- Home

- »

- Consumer F&B

- »

-

Extruded Snacks Market Size, Share, Industry Report, 2030GVR Report cover

![Extruded Snacks Market Size, Share & Trends Report]()

Extruded Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Potato, Corn), By Distribution Channel (Supermarkets & Hypermarkets, Online Retailers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-444-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extruded Snacks Market Summary

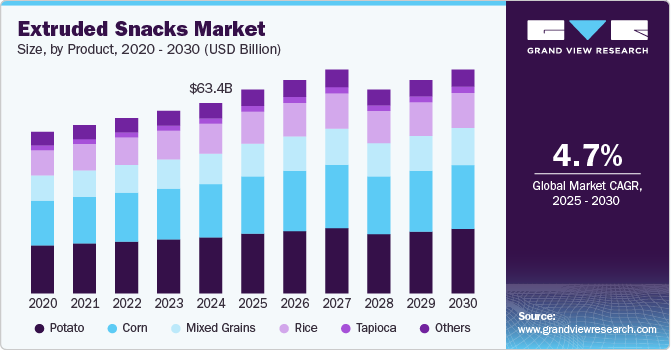

The global extruded snacks market size was estimated at USD 63.38 billion in 2024 and is projected to reach USD 74.52 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. The growing demand for convenience and on-the-go products, driven by busy lifestyles and an expanding workforce, is a key factor in the market's development.

Key Market Trends & Insights

- North America extruded snacks industry held a considerable share in 2024.

- The U.S. extruded snacks industry is expected to grow significantly over the forecast period.

- Based on product, potato-based extruded snacks segment dominated the market, with the largest share of 27.7% in 2024.

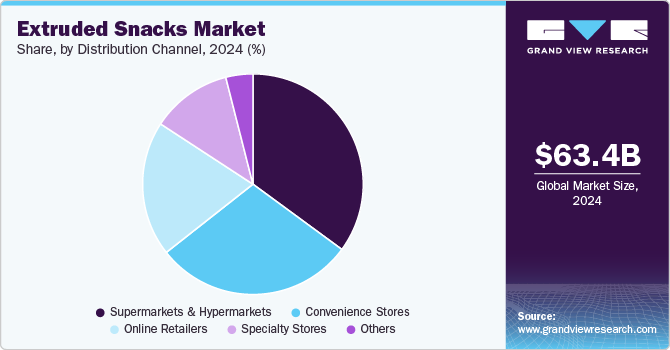

- Based on distribution channel, supermarkets & hypermarkets segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 63.38 Billion

- 2030 Projected Market Size: USD 74.52 Billion

- CAGR (2025-2030): 4.7%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

With higher disposable incomes, consumers are increasingly willing to spend more on convenience items, such as extruded snacks. Additionally, the trend toward healthier snacking options has encouraged consumers to look for nutritious snacks. Innovative products that feature new flavors, shapes, and textures help keep consumers engaged. Furthermore, expansion in emerging markets, especially in regions like Asia Pacific, is contributing significantly to market growth.

Extruded snacks have a large quantity of starch, which allows the product to remain intact during mass production. Through the process of extrusion, mass production of snacks forms an efficient process that confirms uniformity in the final product. Food products manufactured using extrusion include bread, such as croutons, bread sticks, flat bread, many breakfast cereals, soy sticks, ready-to-eat snacks, cookies, some baby foods, and textured vegetable protein.

Malnutrition has become one of the major challenges, which is directly connected to the social living of the people as well as the regional economy. According to the United Nations, the world population is anticipated to reach around 9 billion by 2050, which will further intensify the problem of malnutrition worldwide. Extruded snacks are gaining immense popularity among the young population owing to their increasing nutritional status.

Over the past few years, consumers have become more cautious about their snacking habits and are increasingly preferring healthy extruded snacks. These healthy products help in weight management and improvement of metabolism by delivering essential nutrients and vitamins required by the body, thus expanding the scope of these extruded products in the forthcoming years.

Product Insights

Potato-based extruded snacks dominated the market, with the largest share of 27.7% in 2024. The segment growth is attributed to the widespread popularity of potato snacks, their versatile taste, and the broad consumer base. Additionally, the continuous innovation in potato snack flavors and forms has kept the product category appealing to a wide range of consumers, further solidifying its leading market position. Furthermore, large consumption of potato-based extruded products demands a higher production rate. According to the United States Census Bureau, around 60% of potatoes produced in the U.S. are sold in the form of chips, French fries, dehydrated potato snacks, and other potato products. These trends are anticipated to boost the demand for potato-based extruded snacks over the forecast period.

The corn-based extruded snacks segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. Corn-based extruded snacks are popular due to their versatility, availability, and healthier nutritional profile compared to traditional fried snacks. Additionally, the trend towards healthier eating habits has prompted manufacturers to innovate and introduce a variety of flavored and fortified corn snacks, appealing to health-conscious consumers.

