- Home

- »

- Food Safety & Processing

- »

-

Fat Replacers Market Size And Share, Industry Report, 2030GVR Report cover

![Fat Replacers Market Size, Share & Trends Report]()

Fat Replacers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Protein-based, Fat-based, Carbohydrate-based), By Application (Bakery & Confectioneries, Dairy & Frozen Desserts), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-358-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fat Replacers Market Size & Trends

The global fat replacers market was valued at USD 2.59 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. Growing health consciousness among consumers, the growing need to keep a check on calorie intake, and the demand for food products with clean ingredients are the key driving factors promoting the use of fat replacers. Fat replacers reduce the overall calorie consumption without compromising on the taste, texture, and overall sensory appeal of the food. Besides, the evolving landscape of the food sector is encouraging companies engaged in food manufacturing to invest in research and development activities to develop products with minimal calories and enhanced taste.

Rapid urbanization and increasingly hectic lifestyles have compelled consumers to rely on readily available processed foods. However, growing health consciousness and the rising prevalence of lifestyle diseases linked to unhealthy diets are driving consumers toward healthier alternatives. According to the World Health Organization (WHO), in 2022, 43% of global adults were overweight, and 16% were obese. In response to this trend, food manufacturers have adopted fat replacers to reduce the calorie content of their products without sacrificing taste, texture, or appearance. The American Dietetic Association recognizes fat replacers as a means for consumers to reduce fat intake while maintaining their preferred dietary choices. As a result, fat replacers are being incorporated into a wide range of food products, including baked goods, dairy products (cheese, sour cream, ice cream, yogurt, etc.), salad dressings, sauces, and gravies.

Driven by the increasing demand for healthier food options, industry players are actively engaged in developing and manufacturing high-quality fat replacers. Significant investments are being made to create innovative solutions that can replace natural fats while enhancing the nutritional value of food products. For example, Lypid, a U.S.-based startup, has developed a fully vegan fat with a rich, meaty texture and zero trans-fat content. Similarly, the Spanish company Cubiq Foods has introduced a vegan fat alternative that is suitable for various food applications.

Key developments in the fat replacer industry include plant-based and protein-based fat replacers and the utilization of microbial fermentation to mimic the properties of traditional fats. Natural fat replacers derived from sources such as fruits, starches, and gums are also gaining popularity. Moreover, the growing consumer preference for sustainable and clean-label food products is further stimulating the demand for natural fat replacers.

In response to consumer demand for healthier options, many fast-food chains and restaurants have incorporated fat replacers into their menus. Major brands such as McDonald's, Wendy's, Burger King, Taco Bell, Subway, and Chick-fil-A have begun utilizing modified starches, cellulose, and protein-based fat replacers to offer low-fat versions of their popular items. These fat replacers enable these chains to maintain the distinctive texture of their products without compromising on nutritional value. The increasing demand for fat replacers from multi-chain fast-food restaurants is expected to further propel the growth of the fat replacer industry.

Product Insights

The carbohydrate-based segment dominated the global fat replacers market based on product, with a revenue share of 60.2% in 2024. Carbohydrate-based fat replacers, which effectively mimic traditional fats' flavor, texture, and mouthfeel, have been extensively researched and widely adopted in the food industry. Industry players are leveraging ingredients such as chia seeds, aloe vera, basil seeds, and guar gum to develop innovative fat replacer solutions. Additionally, carbohydrate-based fat replacers offer a cost-effective alternative to traditional fats. These factors have contributed to the dominance of carbohydrate-based fat replacers in the overall fat replacer market.

The protein-based segment is also expected to experience the fastest CAGR from 2025 to 2030. Prioritizing protein consumption and reducing fat intake has emerged as a key dietary goal for contemporary consumers. Numerous studies have explored the potential of protein-based fat replacements. These studies have demonstrated that substituting fat with protein-based fat replacers can mitigate the negative consequences associated with protein interactions in low-fat diets. Furthermore, plant-based protein-derived fat replacers are gaining popularity due to their clean label attributes and sustainability benefits.

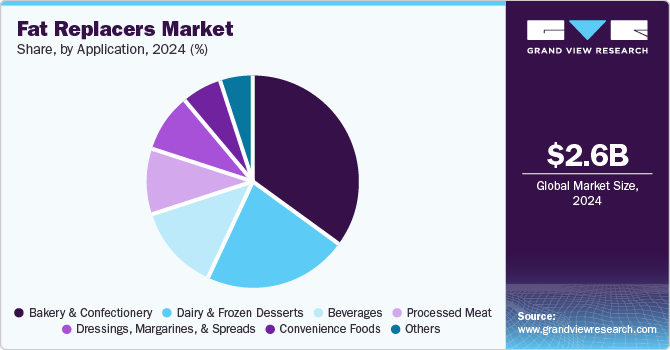

Application Insights

The bakery and confectionery segment held the largest fat replacers market revenue share in 2024. Bakery products and confectioneries, while widely consumed, are often high in fat content, which can contribute to various health issues. Incorporating fat replacers into products such as cakes, muffins, biscuits, crackers, and chocolates offers a healthier alternative without compromising taste or texture. This trend has significantly boosted the demand for fat replacers in the bakery and confectionery industry. Chocolate company Choco Finesse, for example, has successfully developed fat replacers that can reduce the fat content of their products, leading to a 45% reduction in calorie content. Ongoing advancements in fat replacement technology continue to fuel the growth of this sector.

The processed meat segment is expected to experience the fastest CAGR during the forecast period. Meat is traditionally considered a primary source of dietary protein. However, the consumption of processed meat is often associated with high fat intake. Food companies are incorporating fat replacers into processed meat products to address this issue. The inclusion of fat replacers does not compromise the overall appeal of these products while effectively reducing excess fat consumption. As a result, the growing demand for healthier processed meat alternatives is driving the expansion of the fat replacer industry.

