- Home

- »

- Clothing, Footwear & Accessories

- »

-

Fashion Accessories Market Size And Share Report, 2030GVR Report cover

![Fashion Accessories Market Size, Share & Trends Report]()

Fashion Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Jewelry, Watches, Handbags & Purses, Belts & Wallets, Sunglasses), By End-use (Men, Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fashion Accessories Market Summary

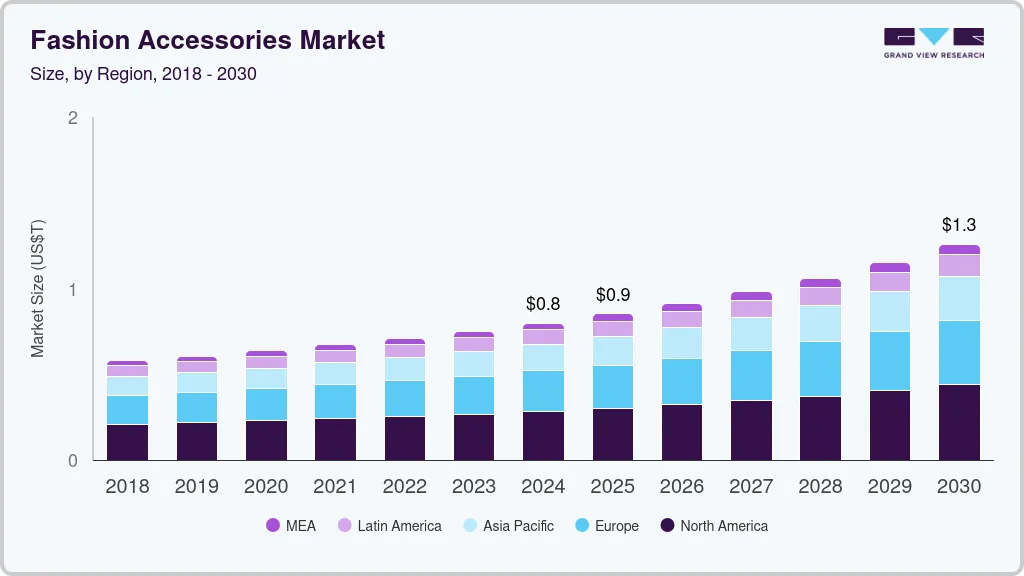

The global fashion accessories market size was estimated at USD 798.81 billion in 2024 and is projected to reach USD 1259.43 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. One of the primary reasons is the affordability and accessibility of fashion jewelry compared to fine jewelry.

Key Market Trends & Insights

- North America fashion accessories market accounted for a revenue share of 35.5% in 2023.

- The fashion accessories market in the U.S. has witnessed significant transformations in recent years.

- By product, the jewelry segment led the market and accounted for a revenue share of 48.4% in 2023.

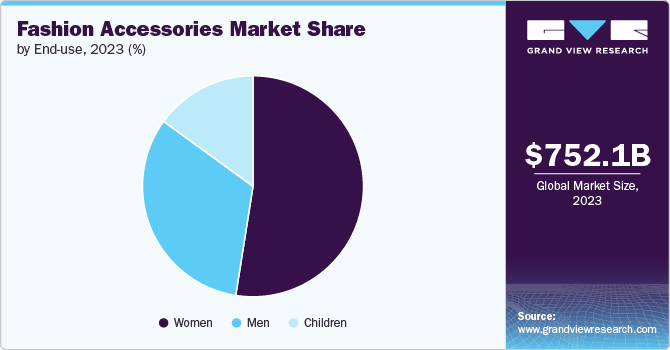

- By end-use, women segment led the market and accounted for a revenue share of 52.5% in 2023.

- By distribution channel, sales segment through specialty stores accounted for a revenue share of 38.8% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 798.81 Billion

- 2030 Projected Market Size: USD 1259.43 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Fashion jewelry, often made from non-precious metals and synthetic stones, is significantly more affordable, making it accessible to a broader audience, including younger consumers who may not have the disposable income to invest in high-end pieces. Besides, the wide range of price points for fashion jewelry allows consumers to purchase multiple items without a significant financial commitment, further driving demand.

Fast fashion trends also contribute to the increasing popularity of fashion jewelry. The fashion industry promotes frequent style changes, and this extends to jewelry as well. Consumers, particularly the younger generation, are eager to keep up with the latest styles and trends, often opting for trendy, affordable jewelry that complements their ever-evolving wardrobes. Brands often release seasonal and trend-based collections, encouraging consumers to regularly update their jewelry collections to stay current with fashion trends. The versatility of fashion jewelry allows for easy mixing and matching, enabling consumers to create different looks and express their individuality without breaking the bank.

