- Home

- »

- Next Generation Technologies

- »

-

Fantasy Sports Market Size & Share, Industry Report, 2030GVR Report cover

![Fantasy Sports Market Size, Share & Trends Report]()

Fantasy Sports Market (2025 - 2030) Size, Share & Trends Analysis Report By Sports (Individual Sports, Partner Sports), By Platform (Web-based, Application-based), By Sports Type, By Gameplay, By Device, By Demographics, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-084-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fantasy Sports Market Summary

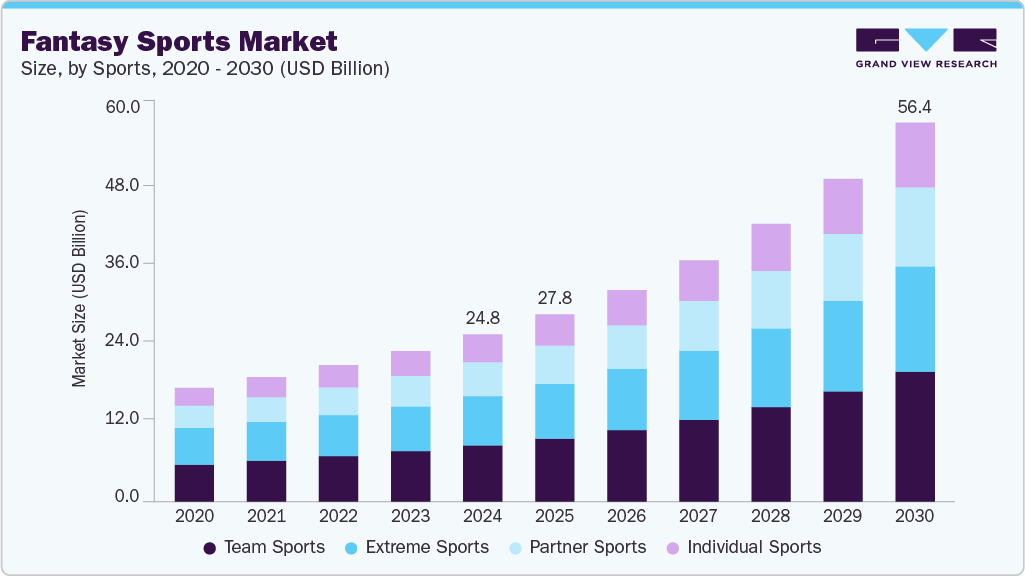

The global fantasy sports market size was estimated at USD 24,853.7 million in 2024 and is projected to reach USD 56,381.2 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. This growth is largely driven by the expanding global fan base across both mainstream and niche sports.

Key Market Trends & Insights

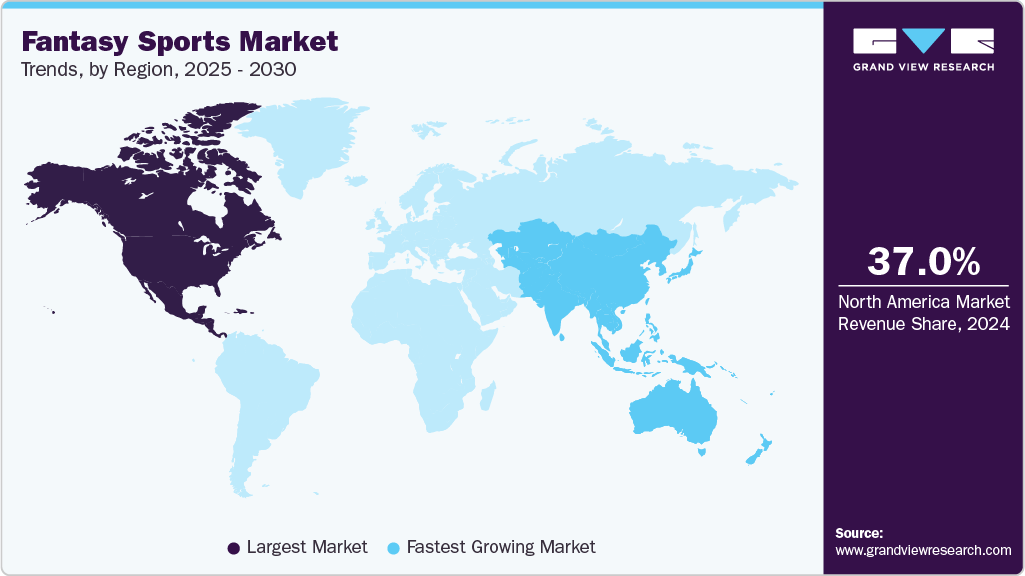

- North America fantasy sports industry dominated globally with a revenue share of over 37% in 2024.