Regional Insights

The North America fat replacers market is anticipated to experience significant growth during the forecast period. North America has a high percentage of individuals suffering from lifestyle disorders such as obesity and cholesterol-related complications. Owing to this, consumers in the region are becoming aware of their consumption patterns and ingredients. Such factors consistently encourage the demand for fat replacers across the region’s bakery & confectionaries, processed meat, and beverages sector.

The U.S. fat replacers market dominated the North American fat replacers market in 2024. Lifestyle diseases, including heart disease, cancer, and diabetes, are the leading causes of mortality and disability in the country. According to the CDC, six in ten Americans suffer from at least one chronic disease, while four in ten suffer from at least two.[TD6] In addition to smoking and sedentary lifestyles, poor dietary habits, particularly excessive fat consumption, are significant contributors to these health issues. These factors have collectively driven the demand for fat replacers in the U.S. market. Many major fast-food chains and local restaurants have introduced low-fat options to cater to health-conscious consumers. Moreover, the growing demand for clean-label ingredients, such as plant-based fat replacers, is further propelling the growth of the fat replacer industry in the country.

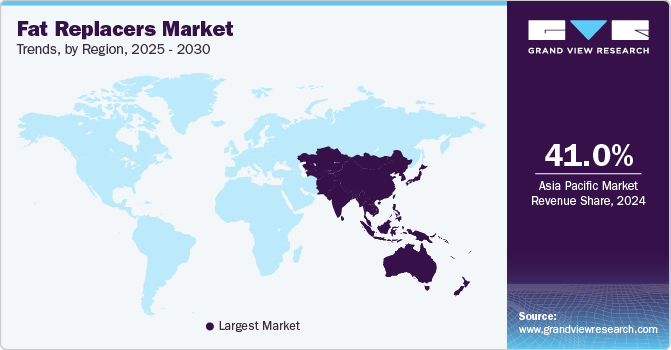

Asia Pacific Fat Replacers Market Trends

The Asia Pacific fat replacers industry dominated the global market, with a revenue share of 41.0% in 2024. Rapid urbanization and shifting consumer lifestyles in urban areas are key drivers of the growing demand for fat replacers in Asia-Pacific. As disposable incomes rise, consumers are increasingly seeking healthier food options. In response, food manufacturers have incorporated fat replacers into convenience foods, processed meats, sauces, and gravies.

China fat replacers market held the largest revenue share of the regional industry in 2024. With its vast population, China is the world's largest producer and consumer of food products. As Chinese consumers become increasingly health-conscious and quality-oriented, food manufacturers are under pressure to enhance the nutritional value of their products. This presents significant growth opportunities for fat replacer manufacturers to expand their market presence.

Europe Fat Replacers Market Trends

The European fat replacers market is anticipated to experience significant CAGR during the forecast period. The European food and beverage industry generates annual revenues exceeding USD 1.1 trillion. European consumers are increasingly discerning, paying close attention to product composition and ingredients. The region's growing health consciousness and demand for sustainable food products have fueled the market for fat replacers. Local food manufacturers, operating under stringent regulatory frameworks, prioritize the nutritional content of their products. This has further stimulated the demand for fat replacers in various food categories, including dairy products, processed meat, beverages, and convenience foods.

Key Fat Replacers Company Insights

Some of the key companies operating in the global fat replacers market are Inter Cargill Incorporated, FMC Corporation, Archer Daniels Midland Company, Ashland Global Holdings Inc., Kerry Group PLC., DKS Co Ltd., and Agritech Worldwide Inc. Companies are engaged in new product developments and collaborations to enhance their product offerings.

-

Cargill Incorporated is a U.S.-based food technology and ingredient company established in 1865. The company offers products across grains, oilseeds, animal nutrition, and oil, fats & food. The company introduced Milfar, a milk fat replacer used across bakeries, confectionaries, and convenience food.

-

Archer Daniels Midland is a U.S.-based multinational food processing and commodities trading company founded in 1902. It offers products in human nutrition, pet nutrition, animal nutrition, and industrial bio-solutions. The company also offers a wide product portfolio of modified and tailored oils, including low-fat oils.

Key Fat Replacers Companies:

The following are the leading companies in the fat replacers market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill Incorporated

- FMC Corporation

- Archer Daniels Midland Company

- Ashland Global Holdings, Inc.

- Kerry Group PLC., DKS Co Ltd.

- Agritech Worldwide, Inc.

Recent Developments

-

In March 2024, Clean Food Group, a U.K.-based food technology company, raised a funding of more than USD 3 million to develop sustainable oil and fat alternatives. The company is planning to launch its healthier oil & fat alternative in 2025.

-

In June 2021, Epogee LLC, a U.S.-based food technology company, introduced a new ingredient called EPG. The company claimed that the EPG can cut up to 92% of calories from fat. The company partnered with Gatsby Chocolate to develop a better-for-you chocolate bar. The EPG is a GMO-free, plant-based fat replacement product.

Fat Replacers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.75 billion

Revenue forecast in 2030

USD 3.75 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Thailand, Indonesia, Brazil, South Africa, UAE

Key companies profiled

Inter Cargill Incorporated, FMC Corporation, Archer Daniels Midland Company, Ashland Global Holdings, Inc., Kerry Group PLC., DKS Co Ltd., and Agritech Worldwide, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fat Replacers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the fat replacers market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein-based

-

Fat-based

-

Carbohydrate-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery and Confectionery

-

Dairy & Frozen Desserts

-

Beverages

-

Processed Meat

-

Dressings, Margarines, and Spreads

-

Convenience Foods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.