- Home

- »

- Homecare & Decor

- »

-

Fabric Softener And Conditioner Market Size Report, 2030GVR Report cover

![Fabric Softener And Conditioner Market Size, Share & Trends Report]()

Fabric Softener And Conditioner Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Type (Organic, Conventional), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-247-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fabric Softener & Conditioner Market Summary

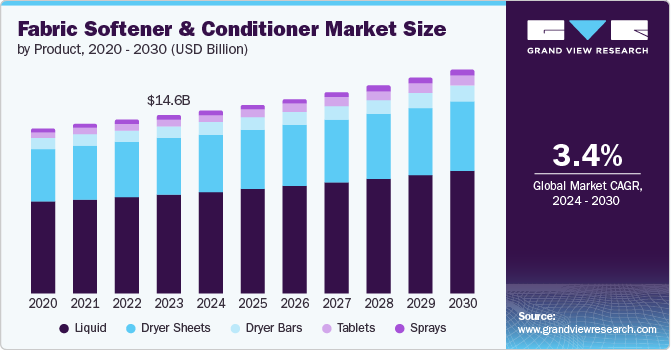

The global fabric softener and conditioner market size was valued at USD 14.59 billion in 2023 and is projected to reach USD 18.35 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. Increasing consumer awareness about the benefits of using fabric softeners & conditioners drives the market.

Key Market Trends & Insights

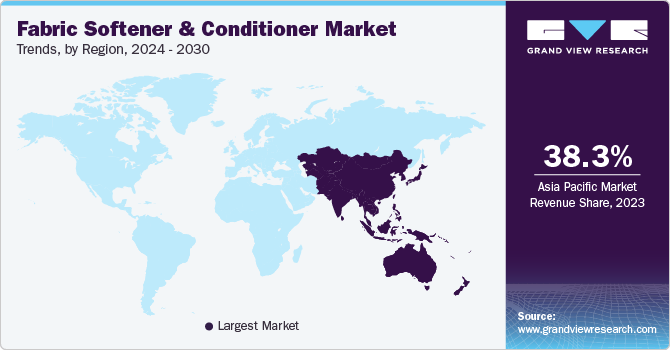

- Asia Pacific dominated the market with largest market revenue share of 38.3% in 2023.

- U.S. fabric softeners & conditioners market dominated the regional market in 2023.

- Based on product, the liquid segment held the largest market revenue share of 55.5% in 2023.

- Based on type, the conventional segment held the largest market revenue share in 2023.

- Based on application, the commercial segment held the largest market revenue share in 2023

Market Size & Forecast

- 2023 Market Size: USD 14.59 Billion

- 2030 Projected Market Size: USD 18.35 Billion

- CAGR (2024-2030): 3.4%

- Asia Pacific: Largest market in 2024

These products are perceived to enhance the comfort and feel of clothes, making them softer and more pleasant to wear. As lifestyles become more dynamic, consumers are looking for ways to simplify their laundry routines while still achieving high-quality results, contributing to the popularity of fabric softeners & conditioners.

The growing emphasis on hygiene and cleanliness is crucial in driving demand. Fabric softeners soften clothes and help reduce static cling and wrinkles, enhancing the overall appearance and feel of garments. In regions with humid climates, fabric softeners are particularly valued for their ability to maintain the freshness of clothes and reduce drying times. This convenience factor appeals to consumers who prioritize efficiency in their laundry processes.

Another factor contributing to the increasing demand is the growing global middle class, especially in emerging markets. As disposable incomes rise, consumers in these regions are more inclined to invest in products that improve their quality of life, including household items like fabric softeners & conditioners. Additionally, manufacturers are innovating with new formulations that offer additional benefits, such as long-lasting fragrances, eco-friendly ingredients, and specialized variants for different fabric types, catering to diverse consumer preferences and needs.

Furthermore, the shift towards sustainable and environmentally friendly products influences market trends. Many consumers now seek biodegradable and plant-based fabric softeners with minimal environmental impact. Manufacturers are responding to this demand by introducing eco-friendly options and expanding their customer base among environmentally conscious consumers.