- The U.S. fantasy sports industry dominated the market with a share of over 86% in 2024.

- Based on sports, the team sports segment dominated the market with a revenue share of over 33% in 2024.

- By sports type, the football/soccer segment accounted for the largest market share in 2024.

- Based on gameplay, the team competition segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24,853.7 Million

- 2030 Projected Market Size: USD 56,381.2 Million

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing sports enthusiasm and awareness, particularly among younger demographics, is enhancing user engagement and participation. The widespread availability of internet access and smartphones further enables fans to interact with their favorite sports and athletes through fantasy platforms, encouraging social interaction and competitive play. In addition, rising disposable incomes and this demographic shift are expanding the market’s reach and supporting sustained long-term growth in the fantasy sports industry. Rapid advancements in mobile technology, high-speed internet, AI, machine learning, augmented reality (AR), virtual reality (VR), and blockchain are revolutionizing the fantasy sports industry. These technologies enable real-time data integration, personalized gaming experiences, enhanced user engagement through gamification, and secure payment systems. AI-driven recommendations and customization improve player retention, while AR/VR offer immersive experiences. Blockchain facilitates transparency and new monetization models such as NFT-based games, all contributing to a more interactive and dynamic fantasy sports industry expansion.

In addition, the rapid adoption of smartphones and improved internet connectivity have made mobile apps the primary gateway for fantasy sports participation, driving market growth and innovation. Fantasy sports apps now offer real-time player performance tracking, live contests, and push notifications, allowing users to make instant decisions and stay engaged throughout live sporting events. The integration of gamification, social features, and seamless user interfaces on mobile platforms is expected to drive the fantasy sports industry growth in the coming years.

Furthermore, fantasy sports platforms are increasingly focusing on user engagement through interactive features such as live contests, social connectivity, player rankings, rewards, and virtual competitions. The adoption of freemium models, in-app purchases, premium subscriptions, and advertising generates diversified revenue streams. Integration with social media and brand promotion activities further amplifies user acquisition and retention. These strategies create immersive and rewarding experiences that attract and maintain a loyal user base, fueling market expansion.

Moreover, companies are focusing on user-centric innovation, strategic partnerships, and mobile-first platforms to drive growth in a competitive market. By leveraging advanced technologies such as AI and real-time analytics, they enhance personalization and engagement, while collaborations with sports leagues and media brands boost credibility and reach. Companies are also diversifying their offerings with new sports, daily fantasy formats, and digital monetization models, all while expanding into new regions and adapting to local regulations to capture a broader audience and thereby driving the fantasy sports industry growth.

Sports Insights

The team sports segment dominated the market with a revenue share of over 33% in 2024, driven by the global popularity of traditional team-based sports such as football, basketball, and baseball. These sports have well-established leagues and tournaments that attract large fan bases, encouraging extensive participation in fantasy leagues. The social and competitive nature of team sports fantasy games, combined with live broadcasting and real-time data availability, enhances user engagement and retention, thereby driving the segmental growth.

The extreme sports segment is expected to witness the fastest CAGR of over 15% from 2025 to 2030, driven by growing global interest in adventure sports such as skateboarding, surfing, and snowboarding, especially among younger, tech-savvy users. The use of real-time data, immersive technologies (AR/VR), and AI-powered insights enhances fan engagement, while social media and streaming platforms boost visibility. Inclusion in major international events and rising demand for interactive, personalized fantasy contests are further expanding the user base and driving engagement in this segment.

Sports Type Insights

The football/soccer segment accounted for the largest market share in 2024, supported by its massive global fan base and extensive league structures such as the English Premier League, La Liga, and FIFA tournaments. The sport’s year-round calendar and high media coverage foster continuous engagement in fantasy leagues. Integration with social media and mobile apps further enhances participation, allowing fans worldwide to connect and compete in real-time, thereby driving segmental growth.

The cricket segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the sport’s surging popularity in emerging markets such as India, Southeast Asia, and the Middle East. Increasing smartphone penetration, affordable internet access, and the rise of T20 leagues have expanded the fan base, thereby driving the segmental growth. Mobile-based fantasy platforms tailored to cricket’s fast-paced format and regional preferences are attracting new users, boosting market growth.

