- Home

- »

- Advanced Interior Materials

- »

-

Extreme Ultraviolet Lithography Market Size Report, 2030GVR Report cover

![Extreme Ultraviolet Lithography Market Size, Share & Trends Report]()

Extreme Ultraviolet Lithography Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment (Light Source, Optics, Mask), By End Use (Integrated Device Manufacturer, Foundries), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extreme Ultraviolet Lithography Market Summary

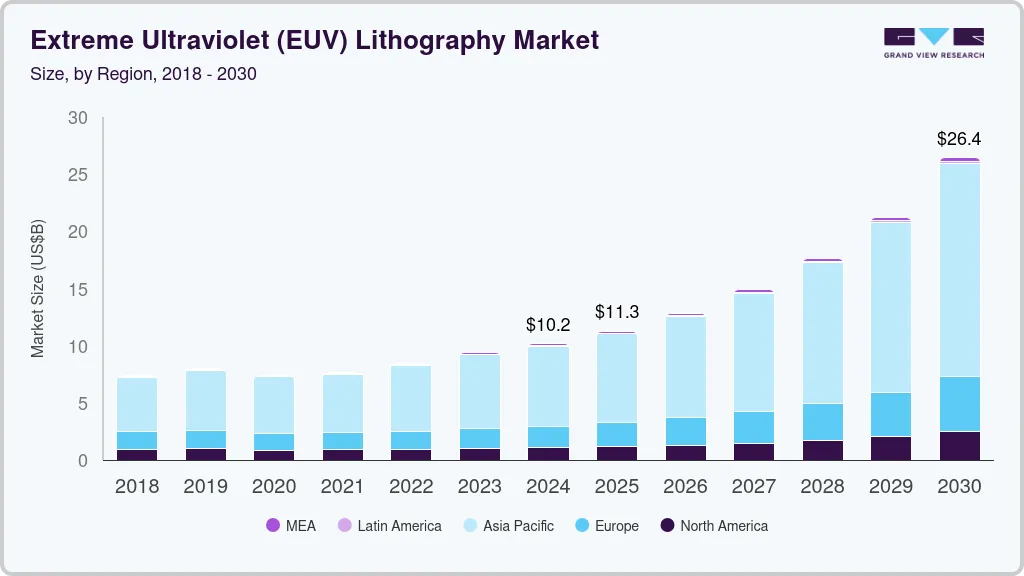

The global extreme ultraviolet lithography market size was estimated at USD 9.42 billion in 2023 and is projected to reach USD 26.43 billion by 2030, growing at a CAGR of 17.3% from 2024 to 2030. The EUV lithography market is experiencing robust growth driven by the rising demand for smaller and more efficient semiconductor devices.

Key Market Trends & Insights

- Asia Pacific holds a significant share of 68.36% in the global market.

- China is estimated to grow at a significant CAGR of 19.2% over the forecast period.

- By equipment, the light source segment led the market and accounted for 40.1% of the global revenue share in 2023.

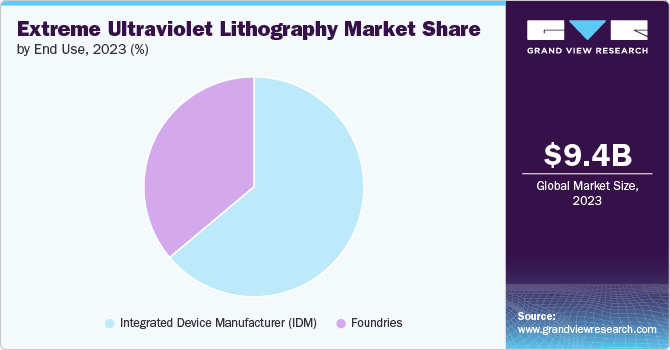

- By end-use, integrated device manufacturer (IDM) end-use segment accounted for 63.9% of the global revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.42 Billion

