- Home

- »

- Pharmaceuticals

- »

-

Fabry Disease Treatment Market Size & Share Report, 2030GVR Report cover

![Fabry Disease Treatment Market Size, Share & Trends Report]()

Fabry Disease Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution, By Treatment (Enzyme Replacement Therapy), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-747-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fabry Disease Treatment Market Summary

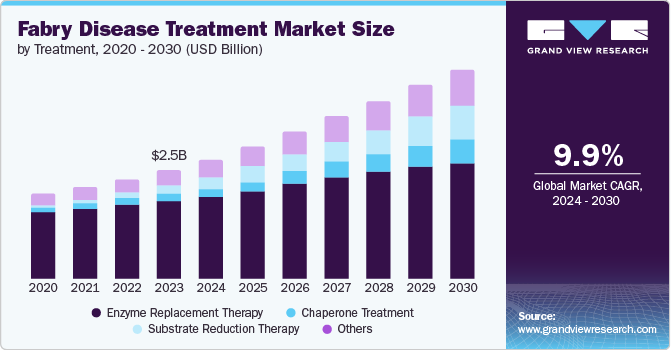

The global fabry disease treatment market size was estimated at USD 2.54 billion in 2023 and is projected to reach USD 4.93 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. Fabry Disease are caused due to aberrant accumulation of globotriaosylceramide, a specific type of fatty matter, in a number of bodily tissues, including the kidney, skin, gastrointestinal tract, heart, brain, and central nervous system.

Key Market Trends & Insights

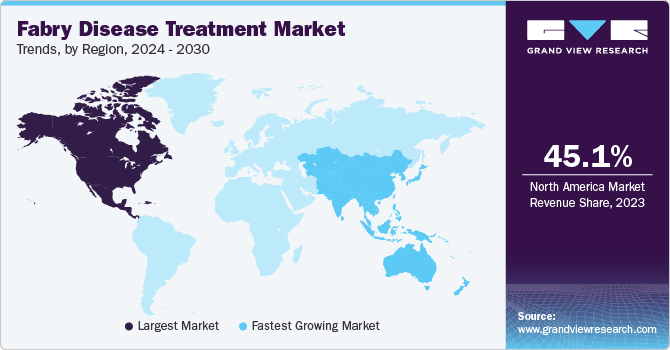

- North America dominated the fabry disease treatment market with a revenue share of 45.1% in 2023.

- The fabry disease treatment market in the U.S. led North America with a revenue share of 90.1% in 2023.

- By route of administration, the intravenous route segment led, with the largest revenue share of 65.9 % in 2023.

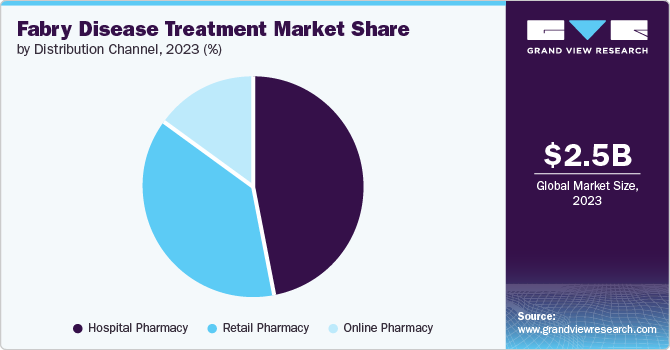

- By distribution channel, the hospital pharmacy segment held the largest revenue share of 46.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.54 Billion

- 2030 Projected Market Size: USD 4.93 Billion

- CAGR (2024-2030): 9.9%

- North America: Largest market in 2023

The number of individuals with fabry disease is increasing, and this, combined with the growing use of innovative treatments such as chaperone therapy, has given the industry an impetus.

This is anticipated to increase at a faster rate throughout the forecast period due to significant R&D efforts and the possible approval of promising pipeline items, including substrate reduction therapies and enzyme replacement therapies. Alpha-galactosidase deficiency results in progressive organ dysfunction, a rare X-linked lysosomal storage disorder.

