Facial Injectable Market Size, Share & Trends Analysis Report By Product (Collagen & PMMA Microspheres, HA), By Application (Facial Line Correction, Lip Augmentation), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-849-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Facial Injectable Market Size & Trends

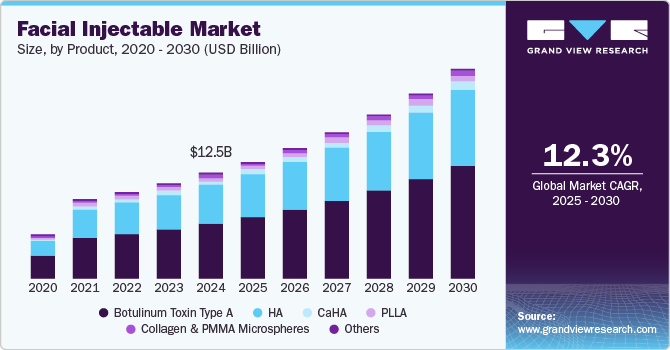

The global facial injectable market size was valued at USD 12.53 billion in 2024 and is expected to grow at a CAGR of 12.3% from 2025 to 2030. A growing focus on physical appearance among consumers has led to an increased demand for facial injectables in recent years. Increasing awareness regarding minimally invasive procedures due to various beauty campaigns being organized by key players in the market is also a driving factor for market growth. According to an article published by the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) in February 2025, fat grafting procedures have increased by 50%, highlighting the growing emphasis on volume restoration. Additionally, with one in four surgeons anticipating further demand for non-surgical treatments, such as injectables and skin tightening procedures, the industry is set to expand rapidly. This trend is further fueled by advancements in aesthetic medicine, evolving beauty standards, and a rising preference for minimally invasive treatments.

The presence of well-established key players such as Allergan, Sinclair Pharma, and Galderma with a comprehensive injectable fillers portfolio treating a broad range of skin indications such as wrinkles, pigmentation, plumping of lips, scars, restoring facial fullness as well as enhancing facial contours is expected to drive the demand for facial injectable procedures thereby boosting market revenue. Increasing social media exposure, rising effectiveness, and approvals for facial injectables as well as the escalating desire among the population to look aesthetically appealing and young is expected to drive the market during the forecast period.

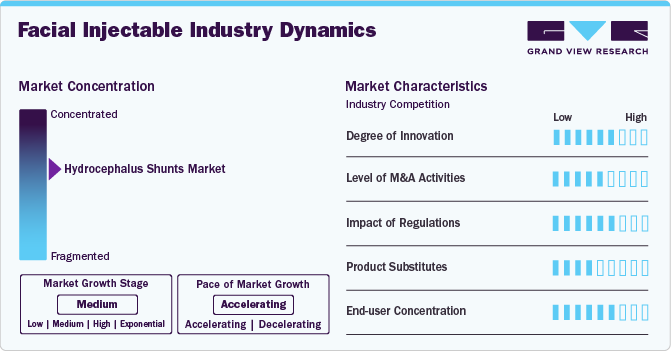

Market Concentration & Characteristics

The industry is witnessing a high degree of innovation, driven by advancements in formulation, longevity, and safety. New-generation hyaluronic acid fillers, biostimulatory injectables (like Radiesse and Sculptra), and next-gen botulinum toxins offer longer-lasting results, improved biocompatibility, and enhanced precision. Additionally, needle-free delivery systems, AI-assisted facial mapping, and regenerative aesthetics are transforming the market, making treatments more effective, personalized, and minimally invasive.

The industry is experiencing a moderate level of mergers and acquisitions (M&A) as key players seek to expand product portfolios, strengthen market presence, and enhance R&D capabilities. Companies like AbbVie (Allergan), Revance, and Evolus have engaged in strategic acquisitions and partnerships to diversify offerings and improve competitive positioning.

Regulations play a crucial role in the industry, impacting product approvals, safety standards, and market entry barriers. Strict regulatory oversight by agencies like the FDA, EMA, and NMPA ensures that injectables meet high safety and efficacy standards, influencing the time-to-market for new products. While stringent regulations enhance consumer trust and product quality, they also increase compliance costs and slow down innovation, making market entry challenging for smaller players.