Product Insights

The liquid segment held the largest market revenue share of 55.5% in 2023. The demand for liquid fabric softeners & conditioners is increasing primarily due to consumer preferences for convenience and effectiveness. Liquid products offer easier application than solid or sheet counterparts, as they can be easily dispensed and mixed into laundry cycles. Moreover, liquid formulations often boast enhanced features such as longer-lasting fragrances and superior fabric conditioning properties for consumers seeking multi-functional benefits. In addition to convenience, liquid fabric softeners are perceived to provide better fabric care by preventing static cling and maintaining fabric softness over multiple washes. This combination of convenience, effectiveness, and perceived superior performance drives the growing market preference for liquid fabric softeners & conditioners.

The sprays segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. The demand for spray fabric softeners & conditioners is expected to increase primarily due to their convenience and targeted application benefits. Sprays allow users to apply the product precisely where needed on clothing or upholstery, offering a more tailored softening experience than traditional formats like liquids or sheets. Moreover, they are perceived as environmentally preferable due to their reduced packaging and water requirements, aligning with the preferences of environmentally conscious consumers. Additionally, their compact size makes them suitable for niche markets, such as travelers or individuals with limited storage space, further driving their adoption in the market.

Type Insights

The conventional segment held the largest market revenue share in 2023. Conventional softeners have a longstanding presence in households compared to newer formulations or specialized products. Moreover, these products often come at a lower price than newer variants, benefiting budget-conscious consumers seeking cost-effective options without compromising fabric care. Additionally, conventional softeners' simplicity and ease of use contribute to their sustained demand.

The organic segment is anticipated to grow at the fastest CAGR over the forecast period. The demand for organic fabric softeners & conditioners is expected to rise primarily due to increasing consumer awareness and preference for natural ingredients and environmentally friendly products. Organic variants are considered safer alternatives to conventional products because they are free from synthetic chemicals like parabens, phthalates, and artificial fragrances. Consumers are increasingly seeking products that align with their health and sustainability values, driving the shift towards organic options in fabric care. For instance, In August 2020, RB announced the launch of a new line of laundry products called Botanical Origin, available exclusively on Amazon. These products are formulated with natural plant ingredients, offering consumers an eco-friendly alternative for laundry care. RB's Botanical Origin line aims to cater to the growing demand for sustainable and plant-based household products.

Application Insights

The commercial segment held the largest market revenue share in 2023. Commercial users such as hotels, hospitals, and laundromats prioritize products that ensure fabric quality and customer satisfaction. These segments require fabric softeners that soften and maintain fabrics' durability and appearance through multiple wash cycles. Additionally, there is a growing emphasis on eco-friendly formulations and hypoallergenic properties in commercial settings, catering to diverse customer needs and regulatory standards. As businesses aim to uphold hygiene standards and offer enhanced comfort to patrons, the adoption of effective fabric softeners & conditioners becomes integral to their operations.

The household segment is expected to witness the fastest CAGR over the forecasted period. Shifting consumer preferences toward products that enhance fabric care and comfort drive the segment's growth. Consumers are increasingly prioritizing convenience and effectiveness in laundry care routines, seeking products that soften fabrics and provide additional benefits such as static reduction and fragrance enhancement. Moreover, as lifestyles become more dynamic, there is a growing preference for products that streamline household chores without compromising on quality.