One of the key factors propelling the growth of the global Fabry's disease treatment market is the prevalence of illnesses and the growing use of innovative medicines such as chaperone treatment. Furthermore, vigorous R&D efforts and the possible approval of promising pipeline items, such as substrate reduction therapies and enzyme replacement therapies, may accelerate the growth of the global market for treatments during the projection period. Some challenges facing the global market for disease treatments include side effects related to treatment choices and a need for diagnostic resources in emerging nations, which results in a lower diagnosis rate. There exist two medication regimens. The enzyme replacement treatment (ERT) is widely utilized. These are given as infusions, replacing any missing or malfunctioning enzyme. This allows your body to break down items containing fatty acids efficiently. Furthermore, it can reduce discomfort and other symptoms brought on by disease.

Treatment Insights & Trends

The enzyme replacement treatment segment dominated the market and accounted for a share of 72.3 % in 2023. Fabrazyme and Replagal's robust revenues along with the possible approval of intriguing pipeline medicines are driving the segment's dominance. However, a significant improvement in patient benefits will require the introduction of new, effective treatment options such as gene treatments. Enzyme replacement therapy is the standard of care for managing diseases.

While both ERTs-Fabrazyme from Sanofi and Replagal Shire-have received approval in Europe, only Fabrazyme has done so in the U.S. The goal of ongoing clinical trials is to enhance the safety and effectiveness profile of ERTs and introduce innovative oral treatments that can replace intravenous infusions as a means of treatment. In 2021, as the first oral chaperone medication, Galafold from Amicus Therapeutics received approval for the treatment of adult patients in the U.S., Canada, Europe, Japan, Australia, Israel, and South Korea.

Route of Administration Insights & Trends

Intravenous route dominated the market with a market share of 65.9 % in 2023 and is also expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. The standard treatment for disease management is enzyme replacement therapy. Although both ERTs, Fabrazyme and Replagal, were approved in Europe, only Fabrazyme was approved in the U.S. Current clinical trials are focused on improving the safety and efficacy profile of ERTs and introducing novel oral therapies that can eliminate the need for intravenous infusions. Recently, Amicus Therapeutics' Galafold received approval as the initial oral chaperone therapy for the treatment of adult patients in the U.S., Canada, European Union, Japan, Australia, Israel, and South Korea.

The enzyme replacement therapy segment held the largest market share in the year 2023. The strong sales of Fabrazyme and Replagal, coupled with the potential approval of promising pipeline candidates, are bolstering the dominance of the segment. Nonetheless, the introduction of novel and efficacious therapeutic alternatives, such as gene therapies, is imperative for a noteworthy enhancement in patient benefits.

Distribution Channel Insights & Trends

Fabry disease treatment market was dominated by hospital pharmacies by 46.8% in 2023 due to hospital pharmacies being responsible for providing pharmaceutical drugs to individuals during hospital-based inpatient or outpatient treatment, referred distribution channel for Fabry disease drugs, such as injectable and oral medications.

In addition, the hospitalpharmacies also contribute to the sales of new drugs, including for rare diseases such as Fabry disease. These pharmacies provide guidance on precise drug dosages, interactions, and potential side effects, as well as oversee patient compliance with medication regimens. This approach has the potential to enhance the patient outcomes.

Regional Insights & Trends

North America dominated the market with a share of 45.1% in 2023. This region is home to some of the most esteemed research and medical centers in the country, which have led the way in the advancement of Fabry disease research and treatment development. These organizations draw the best personnel and support ground-breaking medical advancements. Furthermore, the strong insurance coverage, significant healthcare infrastructure, and advantageous geographic location help for clinical trial sites and pharmaceutical companies.

U.S. Fabry Disease Treatment Market Trends

The fabry disease treatment market in the U.S. dominated North America with a share of 90.1% in 2023 owing to the excellent healthcare infrastructure. The regional pharmaceutical industry is driven by innovation, with a primary focus on the creation of novel medical treatments for various medical conditions. Furthermore, the increasing number of FDA (The Food and Drug Administration) approvals has contributed to the region's continued dominance.

Europe Fabry Disease Treatment Market Trends

Europe fabry disease treatment market was identified as a lucrative region in this industry. The UK fabry disease market is expected to grow rapidly in the coming years due to mature market with a well-developed infrastructure and consumer preferences.

Asia Pacific Fabry Disease Treatment Market Trends

Asia Pacific is a rapidly expanding region in the global fabry disease treatment market, driven by countries such as China, Japan, India, and South Korea. The region has a large population, rising disposable income, and increasing urbanization, which is expected to increase demand for Fabry disease treatment products and services.