The industry is witnessing significant product expansion, with companies introducing next-generation dermal fillers, longer-lasting botulinum toxins, and biostimulatory injectables. Innovations such as hyaluronic acid fillers with enhanced cross-linking, needle-free delivery systems, and combination therapies are broadening treatment options. Additionally, major players are expanding their portfolios into new indications, including jawline contouring, temple augmentation, and skin rejuvenation, driving market growth.

The industry is expanding across emerging regions, driven by rising aesthetic awareness, increasing disposable income, and regulatory approvals. Companies are entering Asia-Pacific, Latin America, and the Middle East & Africa, where demand for minimally invasive procedures is growing rapidly. Strategic partnerships, local manufacturing, and regulatory approvals are enabling global brands to strengthen their presence in these high-growth markets.

Product Insights

The botulinum toxin type A segment led the market in 2024 with a revenue share of more than 53.28%. The increasing adoption of this product is a key driver of growth in the industry. According to Botox Statistics 2025, over 4.7 million botulinum toxin type A procedures were performed in 2024-2025, reflecting the widespread demand for non-surgical wrinkle reduction and facial rejuvenation. Data from the 2023 Plastic Surgery Statistics Report by the American Society of Plastic Surgeons (ASPS) further highlights a 6% increase in these procedures compared to 2022, underscoring the steady market expansion. Leading injectable muscle relaxants, including Botox, Dysport, and Xeomin, continue to be widely used for their efficacy in addressing signs of aging. While Botox remains a market leader, Dysport and Xeomin offer faster onset times, with results appearing in two to three days compared to Botox’s four to five days. The continued clinical validation and safety profile of botulinum toxin injectables further reinforce their credibility, making them a cornerstone of minimally invasive aesthetic treatments. As consumer preference shifts towards quick, effective, and non-surgical anti-aging solutions, the botulinum toxin type A segment is poised for sustained growth within the industry.

The HA segment is expected to register the fastest growth rate in the market over the forecast period, driven by regulatory approvals, market expansion, and innovative treatment combinations. For instance, in February 2025, Evolus, Inc. secured FDA approval for Evolysse Form and Evolysse Smooth, marking its entry into the U.S. HA dermal filler market and increasing its total addressable market by 78% to approximately 6 billion. This milestone underscores the rising demand for advanced HA-based fillers that offer enhanced facial contouring and rejuvenation. Additionally, recent clinical findings emphasize the effectiveness of combining cryolipolysis with HA injections to reduce submental fullness and enhance jawline definition, significantly improving facial symmetry and cervicomental angles with high patient satisfaction and minimal adverse effects. The synergistic approach of fat reduction followed by structural augmentation is gaining traction, as it delivers comprehensive aesthetic enhancement, making HA injectables a preferred choice for non-surgical facial sculpting. With continuous product innovation and expanding treatment applications, the HA segment is poised for sustained growth in the industry.

Application Insights

Based on application, the facial line correction segment dominated the market and accounted for the largest revenue share of 33.2% in 2024. Facial line correction is a significant application within the market, catering to the preferences of individuals seeking nonsurgical cosmetic enhancements. This growth is owing to the increasing use of facial injectables for aesthetic procedures such as facial lines, wrinkles on the face, and lip lines. Factors such as growing awareness about aesthetic procedures and rising disposable income are expected to boost market growth. Also, the growing aging population globally contributes to the segment's expansion. According to UNFPA data, the global share of individuals aged 65 and older has nearly doubled, rising from 5.5% in 1974 to 10.3% in 2024, and is projected to reach 20.7% by 2074. Additionally, the population aged 80 and over is expected to more than triple, further accelerating demand for anti-aging aesthetic solutions. Developed nations currently have the highest proportion of elderly individuals, while developing countries are experiencing rapid population aging due to increased life expectancy and declining fertility rates. As signs of aging, such as wrinkles and fine lines, become more prominent with age, there is an increasing preference for minimally invasive treatments like botulinum toxin and dermal fillers to restore a youthful appearance.

The lip augmentation segment is expected to grow significantly due to the rising aesthetic consciousness, social media influence, and advancements in dermal filler technology. The increasing demand for fuller, well-defined lips, fueled by beauty trends and celebrity influence, has made minimally invasive lip enhancement procedures highly sought after. Hyaluronic acid-based fillers, known for their natural-looking results, safety, and reversibility, continue to dominate the market as patients seek customizable and temporary solutions for lip enhancement. Additionally, the younger demographic is increasingly turning to preventative aesthetic treatments, further boosting the demand for lip fillers. With quick procedure times, minimal downtime, and long-lasting yet non-permanent results, lip augmentation is set to be the fastest-growing application segment, attracting both first-time and repeat consumers in the industry.

