- Home

- »

- Medical Devices

- »

-

Extracorporeal Membrane Oxygenation Cannula Market Report, 2030GVR Report cover

![Extracorporeal Membrane Oxygenation Cannula Market Size, Share & Trends Report]()

Extracorporeal Membrane Oxygenation Cannula Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Veno-arterial, Arterio-venous), By Patient Type (Adult, Pediatric), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-256-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ECMO Cannula Market Size & Trends

The global extracorporeal membrane oxygenation cannula market size was estimated at USD 32.16 million in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. The increasing prevalence of respiratory & cardiac disorders, rising geriatric population, and expanding applications of ECMO therapy are the major factors anticipated to propel market growth. For instance, from self-driving vehicles to crucial life-saving medical gear, AI is being infused virtually into every apparatus and program. AI has proven to be a significant revolutionary element of the upcoming digital era. The increasing prevalence of respiratory and cardiac disorders is expected to increase the adoption of extracorporeal membrane oxygenation (ECMO) as a vital intervention.

This is primarily due to the growing incidence of Acute Respiratory Distress Syndrome (ARDS), Chronic Obstructive Pulmonary Disease (COPD), pneumonia, and heart failure, among others. According to the WHO, COPD has been considered the third leading cause of death globally and caused about 3.23 million deaths in 2019. In addition, as stated by the WHO, Cardiovascular Diseases (CVDs) are the primary cause of mortality worldwide, with an estimated 17.9 million lives succumbing to them annually. Factors including an aging population shifts in lifestyle, environmental influences, and the outbreak of infectious diseases are expected to contribute to market growth.

According to the WHO, tobacco smoking contributes to over 70% of COPD cases in high-income countries. However, in low- & middle-income countries, tobacco smoking is responsible for around 30%-40% of COPD cases. The growing geriatric population has a significant impact on healthcare systems worldwide, particularly regarding the increased prevalence of age-related conditions, such as heart & lung diseases. According to the WHO, by 2030, one out of every six individuals worldwide will be aged 60 years or older. During this period, the proportion of the population aged 60 years & above is expected to rise from 1 billion in 2020 to 1.4 billion.

Conditions, such as congestive heart failure, COPD, and pulmonary fibrosis, often result in respiratory or cardiac failure, which may necessitate advanced life support measures, such as ECMO therapy. As a person ages, their organs may experience a decline in function, making them more susceptible to complications from existing conditions. In addition, age-related changes in the cardiovascular & pulmonary systems can increase the risk of severe respiratory or cardiac failure, necessitating interventions like ECMO to support vital organ function during critical illness. ECMO is employed in cardiac or respiratory failure cases where traditional management approaches, such as Cardiopulmonary Resuscitation (CPR), have proven ineffective.

The use of extracorporeal membrane oxygenation (ECMO) has improved across various medical applications, including Extracorporeal CO2 Removal (ECCO2R), pediatric & neonatal care, serving as a bridge to recovery or transplantation, in-hospital transport, managing cardiac arrest, and addressing cardiac & respiratory failure. Moreover, the adoption of ECMO for in-hospital transport has increased in critical care settings. Furthermore, as per an article published by the National Institute of Health (NIH) in August 2023, adults suffering from obesity may find ECMO, an advanced form of respiratory support, beneficial during intensive care for respiratory failure. Hence, the growing applications of ECMO are expected to contribute to market growth.

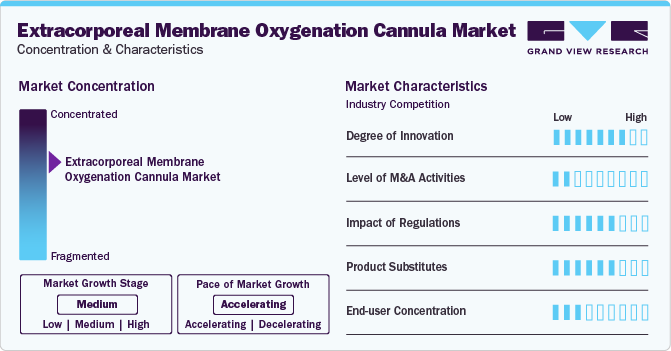

Market Concentration & Characteristics

Market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to the growing demand for improved patient outcomes in critical care settings, such as cardiac surgery and respiratory failure. For instance, in July 2019, LivaNova PLC introduced its novel Bi-Flow, an arterial femoral cannula developed to prevent limb ischemia during cardiac surgery.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by leading players. This is due to several factors, including the need for companies to expand their product portfolios, enhance technological capabilities, and gain access to new markets. Larger medical device companies often acquire smaller firms with innovative ECMO cannula technologies or complementary product lines to strengthen their competitive position and capture a larger market share. For instance, in April 2018, LivaNova PLC acquired a company offering advanced cardiopulmonary temporary support solutions, TandemLife. TandemLife systems have an oxygenator, a pump, and cannulae for cardiopulmonary care.

