- Home

- »

- Consumer F&B

- »

-

Fava Beans Market Size & Share, Industry Report, 2030GVR Report cover

![Fava Beans Market Size, Share & Trends Report]()

Fava Beans Market Size, Share & Trends Analysis Report By Product (Whole Fava Beans, Fava Beans Flour), By Application (Human Nutrition, Animal Feed), By Distribution, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-496-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Fava Beans Market Size & Trends

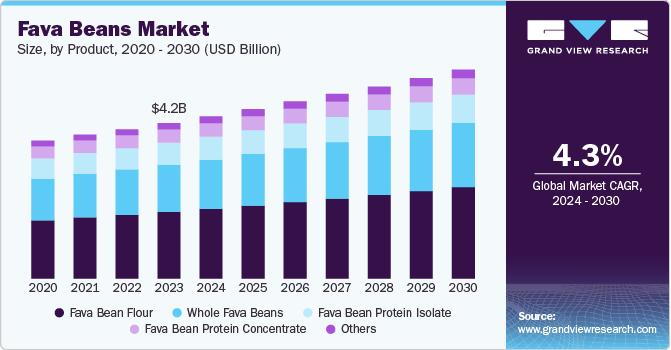

The global fava beans market size was estimated at USD 4.23 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. A key driving factor behind the market's growth is the global expansion of the vegetarian and vegan populations. As more individuals adopt plant-based diets due to ethical concerns, environmental sustainability, and health benefits associated with reduced meat consumption, fava beans have emerged as a vital protein source. Their versatility allows for incorporation into various culinary applications, from traditional dishes to innovative snacks and meat alternatives. Manufacturers are responding to this trend by developing new fava bean-based products that cater to evolving consumer preferences, thus broadening the market's reach.

Sustainable agricultural practices also contribute to the market growth. With increasing awareness of environmental issues and the need for sustainable food sources, farmers are adopting methods that enhance the cultivation of legumes like fava beans. These practices improve soil health and reduce reliance on synthetic fertilizers and pesticides. As a result, fava beans are positioned as an eco-friendly crop that aligns with the growing demand for sustainable food production, appealing to consumers and producers alike.

The rise in disposable incomes, particularly in emerging economies such as India and China, is another significant factor fueling market growth. As more consumers access higher-quality food options, there is a notable shift towards healthier eating habits that include legumes like fava beans. This trend is further supported by cultural practices in these regions where fava beans are already integral to traditional diets. The combination of increased purchasing power and a shift towards nutritious foods positions fava beans favorably within these markets.

Moreover, technological advancements in agriculture enhance the efficiency of fava bean production. The transition from traditional farming methods to modern agricultural techniques has resulted in higher yields and improved quality of fava beans. These advancements make production more sustainable, and help meet the rising consumer demand for high-quality plant-based proteins. The ongoing research into better processing techniques also enhances the taste and texture of fava bean products, making them more appealing to a broader audience.

Lastly, the influence of social media and health trends cannot be overlooked in driving the popularity of fava beans. Increased visibility through platforms promoting healthy eating has raised consumers' awareness about the nutritional benefits of fava beans. Influencers advocating for plant-based diets have helped shift perceptions about legumes as essential to modern diets. This growing reputation has translated into increased sales and market interest, further solidifying fava beans' position as a key player in the global food industry. Collectively, these factors create a robust environment for sustained growth in the fava beans industry over the coming years.

A key challenge for the fava bean industry is competition for alternate products. As the demand for plant-based proteins rises, various legumes and alternative protein sources are vying for consumer attention. Products such as lentils, chickpeas, and pea protein have gained popularity due to their nutritional profiles and versatility in cooking. This competition can dilute the market share for fava beans unless they are effectively marketed for their unique benefits and culinary uses.

Consumer awareness and education regarding the benefits of fava beans also play a crucial role in market growth. While there is increasing interest in plant-based diets, many consumers may not be familiar with incorporating fava beans into their meals or fully understand their nutritional advantages. This lack of knowledge can hinder market expansion as potential buyers may opt for more familiar legumes or protein sources instead.