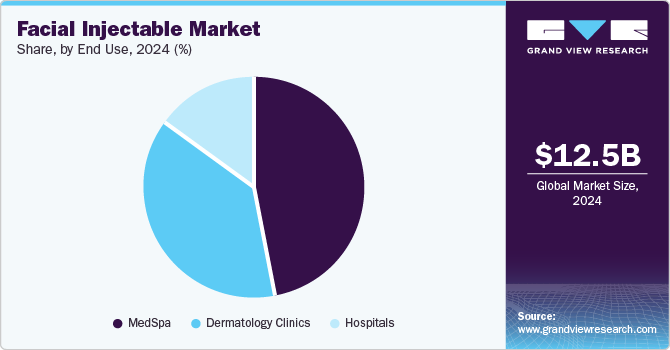

End Use Insights

Based on end-use, the medSpa segment dominated the market and accounted for the largest revenue share of 47.0% in 2024. It is anticipated to continue its dominance with a CAGR of 12.6% over the forecast period. Medspa is a facility where cosmetic services are provided under the supervision of a licensed physician. All non-invasive treatments are performed in these facilities, which include facial injections, non-invasive body contouring, skin rejuvenation, and laser treatments by experienced professionals.

These facilities follow all the regulatory policies and standards set by the government and have to be mandatorily owned by a physician. MedSpas are increasingly adopting novel treatment systems to gain a higher market share. The employees in medspas need to have a license in aesthetics as well as medical education.

Regional Insights

North America facial injectable market dominated the global industry and accounted for the largest revenue share of 38.9% in 2024, driven by an aging population and ongoing regulatory approvals for advanced aesthetic treatments. The FDA’s approval of Juvéderm Voluma XC in March 2024 for treating temple hollowing marks a major milestone, making it the first hyaluronic acid dermal filler approved for this indication, with results lasting up to 13 months. This approval reflects the growing demand for targeted facial rejuvenation solutions as the U.S. population continues to trend older. Currently, 62 million adults aged 65 and older make up 18% of the U.S. population, a figure projected to reach 84 million (23%) by 2054. Additionally, the number of centenarians is expected to double over the next 30 years, highlighting the increasing consumer base seeking non-surgical anti-aging treatments. As life expectancy rises and minimally invasive aesthetic procedures gain popularity, North America remains a key growth hub for the industry, with demand for dermal fillers and botulinum toxin treatments surging among both older adults and younger individuals seeking preventative aesthetic enhancements.

U.S. Facial Injectable Market Trends

The facial injectable market in the U.S. is set for accelerated growth, driven by expanding regulatory approvals and innovation in aesthetic treatments. For instance, in October 2024, Allergan Aesthetics, an AbbVie company, received FDA approval for BOTOX Cosmetic to treat moderate to severe platysma bands, making it the first injectable with four aesthetic indications-forehead lines, frown lines, crow’s feet, and now neck rejuvenation. This breakthrough expands the scope of non-surgical facial and neck treatments, addressing a growing consumer demand for comprehensive, minimally invasive aesthetic solutions. With BOTOX Cosmetic now extending beyond the face, the approval is expected to drive higher adoption rates and broaden the target patient base, further fueling the growth of the industry.

Europe Facial Injectable Market Trends

The facial injectable market in Europe is witnessing strong growth, driven by rising aesthetic consciousness, increasing disposable income, and advancements in non-invasive cosmetic procedures. A growing number of consumers are opting for minimally invasive treatments to enhance facial features and combat signs of aging without the downtime associated with surgery. Additionally, technological innovations in injectables, including longer-lasting formulations and improved safety profiles, are fueling market expansion. Regulatory approvals and product launches, such as Merz Aesthetics’ introduction of Ultherapy PRIME in early 2025, reflect Europe’s role as a hub for cutting-edge aesthetic treatments. With an aging population seeking anti-aging solutions and younger demographics increasingly embracing preventive aesthetics, the demand for facial injectables continues to surge across Europe, positioning the region as a key player in the market.

