Fall Detection Systems Market Size, Share, & Trends Analysis Report By Product, By System (Wearable, Non Wearable), By Technology, By Component, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-400-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Fall Detection Systems Market Size & Trends

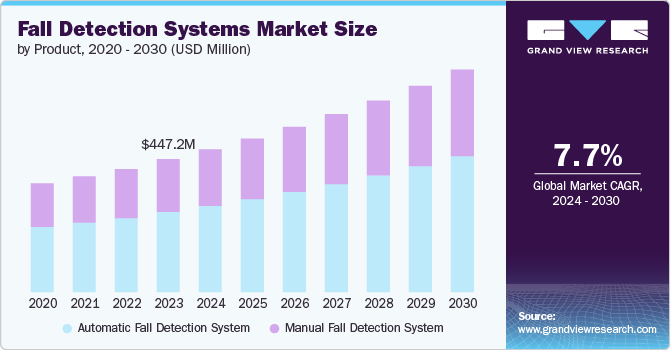

The global fall detection systems market size was estimated at USD 447.18 million in 2023 and is projected to grow at a CAGR of 7.66% from 2024 to 2030. The rising adoption of mobile-based solutions for personal safety, the increasing elderly population globally, and advancements in wearable technology is expected to drive the market growth. As the elderly population continues to rise, there's a significant increase in the demand for solutions to ensure their safety and independence, making fall detection systems essential. Moreover, the growing demand for home healthcare services is expected to fuel market growth.

Advancements in technology to make devices more efficient and accessible, encouraging their adoption. The integration of artificial intelligence and machine learning technologies has improved the accuracy and reliability of fall detection systems, driving market growth. Many industry players are utilizing AI and ML technology to enhance the effectiveness of their products. For instance, in January 2023, Imagimob AB implemented its fall detection application, tinyML, on Syntiant’s ultra-low-power NDP120 Neural Decision Processor to support various applications, including fall detection, sound event detection, anomaly detection, keyword spotting, and gesture detection. This new platform uses data collection to deploy on the edge of a device quickly. In addition, the COVID-19 pandemic has highlighted the importance of remote monitoring and healthcare services, further accelerating the demand for such solutions.

The rising demand for home healthcare services, primarily influenced by an aging global population and the preference for aging in place, is significantly driving the market growth. Furthermore, key players in the industry are forming strategic partnerships to enhance their market presence. For instance, in March 2023, Raytelligence AB, a Swedish-based technological innovation firm, and Valtes, a Dutch-based caretech provider, partnered to develop an assisted living system for informal caregivers in Europe. This partnership aims to integrate Valtes' AI system with Raytelligence AB's Eazense radar technology for localization and fall detection to provide peace of mind for informal caregivers.

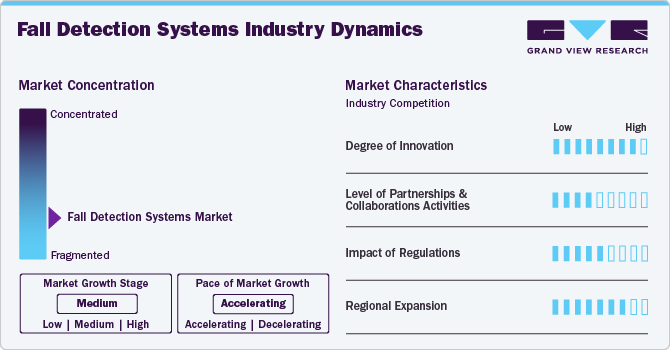

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, degree of innovation, impact of regulations, and regional expansion.

The market is fragmented, with the presence of several emerging service providers dominating the market. The degree of innovation is high, and the level of partnerships & collaborations activities is moderate. The impact of regulations on the industry is moderate, and the regional expansion of the industry is high.

