- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Extrusion Coating Market Size, Share & Growth Report, 2030GVR Report cover

![Extrusion Coating Market Size, Share & Trends Report]()

Extrusion Coating Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Polyurethane, Polypropylene), By Substrate, By Application (Liquid Packaging, Medical Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-333-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extrusion Coating Market Summary

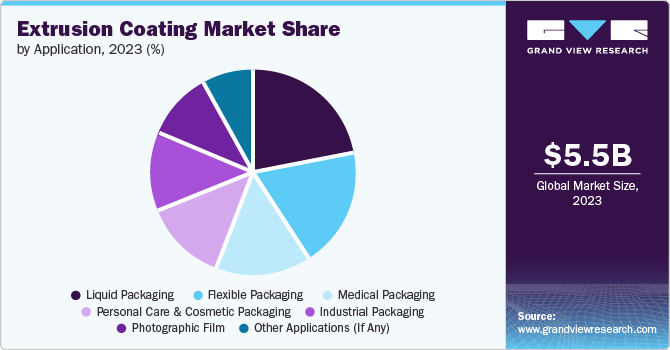

The global extrusion coating market size was estimated at USD 5.5 billion in 2023 and is projected to reach USD 7.69 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The packaging industry is one of the primary users of extrusion coatings, and as the demand for packaged food, beverages, and consumer goods rises, so does the need for advanced packaging solutions.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a 36.0% share in 2023.

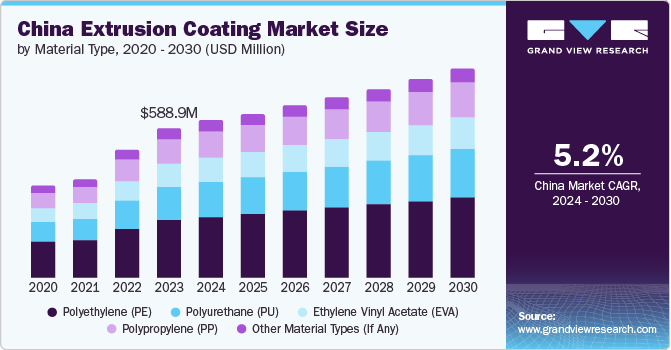

- Extrusion Coating Market in China is growing and dominated the global market.

- By material type, polyethylene dominated the market and accounted for a revenue share of 38.1% in 2023.

- By application, liquid packaging applications dominated the market and accounted for a revenue share of 22.3% in 2023.

- By substrate, paperboards & cardboards dominated the market and accounted for a revenue share of 41.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.5 Billion

- 2030 Projected Market Size: USD 7.69 Billion

- CAGR (2024-2030): 4.8%

- Asia Pacific: Largest market in 2023

Extrusion coatings provide barrier properties, durability, and printability, which are essential for modern packaging requirements. Extrusion coatings are a type of polymer coating applied to substrates, such as paper, paperboard, aluminum foil, and plastic films, through the process of extrusion. In this process, a molten polymer is extruded and applied directly onto the substrate, forming a continuous, uniform layer. This method is widely used in various industries due to its ability to provide excellent barrier properties, such as moisture, gas, and chemical resistance, as well as enhanced durability and aesthetic appeal. These products are particularly valued for their ability to adhere well to different substrates and their capability to create multi-layered structures, improving the functionality and performance of the end product.

A major driver of the demand for the product is the expanding packaging industry, particularly in the food and beverage sector. With the increasing consumer preference for packaged and ready-to-eat food products, there is a growing need for high-quality packaging materials that can ensure product safety, extend shelf life, and provide convenience. These products offer superior barrier properties against moisture, oxygen, and contaminants, making them ideal for food packaging applications. Additionally, advancements in polymer technology have led to the development of biodegradable and recyclable products, aligning with the global trend towards sustainable and eco-friendly packaging solutions.

One significant restraint in the growth of the market is the fluctuation in raw material prices, particularly petroleum-based polymers like polyethylene and polypropylene. The production of these polymers is highly dependent on crude oil prices, which are subject to volatility due to geopolitical tensions, supply-demand imbalances, and other economic factors. This price instability can lead to increased production costs for the product, affecting the profitability of manufacturers and potentially leading to higher prices for end consumers. Additionally, environmental regulations and the push for reducing plastic waste pose challenges for the industry, necessitating continuous innovation and investment in alternative materials and technologies.

