Eyewear Market Size, Share & Trends Analysis Report By Product (Contact Lenses, Prescription (RX) Glasses, Sunglasses), By Distribution Channel (E-Commerce, Brick & Mortar), By End Use (Female, Kids), By Price Range, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-018-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Eyewear Market Size & Trends

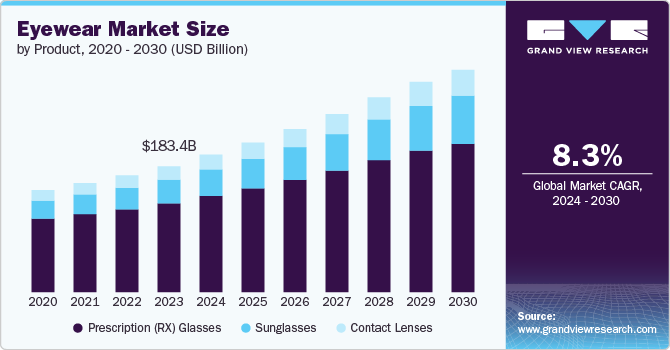

The global eyewear market size was estimated at USD 200.46 billion in 2024 and is expected to grow at a CAGR of 8.6% from 2025 to 2030. This growth is driven by several emerging trends, including the rising prevalence of vision-related issues due to increased screen time and aging populations, which is boosting demand for prescription eyewear. Additionally, growing consumer interest in fashion and personal style is propelling the popularity of designer and customized frames. Technological advancements such as smart glasses and blue light filtering lenses are also reshaping the product landscape. Furthermore, the rapid expansion of e-commerce platforms, coupled with virtual try-on technologies, is transforming the customer purchasing experience and contributing to market expansion.

The eyewear industry is witnessing significant traction for blue light filtering lenses, driven by the digital transformation across workplaces and lifestyles. Prolonged exposure to digital screens has raised consumer awareness around digital eye strain, prompting a surge in demand for specialized eyewear solutions. Corporates and educational institutions increasingly promote screen wellness, which further boosts the adoption of protective eyewear. With remote work and online learning now a permanent fixture in many regions, the need for digitally adaptive eyewear is no longer optional but essential. As a result, eyewear manufacturers are prioritizing R&D investments to deliver stylish yet functional blue light-blocking products.

A key trend shaping the eyewear industry is the growing emphasis on luxury positioning, fueled by rising aspirational spending among middle-class and affluent consumers. Premium brands are increasingly leveraging their brand equity and heritage to justify higher price points across both optical and sunglass segments. Social media influence and celebrity endorsements continue to amplify this trend, encouraging brand-driven purchasing behavior. Eyewear is evolving from a functional vision aid to a fashion-forward accessory, with aesthetics and brand appeal becoming central to consumer choices. In response, retailers and D2C eyewear brands are tapping into this demand by launching exclusive collections and limited-edition releases to attract style-conscious buyers.

The eyewear industry in Southeast Asia is experiencing a surge in demand due to rapid urbanization and increasing disposable income among young, urban consumers. Countries such as Indonesia, Vietnam, and the Philippines are showing strong year-on-year growth in both prescription and fashion eyewear segments. The rise of e-commerce and mobile-first shopping behavior is enabling access to international and regional eyewear brands. Vision awareness campaigns by local governments and NGOs are also increasing the adoption of corrective eyewear. As the middle-class population continues to expand, the eyewear industry in this region is expected to benefit from a growing customer base that is both health-conscious and style-driven.

Furthermore, with evolving shopping behaviors, the eyewear industry is rapidly embracing omnichannel retail strategies to offer seamless customer journeys. Brands are increasingly integrating virtual try-on features, personalized product recommendations, and AI-powered consultations to enhance the online purchasing experience. While physical retail remains important, it is now being enhanced with digital tools to boost customer engagement and drive conversions. Direct-to-consumer (D2C) eyewear brands are at the forefront of this transformation, leveraging tech-enabled solutions to scale efficiently and foster brand loyalty. As customer expectations continue to evolve, delivering seamless, technology-driven experiences is becoming a key competitive advantage in the eyewear market.