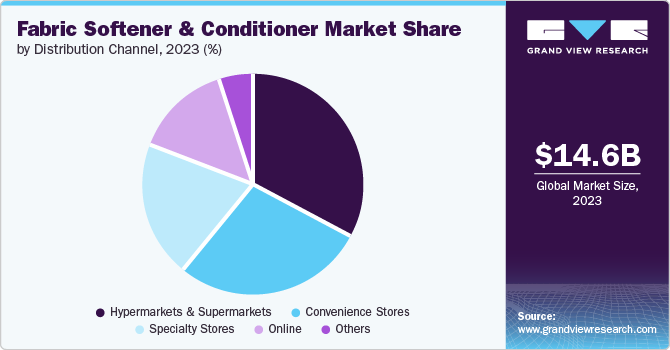

Distribution Channel Insights

The hypermarket and Supermarket segment dominated the market in 2023. Large retail outlets offer consumers a wide variety of choices under one roof, making it convenient for shoppers to compare different brands and products. Hypermarkets and supermarkets often leverage economies of scale to offer competitive pricing, which attracts budget-conscious consumers seeking value for money. Additionally, these stores invest significantly in promotional activities and displays, enhancing product visibility and consumer awareness.

The online segment is anticipated to witness the fastest CAGR over the forecast period. Online platforms offer consumers a convenient shopping experience, allowing them to browse various products and compare prices from various brands without leaving their homes. Additionally, the online segment provides a platform for manufacturers to reach a broader audience beyond traditional retail channels, enabling them to target niche markets or introduce new product innovations more effectively. Lastly, the increasing penetration of smartphones and internet access has further fueled online sales growth, making it a preferred choice for consumers looking for convenience and variety in purchasing fabric care products.

Regional Insights

North America fabric softeners & conditioners market is projected to experience significant market growth over the forecast period. The increasing demand is attributed to consumers' growing trend towards eco-friendly and hypoallergenic products, driven by rising awareness of environmental issues and health concerns. Manufacturers have responded by developing biodegradable formulations free from harsh chemicals, appealing to environmentally conscious consumers. The region's aging population has increased demand for fabric care products that cater to sensitive skin and delicate fabrics, thus boosting sales of gentle and dermatologically tested softeners and conditioners. Additionally, busy lifestyles have led consumers to seek convenience in laundry care, favoring products that simplify the washing process while delivering effective results.

U.S. Fabric Softener And Conditioner Market Trends

U.S. fabric softeners & conditioners market dominated the regional market in 2023. The growing emphasis on fabric care and hygiene among consumers drives the market growth. The trend towards environmentally friendly formulations has spurred innovation in the industry, with manufacturers introducing products perceived as safer for both fabrics and the environment. Additionally, convenience plays a significant role, as active lifestyles prompt consumers to seek products that streamline laundry routines while delivering effective results. Moreover, demographic shifts, such as smaller household sizes and more households with dual incomes, contribute to the demand, as these factors increase the reliance on laundry products that ensure fabric longevity and comfort.

Europe Fabric Softener And Conditioner Market Trends

Europe fabric softener & conditioner market was identified as lucrative in this industry. The market growth is attributed to the growing preference among consumers for clothing that feels softer and more comfortable. This trend is particularly pronounced in regions with colder climates where softer fabrics are perceived as more luxurious and comfortable against the skin. Additionally, as environmental consciousness rises, manufacturers are introducing eco-friendly formulations that appeal to European consumers who prioritize sustainability. Furthermore, the trend towards high-efficiency washing machines, which are more prevalent in Europe, necessitates products that prevent static cling and maintain fabric quality after repeated wash cycles.

U.K. fabric softener and conditioner market is witnessing an impactful growth in 2023. The increasing demand for fabric softeners & conditioners in the UK can be attributed to the growing awareness among consumers about the benefits of using these products. This awareness is fueled by extensive marketing campaigns highlighting the advantages of fabric softeners & conditioners in enhancing garment quality and comfort. Additionally, the trend towards eco-friendly and hypoallergenic formulations has gained traction in the UK market as consumers become more conscious of environmental impact and sensitive skin issues. Furthermore, the convenience offered by fabric softeners, which simplify laundry routines by reducing drying time and making ironing easier, appeals to busy households.

The fabric softener & conditioner market in Germany is anticipated to experience a rapid growth. The demand for fabric softeners & conditioners in Germany is on the rise primarily due to consumers increasingly prioritizing garment's softness and fragrance. As environmental awareness grows, there is a shift towards products that are perceived as eco-friendly and gentle on fabrics. Moreover, the convenience offered by these products, such as reducing drying time and minimizing wrinkles, appeals to active urban lifestyles prevalent in German cities. The competitive market also drives innovation, with brands continuously introducing new formulations and scents tailored to local preferences.