Gameplay Insights

The team competition segment accounted for the largest market share in 2024, primarily driven by the social and interactive aspects of team-based fantasy contests. These competitions promote collaboration and rivalry among friends and communities, enhancing user engagement. The availability of diverse team formats and leagues across multiple sports also broadens appeal, making it a preferred choice for many fantasy sports enthusiasts and thereby driving segmental growth.

The individual competition segment is expected to witness the fastest CAGR from 2025 to 2030, driven by increasing demand for personalized, skill-based contests. AI and machine learning technologies enable real-time player performance tracking and customized game formats, appealing to users who prefer solo challenges. The rise of esports and other individual sports is further fueling the segment growth.

Device Insights

The smartphone segment accounted for the largest market share in 2024, supported by widespread smartphone adoption, improved mobile internet connectivity, and the convenience of mobile apps that allow users to participate anytime and anywhere. Mobile platforms offer user-friendly interfaces, push notifications, and social sharing features, which significantly enhance user engagement and retention.

The others segment is expected to witness a significant CAGR from 2025 to 2030, as cross-platform accessibility improves and users seek diverse ways to engage with fantasy sports. Enhanced web interfaces, tablet applications, and integration with smart TVs and wearable devices contribute to expanding the user base. This diversification caters to different user preferences and broadens market reach.

Demographic Insights

The under-25 years segment held the largest market share in 2024, primarily driven by the tech-savvy youth’s affinity for mobile gaming, social media integration, and interactive fantasy sports platforms. This demographic spends significant time on smartphones and online communities, making fantasy sports a popular avenue for social interaction, entertainment, and competition.

The 25 to 40 years segment is expected to witness a significant CAGR from 2025 to 2030, supported by rising disposable incomes, legalization of sports betting, and increasing interest in fantasy sports as a form of entertainment and social engagement. This age group values skill-based gaming and often participates in paid contests, contributing to market monetization and growth.

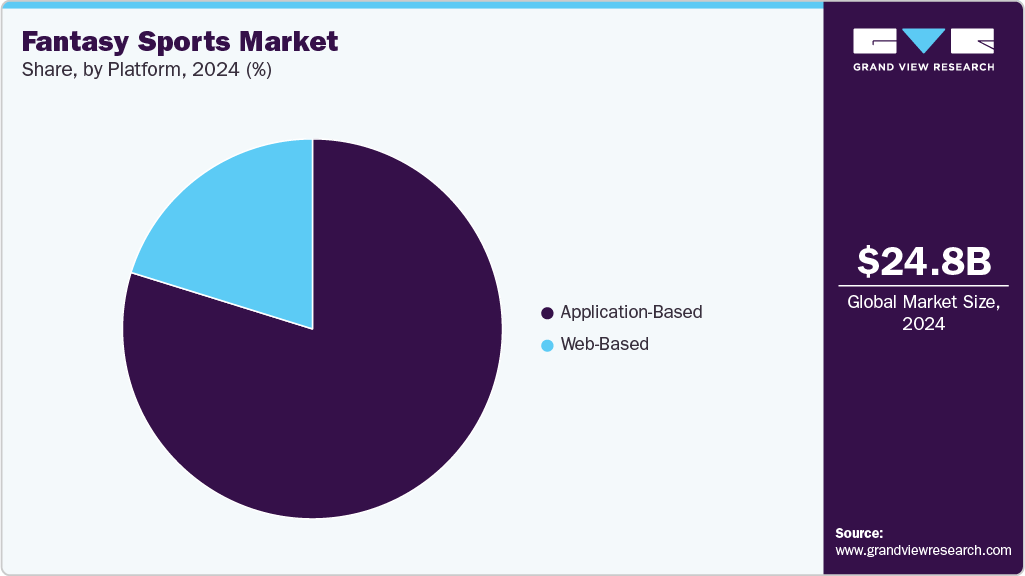

Platform Insights

The application-based segment accounted for the largest market share in 2024, driven by the widespread adoption of smartphones, high-speed internet connectivity, and the demand for seamless, on-the-go user experiences. Advancements in AI and machine learning enable personalized recommendations, predictive analytics, and dynamic notifications, enhancing user engagement and retention. The rise of micro-transactions, multi-sport and niche league support, and enhanced social features further expands the user base, thereby driving the segmental growth.

The web-based segment is expected to witness a significant CAGR from 2025 to 2030, driven by its accessibility across multiple devices without requiring downloads, making it appealing for users who prefer desktop or cross-platform experiences. Web platforms often provide comprehensive interfaces with advanced analytics, real-time data visualization, and community forums, catering to serious fantasy sports enthusiasts and those managing multiple teams or leagues. The segment benefits from increasing internet penetration, cross-platform compatibility, and integration with social media, which enhances user interaction and sharing.

