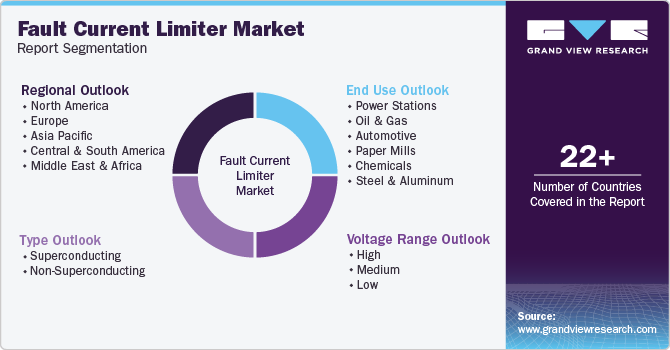

Fault Current Limiter Market Size, Share & Trends Analysis Report By Type (Superconducting, Non-Superconducting), By Voltage Range (High, Medium, Low), By End-use (Power Stations, Oil & Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Fault Current Limiter Market Size & Trends

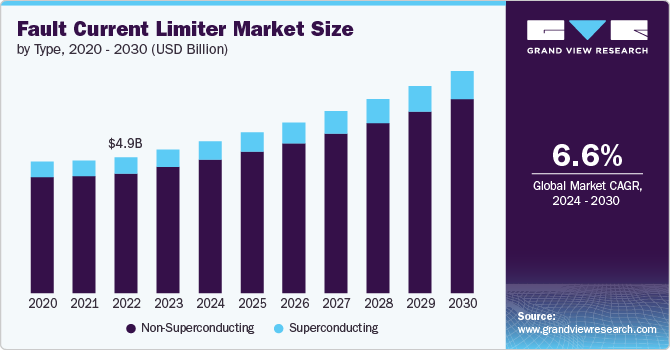

The global fault current limiter market size was estimated at USD 5,178.71 million in 2023 and is projected to grow at a CAGR of 6.56% from 2024 to 2030. The global market is currently being shaped by several key trends, with technological advancements at the forefront. One significant trend is the growing adoption of superconducting fault current limiters (SFCLs), which use superconducting materials to limit fault currents with high efficiency and minimal energy loss. SFCLs are gaining traction due to their ability to handle high currents and provide rapid response times during fault conditions, making them ideal for modern, complex power grids.

As the demand for more resilient and efficient electrical infrastructure grows, SFCLs are becoming increasingly popular, particularly in regions focused on integrating renewable energy sources and upgrading aging power systems.

Another notable trend in the market is the increased emphasis on grid modernization and smart grid technologies. As utilities around the world invest in modernizing their power grids to enhance reliability and integrate more renewable energy, there is a greater need for advanced fault current management solutions. Fault current limiters are crucial in smart grids, where real-time monitoring and rapid response to electrical faults are essential to maintaining stability and preventing widespread outages. This trend is driving demand for innovative fault current limiter solutions that can seamlessly integrate with smart grid technologies, offering both protection and enhanced operational efficiency.

The global shift towards sustainability and renewable energy is influencing the market growth. The integration of renewable energy sources, such as wind and solar, into existing power grids presents unique challenges, including variability in power generation and the need for robust protection systems to manage potential faults. Fault current limiters play a critical role in mitigating these challenges by ensuring that faults do not cause extensive damage or disrupt power supply. As countries worldwide accelerate their transition to cleaner energy, the demand for fault current limiters is expected to grow, supporting a more stable and resilient energy infrastructure that can accommodate diverse and renewable energy sources.

Market Concentration & Characteristics

The global market is characterized by its rapid growth, driven primarily by the increasing demand for enhanced power grid reliability and safety. As power grids expand and become more interconnected, the risk of fault currents due to short circuits and other electrical faults has risen, necessitating the adoption of advanced technologies to protect infrastructure. Fault current limiters, which help prevent damage to electrical systems by limiting the magnitude of fault currents, are becoming increasingly essential in this context. The market is also highly influenced by technological advancements, particularly in superconducting technologies, which offer higher efficiency and faster response times, making them suitable for modern, complex power networks.