Drivers, Opportunities & Restraints

One of the primary drivers of growth for the global market is the increasing demand for flexible packaging solutions across various industries. Flexible packaging offers several advantages, including reduced material usage, lower transportation costs, and enhanced convenience for consumers. For instance, the rise of online food delivery services has significantly boosted the need for flexible, durable, and efficient packaging materials that can preserve food quality and withstand transportation. Furthermore, the development of advanced polymers with improved performance characteristics, such as enhanced heat resistance and better sealing properties, has expanded the application scope of the product in the packaging sector.

Despite its growth potential, the global market faces several restraints, with environmental concerns being a major challenge. The production and disposal of traditional polymer-based products contribute to environmental pollution and plastic waste. Regulatory bodies across the world are increasingly implementing stringent regulations to curb plastic usage and promote recycling. For example, the European Union's Single-Use Plastics Directive aims to reduce the impact of certain plastic products on the environment, compelling manufacturers to seek alternative, eco-friendly solutions. Additionally, the high initial capital investment required for setting up production facilities and the complex manufacturing process can be barriers for new entrants, limiting market expansion.

Amid these challenges, the global market presents significant opportunities for growth, particularly through the development and adoption of bio-based and biodegradable polymers. Innovations in material science have led to the creation of bio-based polymers derived from renewable sources, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), which offer similar performance characteristics to conventional polymers while being environmentally friendly. Companies are increasingly investing in research and development to create sustainable products. For instance, BASF has launched a series of biodegradable and bio-based polymers suitable for extrusion coating applications. This shift towards sustainable materials not only addresses regulatory pressures but also aligns with consumer preferences for eco-friendly products, opening new avenues for market growth.

Material Type Insights

“Polyurethane (PU) emerged as the fastest growing segment with a CAGR of 5.5%”

Polyethylene dominated the market and accounted for a revenue share of 38.1% in 2023. Polyethylene (PE) is one of the most widely used materials due to its excellent balance of properties and cost-effectiveness. The characteristics of polyethylene include good chemical resistance, low moisture permeability, and ease of processing. These properties make it an ideal choice for a wide range of applications. The benefits of using polyethylene in extrusion coatings are numerous. It provides excellent moisture and vapor barriers, which are essential for packaging applications, particularly in the food and beverage industry. PE based products also offer good adhesion to a variety of substrates and can be used in multilayer structures to achieve desired properties. Applications of polyethylene-based products include flexible packaging, liquid packaging, aseptic packaging, and coated paper products. For example, milk cartons and juice boxes often use PE based products to provide a liquid barrier and extend shelf life.

Polyurethane (PU) is a versatile material and is known for its excellent mechanical properties and durability. The characteristics of polyurethane include outstanding abrasion resistance, excellent adhesion to a variety of substrates, and high flexibility. The benefits of using polyurethane in extrusion coatings are its ability to provide a robust protective layer that enhances the substrate’s performance and longevity. PU coatings are widely used in applications that require high wear resistance and flexibility, such as automotive components, industrial equipment, and protective films. For example, PU-coated fabrics are used in outdoor gear and protective clothing due to their durability and resistance to environmental factors. In the packaging industry, PU coatings are used to provide superior mechanical properties and protection for products during transportation and storage.

Polypropylene (PP) is known for its excellent chemical resistance and versatility. The characteristics of polypropylene include good chemical resistance, high tensile strength, and low density. The benefits of using polypropylene in extrusion coatings are its ability to provide excellent protection against moisture, chemicals, and physical damage.

Application Insights

“Flexible Packaging emerged as the fastest growing segment with a CAGR of 5.5%”

Liquid Packaging applications dominated the market and accounted for a revenue share of 22.3% in 2023. Liquid packaging is a critical application for extrusion coatings, especially in the food and beverage industry. This type of packaging involves materials that can securely contain liquids such as milk, juice, water, and other beverages, as well as liquid food products like sauces and soups. Extrusion coatings are applied to substrates like paperboard, aluminum foil, and plastic films to provide a robust barrier against moisture and gases, preventing leakage and contamination.

Flexible packaging is another major application for extrusion coatings, widely used in various industries due to its adaptability and efficiency. This type of packaging includes products such as pouches, bags, wraps, and films that are designed to be flexible and conform to the shape of their contents. Extrusion coatings are applied to enhance the performance of these flexible materials, providing barriers against moisture, gases, and light.