- 2030 Projected Market Size: USD 26.43 Billion

- CAGR (2024-2030): 17.3%

- Asia Pacific: Largest market in 2023

As electronics continue to shrink while simultaneously increasing in power and efficiency, manufacturers are turning to extreme ultraviolet (EUV) lithography as a key technology to produce the next generation of semiconductors. This trend is primarily fueled by the ongoing advancements in sectors such as consumer electronics, automotive, and high-performance computing. The EUV lithography is a cutting-edge technology used in the semiconductor manufacturing process to create highly intricate patterns on silicon wafers. This technology employs extremely short wavelengths of light, in the extreme ultraviolet spectrum, to achieve unprecedented resolutions and precision, enabling the production of semiconductor devices that are smaller, faster, and more efficient. EUV lithography represents a significant advancement over traditional lithography techniques, opening the door to the next generation of microchips required for various high-tech applications, from smartphones and computers to advanced AI and 5G networks.

Another factor contributing to the growth of the EUV lithography market is the rapid pace of innovation and technological advancements within the semiconductor industry itself. As chip manufacturers continue to push the boundaries of what's possible, EUV lithography stands out as a critical tool for realizing these advancements, thanks to its unparalleled precision and scalability.

Drivers, Opportunities & Restraints

EUV lithography, with its ability to print incredibly fine features on chips, is pivotal for the development of chips with 7nm nodes and below, facilitating the production of faster, more powerful processors required for modern applications like artificial intelligence, 5G communication, and autonomous vehicles. The push toward these technologies has led to significant investments by key industry players in EUV lithography to ramp up their manufacturing capabilities and meet the growing market demand.

Moreover, the drive for more energy-efficient electronic devices that can operate at lower power without compromising performance is further propelling the growth of the EUV lithography market. As sustainability concerns become more pronounced, and with energy efficiency being a critical parameter for both consumers and manufacturers, the adoption of EUV lithography plays a crucial role in producing the next wave of eco-friendly electronics. Which will positively influence the demand for EUV lithography market.

The manufacturing and implementation of EUV lithography systems require significant capital investment, not only for the sophisticated equipment itself but also for the development of the infrastructure needed to support these advanced systems. The extreme ultraviolet light sources used in EUV lithography are incredibly complex and expensive to produce, making the initial setup and operational costs prohibitively high for many semiconductor manufacturers.

Equipment Insights

“The demand for mask segment is expected to grow at a CAGR of 17.7% from 2024 to 2030 in terms of revenue”

The light source segment led the market and accounted for 40.1% of the global revenue share in 2023. The light source equipment segment in the extreme ultraviolet (EUV) lithography market is experiencing significant growth, primarily fueled by the semiconductor industry's push toward producing smaller, more efficient chips. This demand is driven by the critical role of EUV lithography in enabling the patterning of sub-10 nanometer features on silicon wafers, essential for next-generation semiconductor devices. Advancements in light source technology, substantial investments from leading semiconductor manufacturers, strategic partnerships for technological innovation, and government support for semiconductor research and development are key factors propelling this market segment.

The mask equipment segment plays a crucial role in the EUV lithography market, exhibiting substantial growth as the demand for advanced semiconductor devices escalates. With EUV lithography enabling the production of chips at sub-7 nanometer geometries, the complexity and precision required in mask making have significantly increased. Masks, or photomasks, are essential for transferring circuit patterns onto semiconductor wafers, and the precision of this process directly influences the performance and yield of the final semiconductor products. The above factors will further drive the demand for extreme ultraviolet (EUV) lithography.

End Use Insights

“The demand from foundries end use segment is expected to grow at a significant CAGR of 16.8 % from 2024 to 2030 in terms of revenue”

Integrated device manufacturer (IDM) end use segment accounted for 63.9% of the global revenue share in 2023. IDMs company which engages in the design, manufacture, and sales semiconductor products, are increasingly adopting EUV lithography to push the boundaries of chip performance, power, and area (PPA). This adoption is driven by the escalating demand for more powerful and efficient electronic devices across various applications, including computing, mobile, automotive, and IoT. Moreover, EUV lithography, with its capability to pattern incredibly fine features onto silicon wafers, is crucial to produce next-generation semiconductor devices.