The market is marked by regional diversity, with significant growth observed in areas undergoing rapid industrialization and infrastructure development, such as the Asia-Pacific region. Countries like China, India, and Japan are key markets due to their substantial investments in upgrading power infrastructure and integrating renewable energy sources. Meanwhile, developed regions like North America and Europe are focusing on grid modernization and resilience, driving demand for advanced fault current limiter solutions to maintain grid stability and meet regulatory standards. Overall, the global market is dynamic, shaped by technological innovation, regional developments, and a growing emphasis on reliable and efficient power distribution systems.

Type Insights

Based on type, the non-superconducting segment led the market with the largest revenue share of 88.11% in 2023. This dominance is primarily due to their proven reliability, lower cost, and widespread applicability across various power systems. Unlike superconducting fault current limiters, which require advanced materials and cooling systems, non-superconducting fault current limiters use more conventional technology, making them easier to integrate into existing grid infrastructure without extensive modifications. Their lower initial costs and minimal maintenance requirements make them an attractive option for utilities and industries looking to enhance their grid protection without significant capital expenditure. These characteristics have led to broad adoption across both developed and developing regions, where upgrading and protecting aging infrastructure remains a top priority.

The non-superconducting segment is expected to grow at the fastest CAGR over the forecast period, driven by ongoing investments in grid modernization and the increasing demand for reliable and cost-effective solutions. As power grids become more complex with the integration of renewable energy sources and the expansion of urban infrastructure, the need for effective fault current management is becoming more critical. Non-superconducting fault current limiters are well-positioned to meet this demand due to their ability to handle a wide range of fault current levels and provide consistent performance in diverse environmental conditions. In addition, their compatibility with existing grid systems and ease of deployment make them a preferred choice for utilities aiming to enhance their network resilience quickly. As a result, the non-superconducting segment is likely to maintain its strong market presence and continue driving market growth.

Voltage Range Insights

Based on voltage range, the high voltage segment led the market with the largest revenue share of 55.00% in 2023. This segment's significant presence is primarily driven by the increasing demand for robust protection solutions in high-voltage power systems, which are integral to long-distance power transmission and large-scale industrial applications. As global energy consumption continues to rise, there is a growing need to expand and upgrade high-voltage transmission networks to accommodate greater loads and ensure efficient power distribution. High-voltage fault current limiters are essential in these systems as they protect critical infrastructure from the potentially catastrophic effects of fault currents, helping to maintain system stability and prevent widespread outages.

The high voltage segment is expected to grow at the fastest CAGR over the forecast period, driven by the ongoing expansion of high-voltage power grids and the integration of renewable energy sources into existing networks. As countries strive to meet their renewable energy targets and reduce carbon emissions, there is a need to connect remote renewable energy generation sites, such as wind and solar farms, to the main power grid. This often requires the use of high-voltage transmission lines, which must be protected from the risk of fault currents. In addition, the modernization of aging grid infrastructure in both developed and developing regions is creating a substantial demand for high-voltage fault current limiters that can enhance grid resilience and reliability. With these factors at play, the high voltage segment is poised for robust growth, reflecting its critical role in supporting the evolving needs of global power networks.

End Use Insights

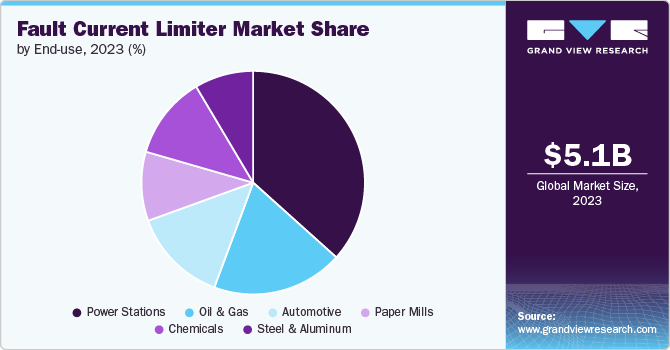

Based on end use, the power stations segment led the market with the largest revenue share of 36.65% in 2023. This significant share is primarily due to the critical role that fault current limiters play in enhancing the safety and reliability of power stations, which are central to the generation and distribution of electricity. Power stations, whether thermal, nuclear, or renewable, are highly susceptible to faults that can result in significant damage to equipment, cause extensive downtime, and lead to substantial financial losses. By integrating fault current limiters, power stations can protect their electrical infrastructure from the damaging effects of excessive fault currents, thereby maintaining continuous operation and ensuring a stable power supply to the grid. The need to safeguard against faults becomes even more crucial as power generation facilities expand to meet rising global energy demands, further driving the adoption of fault current limiters in this segment.