Medical packaging is a highly specialized application for extrusion coatings, where the primary focus is on safety, sterility, and protection. This type of packaging is used for a wide range of medical products, including pharmaceuticals, medical devices, diagnostic kits, and surgical supplies. Extrusion coatings play a crucial role in ensuring that these products remain sterile, safe, and effective throughout their shelf life and during transportation and storage.

Substrate Insights

“Polymer Films emerged as the fastest growing segment with a CAGR of 5.2%”

Paperboards & Cardboards dominated the market and accounted for a revenue share of 41.5% in 2023. Paperboard and cardboard are widely used substrates for extrusion coatings, particularly in the packaging industry. These substrates are made from layers of paper pulp compressed to form a thick, sturdy material. Paperboard is typically used for packaging applications requiring rigidity and strength, such as boxes, cartons, and containers. Cardboard, a thicker and more robust form of paperboard, is used for heavier-duty packaging needs.

Polymer films are versatile substrates, used across various industries due to their flexibility, clarity, and barrier properties. These films are made from a range of polymers, such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polyvinyl chloride (PVC). Each type of polymer film offers unique characteristics, making them suitable for different coating applications.

Metal foils, particularly aluminum foil, are commonly used substrates due to their excellent barrier properties and durability. Aluminum foil is made by rolling aluminum slabs until they are thin sheets. These foils are used in various applications requiring a high degree of protection against moisture, light, and contaminants.

Regional Insights

“Asia Pacific emerged as the fastest growing market with a CAGR of 5.4% from 2024-2030”

Asia Pacific dominated the market and accounted for a 36.0% share in 2023. The Asia Pacific region is one of the fastest-growing markets for extrusion coatings, driven by rapid industrialization, urbanization, and increasing consumer demand. Countries such as India, Japan, South Korea, and Southeast Asian nations contribute significantly to this growth. The region's booming packaging industry, especially in food and beverage, electronics, and consumer goods, is a key driver. The increasing population and rising disposable incomes in these countries boost demand for packaged products, necessitating high-quality extrusion coatings to enhance packaging performance and shelf life.

Extrusion Coating Market in China is growing and dominated the global market, owing to its massive manufacturing base and extensive industrial infrastructure. The country's rapid economic growth and urbanization have led to a surge in demand for packaging materials across various industries, including food and beverage, electronics, automotive, and pharmaceuticals. China's significant production capacity and cost-effective manufacturing processes make it a crucial hub for extrusion coatings.

North America Extrusion Coating Market Trends

North America is a mature market, characterized by advanced technological capabilities, a strong focus on sustainability, and high consumer awareness. The United States and Canada are the major contributors to this market, with a well-established packaging industry and significant demand from sectors such as food and beverage, healthcare, and consumer goods. The region's emphasis on innovation and sustainability drives the development of advanced extrusion coatings.

Europe Extrusion Coating Market Trends

Europe is a significant product market, known for its strong regulatory framework, focus on sustainability, and high-quality manufacturing standards. Countries like Germany, France, the United Kingdom, and Italy are key contributors to this market. The region's advanced packaging industry, coupled with stringent environmental regulations, drives the demand for innovative and eco-friendly extrusion coatings.

Central & South America Extrusion Coating Market Trends

Central and South America represent a growing market, driven by increasing urbanization, rising disposable incomes, and expanding industrial activities. Countries like Brazil, Argentina, and Chile are significant contributors to this market. The region's developing packaging industry, particularly in food and beverage and consumer goods, is a key driver of demand for extrusion coatings.

Middle East & Africa Extrusion Coating Market Trends

The Middle East and Africa region is an emerging market for extrusion coatings, characterized by rapid economic development, increasing urbanization, and growing consumer demand. Countries such as Saudi Arabia, the UAE, South Africa, and Nigeria are significant contributors to this market. The region's developing packaging industry, particularly in food and beverage, healthcare, and consumer goods, is driving the demand for extrusion coatings.

Key Extrusion Coating Company Insights

Some of the key players operating in the global extrusion coating market include PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., and among others.

-

PPG Industries, Inc. is a leading global supplier of paints, coatings, and specialty materials, with a significant presence in the extrusion coatings market. The company's extrusion coatings portfolio includes a variety of high-performance coatings designed for applications in the construction, automotive, and industrial sectors. PPG's extrusion coatings are known for their durability, excellent adhesion, and resistance to environmental factors such as UV radiation, moisture, and corrosion. The company's commitment to innovation is evident in its continuous development of advanced coatings that meet the evolving needs of its customers.

