- Home

- »

- Medical Devices

- »

-

Eye Care Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Eye Care Market Size, Share & Trends Report]()

Eye Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Contact Lens, Ocular Health Products), By Mode Of Purchase (Over-The-Counter, Prescribed), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-316-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Eye Care Market Summary

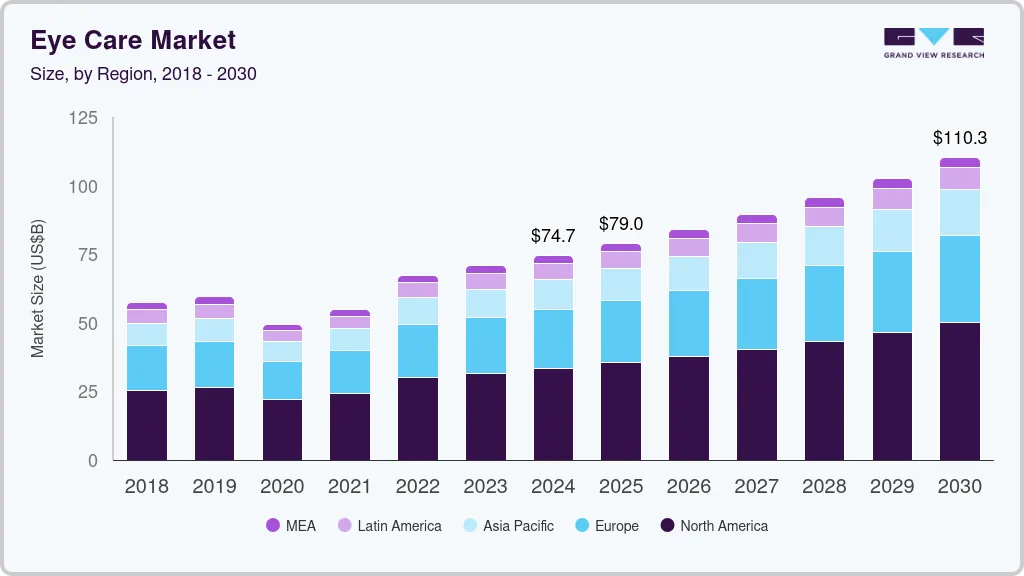

The global eye care market size was estimated at USD 70.78 billion in 2023 and is expected to reach USD 110.33 billion by 2030, growing at a CAGR of 6.72% from 2024 to 2030. The market growth is driven by rising number of people suffering from eye-related disorders, rapidly aging population, technological advancements, and increasing awareness about eye care.

Key Market Trends & Insights

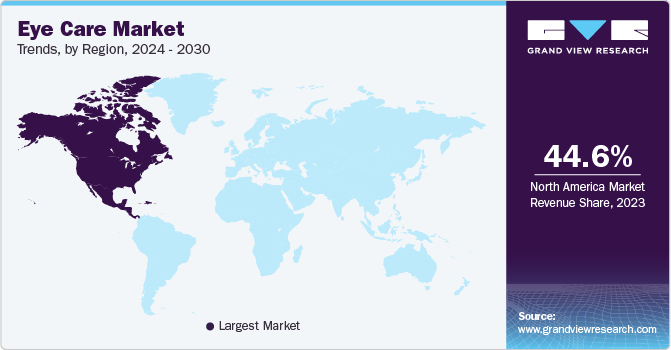

- The North America market dominated the overall global market and accounted for 44.66% revenue share in 2023.

- The eye care market in the U.S. held a significant share of the North America region in 2023.

- By product, the contact lens segment held the largest market share of 36.42% in 2023.

- By mode of purchase, the prescribed products segment held the largest market share of 61.14% in 2023.

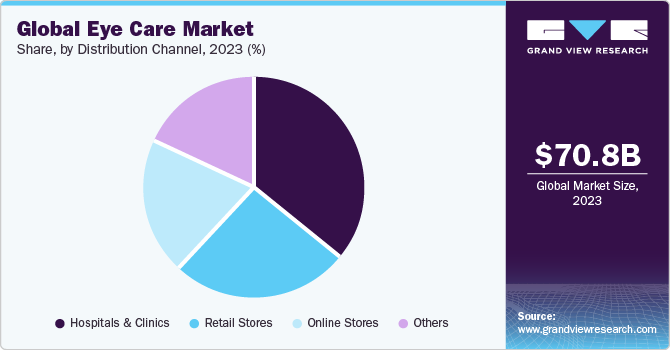

- By distribution channel, the hospitals and clinics segment held the largest market share of 35.92% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 70.78 Billion

- 2030 Projected Market Size: USD 110.33 Billion

- CAGR (2024-2030): 6.72%

- North America: Largest market in 2023

The increasing prevalence of vision disorders, especially vision impairment & presbyopia, presents a significant opportunity for the industry. According to statistics published by WHO in 2023, around 2.2 billion people worldwide suffer from vision impairment, and there are an estimated 1.09 billion cases of presbyopia in the middle-aged to elderly population. Thus, the demand for vision care services and products is expected to grow.