Asia Pacific Fabric Softener And Conditioner Market Trends

Asia Pacific dominated the market with largest market revenue share of 38.3% in 2023. As disposable incomes rise, consumers are increasingly willing to spend money on products that enhance the quality and comfort of their clothing. Fabric softeners are used to maintain garment softness and reduce static cling, which is particularly valued in regions with diverse climates like Asia-Pacific. Additionally, the trend towards automated washing machines and dryers in urban households further drives the demand for fabric care products that help preserve garment quality over repeated wash cycles. Furthermore, heightened awareness of hygiene and cleanliness standards, especially in densely populated urban areas, motivates consumers to invest in products that clean and maintain the softness and freshness of their clothes.

China fabric softener & conditioner market is projected to witness prominent growth in coming years. The demand for fabric softeners & conditioners is increasing due to the increasing disposable income among consumers. Additionally, urban consumers are increasingly aware of fabric care and hygiene, influenced by a desire for cleaner and more comfortable fabrics. Moreover, the rapid urbanization and modernization in China have bolstered the demand for convenience-oriented products, with fabric softeners & conditioners being seen as essential for maintaining fabric quality in modern lifestyles. Furthermore, manufacturers are innovating with products tailored to local preferences, such as formulations suitable for Chinese fabrics and climate conditions, further stimulating market growth.

The fabric softener and conditioner market in India has witnessed a substantial growth. As disposable incomes increase across urban and rural demographics, more Indian households are able to afford and prioritize premium laundry care products like fabric softeners. The growing awareness of personal hygiene and garment care among consumers is driven by urbanization and exposure to global trends through digital media. Additionally, India's climate, which often necessitates frequent washing of clothes, further boosts the need for products that maintain fabric quality over multiple wash cycles.

Key Fabric Softener And Conditioner Company Insights

Some of the key companies in the fabric softener & conditioner market include Procter & Gamble; Unilever PLC; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; Colgate-Palmolive Company

-

Procter & Gamble, with its Downy professional fabric softeners, makes fiber soft and delivers a long-lasting freshness on fabrics. Downy professional is utilized in washing machines by industries such as hotels and healthcare. It is also often used in residential laundry use.

- Unilever PLC's fabric conditioner brand Comfort, with additional variants such as Comfort Easy Iron and Comfort Bright Whites, is used to make cloths smooth, preserve their color, and prevent wrinkles. It also provides long-lasting freshness and fragrances.

Key Fabric Softener And Conditioner Companies:

The following are the leading companies in the fabric softener and conditioner market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Unilever PLC

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- Marico Limited

- LG H&H Co., Ltd.

- Pigeon Singapore Pte Ltd.

- Church & Dwight Co., Inc.

- Melaleuca Inc.

Recent Developments

-

In May 2024, Comfort announced the launch of a new botanical-inspired range of fabric conditioners. This range will include fragrances inspired by natural botanicals that appeal to consumers looking for a refreshing and natural scent experience for their laundry.

-

In August 2023, Colgate-Palmolive announced the launch of Soupline Hearts Concentrates, a new line of fabric conditioners designed to reduce plastic waste. These concentrates offer the same softness and fragrance as traditional fabric conditioners but in a smaller, more concentrated format.

Fabric Softener And Conditioner Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.01 billion

Revenue forecast in 2030

USD 18.35 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S. ; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Procter & Gamble; Unilever PLC; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; Colgate-Palmolive Company; Marico Limited; LG H&H Co., Ltd.; Pigeon Singapore Pte Ltd.; Church & Dwight Co., Inc.; Melaleuca Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fabric Softener And Conditioner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fabric softener and conditioner market report based on product, type, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Dryer Sheets

-

Dryer Bars

-

Tablets

-

Sprays

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.