The power stations segment is expected to grow at the fastest CAGR over the forecast period, fueled by several factors, including the global push for energy transition and the increasing reliance on diverse energy sources. As the energy sector shifts towards renewable energy and adopts newer technologies, there is a growing emphasis on upgrading existing power infrastructure to handle more complex and variable power flows. Power stations must be equipped with advanced fault current management solutions to accommodate the integration of renewables and the challenges associated with grid stability and protection. In addition, the need to modernize aging power plants in developed regions and develop new power generation facilities in emerging economies is creating a steady demand for fault current limiters. These devices help ensure operational efficiency and safety, reinforcing their importance in power stations worldwide and driving sustained growth in this market segment.

Regional Insights

The fault current limiter market in North America is expected to experience at a significant CAGR over the coming years, driven by increasing investments in smart grid technology and the modernization of electrical infrastructure. With the region's aging power grid systems and rising electricity demand, there is a heightened need for advanced solutions to manage fault currents and enhance grid reliability. In addition, the integration of renewable energy sources and the expansion of distributed generation are contributing to the rising adoption of FCLs to protect grid components from potential damage caused by fault currents. Technological advancements in FCL design, such as the development of superconducting and solid-state limiters, are also expected to bolster market growth, offering utilities more efficient and cost-effective solutions to manage fault currents. As utilities focus on enhancing grid resilience and reducing outage times, the demand for FCLs in North America is likely to continue its upward trend.

U.S. Fault Current Limiter Market Trends

The fault current limiter market in the U.S. is driven by the need to modernize an aging power grid and enhance grid reliability amid rising electricity demand. The U.S. is investing significantly in advanced grid technologies, including fault current limiters, to protect its vast electrical infrastructure from the increased risk of short circuits and fault currents. With a strong focus on integrating renewable energy sources and developing smart grid technologies, the U.S. market is expected to experience steady growth, supported by regulatory mandates aimed at improving grid resilience and safety.

Asia Pacific Fault Current Limiter Market Trends

Asia Pacific dominated the fault current limiter market with the largest revenue share of 43.39% in 2023. This dominance is largely driven by the rapid industrialization and urbanization occurring across key countries like China, India, Japan, and South Korea, which are significantly expanding their power infrastructure to meet the growing energy demands. The region’s focus on enhancing grid reliability and safety has led to substantial investments in advanced technologies, including fault current limiters, to protect electrical networks from the risks associated with increased fault currents. Moreover, the Asia Pacific region is experiencing a surge in renewable energy projects, which necessitate the integration of sophisticated fault management solutions to ensure stable and efficient power distribution.

The China fault current limiter market held significant share of about 35.13% in the Asia Pacific region in 2023. In China, the fault current limiter market is expanding rapidly due to the country's ambitious plans for grid modernization and renewable energy integration. As the world's largest producer and consumer of electricity, China faces significant challenges in managing fault currents in its vast and diverse electrical network. The government’s focus on building a strong and resilient power infrastructure, coupled with substantial investments in renewable energy projects, is driving demand for advanced fault current limiters. China's commitment to reducing carbon emissions and increasing energy efficiency is likely to further stimulate market growth.

Europe Fault Current Limiter Market Trends

The fault current limiter market in Europe is expanding due to stringent regulations on grid safety and the ongoing transition to renewable energy sources. Countries across the region are focused on upgrading their electrical infrastructure to meet climate goals and improve energy efficiency. The integration of fault current limiters is crucial for managing the variability and complexity of power flows associated with renewable energy integration. As Europe continues to advance its smart grid initiatives and increase investments in green energy projects, the demand for fault current limiters is expected to grow significantly.

The France fault current limiter market is characterized by its robust energy infrastructure and a strong commitment to nuclear and renewable energy. As a leading producer of nuclear energy, France requires reliable fault current management solutions to protect its nuclear power plants and associated infrastructure. In addition, the country's increasing investments in renewable energy sources, particularly offshore wind, are driving the need for advanced grid protection technologies. Fault current limiters play a vital role in ensuring the stability and safety of France's electrical network, supporting its energy transition goals.