India fabry disease treatment market is expected to grow rapidly in the coming years due advantages from a substantial population, a rising disposable income, and a growing urbanization, resulting in a greater demand for Fabry disease treatment products and services. China Fabry disease market held a substantial market share in 2023 owing to large number of population.

Key Fabry Disease Treatment Company Insights

Some of the key companies in the fabry disease treatment market include Sanofi S.A.; Shire PIc.; Amicus Therapeutics Inc.; ISU Abxis Co Ltd.;J CR Pharmaceuticals Co Ltd.; Protalix Biotherapeutics Inc.; and Idorsia Pharmaceuticals Ltd. The participants are involved in tactical strategy formation, creation of new treatments, and agreements aimed at achieving broad expansion and securing the top spot in the industry.

Sanofi S.A. healthcare companies are a culmination of a diverse group of companies collaborating on healthcare innovation. Also develops various treatments to treat numerous uncommon illnesses such as Fabry diseases. Amicus Therapeutics is a company that makes medicine for people with rare diseases. Amicus Therapeutics is focused on developing and expanding a pipeline of cutting-edge medicines for rare diseases such as fabry disease.

Key Fabry Disease Treatment Companies:

The following are the leading companies in the fabry disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi S.A.

- Shire PIc.

- Amicus Therapeutics Inc.

- ISU Abxis Co Ltd.

- JCR Pharmaceuticals Co Ltd.

- Protalix Biotherapeutics Inc.

- Idorsia Pharmaceuticals Ltd.

- Avrobio Inc.

- Takeda Pharmkceutical Co Ltd.

- Chiesi Farmaceutici SpA

- Freeline Therapeutics Holdings PLC

- Yuhan Corp

- MOP Therapeutics

Recent Developments

-

The FDA approved a record-breaking 55 new medications in 2023 after only 37 new ones were approved in 2022-the fewest since 2016. The list, which came just short of the all-time record of 59 approvals in a single year set in 2018, was the second longest in FDA history. The entire haul amounted to 66 new pharmaceuticals and biologics, since this annual report includes approvals for vaccines and biologics.

-

Protalix Bio Therapeutics, Inc. and Chiesi U.S. Rare Diseases received FDA clearance in May 2023 for Elfabrio (pegunigalsidase alfa-iwxj), which is intended to treat adult patients with Fabry disease. Elfabrio comes in single-dose vials containing 20 mg/10 mL of pegunigalsidase alfa-iwxj. It is a preservative-free solution. Every two weeks, intravenous infusions are used to treat patients.

-

Additionally, in May 2023, Sangamo Therapeutics, Inc.-a genomic medicine firm-obtained fast track designation for isaralgagene civaparvovec, also referred to as ST-920-a gene therapy product candidate that the company owns entirely and is meant to treat Fabry disease. Twenty patients have received doses of ST-920 so far in the Phase 1/2 STAAR research, which is currently evaluating the drug.

Fabry Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.79 billion

Revenue forecast in 2030

USD 4.93 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment Outlook, Route of Administration Outlook and Distribution Channel Outlook.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Sanofi S.A.; Shire PIc; Amicus Therapeutics Inc.; ISU Abxis Co Ltd.;JCR Pharmaceuticals Co Ltd.;Protalix Biotherapeutics Inc.;Idorsia Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

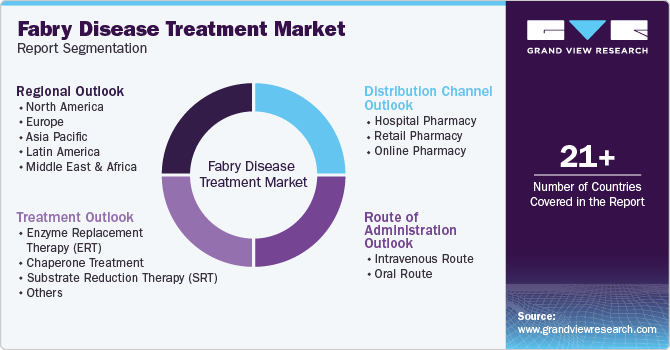

Global Fabry Disease Treatment Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fabry disease treatment market report based on treatment, route of administration, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme Replacement Therapy (ERT)

-

Chaperone Treatment

-

Substrate Reduction Therapy (SRT)

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous Route

-

Oral Route

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.