Germany facial injectable market dominated the European region and is experiencing significant growth, driven by technological advancements, product innovation, and increasing demand for non-invasive aesthetic treatments. For instance, in January 2025, Merz Aesthetics, a Germany-based company, launched Ultherapy PRIME across Europe, the Middle East, and Africa, enhancing its portfolio of non-invasive skin-lifting solutions. This development reflects a growing consumer preference for minimally invasive procedures that offer effective skin rejuvenation with minimal downtime. Additionally, Merz Aesthetics' presentation of six abstracts at the 2025 International Master Course on Aging Science (IMCAS) World Congress highlights Germany's strong role in advancing regenerative aesthetics. With continuous innovation in dermal fillers and botulinum toxin treatments, alongside rising awareness and adoption of aesthetic procedures, Germany remains a key market for facial injectables, with demand expected to grow as new technologies emerge.

Asia Pacific Facial Injectable Market Trends

The facial injectable market in Asia Pacific is expected to grow with the fastest CAGR of 16% during the forecast period. This rapid growth is fueled by the increasing adoption of Korean aesthetic innovations and the rising popularity of HA fillers. Companies like Hugel are actively expanding their influence, as seen in their participation at JAPSA 2024 in Tokyo, where they introduced The Chaeum HA filler and demonstrated its safety and effectiveness. With Korean medical aesthetics gaining global recognition, demand for minimally invasive procedures continues to rise across the region. Additionally, Japan has seen a 44% increase in cosmetic surgery clinics, reflecting a growing consumer interest in facial injectables for aesthetic enhancements.

The Asia-Pacific market is also benefiting from regulatory advancements and product innovations, expanding access to high-quality injectables. For instance, in February 2024, EG Bio Co., LTD, a South Korean company, obtained CE Mark certification for its EDEL X HA Dermal Filler, making it available in the European market. This approval highlights Asia's growing role in aesthetic product innovation and global expansion. The filler’s advanced formulation with lidocaine ensures a comfortable and painless experience, increasing consumer preference for non-surgical facial rejuvenation. With continuous technological advancements and rising aesthetic awareness, the Asia-Pacific region remains a key growth hub for the industry.

China facial injectable market is witnessing significant growth, driven by expanding product availability, increasing aesthetic awareness, and growing consumer demand for non-invasive treatments. In May 2024, Galderma launched Restylane VOLYME in China, addressing mid-face aging concerns with its Shape Up Holistic Individualized Treatment (HIT) approach, reflecting a commitment to personalized aesthetic solutions. Additionally, in September 2024, Allergan Aesthetics introduced BOTOX Cosmetic for the treatment of masseter muscle prominence (MMP), marking it as the first neurotoxin approved in China for this indication. With China’s medical aesthetics market outpacing global growth trends and relatively low market penetration, there remains vast potential for expansion. As global leaders continue investing in advanced injectables and regulatory approvals increase, China's Facial Injectable Market is set for robust growth, fueled by a rising middle-class population, higher disposable incomes, and a growing emphasis on facial aesthetics.

Latin America Facial Injectable Market Trends

The facial injectable market in Latin America is expanding rapidly, driven by increasing product availability, rising aesthetic awareness, and a growing number of procedures. In June 2024, HYAcorp, a leading German manufacturer of biphasic hyaluronic acid dermal fillers, strengthened its presence in the LATAM region, particularly in Mexico, to meet the surging demand for dermal fillers. The ISAPS Survey 2022 reported that Mexico alone accounted for approximately 197,441 hyaluronic acid injectable procedures, representing 26.1% of total procedures that year, emphasizing the region’s strong aesthetic market potential. With regulatory approvals facilitating the entry of international brands and a rising middle-class population increasingly seeking non-invasive cosmetic enhancements, Latin America continues to emerge as a key growth hub for facial injectables.

Brazil facial injectable market is experiencing robust growth, driven by the expansion of aesthetic clinics and a highly skilled workforce. According to a 2023 study by SciELO, Brazil had approximately 4,221 aesthetic clinics and over 139,000 health professionals working in the sector, highlighting the country’s thriving medical aesthetics industry. With a strong cultural emphasis on beauty and self-care, increasing accessibility to non-invasive treatments such as dermal fillers and botulinum toxin injections is further boosting demand. Additionally, technological advancements and the rising influence of social media are encouraging more consumers to opt for facial injectables for rejuvenation and enhancement. As the availability of skilled practitioners and specialized clinics continues to grow, Brazil remains a key player in the Latin American market.

