- Home

- »

- Beauty & Personal Care

- »

-

Eyewear Frames Market Size, Share & Growth Report, 2030GVR Report cover

![Eyewear Frames Market Size, Share & Trends Report]()

Eyewear Frames Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Plastic/Acetate, Metal), By Type (Full-Rim Frames, Semi-Rimless Frames), By Shape (Square/Rectangular), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eyewear Frames Market Summary

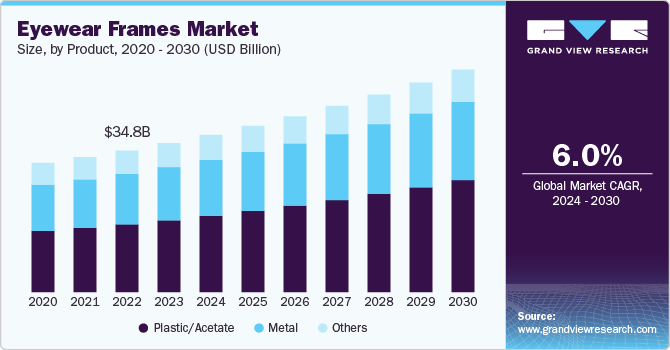

The global eyewear frames market was estimated at USD 36.58 billion in 2023 and is projected to reach USD 54.63 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. The market is primarily driven by increasing global demand for both corrective and fashion eyewear.

Key Market Trends & Insights

- The eyewear frames market in North America accounted for a revenue share of 26.43% in 2023.

- The eyewear frames market in the U.S. is expected to grow at the fastest CAGR of 5.0% from 2024 to 2030.

- Based on type, the full-rim frames segment led the eyeglasses frames market with the largest revenue share of 65.0% in 2023.

- Based on shape, the square/rectangular segment led the market with the largest revenue share of 30.50% in 2023.

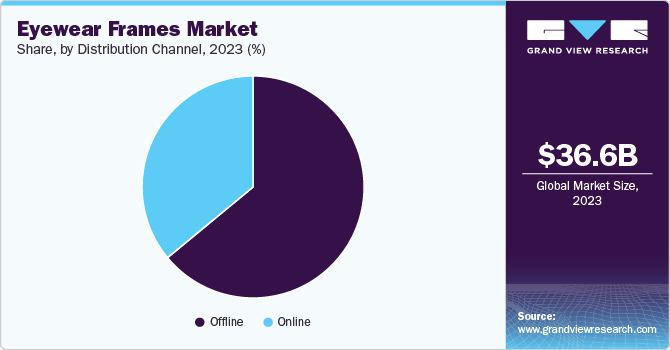

- Based on distribution channel, the offline segment led the market with the largest revenue share of 64% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 36.58 Billion

- 2030 Projected Market Size: USD 54.63 Billion

- CAGR (2024-2030): 6.0%

- Europe: Largest market in 2023

Factors such as rising awareness of vision care, increasing prevalence of visual impairments due to screen time, and expanding aging populations are contributing to the need for prescription eyewear which in turn is driving the demand for eyewear frames.

Plastics like acetate have become the standard in eyewear frames, replacing materials like glass, stone, and crystal, which were used for centuries. Despite the advantages of oil-based plastics, there is growing demand for sustainable alternatives due to the high carbon footprint and environmental impact associated with petroleum-based materials.

Plant-based materials are now entering the global market, offering sustainable options. Bio-acetate, a popular plant-based plastic, has been adopted by high-end brands like Mulberry and more affordable retailers like SpecSavers. Mazzucchelli’s M49 bio-acetate is widely used, with companies like Arnette using it in all their models since 2019. While bio-based materials are gaining traction in frames, the technical requirements of lenses make bioplastic adoption slower in this area. Despite these advances, the higher costs of producing bioplastics pose challenges, especially during economic downturns, as seen with the closure of Pala Eyewear in 2023 due to inflation and market pressures.

The lack of recycling infrastructure for bioplastics remains a significant hurdle for the eyewear industry. Companies like Eastman Chemical are stepping in to address this gap by collecting bio-acetate waste from eyewear brands such as Mykita and Warby Parker, transforming it into recycled materials for new eyewear frames.

Product Insights

The plastic/acetate segment led the market with the largest revenue share of 48.22% in 2023, due to their moldability, lightness, and durability.These materials offer flexibility in design, allowing for intricate shapes and color retention, making them highly appealing to manufacturers and consumers alike. In addition, their lightweight nature ensures comfort for prolonged use, while their durability reduces the risk of breakage, offering a practical and cost-effective alternative to traditional materials like glass and metal. This combination of aesthetic versatility and functional benefits has solidified plastic and acetate as dominant choices in the market.