The primary causes of vision impairment, such as refractive errors and cataracts, are largely preventable or treatable, indicating a vast untapped market for corrective lenses, surgical procedures, and other interventions. The economic burden of vision impairment is estimated to be USD 411 billion annually due to lost productivity, which highlights the importance of accessible and affordable care solutions. The WHO SPECS 2030 initiative aims to increase access to refractive error services by 40%, further highlighting the industry’s potential. Given the demographic shift toward an aging population and the rising awareness of eye health, the industry is well-positioned for growth, driven by the need to address the global burden of vision disorders.

Cataract surgery is the number one surgery performed globally, with 28 million procedures each year. But only 10%-15% of patients are getting advanced optical IOLs specifically designed for astigmatism and presbyopia.

Jacqueline Henderson, President Vision, EMEA, Johnson & Johnson

Technological advancements in vision care, including smart contact lenses, drug-delivering contact lenses, multifocal & Extended Depth-of-Focus (EDOF) Intraocular Lenses (IOLs), automated refraction systems, and digital retinal imaging, are significant drivers for the industry. These innovations enhance the functionality and efficacy of products as well as treat and manage ocular health. For instance, smart contact lenses promise to revolutionize diabetes management by enabling continuous glucose monitoring, while drug-delivering contact lenses offer a novel approach to treating ocular surface diseases. Multifocal and EDOF IOLs improve post-cataract surgery outcomes by providing clearer vision at various distances, reducing dependency on reading glasses.

For instance, in June 2023, Novaliq announced FDA approval of VEVYE (Cyclosporine Ophthalmic Solution) 0.1% for treating dry eye disease signs and symptoms, making it the first cyclosporine solution with proven efficacy in 4 weeks. In addition, in February 2024, Johnson & Johnson MedTech launched the TECNIS PureSee presbyopia-correcting IOL in EMEA. This next-generation lens features a purely refractive design, delivering uninterrupted, high-quality vision with excellent low-light performance and minimal visual symptoms, enhancing cataract surgery outcomes for patients and surgeons. Moreover, automated refraction systems streamline the prescription process, and digital retinal imaging helps in the early detection and monitoring of diseases. These advancements drive the market by addressing unmet needs and opening new markets, thereby fostering innovation & growth in the sector.

“We are starting the new year with the launch of another complex high-value product, which will help drive our continued growth, ophthalmic products represent a less crowded and more durable category, and we continue to expand our portfolio of affordable medicines.”

” Andy Boyer, Executive Vice President, Chief Commercial Officer - Generics. “

Government initiatives involving the Vision and Eye Health Surveillance System (VEHSS) have driven advancements since its inception. VEHSS has evolved to include additional years of data, condition-specific composite estimates for vision impairment, blindness, and age-related macular degeneration, along with mapping & other data visualization capabilities. In 2022, VEHSS expanded its capability to stratify American Community Survey estimates of vision impairment and blindness by social determinants of health, including poverty, unemployment, and other disabilities. This initiative has resulted in numerous peer-reviewed publications & reports, highlighting its impact on understanding and addressing vision loss & conditions in the U.S. In addition, rising public health initiatives and a focus on preventive healthcare are making people more aware of the importance of regular eye exams. In May 2024, The Canadian Association of Optometrists (CAO) launched a nationwide digital campaign to remind people about the importance of eye health. This campaign, supported by provincial optometry groups, encourages Canadians to schedule regular eye exams with their optometrists.

Market Concentration & Characteristics

The industry growth stage is high, and the pace of growth is accelerating. The eye care industry displays a moderate level of concentration, with several key players dominating the market. There are stringent regulatory standards ensuring product quality and safety. Moreover, the industry benefits from increasing demand for ocular healthcare globally due to factors such as rising prevalence of vision disorders and expanding geriatric population. However, challenges such as high initial investment costs and complex regulatory requirements impact market entry.