Middle East & Africa Facial Injectable Market Trends

The facial injectable market in the Middle East and Africa is experiencing rapid expansion, driven by rising disposable incomes, increasing aesthetic awareness, and the region’s growing medical tourism industry. Countries like the UAE, Saudi Arabia, and South Africa are seeing a surge in demand for non-invasive cosmetic treatments, including botulinum toxin injections and dermal fillers, as consumers seek youthful and rejuvenated appearances. The availability of advanced aesthetic procedures, regulatory approvals for international brands, and a growing number of trained practitioners are further fueling market growth. Additionally, social media influence, celebrity culture, and shifting beauty standards are encouraging more individuals to opt for minimally invasive aesthetic enhancements. With government initiatives promoting medical tourism and an increasing number of specialized aesthetic clinics, the MEA market is poised for strong growth in the coming years.

South Africa facial injectable market is witnessing steady growth, fueled by increasing aesthetic awareness, rising disposable incomes, and greater accessibility to non-invasive cosmetic procedures. The expansion of international aesthetic brands into the South African market and the availability of advanced injectables are further contributing to market growth. As technological advancements improve treatment safety and effectiveness, South Africa is set to become a key player in the African medical aesthetics industry.

Key Facial Injectable Company Insights

Companies invest heavily in research and development to introduce new and improved products that cater to the unique requirements of children’s dental health. Regulatory bodies including the FDA closely monitor the Facial Injectable Market to ensure product safety and efficacy. This drives companies to adhere to stringent regulations while launching new products or claiming benefits.

Key Facial Injectable Companies:

The following are the leading companies in the facial injectable market. These companies collectively hold the largest market share and dictate industry trends.

- Ispen

- Abbvie

- Medytox Inc.

- Merz GmbH and Co. KGaA

- Revance Therapeutics, Inc.

- Galderma

- Sinclair Pharma

View a comprehensive list of companies in the Facial Injectable Market

Recent Developments

-

In February 2025, the FDA approved Evolysse Form and Evolysse Smooth, two hyaluronic acid injectable gels, for the treatment of nasolabial folds. This approval marks a significant advancement in dermal filler options for facial rejuvenation.

-

In July 2024, argenx and Zai Lab announced that the China National Medical Products Administration (NMPA) has granted approval for Efgartigimod Alfa Injection (Subcutaneous Injection) for the treatment of generalized myasthenia gravis (gMG). This milestone marks a significant advancement in the availability of innovative treatment options for patients in China.

Facial Injectable Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.9 billion |

|

Revenue forecast in 2030 |

USD 24.9 billion |

|

Growth rate |

CAGR of 12.3% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Ispen; Abbvie; Medytox Inc.; Merz GmbH and Co. KGaA; Revance Therapeutics, Inc.; Galderma; Sinclair Pharma |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Facial Injectable Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global facial injectable market report based on product, application, end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagen & PMMA Microspheres

-

Botulinum Toxin Type A

-

HA

-

CaHA

-

PLLA

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Line Correction

-

Lip Augmentation

-

Face Lift

-

Acne Scar Treatment

-

Lipoatrophy Treatment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

MedSpa

-

Dermatology Clinics

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global facial injectable market size was estimated at USD 12.53 billion in 2024 and is expected to reach USD 24.9 billion in 2024.

b. The global facial injectable market is expected to grow at a compound annual growth rate of 12.3% from 2025 to 2030 to reach USD 24.9 billion by 2030.

b. North America dominated the facial injectable market with a share of 38.9% in 2024. This is attributable to increased spending on aesthetic procedures and the easy availability of the products.

b. Some of the major players included in the facial injectable market are ALLERGAN; Ipsen; Merz Pharma; Suneva Medical, Inc.; Medytox, Inc.; Sinclair Pharma; Bloomage BioTechnology Corporation Limited; Anika Therapeutics, Inc.; Prollenium Medical Technologies Inc.; and Galderma S.A.

b. Factors like rising consciousness about external appearance among young and old individuals and rising awareness regarding the availability of various products and procedures, attributed to increasing globalization and social media influence are projected to further fuel the facial injectable market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."