Product Insights

The prescription (RX) glasses segment accounted for the largest revenue share of over 69% in 2024, driven by digital-first, cost-efficient platforms that cater to price-sensitive consumers. Online retailers are offering prescription eyewear at significantly lower prices by cutting out intermediaries and leveraging scalable manufacturing models. Customers now expect free home trials, virtual try-on technology, and fast lens customization, all of which have become standard across major online players. In emerging markets, the rise of mobile internet usage and simplified prescription uploading tools has made prescription eyewear more accessible than ever before. This shift is enabling the eyewear industry to unlock new customer segments and expand beyond traditional optical stores.

The sunglasses segment is expected to record the highest CAGR of over 10% from 2025 to 2030, driven by the growing influence of fashion culture on consumer preferences. A prominent trend in this space is the rise of strategic collaborations between eyewear brands and luxury fashion houses, streetwear labels, and celebrities, resulting in exclusive, design-forward collections that blend style with cultural relevance. Limited-edition releases and influencer-led marketing are transforming sunglasses into coveted, seasonal fashion statements rather than purely functional items. As demand for fashion-centric eyewear accelerates, the sunglasses category is emerging as a high-margin, brand-driven growth area within the broader eyewear market.

Distribution Channel Insights

The brick & mortar segment accounted for the largest revenue share in 2024, driven by growing demand for personalized in-store experiences. Consumers are increasingly seeking tailored services when purchasing eyewear, prompting retailers to adopt technologies like virtual try-ons and AI-based frame recommendations. This trend is especially strong in high-traffic areas where quick service and expert consultations are expected. The integration of optometry services further enhances the appeal of physical stores, offering a complete, personalized eyewear shopping experience that blends fashion and vision care.

E-commerce is expected to record the fastest CAGR from 2025 to 2030. fueled by the rise of direct-to-consumer (DTC) models. Consumers are increasingly drawn to the convenience, competitive pricing, and personalized experiences offered online. Advanced tools like virtual try-ons, AI-driven recommendations, and 3D frame customization are streamlining the digital shopping journey. DTC brands are also using social media and influencer marketing to engage younger, tech-savvy audiences while leveraging customer data to refine offerings and boost satisfaction. This shift toward tech-enabled, data-driven online retail is transforming e-commerce into one of the fastest-growing segments in the eyewear industry.

Price Range Insights

The $0-$150 segment accounted for the largest revenue share in 2024, driven by rising demand for affordable yet stylish sunglasses. Consumers, especially younger buyers, are seeking trendy designs with quality features like UV protection at accessible prices. Brands are responding with fashionable, durable frames and leveraging DTC channels and online platforms to offer competitive pricing. Frequent discounts and promotions are further fueling growth in this value-driven segment.

The $300-$500 segment is expected to record the fastest CAGR from 2025 to 2030, driven by increasing demand for premium contact lenses focused on comfort and advanced features. Brands are offering high-end lenses with enhanced hydration, UV protection, and materials that reduce dryness and irritation. These lenses are particularly popular among consumers with demanding lifestyles or long wear times. The shift toward customized vision solutions is encouraging consumers to invest in products that enhance both eye health and quality of life.

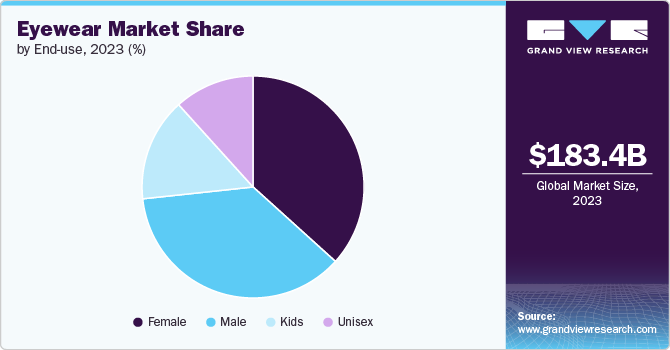

End Use Insights

The female segment accounted for the largest revenue share in 2024, reflecting a strong trend toward fashion-forward eyewear among women. Growing interest in personal style, fueled by social media and evolving fashion trends, is driving demand for eyewear that complements different lifestyles, whether professional, active, or casual. Brands are responding with diverse collections tailored to these preferences. Influencer marketing and celebrity endorsements are also playing a key role, as more women embrace eyewear as a statement accessory, contributing to rising sales in the segment.