The market is also subject to increasing regulatory scrutiny. Compliance with these regulations necessitates substantial investments in research, development, and manufacturing processes to meet the required standards. Regulatory approvals also dictate market entry, affecting competition and market dynamics by influencing which companies can participate and which products can be offered. In the U.S., the FDA primarily regulates ECMO cannulas. The FDA sets stringent guidelines to guarantee the safety, effectiveness, and quality of medical products. Before gaining approval for commercial use, ECMO cannulas are subjected to meticulous evaluations to meet FDA criteria, proving their safety & effectiveness in diverse surgical procedures. The FDA also offers pathways like 510(k) clearance for lower-risk devices, allowing quicker market entry if the device closely resembles an existing approved device. However, the FDA maintains strict oversight, enforcing Good Manufacturing Practices (GMPs) and regular inspections to uphold manufacturing & quality control standards.

There are a limited number of direct product substitutes for the market. These substitutes include mechanical ventilation, cardiac assist devices, and other forms of life support, such as intra-aortic balloon pumps. In addition, advancements in medical management and pharmacotherapy for conditions like ARDS or severe heart failure provide alternatives to ECMO therapy in certain cases.

End-user concentration is a significant factor in the market. Tertiary care centers, academic medical centers, and specialized hospitals constitute the primary end-users of ECMO cannulas because they can handle complex cases requiring extracorporeal life support. Moreover, these key end-users significantly influence market demand, product preferences, and procurement practices, impacting supplier relationships and market strategies within the industry. For instance, as per an article published by the Medical University of South Carolina (MUSC) in February 2023, the MUSC Shawn Jenkins Children’s Hospital received the Platinum Level Award for Excellence in Life Support from ELSO in 2020. This award was provided to the hospital for delivering exceptional patient care for critically ill children under its Pediatric ECMO Program.

Type Insights

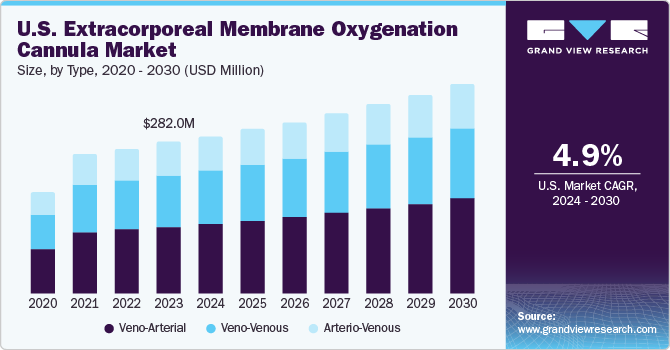

The veno-arterial cannulae segment dominated the market with a share of 44.5% in 2023 and is expected to grow at the fastest CAGR of 5.0% from 2024 to 2030 due to the wide use of Veno-Arterial (VA) ECMO systems & circuits for circulatory and respiratory functions. In the ECMO, a return cannula is inserted into a carotid artery, femoral artery, or ascending aorta, and a drainage cannula is inserted into an internal jugular or femoral vein. The veno-arterial ECMO circuit finds its application in cardiac arrest patients, assisting with algorithmic life support strategies to restore blood circulation. VA-ECMO supports the heart & lung functions. For instance, the study published by the National Library of Medicine in October 2023 showed the application of VA-ECMO during aspiration thrombectomy in a patient suffering from cardiac arrest following massive Pulmonary Embolism (PE).

Thus, such positive results for VA-ECMO are anticipated to boost the demand for VA-ECMO cannulae, which is expected to propel segment growth. The Veno-Venous (VV) cannulae segment is anticipated to grow significantly in the coming years. This type of cannulae is widely used in respiratory issues, such as reversible respiratory failure, including ARDS. This cannulation helps drain blood from a major vein and returns it to a major vein. The companies operating in the market are launching novel ECMO systems that support VV cannulation. For instance, in August 2021, Getinge, a major market player, introduced the Rotaflow II extracorporeal life support system. This system is useful for VV ECMO. Such product launches by key market players are anticipated to propel the segment growth in the coming years.