The extreme ultraviolet (EUV) lithography market for foundries end use is poised for substantial growth, given its critical role in propelling semiconductor manufacturing to new heights. As the semiconductor industry continues its relentless drive toward smaller, more powerful, and energy-efficient devices, foundries are increasingly relying on EUV lithography to meet these advanced technical requirements. This technology, renowned for its ability to pattern extremely fine features on silicon wafers, is vital for producing the next generation of semiconductor chips required for a multitude of applications, including smartphones, artificial intelligence, automotive, and high-performance computing.

Regional Insights

North America extreme ultraviolet (EUV) lithography market is significantly fuelled by the growing demand for smaller, more powerful semiconductor devices across a variety of industries, including computing, telecommunications, and consumer electronics. As the quest for miniaturization continues, with semiconductor manufacturers pushing the boundaries of Moore's Law, EUV lithography has emerged as a critical technology enabling the production of chips with feature sizes well below 10 nanometres, which is driving the expansion of the extreme ultraviolet (EUV) lithography market.

Asia Pacific Extreme Ultraviolet Lithography Market Trends

“China to witness the fastest market growth at 19.2% CAGR”

The extreme ultraviolet (EUV) lithography marketin Asia Pacific holds a significant share of 68.36% in the global extreme ultraviolet (EUV) lithography market, primarily due to its robust semiconductor manufacturing base and the presence of leading semiconductor foundries. Countries like South Korea, Taiwan, and China are home to some of the world's largest semiconductor manufacturing companies and foundries, such as Samsung, TSMC, and SMIC, which are at the forefront of adopting cutting-edge manufacturing technologies, including EUV lithography. Which will drive the demand for extreme ultraviolet (EUV) lithography over the forecast period.

China extreme ultraviolet lithography market is estimated to grow at a significant CAGR of 19.2’% over the forecast period. China's extreme ultraviolet (EUV) lithography market is experiencing rapid growth, driven by China’s increasing investments in research and development, as well as in the acquisition of state-of-the-art chipmaking equipment like EUV lithography systems. EUV lithography, critical for manufacturing next-generation semiconductor devices with smaller, more efficient circuits, is at the heart of China's strategy to excel in sectors such as 5G, artificial intelligence, and electric vehicles are key factors propelling the growth of the China EUV lithography market.

Europe Extreme Ultraviolet Lithography Market Trends

The extreme ultraviolet (EUV) lithography market in Europe is growing at a significant rate owing to advancements in semiconductor technology and a strong ecosystem of research and development. European semiconductor manufacturers and research institutions are heavily invested in leveraging EUV lithography to push the limits of chip miniaturization and performance key to staying competitive in the rapidly evolving tech landscape.

Key Extreme Ultraviolet Lithography Company Insights

Some of the key players operating in the market include ASML Holding NV, Intel Corporation, Samsung Electronics Co. Ltd among others.

-

ASML Holding NV specializes in developing complex machines that allow semiconductor manufacturers to create smaller, more powerful, and energy-efficient microchips, pivotal for driving technological innovation across various sectors. Its product portfolio includes deep ultraviolet (DUV) lithography machines and the groundbreaking extreme ultraviolet (EUV) lithography systems. ASML's EUV technology represents a significant leap forward in lithography, allowing chipmakers to etch patterns on silicon wafers at a large scale.

-

Intel Corporation is engaged in the development and manufacturing of microprocessors and semiconductor chips. As a critical supplier for personal computer manufacturers worldwide, Intel continues to shape the future of computing, artificial intelligence, and broadband digital communications through its relentless pursuit of technological advancement and a steadfast commitment to research and development. The company made a significant stride in the semiconductor industry with the adoption of extreme ultraviolet (EUV) lithography technology. This advancement allows for the creation of smaller, more efficient microprocessors by employing incredibly precise light sources to etch finer circuits on chips.