The market has observed a high degree of innovation, with advancements in technology and methodologies driven by a combination of research, regulatory approvals, and demand. Innovations span from smart contact lenses that monitor glucose levels to drug-delivering contact lenses for ocular surface diseases that enhance post-cataract surgery outcomes.

Regulations influence the market by setting standards for product safety, efficacy, and quality. They ensure that new technologies and treatments meet stringent criteria before reaching consumers, safeguarding patient health and trust in medical devices. Regulatory bodies such as the U.S. FDA oversee the approval of new drugs, devices, and therapies, including smart contact lenses, drug-delivering contact lenses, and at-home digital vision care technologies.

Mergers and acquisitions in the industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in May 2024, Visibly acquired Lensabl to enhance its platform with optical e-commerce, aiming to make vision care more accessible. Lensabl's expertise includes direct-to-consumer sales and a growing B2B sector, offering white-label e-commerce solutions and modernized vision plans. This merger combines Lensabl's retail offerings with Visibly's telehealth services, promising broader access to affordable vision care.

“At Lensabl, we believe in leveraging technology to make access to vision care easier and more affordable, having worked with Visibly for years, we believe by joining forces, our complimentary offerings can help their existing customers provide a more comprehensive range of vision services to the end-consumer."

“Andy Bilinsky, CEO of Lensabl”

The industry is witnessing geographic expansion due to rising global demand. Manufacturers are establishing their presence in the emerging industry to meet growing needs for vision correction solutions. For instance, in January 2024, NVISION Eye Centers expanded in Texas through a joint venture with Parkhurst NuVision (PNV). The partnership aims to enhance patient care and expand services across Texas, leveraging NVISION's management expertise and capital for growth.

“This partnership is an important step in our continued growth and expansion throughout the United States. We have admired what Dr. Parkhurst has built and together we look forward to partnering with other exceptional physician practices throughout Texas”

“Chris Karkenny, CEO of NVISION”

Product Insights

The contact lens segment held the largest market share of 36.42% in 2023.Contact lenses offer a convenient alternative to traditional eyeglasses for vision correction. Their popularity stems from factors such as improved comfort, enhanced aesthetics, and technological advancements. With options ranging from daily disposables to specialized lenses for various vision conditions, contact lenses cater to a diverse consumer base seeking both functional and lifestyle-oriented solutions for their visual needs.

The ocular health products segment is expected to exhibit the fastest growth during the forecast period, driven by increasing awareness of ocular health and preventive care. These products encompass a wide range of solutions, including drops, supplements, and protective eyewear, designed to promote eye wellness and address common conditions such as dryness, irritation, and fatigue. As consumers prioritize proactive measures to maintain optimal vision and overall eye health, the demand for ocular health products is expected to continue rising, shaping the industry’s landscape.

Mode Of Purchase Insights

The prescribed products segment held the largest market share of 61.14% in 2023, necessitating professional diagnosis and supervision for treatment. These products, including prescription eyeglasses, specialized lenses, and medicated drops, address various types of vision impairment and ocular conditions. They require a prescription, thus ensuring tailored solutions & proper management and instilling trust & reliability among consumers. Despite the increase in over-the-counter options, prescribed products remain essential for addressing complex vision issues and maintaining optimal care standards.

The over-the-counter products segment is expected to exhibit the fastest growth during the forecast period, fueled by advancements in self-care options and consumer preferences for convenience. OTC products offer accessible solutions for common concerns such as dryness, redness, & allergies, such as nonprescription eyewear, lubricating drops, and nutritional supplements. With the convenience of direct purchase without a prescription, they empower consumers to take proactive measures in managing their ocular health, contributing to the expanding landscape of self-directed wellness and personalized healthcare.

Distribution Channel Insights

The hospitals and clinics segment held the largest market share of 35.92% in 2023. Hospitals & clinics play a key role in distributing vision care products, especially prescribed items requiring professional diagnosis and supervision. These establishments offer comprehensive care services, including consultations, diagnostics, and treatment, ensuring personalized solutions for patients' vision needs. With access to specialized equipment and expertise, hospitals and clinics serve as trusted hubs for addressing complex conditions and providing continuity of care. Their integration of medical professionals and resources facilitates efficient distribution and ensures adherence to quality standards in the industry.

The online stores segment is projected to grow at the fastest rate over the forecast period, driven by consumer demand for convenience and accessibility. Online platforms offer a diverse range of products, including contact lenses and ocular health supplements, as well as a seamless shopping experience & doorstep delivery. They have several features like virtual try-on tools and user reviews, which enhance the purchasing journey, empowering consumers to make informed decisions about their vision care needs. As e-commerce continues to expand, online stores are reshaping the retail landscape, catering to customers who are comfortable & skilled in using digital tools and seeking convenience & variety in their purchases.