The kids segment is expected to record the fastest CAGR from 2025 to 2030, driven by rising awareness of childhood vision health and growing demand for stylish eyewear among younger consumers. Early vision screenings and increased screen time have led to more children needing corrective eyewear, while parents seek options that reflect their kids’ personalities. Brands are tapping into this trend with colorful, playful designs featuring popular characters and patterns. Influencer culture and social media are also shaping kids’ fashion choices, fueling demand for trendy yet functional eyewear.

Regional Insights

The North America eyewear market accounted for a significant revenue share of over 33% in 2024, driven by the growing variety of stylish and affordable eyewear options. Additionally, the rise of online eyewear retailers is transforming the purchasing experience, offering consumers easy access to a broad selection of products at competitive prices. These factors collectively create a conducive environment for market growth, providing consumers with greater access to eyewear choices that cater to both fashion and function.

U.S. Eyewear Market Trends

The U.S. eyewear market held a dominant position in 2024, supported by an increase in the popularity of contact lenses and the growing prominence of online retailers. Moreover, the availability of advanced, lightweight, and durable eyewear solutions in the market is pushing demand across different consumer segments. The continuous expansion of e-commerce platforms and technological innovations further enhances the market dynamics, giving consumers easy access to a wide range of high-quality products.

Europe Eyewear Market Trends

The European eyewear market accounted for the largest revenue share of 36% in 2024. The growing disposable incomes and increasing awareness of eye health, particularly concerning vision correction, are key drivers of demand for eyewear products. Several leading eyewear providers in the region are investing in research and development to create innovative, high-quality eyewear that meets evolving consumer preferences. Additionally, the trend of using eyewear as a fashion accessory is growing, with consumers seeking stylish and personalized solutions to enhance their overall look, fueling market growth.

The UK eyewear market captured a considerable revenue share in 2024, driven by an aging population and increased demand for corrective lenses. A growing awareness of eye health has led to higher preventive eyewear purchases as people become more conscious of the need for regular vision care. The UK market is also benefiting from advancements in lens technologies, such as the development of innovative coatings and materials, which offer enhanced functionality and comfort. As the trend toward high-quality, stylish eyewear continues, consumers in the UK are demanding products that combine fashion, comfort, and functionality.

Germany eyewear market is anticipated to witness significant growth from 2025 to 2030, driven by a robust focus on eye health and a high rate of corrective eyewear adoption. The increasing prevalence of myopia, astigmatism, and other eye conditions in the country is further propelling demand for eyewear products. Additionally, the growing acceptance of eyewear as a fashion statement has led to a rise in stylish frame designs, which further contributes to the market’s expansion. German consumers are increasingly opting for eyewear that blends aesthetics with functionality, favoring lightweight, durable, and high-quality products that cater to both corrective and cosmetic needs.

Asia Pacific Eyewear Market Trends

The eyewear market in the Asia Pacific region is expected to grow at the highest CAGR of over 10% from 2025 to 2030, driven by a growing population and rising disposable incomes. In addition to eye care awareness, the increasing demand for eyewear as a fashion statement is stimulating market growth. The presence of major eyewear manufacturers and suppliers in the region further intensifies market competition, leading to more innovative and accessible product offerings. This trend is particularly evident in countries like India and China, where evolving retail landscapes and the expanding influence of e-commerce continue to boost eyewear adoption.

India eyewear market is expected to grow significantly in the coming years, driven by a large population base, rising awareness of vision care, and changing lifestyles. The increasing penetration of organized retail and the growing popularity of online eyewear platforms make eyewear more accessible to a wider audience. The rising prevalence of digital device usage is also contributing to the surge in demand for prescription glasses, as consumers seek solutions to combat digital eye strain. The overall shift toward higher-quality eyewear products, coupled with a more fashion-conscious younger generation, presents significant growth opportunities for the Indian eyewear market.