The tapioca-based extruded snacks market is anticipated to expand in the coming years owing to the increasing demand for healthy and nutritious snacks among the young generation worldwide. Tapioca is widely consumed in different forms in Latin America, Africa, and Asia owing to its high nutritional properties. These consumer trends are anticipated to open new avenues for tapioca-based extruded snacks over the forecast period.

Distribution Channel Insights

Supermarkets & hypermarkets dominated the market with the largest revenue share in 2024. The segment growth is attributed to their extensive product range and competitive pricing continue to attract a broad consumer base. For instance, the ability to offer everything from fresh produce to household items under one roof appeals to busy shoppers looking for convenience. Additionally, the expansion of private label products has further strengthened their market position by offering quality alternatives at lower prices. Supermarkets and hypermarkets also benefit from strategic locations in urban and suburban areas, making them easily accessible to a large population. Moreover, the new opening of supermarkets in prime locations is driving the demand. For instance, in September 2024, Co-op launched the first 24-hour rapid grocery delivery service in London, Leeds, and Manchester. Collaborating with Deliveroo, Just Eat, and Uber Eats, this initiative aims to serve late-night snackers, following a survey indicating 40% of quick commerce shoppers would utilize an 11pm to 5am delivery service.

The online retailers are expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping allows consumers to easily browse and purchase a wide variety of snacks from the comfort of their homes. Platforms such as Amazon and Walmart witness a significant increase in snack sales due to their user-friendly interfaces and efficient delivery systems. Additionally, the ability to offer personalized recommendations and targeted promotions based on consumer preferences has enhanced the appeal of online retailers.

Regional Insights

The European extruded snacks industry dominated the global market, with a revenue share of 44.2% in 2024. European consumers' growing preference for convenient, ready-to-eat food products has significantly driven market growth. Busy lifestyles and the need for quick, portable nutrition solutions have led to increased consumption of extruded snacks. Additionally, continuous innovation in flavors and textures and the introduction of healthier ingredient alternatives such as whole grains and reduced additives have catered to evolving consumer palates.

North America Extruded Snacks Market Trends

North America extruded snacks industry held a considerable share in 2024. The growth of the extruded snacks market in North America is primarily driven by changing consumer lifestyles and an increasing demand for convenient food options. Health-conscious consumers are shifting towards healthier, clean-label snacks, which has prompted manufacturers to innovate and diversify their product lines.

U.S. Extruded Snacks Market Trends

The U.S. extruded snacks industry is expected to grow significantly over the forecast period. Rising disposable incomes and a growing preference for on-the-go snacking are significantly influencing market dynamics. The trend towards 'better-for-you' snacks have led to increased research and development aimed at healthier options. For instance, the U.S. Snack Index indicates that many consumers are eager to explore new snack varieties, particularly those that offer convenience and health benefits. This trend is further supported by extensive distribution channels established by major players such as Walmart and Target, enhancing accessibility to a diverse range of extruded snacks.

Asia Pacific Extruded Snacks Market Trends

Asia Pacific extruded snacks industry is expected to grow at the fastest CAGR of 5.6% over the forecast period. Rising disposable incomes and urbanization, which have led to increased demand for convenient snack options among busy consumers. The adoption of Western snacking habits is also contributing to this trend. For instance, local brands are capitalizing on this shift by offering affordable extruded snack products tailored to regional tastes. The expansion of hypermarkets and supermarkets has further facilitated the availability of these snacks, making them more accessible to consumers across urban centers.

Key Extruded Snacks Company Insights:

Some key companies in the extruded snacks market Nestlé, Kellanova, PepsiCo, The Campbell's Company, and others.

-

General Mills Inc. offers a variety of extruded snacks, including corn-based, wheat-based, and multigrain snacks. Their products are designed to cater to health-conscious consumers, featuring options that are low in fat and high in dietary fiber. General Mills has also embraced the trend of healthy snacking by incorporating natural ingredients and clean labels into their products.

Key Extruded Snacks Companies:

The following are the leading companies in the extruded snacks market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- Kellanova

- General Mills Inc.

- PepsiCo

- The Campbell's Company

- Calbee

- ITC Limited

- Old Dutch Foods, Inc.

- Europesnacks

- Universal Robina Corporation

Extruded Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 67.88 billion

Revenue forecast in 2030

USD 74.52 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Volume in kilo tone, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Australia, UAE, Saudi Arabia

Key companies profiled

Nestlé; Kellanova; General Mills Inc.; PepsiCo; The Campbell's Company.; Calbee; ITC Limited; Old Dutch Foods, Inc.; Europesnacks; Universal Robina Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extruded Snacks Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extruded snacks market report based on product, distribution channel, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Potato

-

Corn

-

Rice

-

Tapioca

-

Mixed Grains

-

Others

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retail

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.