-

The Sherwin-Williams Company is a global leader in the development, manufacture, and sale of paints, coatings, and related products, with a robust portfolio in the extrusion coatings market. Sherwin-Williams' extrusion coatings are designed to meet the stringent performance requirements of various industries, including construction, automotive, and general manufacturing. The company's coatings are renowned for their excellent durability, superior adhesion, and resistance to weathering, making them suitable for both interior and exterior applications.

-

Akzo Nobel N.V. is a prominent global manufacturer of paints, coatings, and specialty chemicals, with a strong presence in the extrusion coatings market. The company's extrusion coatings portfolio is characterized by high-performance products designed for a wide range of applications, including architectural, automotive, and industrial sectors. Akzo Nobel's coatings are known for their exceptional durability, excellent adhesion, and resistance to environmental factors such as UV radiation, moisture, and corrosion, making them ideal for both exterior and interior use.

Axalta Coatings Systems, and INEOS are some of the emerging participants in the global extrusion coating market.

-

Axalta Coating Systems is a global leader in coatings and coating systems, offering a broad range of extrusion coatings for various industries. With a strong emphasis on innovation and performance, Axalta's extrusion coatings are designed to provide superior durability, aesthetic appeal, and protection for substrates such as aluminum, steel, and other metals. The company's products are widely used in the automotive, architectural, and industrial sectors.

-

INEOS, a leading global manufacturer of petrochemicals, specialty chemicals, and oil products, has a significant presence in the extrusion coatings market through its polymers and specialty materials division. INEOS provides a range of polymer-based extrusion coatings that offer excellent protection, durability, and aesthetic enhancement for various substrates, including metals, plastics, and composites. These coatings are widely used in the packaging, automotive, and industrial sectors.

Key Extrusion Coating Companies:

The following are the leading companies in the extrusion coating market. These companies collectively hold the largest market share and dictate industry trends.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- Valspar

- Axalta Coating Systems

- Chevron Phillips Chemical Company LLC

- INEOS

Recent Developments

-

In June 2024, Akzo Nobel N.V. announced its investment of USD 3.6 million for its coil coatings and extrusion coatings manufacturing facility in Garcia, Mexico. This investment was made in order to increase production capacity and efficiency for its customers across North America, which include Mexico and Southwest regions of the U.S.

-

In May 2024, PPG Industries, Inc. announced its plan to build new paint & coatings manufacturing facility in Tennessee, U.S., with an investment of USD 300 million.

Extrusion Coating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.80 billion

Revenue forecast in 2030

USD 7.69 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material types, substrate, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Italy, UK, France, Spain, China, India, Japan, South Korea, Saudi Arabia, South Africa, Brazil, Argentina

Key companies profiled

PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., Valspar, Axalta Coating Systems, Chevron Phillips Chemical Company LLC, INEOS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extrusion Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extrusion coating market report based on material type, substrate, application, and region.

-

Material Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyurethane (PU)

-

Ethylene Vinyl Acetate (EVA)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Other Material Types (If Any)

-

-

Substrate Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paperboard & Cardboard

-

Polymer Films

-

Metal Foils

-

Other Substrates (If Any)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid Packaging

-

Flexible Packaging

-

Medical Packaging

-

Personal Care & Cosmetic Packaging

-

Industrial Packaging

-

Photographic Film

-

Other Applications (If Any)

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extrusion coatings market was valued at USD 5.50 billion in 2023 and is expected to reach USD 5.80 billion by 2024.

b. The global extrusion coatings market is expected to witness a CAGR of 4.8% from 2024 to 2030 to reach USD 7.69 billion by 2030.

b. Asia Pacific accounted for the largest revenue share of 36.0% in 2023. The Asia Pacific region is one of the fastest-growing markets for extrusion coatings, driven by rapid industrialization, urbanization, and increasing consumer demand. Countries such as India, Japan, South Korea, and Southeast Asian nations contribute significantly to this growth.

b. Some of the key players operating in the global extrusion coating market include PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., among others.

b. The packaging industry is one of the primary users of extrusion coatings, and as the demand for packaged food, beverages, and consumer goods rises, so does the need for advanced packaging solutions. Extrusion coatings provide barrier properties, durability, and printability, which are essential for modern packaging requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.