Patient Type Insights

The adult segment held the largest market share in 2023 and is anticipated to witness significant growth over the forecast period due to many patients suffering from respiratory conditions, such as ARDS. According to an article published by Yale Medicine in February 2023, about 190,000 people living in the U.S. are diagnosed with ARDS each year. In addition, the study published by Egton Medical Information Systems Limited in June 2023 found that 12.5% of the study population were determined to have ARDS. This study was conducted in a UK adult University Hospital ICU and evaluated around 344 patients. In addition, the risk of ARDS increases with age. Thus, the number of patients suffering from ARDS is anticipated to propel the segment growth.

The pediatric segment is anticipated to register lucrative growth over the forecast period due to the increasing focus of market participants, such as LivaNova PLC, Andocor, Medtronic, and Changzhou KangXin Medical Instruments Co., Ltd., on offering cannulae and ECMO systems for pediatric patients. These companies provide various types of cannulae, such as straight tip, curved tip, and flexible, for pediatric patients suffering from cardiac & respiratory issues. Thus, the availability of a wide range of products from key industry players like Medtronic and LivaNova PLC for pediatric patients is anticipated to propel the segment growth.

Application Insights

The respiratory segment dominated the segment in 2023 and is expected to show significant growth in the coming years due to the extensive use of ECMO in various respiratory conditions, such as respiratory distress syndrome, respiratory failure, pneumonia, and pulmonary hypertension. In addition, the increasing prevalence of these conditions is anticipated to propel segment growth. According to an article published by the American Lung Association in June 2023, around 500-1,000 new Pulmonary Arterial Hypertension (PAH) cases are being diagnosed yearly in the U.S. In addition, as per the study published by the PLOS in January 2022, ARDS affects about 10% of patients admitted to ICUs across the globe, with U.S. incidence as high as 190,600 cases per year.

Thus, the large patient pool suffering from respiratory conditions that can be treated using ECMO is anticipated to propel the segment growth. The Extracorporeal Cardiopulmonary Resuscitation (ECPR) segment is anticipated to witness the fastest CAGR from 2024 to 2030 due to the increasing use of ECPR for treating patients with cardiac arrest who do not respond to conventional cardiopulmonary resuscitation. In addition, ECPR considers VA ECMO cannulation during refractory cardiac arrest.

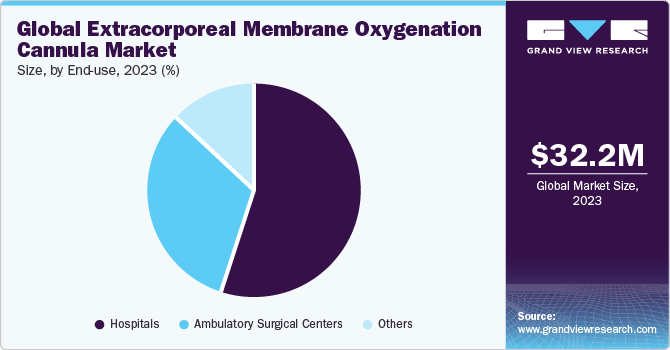

End-use Insights

The hospitals end-use segment dominated the market in 2023 as hospitals are the most-preferred healthcare settings for treatments and surgeries due to the availability of various services under one roof. Several hospitals are also increasingly focusing on ECMO programs. Respiratory & cardiac surgeries are also being performed in major hospitals. For instance, the Sahyadri Hospital is one of the major cardiac surgery hospitals in India. This hospital performs around 75 cardiac surgeries and 80 angioplasties every month. In addition, the rising number of hospitals, such as Northwell Health and Barnes-Jewish Hospital, offering treatments and surgeries for respiratory & cardiac patients is anticipated to boost the segment growth.

The ambulatory surgical centers (ASCs) segment is expected to register the fastest CAGR from 2024 to 2030. Technological breakthroughs and an increasing number of ASCs are important factors that drive the demand for treatments at these centers. Furthermore, ASCs offer a cost-effective, high-quality alternative to hospital care for surgical treatments. Furthermore, industry participants focus on providing cardiovascular procedures through ASCs due to their increasing popularity. For instance, in June 2022, Atlas Healthcare Partners, a corporation specializing in managing & developing ambulatory surgery centers, teamed with MedAxiom to form a cardiovascular-focused ASC company. Such initiatives undertaken by various industry participants can result in an increasing number of cardiac surgeries being performed in ASCs, which is further anticipated to boost the segment growth.