Regional Insights

The North America eye care market dominated the overall global market and accounted for 44.66% revenue share in 2023 owing to various factors such as a large geriatric population, technological advancements in diagnostic & treatment options, increasing prevalence of vision problems due to digital device usage, greater awareness about ocular health, and improved healthcare access & insurance coverage.

U.S. Eye Care Market Trends

The eye care market in the U.S. held a significant share of the North America region in 2023, driven by a demographic shift toward an aging population, technological advancements in diagnostic & treatment options, increasing prevalence of vision problems due to digital device usage, awareness about ocular health, and improvements in healthcare access & insurance coverage for vision care services.

Europe Eye Care Market Trends

The eye care market in Europeis driven by a rapidly aging population, technological innovations in diagnostic & treatment modalities, rising prevalence of vision impairment due to lifestyle changes, increasing awareness of eye health, and improving healthcare accessibility and insurance coverage for vision-related services.

The eye care market in the UK is influenced by a demographic shift toward an aging population, technological innovations in diagnostics and treatments, increasing awareness of eye health, and regulatory changes ensuring quality standards & access to vision care services.

The France eye care market is growing due to shifting consumer preference toward preventative care, rising digital eye strain, and the growing popularity of natural & organic products.

The eye care market in Germany is expected to expand in the foreseeable future as people become more aware of potential issues linked to eye care, like infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products.

Asia Pacific Eye Care Market Trends

The eye care market in Asia Pacificis driven by the growing prevalence of eye diseases such as cataracts, glaucoma, and refractive errors as well as the increasing age of population and workforce. Technological advancements and government initiatives to improve healthcare infrastructure further boost market growth. Countries such as India and China, with a large population and rising number of cataract surgeries, significantly contribute to this trend. However, challenges such as lack of awareness and rural accessibility hinder market expansion.

The Japan eye care market is witnessing significant growth, driven by a rapidly aging population, increasing awareness about eye health, and a cultural emphasis on preventive measures. The demand for products such as vitamins and supplements is rising along with a preference for natural and organic ocular health items. Technological advancements, such as contact lenses with UV protection & moisture retention, and wearable technologies for vision management, are also contributing to market expansion.

The eye care market in China is driven by a rapidly aging population, a rising middle class with higher disposable income, and increasing awareness about the importance of eye health. The market is observing growth in demand for various products, such as contact lenses, drops, and vitamins, due to the harmful effects of digital screens on eye health and government initiatives like the National Eye Health Program. With China having the world's largest population and a significant portion suffering from vision problems, the potential for ocular health products is vast, further amplified by the country's rapid economic growth and urbanization.

The eye care market in India is rapidly growing, driven by an increasing awareness about eye health, growing prevalence of myopia & cataracts, and rising government initiatives to improve access to eye care services through programs such as the National Programme for Control of Blindness and Visual Impairment. The market is also benefiting from the adoption of advanced technologies and treatments, and the convenience offered by online platforms for purchasing eye care products.

Latin America Eye Care Market Trends

The Latin America eye care market is witnessing robust growth, primarily driven by the increasing demand for prescribed products among the elderly population due to the rising prevalence of eye disorders. Major players are enhancing their market presence through collaborations and acquisitions. The market is also influenced by the increasing usage of digital devices, surging demand for prescribed spectacles, and the rising prevalence of vision impairment.

Middle East & Africa Eye Care Market Trends

The eye care market in MEA is growing, driven by the increasing prevalence of Age-related Macular Degeneration (AMD) and amblyopia, especially in the geriatric population, and rising disposable income leading to better access to healthcare services. Government initiatives focusing on health awareness and investment in modern diagnostic tools & surgical equipment are also significant drivers. In addition, the market benefits from the entry of international brands offering innovative solutions, including contact lenses and prescription glasses, catering to the unique needs of the region.

The eye care market in Saudi Arabia is witnessing significant growth, fueled by increasing awareness about eye health, a high prevalence of vision-related conditions, and the adoption of advanced technologies such as contact lenses. The industry is also influenced by the country's young population, high disposable income, and the convenience offered by online platforms for purchasing products.

The Kuwait eye care market is driven by the increasing prevalence of eye diseases, especially in the aging population, and the government's focus on healthcare improvements. Moreover, the rise in disposable income and lifestyle changes, including increased screen time, contribute to heightened demand for vision care services and products.

