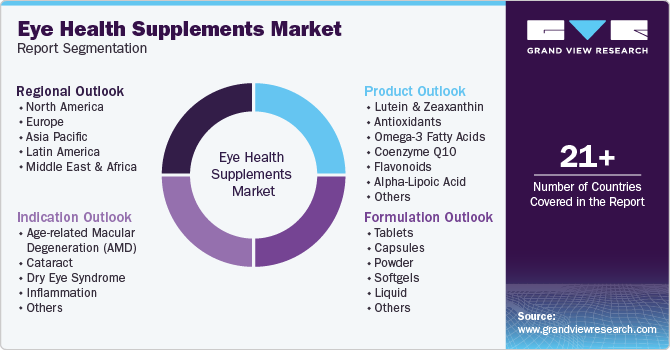

Eye Health Supplements Market Size, Share & Trends Analysis Report By Ingredient Type (Lutein & Zeaxanthin, Antioxidants), By Indication (AMD, Cataract), By Formulation, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-148-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Eye Health Supplements Market Trends

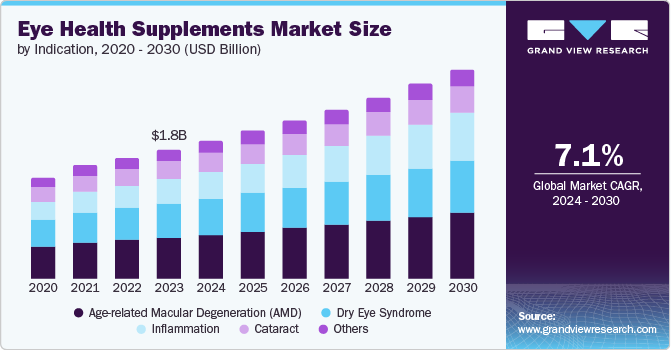

The global eye health supplements market size was valued at USD 1.83 billion in 2023 and is expected to grow at a CAGR of 7.06% from 2024 to 2030. The growing geriatric population, increasing prevalence of eye diseases, and growing awareness about eye health are anticipated to impel the market growth for eye health supplements. Moreover, the growing incidences of vision impairment and rising myopic population, particularly during the COVID-19 pandemic, owing to an increased usage of screens and joining virtual meetings while working from home, is one of the key factors driving the market.

The COVID-19 pandemic has positively impacted the eye health supplements market. With increased screen time due to remote work and online activities, many people have become more aware of eye strain and its effects. This awareness has led to a rise in the demand for supplements designed to support eye health, such as those containing lutein, zeaxanthin, and other antioxidants. The rise in digital eye strain has driven demand for supplements aimed at alleviating related symptoms, while the overall focus on health and wellness has led more consumers to seek out products that support eye health. Additionally, the pandemic’s emphasis on immune support has further boosted interest in supplements that offer comprehensive benefits.

According to the WHO, around 2.2 billion individuals across the globe in 2019 have been registered with vision impairment or blindness. Low and middle-income countries such as South Asia and western and eastern sub-Saharan Africa have been reported to witness eight times higher rates of blindness as compared to the high-income countries. Particularly in low and middle-income countries, women are expected to have a higher incidence of eye disorders such as cataracts and AMD. Consumers in developed countries, such as the U.S., Canada, Australia, and the U.K., have high per-capita expenditures, thus registering high spending on healthcare products, including eye health supplements, which contributes to market growth. Moreover, increasing demand for Lutein and Zeaxanthin supplements and bilberry extract supplements for eye health and convenient access to these supplements via direct sales and e-commerce platforms is driving the market.

Moreover, the increasing launch of eye health supplements in order to cater to the unmet demand from 1.0 billion unaddressed individuals suffering from vision impairment worldwide is projected to deliver robust growth in the market. This, in turn, is expected to further drive the sales of eye health supplements in the near future. For instance, Bausch + Lomb, in October 2019, launched its eye health supplement - PreserVision AREDS 2 Formula mini gel eye vitamins in the U.S. The PreserVision AREDS 2 Formula mini gel is an easier-to-swallow alternative for the company’s PreserVision AREDS 2 Formula soft gels, indicated for advanced AMD.

In addition, high myopia can be attributable to an increased risk of various progressive eye disorders such as cataracts, glaucoma, and age-related macular degeneration. Increasing preference for eye health supplements among the older group of individuals and millennials highly prone to digital eye fatigue and myopia is further driving the market worldwide. An increase in the prevalence of various eye conditions including Age-related Macular Degeneration (AMD), dry eye syndrome, cataracts, and inflammation along with the glowing recommendation for eye health supplements by ophthalmologists for the prevention and treatment of these disorders is further driving the market.