Product Insights

The Fava bean flour segment was estimated at USD 1.81 billion in 2023. As health consciousness rises globally, more individuals seek nutritious food options that provide substantial health benefits. Fava bean flour is recognized for its high protein, fiber, and mineral content, making it an attractive choice for those looking to enhance their diets with nutrient-dense ingredients. This increasing awareness about the nutritional advantages of fava beans, including their role in maintaining blood pressure and improving overall health, drives demand for fava bean flour in various culinary applications.

The versatility of fava bean flour in cooking and baking enhances its appeal. It can be easily incorporated into various recipes, including bread, pasta, snacks, and baked goods. This adaptability allows manufacturers and home cooks to experiment with fava bean flour in diverse culinary contexts, thus broadening its market reach. The growing popularity of gluten-free diets also plays a role, as fava bean flour is an excellent alternative to traditional wheat flour for those with gluten sensitivities or celiac disease.

The whole fava beans industry is expected to grow at a CAGR of 4.3% from 2024 to 2030. The rise in vegetarianism and veganism also significantly contributes to the demand for whole fava beans. As individuals increasingly adopt plant-based diets due to ethical concerns, environmental sustainability, and health benefits associated with reduced meat consumption, fava beans have become a crucial protein source.

Fava bean protein isolate was another key product of the market and is expected to witness robust growth in the forecast period. The sustainability aspect of fava beans also plays a crucial role in their market growth. With increasing awareness of environmental issues associated with food production, consumers seek sustainable alternatives to traditional animal proteins. Fava beans require significantly less water and resources to cultivate than livestock, making them an environmentally friendly choice. This sustainability narrative resonates with consumers who prioritize ethical and ecological considerations in their purchasing decisions, boosting the demand for fava bean protein isolates.

Distribution Insights

Supermarkets and hypermarkets were essential distribution channels for the fava beans industry and are expected to be valued at USD 1.59 billion in 2023. Supermarkets and hypermarkets provide various fava bean products, including dried beans, flour, and innovative processed items like pasta and snacks. This extensive selection caters to the increasing consumer demand for nutritious and versatile plant-based foods, particularly as the trend towards veganism and vegetarianism continues to rise. The ability to find various fava bean products in one location encourages consumers to experiment with these ingredients, thereby boosting sales.

Furthermore, the growing trend of incorporating plant-based proteins into everyday meals has led supermarkets to expand their offerings, positioning fava beans as a staple ingredient in modern diets. This strategic focus on health-oriented products aligns with consumer preferences for sustainable and nutritious food options, driving further growth in fava bean sales through these distribution channels.

The online sales of fava beans are expected to grow at a CAGR of 4.9% from 2024 to 2030. Online platforms like Amazon offer various fava bean products, including whole beans, flour, and snacks, making it easier for consumers to access these nutritious options without the limitations of physical store inventories. This accessibility allows health-conscious consumers to explore and purchase fava beans from the comfort of their homes, contributing to increased sales through online channels.

Online retailers often provide detailed product information, nutritional benefits, and recipe ideas, which educate consumers and encourage them to incorporate fava beans into their diets. This trend is particularly pronounced in regions like the Asia Pacific, where fava beans are traditionally consumed as snacks. These further drive demand through online sales as consumers seek convenient purchasing options that align with their dietary preferences.

