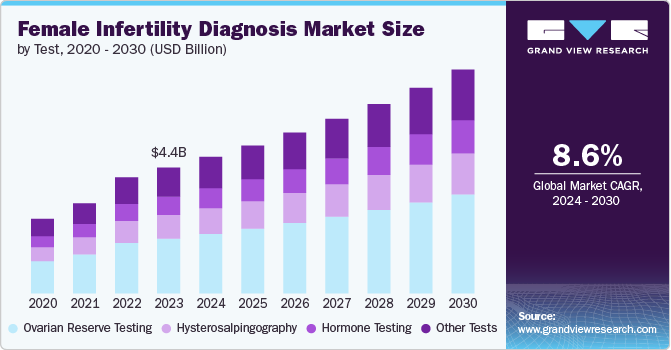

The global female infertility diagnosis market size was estimated at USD 4.45 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The market’s growth is driven by the growing changes in lifestyle, which contribute to the rise in infertility and the prevalence of conditions such as polycystic ovary syndrome (PCOS). According to a World Health Organization (WHO) report published in June 2023, PCOS affects approximately 8-13% of women of reproductive age, with up to 70% of those affected going undiagnosed globally.

Additionally, a constant increase in the incidence of infertility in both sexes is projected to drive the market.For instance, according to a study published in Journal of Korean Medical Science, in June 2022, South Korea has experienced the most significant decline in fertility rates among all OECD countries in the last three decades. The Korean government has acknowledged the importance of promoting healthy pregnancies and childbirth considering this trend and has introduced policies aimed at addressing the low fertility rate and supporting advanced maternal age pregnancies through initiatives such as ‘The Fourth Basic Plan on Low Fertility and Aging Society’ launched in 2021. Consequently, the low fertility rate is expected to drive up the demand for infertility diagnosis and assisted reproductive technologies, leading to an expansion in the market growth.

The lifestyle habits play a significant role in influencing fertility in both men and women. Factors such as smoking, excessive alcohol consumption, poor diet, and sedentary habits can have detrimental effects on reproductive health. In addition, these lifestyle habits can impact fertility through various mechanisms, including hormonal imbalances, oxidative stress, inflammation, and impaired reproductive function. According to WHO, prevalence of infertility is 16.5% in low & middle income countries and 17.8% in high income countries.

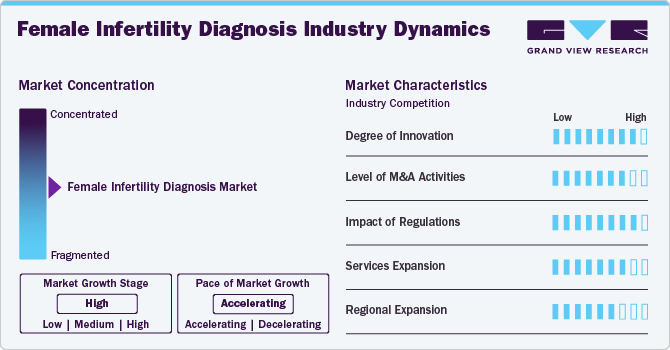

Market Concentration & Characteristics

The market is highly fragmented, with the presence of many local and regional clinics. Furthermore, the degree of innovation is medium, and the level of M&A activities is high. The impact of regulations on the market is high, while geographic expansion is low. However, service expansion is moderate in the market.

The female infertility diagnosis industry exhibits a high degree of innovation, such as cutting-edge technology to streamline and speed up diagnosing infertility. By utilizing advanced algorithms and data analysis, the platform can quickly assess various factors contributing to infertility and provide healthcare professionals with comprehensive insights in a matter of days. For instance, in January 2023, Enhanced Fertility introduced a groundbreaking digital platform aimed at revolutionizing the diagnosis of infertility. This innovative platform significantly reduces the time required for diagnosing infertility from years to just a few days. The introduction of this digital solution marks a significant advancement in the field of fertility healthcare, offering hope and efficiency to individuals struggling with infertility issues.