Japan eyewear market is expected to experience significant growth from 2025 to 2030, with increasing demand driven by the rising prevalence of eye conditions and a growing aging population. In addition, the growing trend of online shopping, coupled with the availability of a wide range of eyewear options, has contributed to market expansion. Furthermore, technological innovations in lens materials and designs are making eyewear more comfortable and effective for users, contributing to market growth.

Key Eyewear Company Insights

Some of the key players operating in the eyewear market include Bausch + Lomb Corporation and Johnson & Johnson Vision Care Inc.

-

Bausch & Lomb Corporation continues to strengthen its position in the global eye care market through its diverse product offerings, including contact lenses, lens care solutions, and ophthalmic medications. The company's growing focus on specialty lenses for conditions like astigmatism, presbyopia, and cataracts reflects a rising demand for personalized vision correction. Its comprehensive portfolio of eye health products also supports its market penetration in both consumer and professional eye care segments. Moreover, Bausch & Lomb’s contract manufacturing services for sterile and non-sterile pharmaceutical solutions cater to increasing outsourcing trends in the healthcare and pharmaceutical industries.

-

Johnson & Johnson Vision Care has emerged as a dominant player in the disposable contact lens segment, driven by continuous innovation in proprietary manufacturing technologies. With its VISTAKON division and patented Stabilized Soft Molding (SSM) process, the company ensures high precision and comfort in its lens offerings. The Acuvue brand stands out as a leader in the U.S. market for correcting astigmatism and presbyopia, reflecting growing consumer demand for condition-specific solutions. As the global population ages and digital eye strain increases, the company is well-positioned to meet the evolving vision care needs of a tech-savvy, health-conscious demographic.

Warby Parker, and Shamir Optical Industry are some emerging market participants in the market.

-

Warby Parker is revolutionizing the eyewear retail experience through its seamless integration of online and offline channels. The company leverages digital tools like virtual try-on and home try-on kits, addressing consumer preferences for convenience and personalization. Its direct-to-consumer model enables competitive pricing and strong brand loyalty, especially among younger, fashion-forward consumers. Additionally, Warby Parker’s ongoing expansion of physical stores complements its e-commerce strength, solidifying its omnichannel strategy in the highly competitive eyewear market.

-

Shamir Optical Industry Ltd. is at the forefront of innovation in premium progressive lenses, driven by a robust portfolio of proprietary technologies. Its focus on personalized lens design through technologies such as EyePoint III, IntelliCorridor, and Natural Posture addresses growing consumer expectations for precision and comfort. The company’s integration into EssilorLuxottica since August 2022 has further enhanced its R&D capabilities and global distribution network. This acquisition strategically positions Shamir to capitalize on the rising demand for advanced multifocal solutions, particularly among aging populations worldwide.

Key Eyewear Companies:

The following are the leading companies in the eyewear market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch + Lomb Corporation

- Zeiss Group

- CHARMANT INC.

- CHEMIGLAS CORPORATION

- CooperVision Limited

- De Rigo Vision S.p.A.

- ESSILORLUXOTTICA

- Fielmann AG

- HOYA Corporation

- JINS Inc.

- Johnson & Johnson Vision Care Inc.

- Marchon Eyewear Inc.

- Marcolin S.p.A.

- Prada S.p.A

- Rodenstock GmbH

- Safilo Group S.p.A

- Seiko Optical Products Co. Ltd.

- Shamir Optical Industry Ltd.

- Silhouette International Schmied AG

- Warby Parker

- Zenni Optical Inc.

Recent Developments

-

In February 2025, EssilorLuxottica announced plans to increase its smart glasses production capacity to 10 million units annually by the end of 2026, expanding manufacturing in China and Southeast Asia. The company aims to enhance its collaboration with Meta and integrate additional third-party brands and features into its smart eyewear platform. Since the launch of Ray-Ban Meta smart glasses in September 2023, over 2 million units have been sold, with growing user engagement

-

In February 2025, Innovative Eyewear unveiled its Reebok Smart Eyewear line at MIDO 2025 in Milan, introducing sport-focused frames with open-ear audio, voice assistant integration, and customizable lenses. The collection features upgraded hi-fi speakers and amplifiers for enhanced sound quality, catering to active lifestyles. Attendees experienced real-time demonstrations and previews of upcoming products from Lucyd, Nautica, and Eddie Bauer.