The degree of innovation in the industry is high. Key players in this market are leveraging advancements in artificial intelligence, wearable technology, and sensor capabilities to develop more accurate and user-friendly solutions. These innovations aim to offer real-time monitoring, reduce false alarms, and facilitate swift assistance, ultimately improving the quality of life for seniors and those with mobility challenges. For instance, in November 2022, Wakayama Medical University and Fujitsu partnered to begin trials of a technology designed to assist caregivers and nurses in visually monitoring patients in privacy-sensitive environments such as nursing facilities and hospital rooms. The technology utilizes Fujitsu’s millimeter-wave sensor for accurate posture estimation and Actlyzer AI technology for analyzing human behaviors.

The industry's level of partnerships & collaborations is moderate. This is due to the focused nature of the technology and the specialized need of its end uses. Companies within this niche are cautious about forming partnerships and ensure that collaborations bring in complementary technologies or market access that align closely with their strategic goals.

The impact of regulations on the market is moderate due to the increasing use of technology and connectivity in fall detection systems; privacy and data protection have become significant concerns. Stringent data governance frameworks, such as the General Data Protection Regulation (GDPR) in Europe, mandate rigorous standards for the management of personal information. Although adherence to these regulations challenges and potentially restricts certain operations for manufacturers, it equally catalyzes advancing privacy and security protocols.

The level of regional expansion in the industry is high due to the growing awareness regarding the importance of elderly care and the effectiveness of fall detection systems in ensuring their safety. Many players are expanding their regional presence, undergoing strategic initiatives such as partnerships & collaboration, mergers & acquisitions, and other strategies. Some of the market players with their presence globally include Koninklijke Philips N.V., Apple Inc., Medical Guardian LLC, Semtech Corporation, and others.

Product Insights

The automated fall detection system segment led the market with the largest revenue share of 60.34% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment is attributed to the broader landscape of fall detection technologies as the aging global population. As more individuals enter their senior years, the demand for efficient, reliable, and non-intrusive methods of monitoring and providing immediate assistance in the event of a fall significantly increases. In addition, the integration of these technologies with wearable devices and smart home systems further broadens their appeal and utility, making them an essential tool in eldercare and healthcare sectors.

The manual fall detection system segment is anticipated to grow at a significant CAGR over the forecast period. Manual systems offer better accessibility to aid in case of falls, resulting in reduced medical expenses. Furthermore, the increasing demand for smartphones and wearable technology is driving the need for manual fall detection systems that can be integrated with these devices to enable the detection of falls and the transmission of alerts.

Type Insights

Based on type, the wearable segment led the market with the largest revenue share of 68.65% in 2023 and is anticipated to grow at a fastest CAGR over the forecast period. The growth of this segment is attributed to the rising demand for independent living among the elderly and the need for affordable, efficient healthcare solutions. Wearable devices, such as pendants and watches, offer real-time monitoring and prompt assistance for falls, enhancing user and family security. The addition of functionalities such as heart rate monitoring, GPS tracking, and emergency call capabilities has boosted their popularity. Moreover, increased smartphone penetration and compatible mobile app development accelerate wearable fall detection system adoption.

The non-wearable segment is anticipated to grow at a significant CAGR over the forecast period. The growth of this segment is due to a rising preference for passive, non-intrusive monitoring solutions, especially among seniors who often resist wearing devices consistently due to discomfort, and stigma. Non-wearable fall detection technologies, like floor and wall sensors or motion-detecting algorithms in home systems, offer 24/7 monitoring without the need for personal wearables. This method enhances acceptance and compliance, ensuring reliable, effective monitoring. Technological advancements, including improved sensor precision and AI integration to distinguish falls from regular activities, further enhance the appeal of non-wearable systems for users and caregivers alike.

Technology Insights

Based on technology, the sensor-based segment led the market with the largest revenue share of 43.49% in 2023. The growth of this segment is due to technological advancements that improve the sensitivity, accuracy, and reliability of sensors. This, combined with the increased adoption of wearable technologies among the elderly and individuals at risk of falls, to drive the demand for these systems. Furthermore, the integration of sensor-based fall detection systems with smart home technologies and mobile devices to improve their convenience and effectiveness, further contributing to their growing popularity.

