- Home

- »

- Advanced Interior Materials

- »

-

Fast Curing Nitrile Butadiene Rubber Market Report, 2030GVR Report cover

![Fast Curing Nitrile Butadiene Rubber Market Size, Share & Trends Report]()

Fast Curing Nitrile Butadiene Rubber Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Automotive, Mechanical Engineering, Oil & Gas, Medical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-827-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

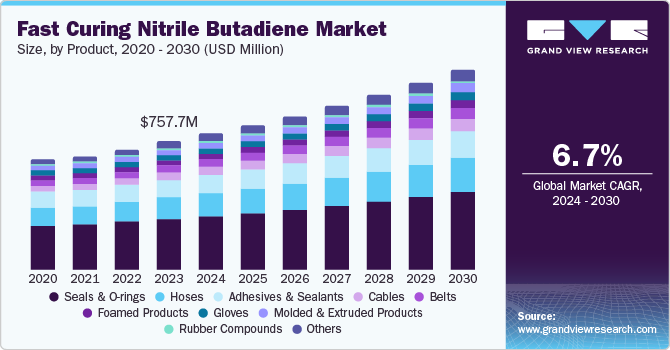

The global fast curing nitrile butadiene rubber market size was valued at USD 757.7 million in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Fast curing nitrile butadiene rubber (NBR) offers a unique advantage as it can be formulated with bio-based materials or recycled content without compromising performance. This shift towards sustainable practices enhances product appeal. It aligns with global efforts to reduce carbon footprints, thus propelling the demand for fast curing NBR in diverse applications such as construction, consumer goods, and industrial machinery.

NBR is widely used in manufacturing seals, gaskets, and hoses due to its excellent resistance to oil, fuel, and other chemicals. As the automotive industry continues to innovate with more efficient engines and advanced technologies, the need for durable and reliable components made from fast curing NBR is expected to rise, driving market expansion. Fast curing NBR is widely used in industrial applications due to its chemical resistance and ability to withstand harsh environments. As industrial operations become more complex and rigorous, the need for reliable materials to perform under extreme conditions has increased. This has led to greater adoption of fast curing NBR in manufacturing equipment, machinery, and other critical industrial components, thereby boosting the market.

The rapid expansion of infrastructure projects worldwide, such as roads, bridges, and buildings, has increased the need for durable materials to withstand harsh environmental conditions. Due to its superior elasticity and weather resistance, curing NBR is utilized in various construction applications, including flooring, roofing membranes, and sealants. As governments invest heavily in infrastructure development to stimulate economic growth post-pandemic, the demand for curing butadiene rubber products is anticipated to rise.

Advances such as improved polymerization techniques and enhanced compounding methods have led to higher-quality products with better performance characteristics at lower costs. These innovations not only improve production efficiency but also enable manufacturers to develop specialized formulations tailored for specific applications across diverse industries, including automotive, aerospace, and consumer goods. The continuous evolution of manufacturing technologies will likely sustain competitive advantages for companies in this market.

Product Insights

Hoses accounted for the largest market revenue share of 17.0% in 2023. Fast curing NBR hoses resist abrasion, weathering, and chemical exposure, which are essential for the demanding conditions of construction sites and infrastructure projects. As urbanization and infrastructure development projects increase globally, the demand for robust and reliable hoses will likely drive further growth in the fast curing NBR market.

Belts segment is expected to register the fastest CAGR of 7.9% during the forecast period. The development of faster and more efficient curing processes has enabled the production of high-quality NBR belts at a lower cost. This improvement in manufacturing efficiency enhances belt performance and makes them more accessible to a broader range of applications. As industries increasingly adopt automated systems and sophisticated machinery, the demand for high-performance belts that deliver reliable and consistent performance has surged. With their superior mechanical properties and durability, fast curing NBR belts are well-suited for use in automated systems where reliability is critical.

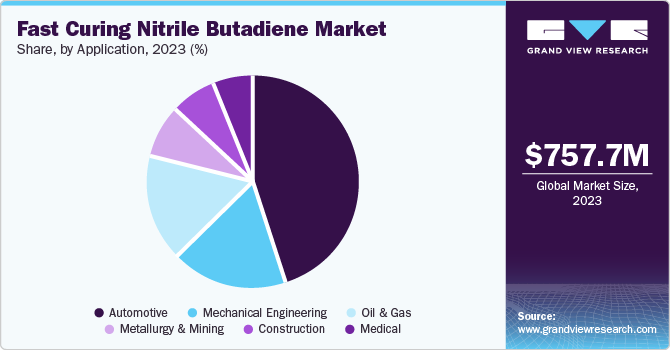

Application Insights

Automotive accounted for the largest market revenue share in 2023. As the automotive industry transforms with the rise of EVs and the development of advanced engine technologies, there is a growing need for specialized rubber components that can withstand new operating conditions. Fast curing NBR is well-suited to meet these evolving requirements due to its ability to perform under extreme temperatures and varied chemical exposures. The need for high-quality seals, gaskets, and hoses in these new vehicle types drives increased demand for fast curing NBR in the automotive sector.