-

In August 2024, Innovative Eyewear partnered with Geenee Inc. to enhance smart eyewear retail experiences through augmented reality. The collaboration introduced the Lucyd Kiosk-a 5-foot-tall, 32-inch touchscreen display featuring virtual try-on technology, audio demos, and TikTok content-intended for placement in high-traffic retail locations. Additionally, they plan to launch an improved virtual try-on experience on Lucyd.co and personalized web advertisements, allowing users to try on eyewear while browsing online.

Eyewear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 221.90 billion |

|

Revenue forecast in 2030 |

USD 335.90 billion |

|

Growth rate |

CAGR of 8.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

April 2025 |

|

Quantitative units |

Volume in million Units, Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, end use, price range, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Austria; Belgium; Czech Republic; Denmark; Finland; Germany; France; Iceland; Ireland; Italy; Netherlands; Norway; Poland; Spain; Sweden; Switzerland; UK; Australia; China; Hong Kong; India; Indonesia; Japan; Malaysia; New Zealand; Philippines; Singapore; South Korea; Taiwan; Thailand; Vietnam; Brazil; Argentina; Chile; Israel; Nigeria; UAE; Saudi Arabia; Turkey; and South Africa |

|

Key companies profiled |

Bausch + Lomb Corporation; Zeiss Group; CHARMANT INC.; CHEMIGLAS CORPORATION; CIBA Vision (Alcon); CooperVision Limited; De Rigo Vision S.p.A.; ESSILORLUXOTTICA; Fielmann AG; HOYA Corporation; JINS Inc.; Johnson & Johnson Vision Care Inc.; Marchon Eyewear Inc.; Marcolin S.p.A.; Prada S.p.A; Rodenstock GmbH; Safilo Group S.p.A; Seiko Optical Products Co. Ltd.; Shamir Optical Industry Ltd.; Silhouette International Schmied AG; Warby Parker; and Zenni Optical Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Eyewear Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eyewear market report based on product, distribution channel, end use, and region.

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Contact Lenses

-

Premium Contact Lenses

-

Mass Contact Lenses

-

-

Prescription (RX) Glasses

-

Prescription Glasses, by Frame

-

Frame Type

-

Full Frame

-

Half Frame

-

Rimless

-

-

Frame Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

Frame Material

-

Metal

-

Nylon

-

Others

-

-

-

Prescription Glasses, by Lens

-

Single Vision Lenses

-

Multi-vision Lenses

-

Progressive Lenses

-

Others

-

-

-

Sunglasses

-

Sunglasses, by Frame

-

Frame Type

-

Full Frame

-

Half Frame

-

Rimless

-

-

Frame Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

Frame Material

-

Metal

-

Nylon

-

Others

-

-

-

Sunglasses, by Lens

-

Lens Type

-

Polarized Sunglasses

-

Non-Polarized Sunglasses

-

-

Lens Material

-

CR-39

-

Polycarbonate

-

Polyurethane

-

Others

-

-

-

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

E-Commerce

-

Brick & Mortar

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Unisex

-

Kids

-

-

Price Range Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

$0-$150

-

$150-$250

-

$250-$300

-

$300-$500

-

$500+

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Iceland

-

Ireland

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Hong Kong

-

Indonesia

-

Japan

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

South Korea

-

Taiwan

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa (MEA)

-

Israel

-

Nigeria

-

Saudi Arabia

-

South Africa

-

Turkey

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global eyewear market size was valued at USD 200.46 billion in 2024 and is expected to reach USD 221.89 billion in 2025.

b. The global eyewear market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 335.90 billion by 2030.

b. The prescription (RX) glasses dominated the eyewear market with a revenue share of over 69% in 2024. The increasing prevalence of eye conditions such as myopia, hyperopia, astigmatism, and presbyopia is driving the demand for corrective eyewear.

b. Some of the key players in the global eyewear market include Bausch and Lomb Inc.; Carl Zeiss AG; Charmant Group; CooperVision; Warby Parker; and EssilorLuxotttica.

b. Key factors that are driving the eyewear market growth include the growing number of ophthalmic disorders, awareness regarding eye examinations, and perception of eyewear as a fashion accessory.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."