Application Insights

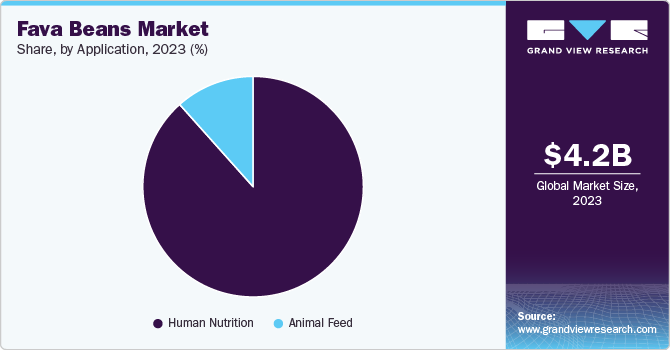

Human nutrition was the most significant application of fava beans and is expected to account for over 80% of the market in 2023. The high protein content of fava beans significantly contributes to their popularity in vegan diets by providing a complete source of essential amino acids that are often challenging to obtain from plant-based foods. Fava beans offer approximately 13 grams of protein per cooked cup and contain all nine essential amino acids, making them a rare complete protein among legumes. This characteristic is particularly appealing to vegans and vegetarians who need to ensure they receive adequate protein without relying on animal products. Specific amino acids, such as leucine and lysine, support muscle growth and repair, which is crucial for individuals following an active lifestyle or engaging in regular exercise.

Animal feed is a developing application of fava beans and is expected to grow at a CAGR of 3% from 2024 to 2030. The increasing demand for sustainable and cost-effective feed alternatives has prompted farmers and feed manufacturers to explore fava beans as a viable option. As concerns about the environmental impact of soybean cultivation grow, fava beans are more sustainable due to their ability to thrive in cooler climates and their lower oil content than soybeans. Modern fava bean varieties have been developed to minimize anti-nutritional factors, making them safer for animal consumption when included at appropriate levels (typically up to 10-15% in layer diets). This adaptability and improved safety profile allow fava beans to be integrated into various livestock diets without compromising animal health or performance, further driving their popularity in the animal feed market.

Regional Insights

The North America fava beans market was valued at USD 1.21 billion in 2023. There is a significant shift towards plant-based diets among consumers, fueled by increasing health consciousness and awareness of the nutritional benefits of legumes. Fava beans are recognized for their high protein content, fiber, and essential vitamins and minerals, making them an attractive option for health-conscious individuals and those seeking to reduce meat consumption. The rise of vegetarianism and veganism and concerns about the health risks associated with red meat have led to a growing demand for nutritious plant-based alternatives like fava beans.

U.S. Fava Beans Market Trends

The U.S. Fava beans market is expected to exceed USD 1 billion by 2030. The influence of social media and marketing strategies has significantly enhanced the visibility and reputation of fava beans in the market. Influencers and health advocates increasingly use social media platforms to promote fava bean products, educate consumers about their nutritional benefits, and encourage mindful eating practices. Expanding distribution channels, mainly through supermarkets and online retailers, has made fava beans more accessible to consumers. This increased availability aligns with the broader trend of health-conscious eating, driving sustained demand for fava bean products across the United States.

Asia Pacific Fava Beans Market Trends

The Asia Pacific fava beans market accounted for 40% of the global demand in 2023. The increasing population and rising disposable incomes in countries like China and India are significant drivers. As more consumers access higher income levels, there is a growing demand for nutritious food options, including plant-based proteins. Fava beans, rich in protein, fiber, and essential nutrients, are becoming popular among health-conscious consumers seeking meat alternatives. In addition, the traditional use of fava beans in various Asian cuisines-such as in dishes like ful medames and falafel-supports their continued consumption and integration into modern diets. This cultural familiarity enhances their appeal as a staple ingredient in traditional and contemporary recipes.

Secondly, the shift towards healthier eating habits propels the fava bean market forward. With increasing awareness of the health benefits associated with legumes, including improved digestion and heart health, consumers are more inclined to incorporate fava beans into their diets. The rise of vegetarianism and veganism across Asia also contributes to this trend, as more individuals seek plant-based protein sources. Furthermore, innovative product development-such as fava bean flour and snacks-alongside effective marketing strategies by retailers, particularly in supermarkets and online platforms, are making fava beans more accessible to a broader audience. This combination of economic growth, cultural integration, and health awareness positions the fava bean industry for sustained regional growth.

Key Fava Beans Company Insights

The competitive landscape is shaped by ongoing innovations in product development, such as new varieties of fava beans that enhance yield and nutritional profile, as well as strategic partnerships between companies to expand product offerings and market reach. For instance, collaborations between food manufacturers and agricultural institutions aim to improve fava bean varieties for better performance in diverse climates.