Mechanical engineering is expected to grow significantly over the forecast period. The mechanical engineering sector is increasingly adopting automation and advanced manufacturing techniques that require materials capable of withstanding harsh operational conditions. Fast curing NBR’s ability to cure quickly allows manufacturers to streamline production processes, reduce lead times, and enhance overall productivity. This efficiency lowers costs and meets the growing consumer demand for faster delivery times without compromising quality. As a result, manufacturers are more inclined to integrate fast curing NBR into their production lines.

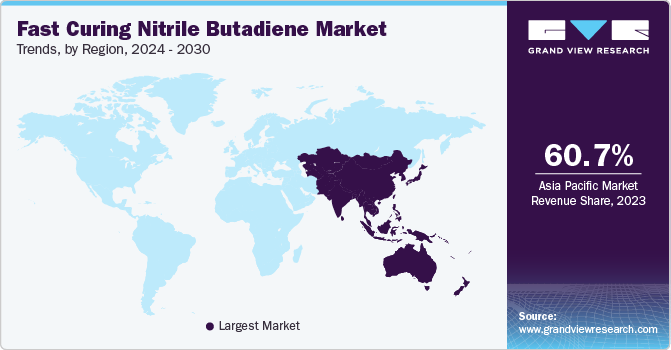

Regional Insights

North America fast curing nitrile butadiene rubber market was identified as a lucrative region in 2023 due to thriving automotive sector, with a particular emphasis on lightweight and fuel-efficient vehicles. The demand for durable and high-performance rubber components is increasing, fueled by stringent emissions regulations and consumer preference for advanced features. The region's robust infrastructure development, including road construction and expansion, also creates a steady demand for rubber-based products. The oil and gas industry, focusing on exploration and production, also contributes to market growth due to the need for durable and resilient rubber components.

U.S. Fast Curing Nitrile Butadiene Rubber Market Trends

The U.S. fast curing nitrile butadiene rubber market is anticipated to grow significantly over the forecast period. The U.S. is home to various industries, including aerospace, oil and gas, chemicals, and machinery, all of which require durable and reliable materials. Fast curing NBR's ability to withstand extreme temperatures, chemicals, and mechanical stress makes it a preferred choice for industrial applications. As U.S. manufacturing continues to grow and modernize, driven by technological advancements and infrastructure investments, the need for high-quality NBR components will continue to rise.

Europe Fast Curing Nitrile Butadiene Rubber Market Trends

Europe fast curing nitrile butadiene rubber market held a substantial market revenue share in 2023. European manufacturers are at the forefront of developing and implementing cutting-edge technologies that enhance the performance and efficiency of fast curing NBR. Innovations in curing methods and polymer formulations have improved the material's flexibility, strength, and overall quality. These advancements enable the production of high-performance NBR components that meet the stringent demands of various industries, further driving market growth in Europe.

The UK fast curing nitrile butadiene rubber market is expected to grow rapidly in the coming years. As the UK automotive industry continues to evolve, focusing on fuel efficiency and sustainability, manufacturers are increasingly adopting advanced materials like fast curing NBR, which offer quick processing times and enhanced performance characteristics.

Asia Pacific Fast Curing Nitrile Butadiene Rubber Market Trends

Asia Pacific fast curing nitrile butadiene rubber market accounted for the largest market revenue share of 60.7% in 2023 due to rapid industrialization, urbanization, and a booming automotive sector. Countries such as China and India, with their large populations and increasing disposable incomes, are major contributors to market expansion. With ongoing infrastructure development projects, the construction industry is another key driver. The growing electronics and appliances industry also creates a demand for rubber components in various applications.

Japan fast curing nitrile butadiene rubber market is expected to grow rapidly in the coming years. Due to its superior chemical resistance and durability, fast curing NBR is increasingly used to produce medical gloves, tubes, and various medical devices. With Japan's aging population and the rising focus on healthcare and hygiene, the demand for high-quality medical supplies is growing. The need for reliable and safe medical products will continue to drive the demand for fast curing NBR in the healthcare industry.