Regional Insights

North America fantasy sports industry dominated globally with a revenue share of over 37% in 2024, driven by the legalization and rapid expansion of sports betting across multiple states, with daily fantasy sports (DFS) dominating due to their shorter commitment and frequent play. The region benefits from high internet penetration, widespread smartphone adoption, and increasing consumer spending on fantasy sports, particularly in football, basketball, and baseball. Regulatory clarity and technological integration, including AI and mobile-first platforms, further fuel growth.

U.S. Fantasy Sports Market Trends

The U.S. fantasy sports industry dominated the market with a share of over 86% in 2024, driven by technological advancements, such as AI-driven analytics and user-friendly interfaces, which enhance the gaming experience. Partnerships between fantasy platforms and professional leagues, along with engaging features like live drafts and rewards, continue to attract a diverse audience in the U.S.

Europe Fantasy Sports Market Trends

The European fantasy sports industry is expected to grow at a CAGR of over 12% from 2025 to 2030, owing to the growing legalization of sports betting, rising internet penetration, and increasing popularity of football and basketball fantasy leagues. Countries such as Germany, the UK, and France are key contributors, supported by strong sports culture and digital infrastructure. The market is further driven by innovations in AI, real-time data analytics, and immersive technologies like AR/VR, enhancing user engagement.

The UK fantasy sports industry is expected to grow at a significant rate in the coming years, driven by widespread sports enthusiasm, particularly for football and cricket, combined with a mature digital ecosystem and progressive regulatory environment for sports betting and fantasy gaming. Leading platforms integrate AI and machine learning for personalized user experiences, while partnerships with major sports leagues and broadcasters enhance content offerings. The rise of mobile gaming and social features also boosts participation and monetization opportunities.

The Germany fantasy sports industry is driven by increasing legalization of sports betting, strong football fandom, and rising adoption of mobile and online fantasy platforms. The market benefits from technological advancements in AI and data analytics, improving game formats and player engagement. Government initiatives to regulate and promote responsible gaming create a stable environment for market expansion.

Asia Pacific Fantasy Sports Market Trends

The Asia Pacific fantasy sports industry is expected to grow at a CAGR of over 17% from 2025 to 2030, fueled by a large, young, and tech-savvy population, rising smartphone penetration, and increasing disposable incomes. The market growth is further driven by increasing interest in cricket, football, and basketball fantasy leagues. The market also benefits from localized content, partnerships with sports leagues, and innovations such as AI and AR/VR integration.

The Japan fantasy sports industry is gaining traction, driven by the country’s strong sports culture, high smartphone usage, and increasing interest in fantasy leagues for baseball, soccer, and sumo wrestling. The market benefits from technological advancements such as AI-based player performance predictions and mobile app innovations. Regulatory frameworks are evolving to accommodate fantasy sports and sports betting, encouraging new entrants and partnerships with major sports leagues and media companies.

The China fantasy sports industry is rapidly expanding, driven by increasing internet and mobile device penetration and government initiatives to promote digital entertainment and sports engagement. However, regulatory restrictions on gambling and betting create challenges. The market focuses on social and casual fantasy games with an emphasis on basketball and football, supported by rising esports popularity. Integration of AI-driven analytics and partnerships with local sports organizations helps enhance user experience and market potential.

Key Fantasy Sports Company Insights

Some of the key players operating in the market are DraftKings, Inc., and FanDuel, among others.

-

DraftKings, Inc. is a U.S.-based sports technology company, initially launched as a daily fantasy sports platform. DraftKings expanded into sports betting and iGaming following the 2018 Supreme Court ruling that legalized sports betting in the U.S. The company offers a comprehensive suite of services, including daily fantasy sports, an online sportsbook, and casino games.

-

FanDuel is a premier mobile gaming destination in North America, offering a range of services including sports betting, iGaming, horse racing, and daily fantasy sports. The company was acquired by Flutter Entertainment in 2018 and operates FanDuel TV and FanDuel TV+, providing extensive sports content and live events. FanDuel is known for its user-friendly platforms and innovative features, such as Same Game Parlays, and maintains strong partnerships with major sports leagues such as the NFL, NBA, and MLB.

Dream Sports Group and MY11Circle are some of the emerging market participants in the fantasy sports industry.

-

Dream Sports Group operates a portfolio of brands, including Dream11, the world's largest fantasy sports platform with over 230 million users. Other brands under its umbrella include FanCode, a digital sports platform offering live streaming and merchandise, and DreamSetGo, a sports travel and experiences platform. Dream Sports aims to "Make Sports Better" by leveraging technology to enhance the sports ecosystem in India.