NTT Advanced Technology Corporation, Canon Inc. and Nikon Corporation, are some of the emerging market participants in the extreme ultraviolet (EUV) lithography market.

-

Nikon Corporation has diversified its portfolio to include a range of optical products, including microscopes, binoculars, and measurement instruments, showcasing its prowess in precision optics and imaging technology. The company's commitment to excellence and innovation has solidified its position in the market, allowing it to adapt to the rapidly changing technological landscape while continuing to inspire and empower visual storytelling through its advanced and user-friendly products. Company EUV products are capable of etching features on silicon wafers with unparalleled precision, supporting the semiconductor industry's relentless push toward miniaturization and the development of next-generation chips.

-

Canon Inc., a renowned global leader in imaging and optical products, has made significant strides in the semiconductor lithography equipment market with its entry into Extreme Ultraviolet (EUV) lithography technology. This move represents a pivotal advancement in chip manufacturing, allowing for more intricate and smaller microchip designs. EUV lithography stands out because it uses extremely short wavelengths, significantly improving the resolution and efficiency of the photolithography process, essential for producing next-generation semiconductor devices.

Key Extreme Ultraviolet Lithography Companies:

The following are the leading companies in the extreme ultraviolet lithography market. These companies collectively hold the largest market share and dictate industry trends.

- ASML Holding NV

- NTT Advanced Technology Corporation

- Canon Inc

- Nikon Corporation

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company Limited

- Samsung Electronics Co. Ltd

- Toppan Photomasks Inc

- ZEISS Group

- Ushio, Inc.

Recent Developments

- In January 2024, ZEISS Group introduced its High-NA (Numerical Aperture) Extreme Ultraviolet (EUV) lithography system. This cutting-edge system represents a monumental leap in semiconductor manufacturing, enabling the creation of microchips with incredibly fine features, compared to existing EUV systems.

Extreme Ultraviolet Lithography Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.16 billion

Revenue forecast in 2030

USD 26.43 billion

Growth Rate

CAGR of 17.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, end use and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, South Korea, Taiwan, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

ASML Holding NV, NTT Advanced Technology Corporation, Canon Inc., Nikon Corporation, Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited, Samsung Electronics Co. Ltd, Toppan Photomasks Inc, ZEISS Group, Ushio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extreme Ultraviolet Lithography Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extreme ultraviolet lithography market report on the basis of equipment, end use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Source

-

Optics

-

Mask

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Device Manufacturer (IDM)

-

Foundries

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Taiwan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global extreme ultraviolet lithograph market size was estimated at USD 9.42 billion in 2023 and is expected to reach USD 10.16 billion in 2024.

b. The global extreme ultraviolet lithograph market, in terms of revenue, is expected to grow at a compound annual growth rate of 17.3% from 2024 to 2030 to reach USD 26.43 billion by 2030

b. Asia Pacific dominated the extreme ultraviolet lithograph market with a revenue share of 68.3% in 2023. The Asia Pacific region holds a significant share in the global extreme ultraviolet (EUV) lithography market, primarily due to its robust semiconductor manufacturing base and the presence of leading semiconductor foundries. Which will drive the demand for extreme ultraviolet (EUV) lithography over the forecast period.

b. Some of the key players operating in the extreme ultraviolet (EUV) lithography market include ASML Holding NV, NTT Advanced Technology Corporation, Canon Inc., Nikon Corporation, Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited, Samsung Electronics Co. Ltd, Toppan Photomasks Inc, ZEISS Group, Ushio, Inc.

b. The extreme ultraviolet (EUV) lithography market is experiencing robust growth driven by the escalating demand for smaller, more efficient semiconductor devices. As electronics continue to shrink while simultaneously increasing in power and efficiency, manufacturers are turning to extreme ultraviolet (EUV) lithography as a key technology to produce the next generation of semiconductors. This trend is primarily fueled by the ongoing advancements in sectors such as consumer electronics, automotive, and high-performance computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.