Middle East & Africa Fast Curing Nitrile Butadiene Rubber Market Trends

Middle East & Africa fast curing nitrile butadiene market is anticipated to grow significantly over the forecast period. The Middle East is one of the world’s largest oil and gas producers, considerably contributing to the regional economy. The oil and gas sector’s expansion drives demand for specialized materials that can withstand harsh operating conditions. Fast curing nitrile butadiene rubber is particularly valued in this industry for its superior chemical resistance and mechanical properties. Applications include seals for pumps, valves, and other equipment exposed to hydrocarbons. As exploration and production activities ramp up in response to global energy demands, the need for reliable materials like fast curing NBR will continue to grow.

Key Fast Curing Nitrile Butadiene Rubber Company Insights

Some of the key companies in thefast curing nitrile butadiene rubber market include LANXESS AG, Zeon Corporation, Kumho Petrochemical Co., Ltd., and others.

-

LANXESS AG offers fast curing nitrile butadiene rubber with enhanced mechanical properties such as tensile strength and elasticity. These characteristics make it suitable for demanding environments where durability is critical. The company leverages advanced polymer technology to produce NBR grades that meet stringent industry requirements, ensuring that its products are reliable and efficient.

-

Zeon Corporation offers fast curing nitrile butadiene rubber (NBR) engineered to meet the demanding requirements of various industrial applications. This type of rubber is characterized by its superior resistance to oils, fuels, and other chemicals, making it an ideal choice for manufacturing seals, gaskets, and hoses exposed to harsh environments.

Key Fast Curing Nitrile Butadiene Companies:

The following are the leading companies in the fast curing nitrile butadiene market. These companies collectively hold the largest market share and dictate industry trends.

- LANXESS AG

- Zeon Corporation

- Kumho Petrochemical Co., Ltd.

- Nitriflex S.A.

- LG Chem Ltd.

- JSR Corporation

- SIBUR Holding

- Versalis S.p.A.

- OMNOVA Solutions Inc.

- Shin-Etsu Chemical Co., Ltd.

- Synthos S.A.

- PetroChina Company Limited

- Trinseo S.A.

- Trelleborg AB

- ARLANXEO Holding B.V.

Recent Developments

-

In February 2024, LANXESS AG expanded its Rhenodiv production facility at the Jhagadia site, significantly enhancing its capacity to produce fast curing nitrile butadiene rubber (NBR). This strategic move aims to meet the growing demand for high-performance elastomers in various applications, particularly in the automotive and industrial sectors.

-

In December 2023, Synthos S.A. entered into a partnership with OMV and signed a Memorandum of Understanding (MoU) to foster cooperation in developing sustainable raw materials, specifically focusing on butadiene. This partnership is particularly significant as it targets the production of synthetic rubber for high-performance tires, which are essential in the automotive industry.

Fast Curing Nitrile Butadiene Rubber Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 805.1 million

Revenue forecast in 2030

USD 1,188.6 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Mexico, Saudi Arabia, UAE, Kuwait, and South Africa

Key companies profiled

LANXESS AG, Zeon Corporation, Kumho Petrochemical Co., Ltd., Nitriflex S.A., LG Chem Ltd., JSR Corporation, SIBUR Holding, Versalis S.p.A., OMNOVA Solutions Inc., Shin-Etsu Chemical Co., Ltd., Synthos S.A., PetroChina Company Limited, Trinseo S.A., Trelleborg AB, ARLANXEO Holding B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

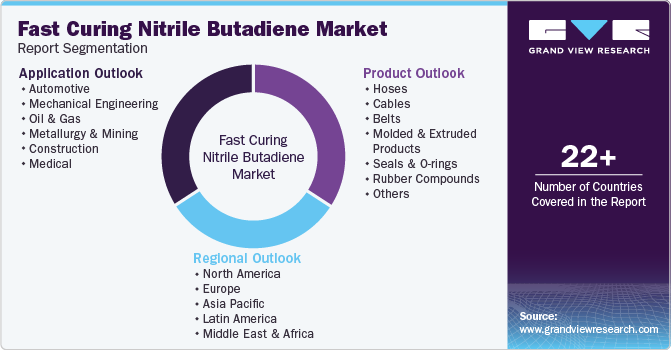

Global Fast Curing Nitrile Butadiene Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the fast curing nitrile butadiene rubber market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

Hoses

-

Cables

-

Belts

-

Molded & Extruded Products

-

Seals & O-rings

-

Rubber Compounds

-

Adhesives & Sealants

-

Gloves

-

Foamed Products

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

Automotive

-

Mechanical Engineering

-

Oil & Gas

-

Metallurgy & Mining

-

Construction

-

Medical

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume, Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.