Regulations in the female infertility diagnosis industry significantly influence product development, market entry, and consumer trust. For instance, the Human Fertilization and Embryology Authority (HFEA) in the UK is responsible for regulating fertility treatments and research involving human embryos. In 2023, the HFEA conducted a public consultation on law reform to modernize regulations in this field. The consultation aimed to gather feedback from stakeholders, experts, and the public on proposed changes to the existing laws governing fertility treatments and research involving human embryos.

Mergers and acquisitions in the female infertility diagnosis industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in July 2023, BPEA EQT acquired a majority stake in Indira IVF, which is India’s largest chain of fertility clinics. This acquisition marks a significant move in the healthcare sector, particularly in the field of assisted reproductive technology.This agreement is expected to bring synergies between Indira IVF’s domain expertise and BPEA EQT’s financial backing and strategic guidance.

Female infertility diagnosis is leveraging technology to enhance the overall patient care services. In June 2022, Maven Clinic added Cleveland Clinic to its Fertility Clinic Network, providing families with access to top-tier virtual and in-person fertility care services. This partnership aims to offer patients a comprehensive range of fertility treatments and support, combining Maven’s innovative virtual care platform with Cleveland Clinic’s renowned expertise in reproductive medicine. The collaboration between Maven Clinic and Cleveland Clinic represents a significant advancement in expanding access to high-quality fertility care for individuals and families seeking assistance with their reproductive health journey.

The companies are leveraging their combined expertise, resources, and technologies to improve patient outcomes further and advance the field of reproductive medicine. For instance, in August 2023, Reproductive Medicine Associates (RMA) recently announced the addition of Conceptions Reproductive Associates of Colorado to its network of fertility clinics. This merger marks a significant development in the field of reproductive medicine, bringing together two prominent organizations to enhance their services and expand their reach.

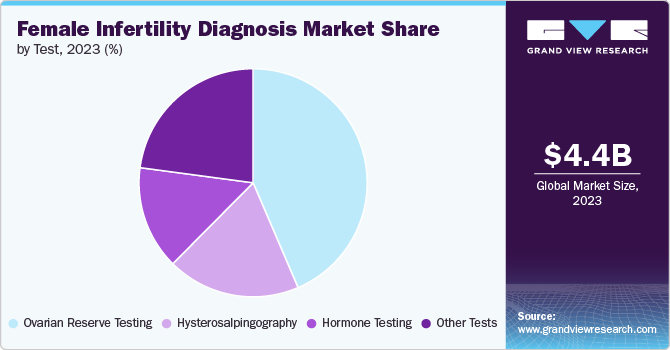

Test Insights

The ovarian reserve testing segment accounted for the largest market share of 43.6% in 2023 and is anticipated to grow at fastest growth rate over the forecast period. This dominance is driven by the increasing women reproductive health issues. Ovarian reserve testing plays a crucial role in assessing a woman’s fertility potential by evaluating the quantity and quality of her remaining eggs. This type of testing is particularly important for women who are considering delaying childbearing, those with a family history of early menopause, or individuals undergoing treatments like chemotherapy that may impact ovarian function.

Moreover, ovarian reserve testing is crucial in the realm of assisted reproductive technologies (ART), such as in vitro fertilization (IVF). Understanding a woman’s ovarian reserve aids in customizing treatment plans and predicting responses to stimulation. By assessing markers like anti-Müllerian hormone (AMH) levels, antral follicle count (AFC), and follicle-stimulating hormone (FSH) levels, healthcare providers can provide tailored advice, empowering women to make well-informed choices about their reproductive paths.

Regional Insights

North America female infertility diagnosis market is expected to grow at hold a significant share in 2023. The market is expected to expand significantly in North America due to due to the rising infertility rate and the need for external support in the region. The declining fertility rate in Canada has significantly contributed to the growth of the market in the region. For instance, according to the data from Statistics Canada published in September 2022, shows a substantial decrease in the fertility rate over the past five years. In 2021, the fertility rate in Canada was recorded at 1.43 children per woman, well below the replacement level of 2.1 children per woman.