-

RotoWire is a U.S.-based provider of expert fantasy sports news and advice that offers comprehensive coverage across major sports, including MLB, NFL, NBA, NHL, college football, college basketball, esports, MMA, and more. In January 2022, RotoWire was acquired by Gambling.com Group Limited (NASDAQ: GAMB), a performance marketing company specializing in the online gambling industry. This acquisition has enabled RotoWire to expand its offerings into sports betting, including the launch of "Prop Points," a daily TV show on VSiN featuring RotoWire analysts discussing player props across fantasy sports and the betting market.

Key Fantasy Sports Companies:

The following are the leading companies in the fantasy sports market. These companies collectively hold the largest market share and dictate industry trends.

- Dream Sports Group

- CBS Sports Digital

- Realtime Fantasy Sports Inc.

- Flutter Entertainment plc

- Vauntek Inc. (Fantrax)

- DraftKings

- Pure Win (Sweetspot N.V.)

- FanDuel

- FantasyPros.com

- MY11Circle

- FANTACALCIO (Quandronica Srl)

- RotoWire (GDC Media Limited)

- NBC Sports Edge (NBC Sports Group)

- MyFantasyLeague (Sideline Software Inc.)

- Office Football Pool (OFP Hosting Inc.)

Recent Developments

-

In May 2025, Dream Sports Group announced a strategic partnership with Microsoft at WAVES 2025 to publish Microsoft’s gaming portfolio in India and co-develop AI-driven gaming experiences tailored for Indian gamers. This collaboration aims to leverage Microsoft’s technical and AI expertise alongside Dream Sports’ 250 million user base to redefine the future of online gaming in India

-

In May 2025, CBS Sports announced a landmark multi-platform rights agreement with World Rugby, making Paramount+ the exclusive U.S. home for all men’s and women’s World Rugby events, including the next three Rugby World Cups and all USA national team matches. This deal significantly expands rugby’s visibility and fan engagement in the U.S. across streaming and linear platforms.

-

In March 2025, U.S. Soccer and CBS Sports reached a multi-year multimedia rights agreement, granting CBS Sports exclusive English-language coverage of the Lamar Hunt U.S. Open Cup. CBS Sports will stream every match live on Paramount+ and provide extensive ancillary content, boosting the tournament’s accessibility and popularity among U.S. soccer fans.

Fantasy Sports Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27,837.1 million

Revenue forecast in 2030

USD 56,381.2 million

Growth rate

CAGR of 15.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sports, sports type, platform, gameplay, device, demographic, region

Country scope

U.S.; Canada; Germany; UK; France; Italy; China; Japan; India; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Dream Sports Group; CBS Sports Digital; Realtime Fantasy Sports Inc.; Flutter Entertainment plc; Vauntek Inc. (Fantrax); DraftKings, Inc.; Pure Win (Sweetspot N.V.); FanDuel; FantasyPros.com; MY11Circle; FANTACALCIO (Quandronica Srl); RotoWire (GDC Media Limited); NBC Sports Edge (NBC Sports Group); MyFantasyLeague (Sideline Software Inc.); Office Football Pool (OFP Hosting Inc.)

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Fantasy Sports Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the fantasy sports market report based on sports, sports type, platform, gameplay, device, demographic, and region:

-

Sports Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Sports

-

Partner Sports

-

Team Sports

-

Invasion Game

-

Net Game

-

Field & Striking Game

-

Target Game

-

-

Extreme Sports

-

-

Sports Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Type

-

American Football (Rugby)

-

Baseball

-

Basketball

-

Car Racing

-

Cricket

-

Football/Soccer

-

Others (MMA, Boxing, Golf, eSports, Etc.)

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-Based

-

Application-Based

-

-

Gameplay Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Competition

-

Team Competition

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Computer

-

Others

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Under 25 Years

-

25 to 40 Years

-

Above 40 Years

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fantasy sports size was estimated at USD 24,853.7 million in 2024 and is expected to reach USD 27,837.1 million in 2025.

b. The global fantasy sports market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 56,381.2 million by 2030.

b. Based on the sports type, football/soccer segment dominated the fantasy sports market with a share of over 21% in 2024. This is attributable to growing popularity of fantasy sports among the millennials.

b. Some key players operating in the fantasy sports market include Dream Sports Group, CBS Sports Digital, NFL Enterprise LLC, and Others

b. Key factors that are driving the fantasy sports market growth include rising affordability of high-speed internet services and increased penetration of smartphones.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.