Key Fava Beans Companies:

The following are the leading companies in the fava beans market. These companies collectively hold the largest market share and dictate industry trends.

- Prairie Fava Ltd.

- Unigrain Pty Ltd

- Roland Beans

- Aviip Group

- Alberta Pulse Growers Commission

- Stamp Seeds Inc.

- Pawnee Buttes Seed Inc.

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Bunge Limited

- AGT Food and Ingredients Inc.

- Ingredion Incorporated

- SunOpta Inc.

- The Scoular Company

- Roquette Frères

- Verdient Foods Inc.

- Grain Millers Inc.

- Best Cooking Pulses Inc.

- The Andersons Inc.

- Legumex Walker Inc.

Fava Beans Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.41 billion

Revenue forecast in 2030

USD 5.68 billion

Growth rate (Revenue)

CAGR of 4.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Egypt

Key companies profiled

Prairie Fava Ltd.; Unigrain Pty Ltd; Roland Beans; Aviip Group; Alberta Pulse Growers Commission; Stamp Seeds Inc.; Pawnee Buttes Seed Inc.; Archer Daniels Midland Company (ADM); Cargill Incorporated; Bunge Limited; AGT Food and Ingredients Inc.; Ingredion Incorporated; SunOpta Inc.; The Scoular Company; Roquette Frères; Verdient Foods Inc.; Grain Millers Inc.; Best Cooking Pulses Inc.; The Andersons Inc.; Legumex Walker Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Fava Beans Market Report Segmentation

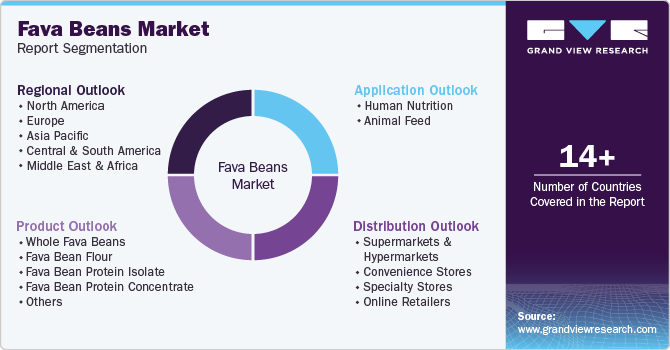

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fava beans market report by product, application, distribution, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Whole Fava Beans

-

Fava Bean Flour

-

Fava Bean Protein Isolate

-

Fava Bean Protein Concentrate

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Nutrition

-

Animal Feed

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global fava beans market was valued at USD 4.23 billion in 2023 and is expected to reach USD 4.41 billion in 2024.

b. The global fava beans market is expected to grow at a CAGR of 4.3% from 2024 to 2030 to reach USD 5.68 billion by 2030.

b. Human nutrition was the most significant application of fava beans and is expected to account for over 80% of the market in 2023. The high protein content of fava beans significantly contributes to their popularity in vegan diets by providing a complete source of essential amino acids that are often challenging to obtain from plant-based foods. Fava beans offer approximately 13 grams of protein per cooked cup and contain all nine essential amino acids, making them a rare complete protein among legumes.

b. Human nutrition was the most significant application of fava beans and is expected to account for over 80% of the market in 2023. The high protein content of fava beans significantly contributes to their popularity in vegan diets by providing a complete source of essential amino acids that are often challenging to obtain from plant-based foods. Fava beans offer approximately 13 grams of protein per cooked cup and contain all nine essential amino acids, making them a rare complete protein among legumes.

b. A key driving factor behind the market's growth is the global expansion of the vegetarian and vegan populations. As more individuals adopt plant-based diets due to ethical concerns, environmental sustainability, and health benefits associated with reduced meat consumption, fava beans have emerged as a vital protein source. Their versatility allows for incorporation into various culinary applications, from traditional dishes to innovative snacks and meat alternatives. Manufacturers are responding to this trend by developing new fava bean-based products that cater to evolving consumer preferences, thus broadening the market's reach.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."