Social media and celebrity culture have a significant influence on the popularity of fashion jewelry. With the rise of social media platforms like Instagram, TikTok, and Pinterest, fashion jewelry has become a prominent feature in fashion content. Influencers and celebrities frequently showcase new jewelry styles, creating a desire among their followers to emulate these looks. This constant exposure to new designs and trends on social media platforms encourages consumers to purchase more fashion jewelry. Young consumers, in particular, are highly influenced by the styles and accessories worn by their favorite influencers and celebrities, leading to increased demand for these items.

Sustainability and ethical considerations are also driving factors behind the growing demand for fashion jewelry. As consumers become more conscious of the environmental impact of their purchases, many are turning to fashion jewelry made from sustainable or recycled materials as an eco-friendly alternative to fine jewelry, which may involve extensive mining and resource extraction. This appeal to ethical consumption is particularly strong among younger generations, who are more likely to support brands that emphasize ethical sourcing and sustainable practices.

Innovation in design is another factor contributing to the rising demand for fashion jewelry. Brands are increasingly experimenting with new materials, colors, and designs, creating unique and creative pieces that appeal to young consumers. Collaborations between jewelry brands and designers, artists, or influencers often result in limited-edition collections that are both unique and desirable. These collaborations appeal to younger consumers who seek exclusive, innovative pieces that allow them to stand out. Additionally, the rise of direct-to-consumer (DTC) brands has made fashion jewelry more accessible through online shopping, further driving demand.

Product Insights

The jewelry segment led the market and accounted for a revenue share of 48.4% in 2023. Consumers are increasingly interested in jewelry that reflects their style or has special meaning. The trend toward personalized and customizable jewelry, such as engraved pieces or birthstone jewelry, appeals to customers seeking unique accessories that resonate with their individuality and personal experiences. Many consumers are seeking affordable luxury items that offer a sense of prestige without the high price tag associated with traditional luxury brands. Fashion jewelry often falls into this category, offering stylish and well-crafted pieces that provide the look and feel of luxury at a more accessible price point.

Handbags & purses are expected to grow at a CAGR of 9.3% from 2024 to 2030. Handbags and purses are considered essential fashion accessories that not only serve a functional purpose but also enhance an outfit's overall style. With an increased emphasis on fashion and personal expression, consumers are investing more in handbags and purses to complement their looks and reflect their personality. As disposable income levels rise, particularly among younger consumers and working professionals, there is a greater willingness to spend on luxury and designer handbags and purses. These accessories are often seen as status symbols, and consumers are more inclined to invest in high-quality, branded pieces that offer both aesthetic appeal and perceived social value.

Distribution Channel Insights

Sales of fashion accessories through specialty stores accounted for a revenue share of 38.8% in 2023. Specialty stores often provide a tailored and curated shopping experience that focuses on specific types of accessories. Customers appreciate the expertise and personalized service these stores offer, which helps them find unique and high-quality items that might not be available in general retail outlets. Specialty stores frequently carry exclusive or limited-edition accessories that are not found in mainstream retailers. This exclusivity attracts consumers who are looking for distinctive and unique items that help them stand out and express their style.

Sales of fashion accessories through online channels are expected to grow at a CAGR of 8.4% from 2024 to 2030. Online shopping provides unparalleled specialty and accessibility for consumers seeking fashion accessories. With the ability to browse and purchase from anywhere, at any time, shoppers can easily access a wide range of fashion accessories products without the limitations of physical store hours or geographical constraints. This specialty is particularly appealing to consumers who may not have local access to specialty stores that offer halal apparel.

End-use Insights

Fashion accessories for women led the market and accounted for a revenue share of 52.5% in 2023. As women's awareness of fashion trends and personal style grows, there is a greater emphasis on accessorizing to complete outfits. Fashion accessories like jewelry, scarves, handbags, and hats are seen as essential elements for expressing individuality and staying on-trend, driving higher demand. With rising disposable incomes, many women have more financial flexibility to spend on fashion and luxury items. This increased spending power allows for greater investment in accessories, which are often perceived as affordable indulgences compared to larger fashion purchases like clothing or footwear.

Fashion accessories for men are expected to grow at a CAGR of 8.3% from 2024 to 2030. Traditional notions of masculinity are evolving, leading to a greater acceptance and interest in fashion among men. Accessories like watches, cufflinks, belts, and bags are now viewed as essential components of a stylish and well-put-together look, reflecting a broader acceptance of fashion and personal grooming. Additionally, as the modern workplace becomes more diverse in terms of dress codes, there is a growing emphasis on professional appearance. Accessories such as high-quality briefcases, stylish ties, and elegant watches are perceived as important for making a positive impression and conveying professionalism, leading to higher demand.