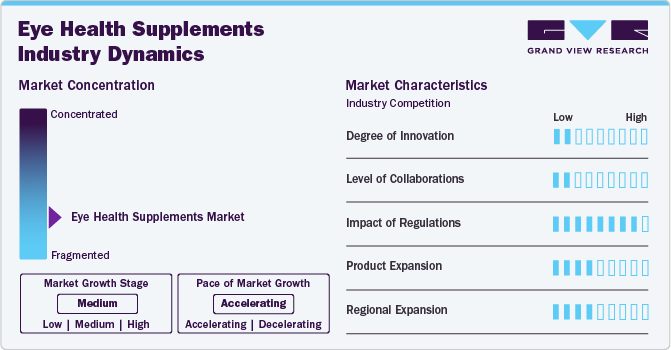

Industry Dynamics

The market growth stage is medium, and the pace of the market growth is accelerating. These may include growing interest & consumer demand, increased awareness of digital eye strain, and increase in conditions such as dry eye syndrome and age-related macular degeneration. Additionally, the increasing number of older adults, which are more prone toward eye health issues like macular degeneration and cataracts, is further driving the demand for supplements.

In the eye health supplements market, partnerships and collaboration activities are low owing to the fragmented nature of the industry and the prevalence of numerous small and mid-sized players. However, as the market matures, companies are likely to recognize the benefits of collaboration, such as sharing research and development costs, establishing industry standards, and navigating regulatory challenges more effectively.

The lack of standardization in the eye health supplements industry can lead to significant issues, including variability in product quality, regulatory challenges, and consumer confusion. Without consistent guidelines, the efficacy and safety of supplements can differ widely between brands, complicating informed consumer choices and potentially allowing substandard products to enter the market.

The eye health supplements industry currently exhibits a moderate level of product expansion. This growth reflects a steady increase in the range of available products, driven by rising consumer awareness of eye health and advancements in supplement formulations.

The eye health supplements industry currently demonstrates a moderate level of regional expansion. Regional expansion is likely driven by increasing consumer awareness and demand for eye health products but varies in intensity depending on local market conditions and consumer preferences.

Ingredient Type Insights

Based on ingredient type, lutein & zeaxanthin ingredients for eye health supplements accounted for the largest revenue share of 33.10% in 2023. Increasing awareness regarding the benefits offered by lutein & zeaxanthin supplements in the prevention and effective treatment of various eye disorders, majorly AMD, diabetic retinopathy, uveitis, and cataract, is attributing to the significant segment growth. Moreover, the rising prevalence of eye disorders, mainly AMD, and the glowing recommendation for these supplements by ophthalmologists, clinicians, and vision scientists is resulting in the growth of the segment.

According to "The Eye Disease Case-Control Study," people with the highest intake of lutein & zeaxanthin supplements had a 43% lower risk of developing AMD compared to those with low intakes. The National Institutes of Health’s Office of Dietary Supplements states that the global average daily intake of Lutein and Zeaxanthin is 1-3 mg for general eye health. However, to reduce the risk of AMD, eye doctors recommend 6-20 mg per day. Therefore, adding these supplements to the daily diet is strongly recommended, driving market growth.

The flavonoids segment is projected to witness a significant growth rate of 5.93% over the forecast period owing to the rising demand for bilberry supplements among consumers. Bilberry extract, being one of the key eye health supplements, has been extensively used to relieve eye fatigue along with the treatment of various eye disorders of the retina, cataracts, glaucoma, and nearsightedness. The increasing availability of bilberry extract for eye health at affordable rates is driving the adoption of flavonoids as eye health supplements, which in turn, is positively impacting the market growth.

Indication Insights

Based on indication, the Age-related Macular Degeneration (AMD) accounted for the largest revenue share of 32.22% in 2023. The rise in age-related macular degeneration (AMD) worldwide is boosting the segment. According to the International Agency for the Prevention of Blindness (IAPB), AMD is the third leading cause of blindness globally and the top cause in higher-income countries with aging populations. The BrightFocus Foundation reports that about 11 million people in the U.S. had AMD in 2019, a number expected to double to 22 million by 2050. Globally, the number of people with macular degeneration was around 196 million in 2020 and is projected to increase to 288 million by 2040.

The dry eye syndrome segment is expected to witness a significant CAGR of 5.91% over the forecast period. Growing recommendation to increase the intake of dietary supplements by around 46.0% of the ophthalmologists in Asian countries to their dry eye patients is one of the key factors driving demand for eye health supplements to treat dry eye conditions, thereby aiding the segment growth. In addition, approximately 60.7% of dry eye patients are consuming Omega-3 fatty acid supplements, as omega-3 has shown evidence of treating dry eye and ocular surface disease in an effective manner.