Key Eye Care Company Insights

The eye care market is highly competitive, with key players such as Johnson and Johnson Eye Care, Inc., Alcon, Inc., Carl Zeiss Meditec AG (ZEISS International), and Bausch & Lomb Incorporated holding significant positions. Major companies are implementing various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and geographic expansion to address the unmet needs of their customers.

STAAR Surgical Company and HOYA CORPORATION, among others, are some of the emerging players in the industry. These companies focus on gaining funding support from government bodies & healthcare organizations and launching novel products to capitalize on untapped opportunities.

Key Eye Care Companies:

The following are the leading companies in the eye care market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon, Inc.

- Johnson and Johnson Eye Care, Inc.

- Bausch & Lomb Incorporated

- Carl Zeiss Meditec AG (ZEISS International)

- Essilor International

- CooperVision

- HOYA CORPORATION

- Rayner Group

- STAAR SURGICAL

- Novartis AG

Recent Developments

-

In December 2023,Carl Zeiss Meditec AG acquired the Dutch Ophthalmic Research Center for USD 1,052 million. This acquisition is expected to enhance ZEISS Medical Technology’s broad ophthalmic portfolio.

-

In July 2023, Bausch + Lomb expanded its OTC product line by acquiring the Blink Eye Drops product line from Johnson & Johnson Vision for USD 106.5 million. This acquisition aligns with Bausch + Lomb's strategy to enhance consumer convenience in eye care, catering to the growing demand for dry eye relief. The Blink portfolio includes a range of eye and contact lens drops designed to provide immediate and lasting symptom relief, addressing a significant unmet need in the market.

-

In July 2023, Alkem Laboratories, an Indian pharmaceutical company, ventured into the ophthalmology market with the launch of a range of eye care products, marking its first foray into this field.

-

In April 2022, Sandoz launched a brimonidine tartrate/timolol maleate eyedrop in the U.S. for patients with ocular hypertension. This move expands Sandoz's leading ophthalmic portfolio, offering a cost-effective solution for lowering eye pressure.

Eye Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 74.67 billion

Revenue forecast in 2030

USD 110.33 billion

Growth rate

CAGR of 6.72% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of purchase, distribution channel, region

Regional scope

North America: Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Alcon, Inc.; Johnson and Johnson Eye Care, Inc.; Bausch & Lomb Incorporated; Carl Zeiss Meditec AG (ZEISS International); HOYA CORPORATION; Rayner; STAAR SURGICAL; Novartis AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Eye Care Market Report Segmentation

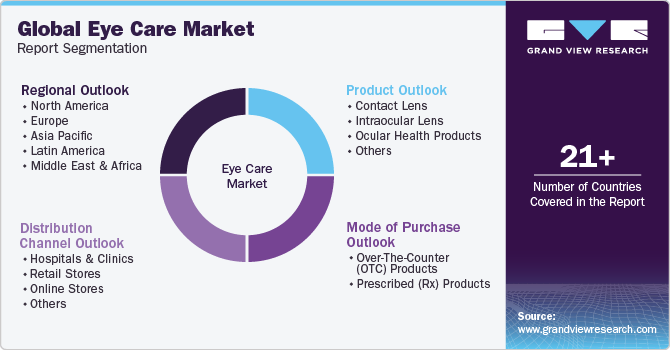

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the eye care market report based on product, mode of purchase, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact Lens

-

Intraocular Lens

-

Ocular Health Products

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Over-The-Counter (OTC) Products

-

Prescribed (Rx) Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Retail Stores

-

Online Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global eye care market size was estimated at USD 70.78 billion in 2023 and is expected to reach USD 74.67 billion in 2024.

b. The global eye care market is expected to grow at a compound annual growth rate of 6.72% from 2024 to 2030 to reach USD 110.33 billion by 2030.

b. North America dominated the eye care market with a share of 44.7% in 2023. This is attributable to advancements in eye care devices, which help in the efficient diagnosis and treatment of retinal disorders, glaucoma, and other eye disorders.

b. Some key players operating in the eye care market include Alcon, Inc., Johnson and Johnson Eye Care, Inc., Bausch & Lomb Incorporated, Carl Zeiss Meditec AG (ZEISS International), HOYA CORPORATION, Rayner, STAAR SURGICAL, Novartis AG

b. Key factors that are driving the eye care market growth include the rising prevalence of eye diseases, technological advancements in eye care devices, and government initiatives for increasing awareness regarding visual impairment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.