Moreover, the increasing awareness programs in the region are further propelling the market growth. For instance, in June 2022, Organon Canada, a subsidiary of Organon, a global women’s healthcare company, emphasized the significance of access to reproductive healthcare by empowering aspiring parents during World Infertility Awareness Month. The company’s goal is to recognize and shed light on the obstacles to fertility while working towards breaking down these barriers.

U.S. Female Infertility Diagnosis Market Trends

The U.S. female infertility diagnosis marketheld a significant in 2023.The market growth is driven by increasing infertility rates in the country. For instance, as per the data published by CDC in May 2024, it is projected that in the U.S., approximately 19% of heterosexual women aged 15 to 49 years with no prior births are unable to conceive after one year of trying, while around 26% experience challenges in getting pregnant or maintaining a pregnancy. This suggests that the market for fertility treatments and services is poised for continued growth.

Moreover, the growing expansion by the companies with the aim to offer enhanced fertility solutions to a broader audience is boosting the market growth in the U.S. For instance, in September 2022, Oma Fertility initiated its national expansion in the U.S. by acquiring New York Reproductive Wellness. This strategic move marks a significant step for Oma Fertility as it aims to broaden its reach and services in the field of reproductive health and fertility treatments.This acquisition signifies a consolidation within the fertility industry, allowing Oma Fertility to strengthen its presence in key markets and enhance its offerings to a wider patient base.

Europe Female Infertility Diagnosis Market Trends

Female infertility diagnosis market in Europeheld the largest share of 35.9% due to increasing demand for infertility diagnosis and treatment. According to a report by the European Society of Human Reproduction and Embryology (ESHRE) published in July 2024, it was revealed that women in Europe are now receiving more cycles of in vitro fertilization (IVF) treatment compared to previous years. This increase in the number of IVF cycles suggests a growing trend toward utilizing assisted reproductive technologies to overcome infertility issues.

Female infertility diagnosis market in the UK is experiencing notable growth, driven by the increase in fertility issues is lifestyle choices. Factors such as smoking, excessive alcohol consumption, poor diet, lack of exercise, and high levels of stress can all impact fertility negatively. These lifestyle habits can affect both male and female fertility by disrupting hormone levels, sperm quality, ovulation, and overall reproductive health.

France female infertility diagnosis market is evolving due to the rising infertility rates and raising concerns about the country’s demographic future. In January 2024, France announced plans to introduce fertility tests for young people as part of a broader effort to address declining birth rates in the country. The initiative aims to tackle rising infertility rates among French couples, which have been attributed to various factors such as lifestyle changes, environmental influences, and delayed childbearing.

Asia Pacific Female Infertility Diagnosis Market Trends

Female infertility diagnosis market in Asia Pacific is experiencing significant growth driven by increasing healthcare awareness and group initiatives. The expert group meeting on population ageing and low fertility held in July 2023 aimed to address the implications of these demographic trends for sustainable development. The meeting brought together experts, policymakers, and stakeholders to discuss the challenges and opportunities associated with population ageing and declining fertility rates. The meeting highlightedthe aging population in the Asia-Pacific region is a significant demographic trend that has far-reaching implications for societies, economies, and healthcare systems.

Japanfemale infertility diagnosis market is poised for rapid growth, driven by the increasing demand for fertility detection and treatments due to various factors such as delayed marriages, career pressures, and declining birth rates. This trend has led to the emergence of fertility start-ups that are stepping in to address the increasing need for reproductive assistance.

Female infertility diagnosis market in India, is gaining traction for healthcare monitoring due to the increasing infertility issues in the country. In 2022, around 27.5 million men and women suffered from infertility. Around 40% - 50% of cases were caused due to abnormalities in the female reproductive system.

Latin America Female Infertility Diagnosis Trends

Female infertility diagnosis market in Latin America is fueled by accelerating decline in fertility rates across Latin America. As fertility rates decrease, more women are facing challenges in conceiving naturally, leading to an increased demand for diagnostic services to identify the underlying causes of infertility. Furthermore, the growing urbanization, increased access to education and career opportunities for women, delayed marriages, changing societal norms has increased demand for fertility services in the region.