The mobile phone-based segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is owing to the rising adoption of sensor-equipped smartphones, which significantly drives the market growth. Modern smartphones, featuring accelerometers and gyroscopes, offer precise fall detection capabilities. Their compatibility with health apps and emergency systems enhances their attractiveness for this purpose. Furthermore, the affordability and ongoing technological improvements in smartphones enhance the performance and reliability of these fall-detection solutions.

Component Insights

Based on component, the accelerometers and gyroscopes segment led the market with the largest revenue share of 38.15% in 2023. The growth of this segment is due to advances in MEMS (micro-electromechanical system) technology that enhance the precision and affordability of motion sensing. This innovation is important for accurate fall detection, ensuring swift responses that can save lives. Coupled with the integration of AI and machine learning, these sensors become more reliable, significantly reducing false alarms and bolstering user confidence.

The multimodal sensors segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is due to the rising demand for precise and dependable fall detection solutions, especially in elderly care and the expanding popularity of wearable technology and smart homes, underscores the significance of integrating multimodal sensors into everyday devices. This integration makes fall detection systems more user-friendly and seamlessly integrated into the lives of potential users.

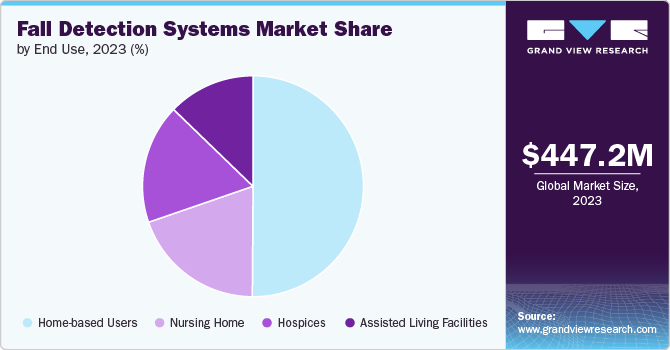

End Use Insights

Based on end use, the home-based users segment led the market with the largest revenue share of 50.10% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The growth of this segment is due to the growing global elderly population, which is more prone to falls due to factors such as reduced mobility, impaired balance, or chronic conditions like arthritis and Parkinson’s disease. Moreover, there is an increasing inclination towards aging-in-place, or the desire among older individuals to stay in their homes as long as possible, and the COVID-19 pandemic has emphasized the importance of remote monitoring solutions, accelerating the adoption of such systems to ensure the safety and well-being of the elderly without the need for constant physical supervision.

The nursing home segment is anticipated to grow at a significant CAGR over the forecast year. The growth is attributed to the rising implementation of state-of-the-art fall detection technology to safeguard residents in nursing homes. These systems, featuring sensors and wearables, provide instant monitoring and alerts, facilitating swift action during falls. This development to drive the desire to reduce healthcare costs and alleviate the burden associated with falls in these environments.

Regional Insights

North America dominated the fall detection systems market with the largest revenue share of 38.55% in 2023. This is due to the increasing elderly population; there is increasing need for solutions that enhance safety and provide immediate assistance in case of falls. Moreover, key players in the region are forming strategic partnerships to enhance their market presence. For instance, in April 2024, Koninklijke Philips N.V. partnered with smartQare, to use advanced sensors to monitor and respond to falls, reflecting the trend toward integrating these technologies into healthcare services.

U.S. Fall Detection Systems Market Trends

The U.S. fall detection systems market held the largest share in North America in 2023. This is due to the country’s aging population and the increasing need to provide them with reliable safety solutions. Fall detection systems, which help to automatically alert caregivers or emergency services in the event of a fall, represent a critical aspect of this safety net.