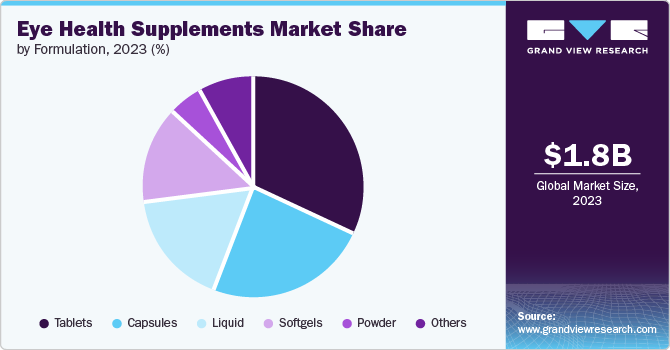

Formulation Insights

Based on formulation, the tablets segment dominated the eye health supplements market and accounted for the largest revenue share of 32.38% in 2023. The demand for eye health supplements in tablet form is growing because they come in many types like chewable, sustained release, and sublingual tablets. Tablets are also more affordable and widely accepted by people of all ages. Additionally, they have a longer shelf life compared to powders and liquids, making them more popular.

The softgels segment is expected to witness a significant growth rate over the forecast period. Softgels are great for delivering liquid or oil-based supplements. Researchers say that supplements in their original form work better than modified ones. Nutrients like fish oil and krill oil are often in softgels to avoid bad tastes and smells. Major brands like Nature's Bounty, VisionShield, GNC, Viteyes, and NOW offer these softgel eye health supplements at affordable prices, which boosts their popularity.

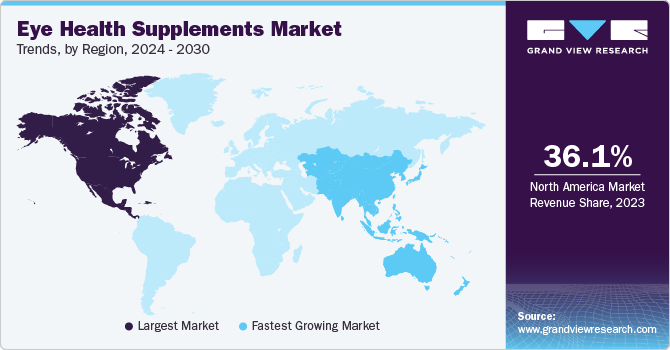

Regional Insights

North America has dominated market share in 2023 for the eye health supplements market. The increasing prevalence of chronic eye disorders, majorly AMD, diabetic retinopathy, glaucoma, and dry eye syndrome, coupled with growing awareness and high availability of commercialized eye health supplements, are some of the key factors attributable to the largest revenue share of the market in North America. In addition, an increase in product launches for eye health supplements in the region is another key factor propelling market growth in North America.

U.S. Eye Health Supplements Market Trends

The eye health supplements market in the U.S. is expected to grow over the forecast period. In 2019, Bausch + Lomb launched Ocuvite Eye Performance vitamin supplements in the U.S. in order to meet the increasing needs of U.S. consumers. Also, in 2014, the U.S. registered nearly 45.0% of product launches for eye health supplements.

Europe Eye Health Supplements Market Trends

The eye health supplements market in Europe is experiencing significant growth, driven by increasing awareness of eye health and a rising aging population. Moreover, factors such as the prevalence of eye disorders like macular degeneration, cataracts, and glaucoma are fueling demand for these supplements.

UK eye health supplements market is expected to grow over the forecast period. Increased screen time and the prevalence of eye disorders such as macular degeneration and cataracts are driving demand for supplements rich in lutein, zeaxanthin, and omega-3 fatty acids.

The eye health supplements market in France is expected to grow over the forecast period due to increasing awareness of awareness of eye health and growing geriatric population.

Germany eye health supplements market is expected to grow over the forecast period. Rising prevalence of vision issues due to extensive screen time and exposure to environmental pollutants boosts demand for supplements with ingredients like lutein and zeaxanthin.

Asia Pacific Eye Health Supplements Market Trends

The eye health supplements market in Asia Pacific is anticipated to grow at the fastest rate of 9.11% over the forecast period. The presence of a large number of local market players offering innovative and affordable eye health supplements, and emerging contract manufacturing hubs for eye health supplements including China, India, and the Philippines, are factors driving the market in the region. In addition, increasing eye health awareness is also positively impacting market growth in the region. Furthermore, the increasing prevalence of eye-related disorders in Asian countries is expected to be a key driving factor for the market.