The metal segment is projected to grow at the fastest CAGR of 5.7% from 2024 to 2030, driven byincreasing demand for lightweight, durable, and sleek designs that cater to both fashion and functionality. Metal frames, particularly those made from stainless steel, titanium, and aluminum, offer strength and flexibility while maintaining a minimalist aesthetic, appealing to consumers seeking premium and modern styles. In addition, metal frames' hypoallergenic properties and corrosion resistance make them suitable for long-term wear, further boosting their popularity in the market.

Type Insights

Based on type, the full-rim frames segment led the eyeglasses frames market with the largest revenue share of 65.00% in 2023, attributed to their superior durability, robust support for various lens types, and versatility in design. These frames offer better protection for lenses, particularly for high-prescription and progressive lenses, making them a practical choice for everyday use. In addition, full-rim frames accommodate a wide range of materials, including plastic and metal, and are favored for their ability to balance fashion-forward designs with functional support, appealing to a broad consumer base.

The rimless frame segment is projected to grow at the fastest CAGR of 6.8% from 2024 to 2030, driven bythe increasing demand for lightweight and minimalistic eyewear options among consumers. These frames are favored for their sleek, unobtrusive design, providing a modern aesthetic that appeals to fashion-conscious individuals. In addition, the growing popularity of personalized and customizable eyewear solutions enhances their appeal, as rimless frames can be tailored to individual styles and preferences.

Shape Insights

Based on shape, the square/rectangular segment led the market with the largest revenue share of 30.50% in 2023, due to their versatility and suitability for a wide range of face shapes, particularly those with round or oval features. Their geometric design exudes a contemporary and professional appearance, making them popular among both fashion-forward consumers and professionals seeking a polished look. In addition, the availability of various colors, materials, and patterns enhances their appeal, allowing consumers to express personal style while enjoying a classic silhouette.

The cat-eye frames segment is projected to grow at a CAGR of 7.0% from 2024 to 2030, driven by timeless elegance, modern adaptability, and increasing consumer preference for distinctive, stylish eyewear. Cat-eye glasses, known for their iconic upswept angles and feminine design, are experiencing a resurgence as the next big trend in eyewear, blending vintage charm with modern sophistication. With a wide variety of styles, they appeal to a diverse audience.

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 64% in 2023, largely due to the traditional consumer preference for in-person shopping experiences. Many customers value the ability to physically try on frames to assess fit, comfort, and style before making a purchase. In addition, brick-and-mortar stores offer personalized customer service, allowing consumers to seek advice from knowledgeable staff, which enhances the buying experience. The prevalence of optical shops and retail chains in various regions also contributes to this dominance, as they provide a wide selection of eyewear and often feature exclusive promotions that attract shoppers.

Despite the rising trend in online shopping, the majority of optical products are still purchased in-person. Prescription eyeglasses are most commonly bought in-store (85%), followed by non-prescription reading glasses (79%) and sunglasses (77%), according to the Vision Council's recent report of, "Focused Insights 2024”.

The online segment is expected to grow at the fastest CAGR of 6.8% from 2024 to 2030, driven by the increasing consumer preference for the convenience of online shopping, particularly following the COVID-19 pandemic. Advances in technology, such as virtual try-on features and augmented reality applications, enhance the online shopping experience, allowing customers to visualize how frames will look on their faces before making a purchase. In addition, the proliferation of e-commerce platforms and targeted digital marketing strategies effectively reach a broader audience, coupled with competitive pricing and exclusive online offers that further incentivize purchases.

Regional Insights

The eyewear frames market in North America accounted for a revenue share of 26.43% in 2023, primarily due to the region having a high prevalence of vision impairment, driving demand for corrective eyewear and frames. North America also showcases a strong consumer preference for premium and designer eyewear brands, with a focus on quality and fashion, which boosts market revenue.

U.S. Eyewear Frames Market Trends

The eyewear frames market in the U.S. is expected to grow at the fastest CAGR of 5.0% from 2024 to 2030.The Vision Council recently released a report titled "Focused inSights 2024: Consumer Perception and Sentiments on 'Made in the USA' Products," revealing that over half of American consumers prioritize "Made in the USA" labels when making purchasing decisions. Conducted between August 7 to August 29 with a sample of 1,500 adults, the survey underscores a significant willingness among consumers to pay a premium for American-made products, particularly in the eyewear sector. Key findings indicate that 52% of consumers consider the "Made in the USA" designation important, with 44% frequently buying American-made products. On average, 45% are willing to pay at least 5% more for American-made eyewear. Critical factors for labeling eyewear as "Made in the USA" include domestic assembly, craftsmanship, quality testing, and design.