Europe Fall Detection Systems Market Trends

The fall detection systems market in Europe is driven by the rising integration of advanced technologies in fall detection systems, such as AI, IoT, and machine learning, to make these systems more reliable and user-friendly. In addition, leading companies in the fall detection systems market, such as Koninklijke Philips N.V., Tunstall Healthcare, and ADT, are expanding their product offerings and market presence in Europe. For instance, in May 2022, Tunstall Healthcare acquired Oy Verifi Ab, a provider of alarm monitoring services in Finland. This acquisition expanded Tunstall Healthcare's presence in Finland and introduced an alarm monitoring system to help secure the daily lives of older people in their own homes. It also aimed to increase the efficiency and security of healthcare and social operations.

The UK fall detection systems market held the largest market share in Europe in 2023, owing to the growing healthcare sector initiatives, technological advancements, regulatory support, and increased consumer awareness. For instance, the National Health Service (NHS) has been focusing on reducing falls among older patients in both Hospices and care homes. Initiatives such as the NHS Falls Prevention Program are pushing for the adoption of advanced fall detection technologies to monitor and respond to incidents promptly, thereby reducing hospital admissions and related healthcare costs.

The fall detection systems market in Germany held a significant market share in Europe in 2023, due to enhanced healthcare regulations and policies favoring elderly care innovations. The German Social Code (SGB) facilitates the funding and support for assistive technologies like fall detection systems, aiming to boost elderly and disabled care quality.

Asia Pacific Fall Detection Systems Market Trends

The fall detection systems market in Asia Pacific is expected to witness at the fastest CAGR over the forecast period, owing to the growing elderly population in countries such as Japan, China, and India. As the number of older adults increases, the need for effective fall-detection solutions to enhance safety and prevent injuries is expected to drive the market growth. This demographic trend underscores the urgent demand for advanced fall detection systems. By 2050, approximately 25% of individuals in Asia and the Pacific will be 60 or older. The number of older adults (those over 60) in the region is expected to triple from 2010 to 2050, surging to nearly 1.3 billion.

The China fall detection systems market held the largest share in Asia Pacific in 2023. With a significant rise in elderly individuals, there is a growing demand for technologies that monitor and respond to falls. These systems are becoming essential for improving safety and care for older adults in China. For instance, China has one of the fastest-growing aging populations in the world. Due to longer life expectancy and declining fertility rates, the population of people over 60 is projected to reach 28% by 2040.

The fall detection systems market in India is driven by the launch of new products that positively affect the market by addressing local needs, increasing accessibility, driving technological advancements, expanding market penetration, enhancing competition, raising awareness, and encouraging further investment and innovation. For instance, in February 2024, Dozee, a Bengaluru-based company, introduced a Fall Prevention Alert (FPA) feature designed to improve patient safety in Hospices. This system leverages real-time monitoring and proactive alerts to notify healthcare providers when a patient is at risk of falling. The technology uses the Dozee Sensor Sheet for bed exit logging and offers customizable alerts for high-risk patients, ensuring timely intervention and reducing fall risks.

Latin America Fall Detection Systems Market Trends

The fall detection systems market in Latin America is experiencing growth due to the increasing geriatric population and the subsequent rise in fall-related health concerns among the elderly. This demographic shift, combined with a greater awareness of the benefits of fall detection technologies in preventing serious injuries, is driving demand in the region.

The Brazil fall detection systems marketis projected to grow at a significant CAGR over the forecast period. Increasing elderly population and rising concerns about safety are driving demand for these devices. Innovations in technology and affordable solutions is expected to contribute to market expansion in the coming years.

Middle East & Africa Fall Detection Systems Market Trends

The fall detection systems market in Middle East & Africa is expected to grow at a significant CAGR during the forecast period, due to the ongoing development of healthcare infrastructure,coupled with growing awareness about the importance of early detection and intervention in preventing fall-related injuries, are propelling market growth. Moreover, the growing government initiatives and increased healthcare spending is contributing to the expansion of this market.

The Saudi Arabia fall detection systems market is anticipated to grow at a significant CAGR over the forecast period, owing to increased investment in healthcare services as part of the country's national development initiatives, such as Saudi Arabia's Vision 2030. This initiative aims to enhance healthcare infrastructure and integrate advanced technologies. As part of this initiative, there is a significant investment in smart healthcare solutions, including fall detection systems. These efforts are designed to improve patient safety and care through innovative technologies.