China eye health supplements market is expected to grow over the forecast period. As per a study published by International Finance Corporation, China is witnessing a 6.0% increase in blindness cases annually, accommodating nearly one-fifth of the world’s blind population in the country.

The eye health supplements market in Japan is expected to grow over the forecast period. In May 2024, Japan's Natural Tech announced the launch of a new eye supplement to meet rising demand driven by modern lifestyles and an aging population.

India eye health supplements market is expected to grow over the forecast period. In April 2022, Wellbeing Nutrition introduces ‘Melts Eye Care’, the world’s first all-natural eye vitamins using advanced nano technology for superior absorption and effectiveness.

Middle East & Africa Eye Health Supplements Market Trends

The eye health supplements market in the Middle East & Africa is expected to experience substantial growth over the forecast period due to several key factors. Rising concerns over eye health, driven by factors like high sun exposure and dietary deficiencies, are boosting demand for supplements with protective ingredients like lutein and zeaxanthin.

Saudi Arabia eye health supplements market is expected to grow over the forecast period. The growing awareness of preventive health and increasing cases of vision problems related to high screen use and environmental factors is anticipated to boost the market.

The eye health supplements market in Kuwait is expected to grow over the forecast period. This is attributed to a rising prevalence of lifestyle-related eye conditions and a growing trend toward holistic health.

Key Eye Health Supplements Company Insights

The market players operating in the eye health supplements market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Eye Health Supplements Companies:

The following are the leading companies in the eye health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- The Nature's Bounty Co.

- Vitabiotics Ltd.

- Pfizer Inc

- Amway International

- Bausch & Lomb

- Nutrivein

- ZeaVision LLC

- Kemin Industries, Inc.

- EyeScience

- Nutrachamps

Recent Developments

-

In June 2024, Bausch + Lomb introduced Blink NutriTears, an OTC supplement designed for addressing dry eye disease and enhancing tear production, formulated with lutein, zeaxanthin, curcumin, and vitamin D.

-

In May 2024, HealthyCell launched Eye Health MicroGel, an ultra-absorbable supplement designed to support vision. It features a blend of carotenoids and essential micronutrients, including lutein, zeaxanthin, astaxanthin, lycopene, vitamin A, and vitamin E.

-

In January 2024, Cepham introduced Luteye, a new eye health formulation combining lutein, zeaxanthin, and oleocanthal-enriched extra virgin olive oil to address aging effects on vision.

-

In October 2023, Supersmart, a company in dietary supplements, launched Vision Postbiotic EYEMUSE. This new product, the first of its kind in Europe, is designed to help reduce digital eye fatigue.

Eye Health Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.95 billion |

|

Revenue forecast in 2030 |

USD 2.94 billion |

|

Growth rate |

CAGR of 7.06% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredient type, indication, formulation, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

The Nature's Bounty Co.; Vitabiotics Ltd.; Pfizer Inc; Amway International; Bausch & Lomb; Nutrivein; ZeaVision LLC; Kemin Industries, Inc.; EyeScience; Nutrachamps |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Eye Health Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global eye health supplements market report based on ingredient type, indication, formulation, and region.

-

Ingredient Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lutein & Zeaxanthin

-

Antioxidants

-

Omega-3 Fatty Acids

-

Coenzyme Q10

-

Flavonoids

-

Alpha-Lipoic Acid

-

Astaxanthin

-

Others

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Age-related Macular Degeneration (AMD)

-

Cataract

-

Dry Eye Syndrome

-

Inflammation

-

Others

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global eye health supplements market size was estimated at USD 1.83 billion in 2023 and is expected to reach USD 1.95 billion in 2030.

b. The global eye health supplements market is expected to grow at a compound annual growth rate of 7.06% from 2024 to 2030 to reach USD 2.94 billion by 2030.

b. North America dominated the eye health supplements market with a share of 35.11% in 2023. This is attributable to the increasing prevalence of chronic eye disorders majorly AMD, diabetic retinopathy, glaucoma, and dry eye syndrome coupled with growing awareness and high availability of commercialized eye health supplements in the region.

b. Some key players operating in the eye health supplements market include The Nature's Bounty Co.; Vitabiotics Ltd.; Pfizer Inc.; Amway International; Bausch & Lomb; Nutrivein; ZeaVision LLC; Kemin Industries, Inc.; EyeScience; and Alcon.

b. Key factors that are driving the eye health supplements market growth include rising elderly population, growing exposure to blue light, and increasing prevalence of various eye disorders such as macular degeneration, refractive errors, cataract, inflammation, diabetic retinopathy, corneal opacity, trachoma, and dry eye syndrome.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."