Europe Eyewear Frames Market Trends

The eyewear frames market in Europe accounted for a largest revenue share of 34% in 2023. The region has a strong emphasis on fashion and aesthetics, leading to a high demand for trendy and designer eyewear frames, with consumers willing to invest in high-quality products. In addition, the aging population in many European countries has increased the need for vision correction, further driving sales. The presence of numerous well-established eyewear brands and luxury labels enhances consumer choice and encourages purchases.

Asia Pacific Eyewear Frames Market Trends

The eyewear frames market in Asia Pacific is expected to grow at the fastest CAGR of 7.5% from 2024 to 2030, as the region is witnessing a significant increase in disposable income, leading to greater consumer spending on fashion and eyewear. In addition, the growing awareness of eye health, spurred by rising digital device usage, is driving demand for corrective eyewear, driving the demand for frames. The younger population in countries like China and India is increasingly influenced by fashion trends and brand consciousness, leading to a surge in demand for stylish and designer frames.

Key Eyewear Frames Company Insights

The market is fragmented in nature, characterized by a diverse range of players, including both established brands and emerging designers, catering to various consumer preferences and price points. This fragmentation leads to intense competition as companies strive to differentiate themselves through unique designs, materials, and technological innovations. Key strategies employed by companies to gain a competitive edge include investing in research and development to create innovative products, such as lightweight and sustainable materials, and incorporating advanced technologies like augmented reality for virtual try-ons.Collaborations with fashion influencers and partnerships with optical retailers are also common strategies to boost brand visibility and reach a broader audience.

Key Eyewear Frames Companies:

The following are the leading companies in the eyewear frames market. These companies collectively hold the largest market share and dictate industry trends.

- EssilorLuxottica

- Marchon Eyewear, Inc.

- Safilo Group S.p.A.

- De Rigo Vision S.p.A.

- Fielmann AG

- Marcolin S.p.A.

- CHARMANT USA Inc.

- Charmant Inc.

- Kenmark Eyewear

- Silhouette International

Recent Developments

-

In January 2024, National Vision, Inc. partnered with Black women-owned Vontélle Eyewear to release an exclusive limited-edition frame collection for Black History Month. The "Official by Vontélle" frames, available at over 900 America's Best locations, feature bold designs tailored for diverse faces with wider nose bridges and larger lenses. Inspired by notable African American figures, the frames celebrate cultural heritage and diversity. Vontélle's innovative collection makes luxury eyewear more accessible to a broader audience

-

In September 2024, Pair Eyewear launched The Met x Pair Eyewear capsule top frame collection, featuring 16 new frames inspired by iconic artworks from The Metropolitan Museum of Art. This collaboration highlights Pair Eyewear's commitment to personalization and innovation in the eyewear industry, appealing to consumers' desire for unique and artistic designs. The brand, co-founded in 2019, continues to expand globally while enhancing its manufacturing capabilities to offer affordable, high-quality eyewear. This move reflects broader trends in the global market, emphasizing customization and artistic collaboration

Eyewear Frames Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.60 billion

Revenue forecast in 2030

USD 54.63 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, shape, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

EssilorLuxottica; Marchon Eyewear, Inc.; Safilo Group S.p.A.; De Rigo Vision S.p.A.; Fielmann AG; Marcolin S.p.A.; CHARMANT USA Inc.; Charmant Inc.; Kenmark Eyewear; Silhouette International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eyewear Frames Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eyewear frames market report based on product, type, shape, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic/Acetate

-

Metal

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full-Rim Frames

-

Semi-Rimless Frames

-

Rimless Frames

-

-

Shape Outlook (Revenue, USD Billion, 2018 - 2030)

-

Square/Rectangular Frames

-

Oval & Round Frames

-

Aviator Frames

-

Cat-Eye Frames

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global eyewear frames market size was estimated at USD 36.58 billion in 2023 and is expected to reach USD 38.60 billion in 2024.

b. The global eyewear frames market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 54.63 billion by 2030.

b. The eyewear frames market in North America accounted for a share of 26.43% of the global market revenue in 2023, primarily due to the region having a high prevalence of vision impairment, driving demand for corrective eyewear and frames.

b. Some of the key players operating in the eyewear frames market include EssilorLuxottica, Marchon Eyewear, Inc., Safilo Group S.p.A., and De Rigo Vision S.p.A.

b. Factors such as rising awareness of vision care, increasing prevalence of visual impairments due to screen time, and expanding aging populations are contributing to the need for prescription eyewear which in turn is driving the demand for eyewear frames.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.