Key Fall Detection Systems Company Insights

The market is fragmented, with several major players and emerging players operating in this space are adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices. Some emerging market players in the global market include Cherish Health, Inc., Gamgee, FallCall Solutions, LLC, and Owlytics Healthcare.

Key Fall Detection Systems Companies:

The following are the leading companies in the fall detection systems market. These companies collectively hold the largest market share and dictate industry trends.

- ADT

- Apple Inc.

- Connect America

- Koninklijke Philips N.V.

- MariCare

- Medical Guardian LLC

- MobileHelp

- SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches

- Semtech Corporation

- Tunstall Group

Recent Developments

-

In July 2024, Gamgee, an Amsterdam-based tech company, launched its Wi-Fi Fall Protection system, an AI-powered and advanced Wi-Fi fall detection system for elderly care. This innovative system enhances the lives of seniors by offering instant alerts to family members and caregivers through an app

-

In February 2024, Mount Prospect Senior Living partnered with SafelyYou, Inc., a provider of real-time AI video technology for dementia care and 24/7 remote clinical support. This collaboration aimed to establish higher standards for fall detection care by addressing fall incidents, providing reassurance to families, and attracting new residents to senior living communities. The integration of SafelyYou's technology aims to provide solutions for Mount Prospect Senior Living residents and their families

-

In November 2023, MOBOTIX AG partnered with Kepler Vision Technologies to launch an intelligent sensor embedded in the MOBOTIX c71 Hemispheric Indoor Camera. The sensor is designed for elderly care, Hospices, and care facilities to accurately detect incidents like people falling and leaving the bed. This technology aims to reduce the workload of staff and increase cost efficiency

-

In January 2023, FallCall Solutions, LLC partnered with Talius Group Limited (HSC Technology Group) to launch an Android-based and iPhone medical alert system in Australia. This partnership aims to integrate next-generation Bluetooth medical alert devices and the HSC Talius Smart Care System into the FallCall application on a user’s Android or iPhone device

Fall Detection Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 480.65 million |

|

Revenue forecast in 2030 |

USD 748.40 million |

|

Growth rate |

CAGR of 7.66% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, technology, component, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Koninklijke Philips N.V.; Tunstall Group; Apple Inc.; ADT; Medical Guardian LLC; MobileHelp; MariCare; Semtech Corporation; Connect America; SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Fall Detection Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fall detection systems market report based on product, type, technology, component, end use, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic Fall Detection System

-

Manual Fall Detection System

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wearable

-

Wrist-Wear

-

Neckwear

-

Body-wear

-

Others

-

-

Non-Wearable

-

Camera

-

Floor Sensors

-

Wall Sensors

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

GPS-Based

-

Mobile Phone-Based

-

Sensor-Based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Accelerometers and Gyroscopes

-

Multimodal Sensors

-

Other Unimodal/Bimodal Sensors

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home-based users

-

Nursing home

-

Hospices

-

Assisted Living Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fall detection system market is expected to grow at a compound annual growth rate of 7.66% from 2024 to 2030 to reach USD 748.40 million by 2030.

b. North America dominated the market, with a share of over 38% in 2023. This is due to the increasing elderly population; there is increasing need for solutions that enhance safety and provide immediate assistance in case of falls.

b. "Some key players operating in the fall detection system market include Koninklijke Philips N.V.; Tunstall Group; Apple Inc.; ADT; Medical Guardian LLC; MobileHelp; MariCare; Semtech Corporation; Connect America; SafeGuardian Senior Medical Alarm SOS Pendants & Smartwatches.

b. Key factors that are driving the fall detection system market growth include increasing penetration of smartphones, technology advancements, and increasing demand for multimodal technology.

b. The global fall detection system market size was estimated at USD 447.18 million in 2023 and is expected to reach USD 480.65 million in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."