Regional Insights

North America fashion accessories market accounted for a revenue share of 35.5% in 2023. There is a rising awareness and acceptance of diverse cultural practices and religious observances in North America, driven by increasing inclusivity within the fashion industry. Mainstream brands are recognizing the importance of catering to the Muslim consumer market by launching fashion accessories lines and modest clothing collections. This shift toward inclusivity is making fashion accessories more accessible and appealing to a wider audience.

U.S. Fashion Accessories Market Trends

The fashion accessories market in the U.S. has witnessed significant transformations in recent years, driven by evolving consumer preferences and socio-economic factors. The rise of e-commerce has greatly influenced shopping behaviors, enabling consumers to access a wider range of styles and brands from the comfort of their homes. This accessibility has accelerated sales in various categories, including jewelry, handbags, and eyewear, as online platforms offer personalized shopping experiences and targeted marketing. Moreover, the integration of technology in fashion accessories, such as smartwatches and tech-enabled jewelry, is another trend that appeals to tech-savvy consumers seeking functionality without compromising style. As these trends continue to evolve, the U.S. fashion accessories market is poised for growth, with brands that strategically align their offerings with consumer values and preferences likely to thrive in this competitive landscape.

Europe Fashion Accessories Market Trends

The fashion accessories market in Europe is expected to grow at a CAGR of 8.0% during the forecast period. There is a broader trend in Europe toward modest fashion, not only among Muslim consumers but also among those who appreciate the style and comfort it offers. This trend is being driven by a growing awareness and acceptance of diverse cultural practices, as well as a desire for more versatile and modest clothing options. As a result, fashion accessories are becoming increasingly popular among a wider audience, not just within Muslim communities.

Asia Pacific Fashion Accessories Market Trends

The fashion accessories market in Asia Pacific is expected to grow at a CAGR of 8.7% during the forecast period from 2024 to 2030. The Asia Pacific region is home to some of the largest Muslim populations in the world, including countries like Indonesia, Malaysia, and Bangladesh. As the Muslim population continues to grow, so does the demand for clothing that aligns with Islamic principles of modesty and halal standards. This demographic trend is a significant driver of the increasing demand for fashion accessories in the region. Additionally, the increased availability and accessibility of fashion accessories in both physical and online retail channels are making it easier for consumers to find products that align with their values, further driving demand.

Key Fashion Accessories Company Insights

The fashion accessories market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Fashion Accessories Companies:

The following are the leading companies in the fashion accessories market. These companies collectively hold the largest market share and dictate industry trends.

- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Richemont International SA

- Chanel S.A.

- Hermès International S.A.

- Burberry Group plc

- Coach, Inc.

- Michael Kors Holdings Limited

- Prada S.p.A.

- Tiffany & Co.

Recent Developments

-

In July 2024, HIE launched a customizable vegan handbag collection that allows customers to personalize their bags according to their preferences. The collection features a variety of styles and colors made from sustainable materials, emphasizing the brand's commitment to eco-friendly fashion. Customers can choose different components, such as straps and embellishments, to create unique combinations that reflect their style.

-

In July 2024, The Aditya Birla Group launched its in-house jewelry brand, Indriya, aiming to establish a strong presence in the rapidly expanding Indian jewelry market, valued at ₹6.7 lakh crore. The group plans to invest USD 596.31 million into Indriya to position it among the top three jewelry retailers in India within the next five years. This move directly competes with established brands like Tata Group’s Tanishq and Reliance Jewels, as well as other national chains such as Kalyan Jewelers and Joyalukkas.

Fashion Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 851.85 billion

Revenue forecast in 2030

USD 1259.43 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

LVMH Moët Hennessy Louis Vuitton SE; Tiffany & Co.; Kering S.A.; Richemont International SA; Chanel S.A.; Hermès International S.A.; Burberry Group plc; Coach; Inc.; Michael Kors Holdings Limited; Prada S.p.A.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Fashion Accessories Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fashion accessories market report based on product, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Jewelry

-

Watches

-

Handbags & Purses

-

Belts & Wallets

-

Sunglasses

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fashion accessories market size was estimated at USD 752.1 billion in 2023 and is expected to reach USD 798.82 billion in 2024.

b. The global fashion accessories market is expected to grow at a compounded growth rate of 7.9% from 2024 to 2030 to reach USD 1,259.44 billion by 2030.

b. Fashion accessories for women accounted for a share of 52.5% in 2023. More women are becoming aware of the importance of dressing modestly in accordance with Islamic guidelines. This increased awareness, coupled with a stronger adherence to religious practices, has led to a higher demand for clothing that aligns with their values, such as fashion accessories that respects modesty requirements.

b. Some key players operating in fashion accessories market include LVMH Moët Hennessy Louis Vuitton SE, Tiffany & Co., Kering S.A., Richemont International SA, and others.

b. Key factors that are driving the market growth include rising expenditure on luxury products and increasing disposable income

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.