Middle East & Africa Fault Current Limiter Market Trends

The fault current limiter market in Middle East & Africa is expected to grow at the fastest CAGR of approximately 6.02% over forecast period. The market in the Middle East & Africa is gaining traction as countries in the region invest in expanding and modernizing their power grids. With a strong emphasis on diversifying energy sources and improving grid stability, especially in countries with rapid urban growth, there is a growing need for reliable fault current management solutions. In addition, the increasing deployment of renewable energy projects, particularly in solar and wind, is driving demand for fault current limiters to manage the unique challenges posed by integrating these energy sources into the grid.

The Saudi Arabia fault current limiter market is evolving as the country undertakes major initiatives to transform its power sector under its Vision 2030 strategy. With a focus on diversifying energy sources and enhancing grid reliability, Saudi Arabia is investing in advanced technologies to support the expansion of its power infrastructure. The development of large-scale renewable energy projects, such as solar and wind farms, necessitates the use of fault current limiters to ensure grid stability and safety. As the country continues to modernize its grid and integrate new energy sources, the demand for fault current limiters is expected to grow steadily.

Key Fault Current Limiter Market Company Insights

The market is fragmented, characterized by the presence of numerous players ranging from well-established multinational corporations to smaller specialized companies. This fragmentation is due to the diverse applications and technologies within the market, such as superconducting and non-superconducting fault current limiters, each catering to different segments of the power industry. In addition, regional variations in power grid infrastructure and differing regulatory environments contribute to the market's fragmented nature, with different players focusing on specific regions or types of fault current limiter technology. As a result, no single company dominates the global market, allowing for competitive dynamics and opportunities for new entrants and technological innovations. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Fault Current Limiter Companies:

The following are the leading companies in the fault current limiter market. These companies collectively hold the largest market share and dictate industry trends.

- Rongxin Power Electronic Co. Ltd.

- Applied Materials

- American Superconductor Corporation

- Alsto

- Zenergy Power Electric Co.

- Nexans

- Superconductor Technologies Inc.

- ABB Ltd.

- Applied Materials

- Alstom

- Zenergy Power Electric Co.

- Siemens AG

Recent Developments

-

In February 2024, COSEL Co, Ltd launched a PDA series of AC/DC power supplies, which includes inrush current limiting and further enhances reliability for industrial applications

-

In July 2024, Nexperia launched new high-current electronic fuses, NPS3102A and NPS3102B, in its power device portfolio. These newly launched eFuses are low-ohmic, high current, and resettable electronic fuses used to protect downstream loads from excessive voltages

Fault Current Limiter Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5,480.63 million |

|

Revenue forecast in 2030 |

USD 8,022.04 million |

|

Growth rate |

CAGR of 6.56% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Type, voltage range, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Rongxin Power Electronic Co. Ltd.; Applied Materials; American Superconductor Corporation; Alsto; Zenergy Power Electric Co.; Nexans; Superconductor Technologies Inc.; ABB Ltd.; Applied Materials; Alstom, Zenergy Power Electric Co.; Siemens AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fault Current Limiter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fault current limiter market report based on type, voltage range, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Superconducting

-

Non-Superconducting

-

-

Voltage Range Outlook (Revenue, USD Million, 2018 - 2030)

-

High

-

Medium

-

Low

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Stations

-

Oil & Gas

-

Automotive

-

Paper Mills

-

Chemicals

-

Steel & Aluminum

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fault current limiter market size was estimated at USD 5,178.71 million in 2023 and is expected to reach USD 5,480.63 million in 2024.

b. The global fault current limiter market is expected to grow at a compound annual growth rate of 6.56% from 2024 to 2030 to reach USD 8,022.04 million by 2030.

b. Based on voltage range, high voltage range was the dominant segment in 2023 with a revenue share of about 55.00% in 2023. This is attributable to the increasing demand for robust protection solutions in extensive power transmission networks and large-scale industrial applications. This segment's prominence is driven by the need to safeguard critical infrastructure from high fault currents and maintain grid stability amid rising electricity demands and the integration of renewable energy sources.

b. Some of the key players operating in this industry include Rongxin Power Electronic Co. Ltd., Applied Materials, American Superconductor Corporation, Alsto, Zenergy Power Electric Co., Nexans, Superconductor Technologies Inc., ABB Ltd., Applied Materials, Alstom, Zenergy Power Electric Co., Siemens AG.

b. The key factors driving the fault current limiter market include the need for enhanced grid reliability and safety amidst rising electricity demand and the integration of renewable energy sources. Additionally, the modernization of aging infrastructure and regulatory requirements for improved grid protection are contributing to increased adoption of fault current limiters.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."