MEA Female Infertility Diagnosis Trends

MEA female infertility diagnosis market is fueled by the growingowing to the advancements in medical technology and healthcare infrastructure improvements in countries across the Middle East and Africa have led to better access to fertility clinics, specialized diagnostic tests, and treatments for female infertility. Moreover, growing awareness about reproductive health issues and changing societal norms regarding seeking medical help for infertility problems have also fueled the demand for diagnostic services in this market.

Key Female Infertility Diagnosis Company Insights

The market is highly fragmented due to the presence of regional and national companies offering a range of infertility diagnostic and treatments. Major companies are undertaking various organic as well as inorganic strategies such as new service launches, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Female Infertility Diagnosis Companies:

The following are the leading companies in the female infertility diagnosis market. These companies collectively hold the largest market share and dictate industry trends.

- PFCLA

- Mayo Foundation for Medical Education and Research (MFMER)

- Cleveland Clinic

- Apricity Fertility UK Limited

- King’s Fertility Limited

- Dallas IVF

- Midwest Fertility Specialists

- Europe IVF

- Care Fertility

- Aspire Fertility

Recent Developments

-

In February 2024, Health Minister Robin Swann revealed that publicly funded IVF treatment in Northern Ireland is likely to now cover one full cycle for eligible women. This decision marks a significant step towards improving access to fertility treatments for couples struggling with infertility issues. The move is expected to alleviate some of the financial burdens associated with IVF procedures, which can be costly and often require multiple cycles to achieve success.

-

In February 2024, Femasys received FDA clearance for its FemaSeed product. This development marks a significant milestone in the field of infertility treatment, offering a novel alternative to traditional methods like in vitro fertilization (IVF). FemaSeed is positioned as a first-line treatment option for couples struggling with infertility, providing them with a less invasive and more accessible solution.

-

In August 2023, Main Line Fertility integrated Sincera Reproductive Medicine into its services. This integration is a significant development in the field of reproductive medicine, as it brings together two reputable fertility clinics to provide enhanced care and expertise to patients seeking fertility treatments.

Female Infertility Diagnosis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.83 billion

Revenue forecast in 2030

USD 7.92 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK, Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

PFCLA; Mayo Foundation for Medical Education and Research (MFMER); Cleveland Clinic; Apricity Fertility UK Limited; King’s Fertility Limited; Dallas IVF; Midwest Fertility Specialists; Europe IVF; Care Fertility; Aspire Fertility

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Female Infertility Diagnosis Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the female infertility diagnosis market report based on test and region:

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Ovarian Reserve Testing

-

Hysterosalpingography

-

Hormone testing

-

Other Tests

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global female infertility diagnosis market size was estimated at USD 4.45 billion in 2023 and is expected to reach USD 4.83 billion in 2024.

b. The global female infertility diagnosis market is expected to grow at a compound annual growth rate of 8.60% from 2024 to 2030 to reach USD 7.92 billion by 2030.

b. The ovarian reserve testing segment accounted for the largest female infertility diagnosis market share of 43.6% in 2023 and is anticipated to grow at fastest growth rate over the forecast period. This dominance is driven by the increasing women reproductive health issues. Ovarian reserve testing plays a crucial role in assessing a woman’s fertility potential by evaluating the quantity and quality of her remaining eggs.

b. Some prominent players in the female infertility diagnosis market include PFCLA; Mayo Foundation for Medical Education and Research (MFMER); Cleveland Clinic; Apricity Fertility UK Limited; King’s Fertility Limited; Dallas IVF; Midwest Fertility Specialists; Europe IVF; Care Fertility; Aspire Fertility.

b. Key factors that are driving the female infertility diagnosis market growth include growing changes in lifestyle which contribute to the rise in infertility and the prevalence of conditions such as polycystic ovary syndrome (PCOS).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."