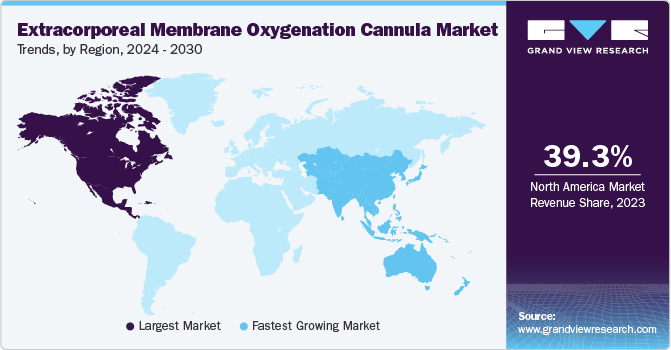

Regional Insights

The North America extracorporeal membrane oxygenation (ECMO) cannula marketaccounted for the maximum revenue share of 39.3% of the global revenue in 2023 owing to the established healthcare sector, commitment to innovation, advanced infrastructure, a strong emphasis on R&D, and high prevalence of chronic conditions, such as CVDs. As per the CDC, about 6 in 10 American adults suffer from at least one chronic condition that requires specialized care and attention. Moreover, favorable government regulations and reimbursement policies contribute to the region’s dominance. Regulatory bodies, such as the FDA, ensure rigorous quality standards, assuring healthcare professionals and patients of the safety & effectiveness of various healthcare products, including ECMO cannula.

U.S. Extracorporeal Membrane Oxygenation Cannula Market Trends

The extracorporeal membrane oxygenation (ECMO) cannula market in the U.S. held a revenue share of 32.6% in 2023. The prevalence of chronic diseases and the resulting rise in the number of cardiovascular surgeries in the U.S. are anticipated to propel the demand for ECMO cannulas. Approximately 150 million Americans suffer from at least one chronic illness, which frequently requires surgery, according to the CDC data. Respiratory problems and heart ailments are among the conditions that significantly contribute to the rising number of surgical procedures.

Europe Extracorporeal Membrane Oxygenation Cannula Market Trends

The Europe ECMO cannula market is expected to witness significant growth due to factors such as rising adoption of ECMO therapies, favorable reimbursement policies, and increasing government investments in R&D for medical devices. However, the market landscape is competitive, with established players and emerging companies vying for market share.

The UK extracorporeal membrane oxygenation cannula market reflects the European scenario with presence of dominating players such as Medtronic and Terumo. Emerging players such as LivaNova have a home advantage, however all companies must navigate the NHS procurement process and prioritize cost-effectiveness. Collaborations with UK research and value-added services can be differentiators. Brexit adds some complexity, however the UK's focus on advanced therapies could drive demand for specialized cannulas.

The Extracorporeal Membrane Oxygenation Cannula market in France is expected to grow over the forecast period. Collaborations with local research and understanding French practices can give an advantage. This competitive market rewards companies that navigate AP-HP procurement, prioritize affordability, and demonstrate value through local partnerships.

The Germany extracorporeal membrane oxygenation cannula market presents a distinct opportunity. Local market players such as Maquet Getinge experience a natural advantage, however established international companies remain formidable. While cost is a consideration, German hospitals prioritize solutions that deliver superior patient outcomes. Strategic partnerships with German research institutions and a deep understanding of these specific needs are considered crucial for success.

Asia Pacific Extracorporeal Membrane Oxygenation Cannula Market Trends

The APAC ECMO cannula market presents a high-growth opportunity, fueled by rising ECMO therapy adoption and government backing. However, the landscape is fragmented. Established players like Medtronic hold a strong position, however regional competitors from China and India are emerging. Strategic partnerships with local players and conducting clinical trials in the region are considered essential for market growth.

The Japan extracorporeal membrane oxygenation cannula market prioritizes high-quality medical devices with proven safety and efficacy. Manufacturers need to showcase advanced cannula designs and materials. Navigating the strict regulatory requirements set by Japanese authorities such as the Pharmaceuticals and Medical Devices Agency (PMDA) can cater to the specific needs of the market.

Extracorporeal membrane oxygenation cannula market in China is evolving, with a growing emphasis on domestic clinical trials and product approvals by the National Medical Products Administration (NMPA). There is a growing interest in innovative cannula designs and materials, with potential for domestic players to contribute to these advancements.

India extracorporeal membrane oxygenation cannula market has wide presence of established international players such as Medtronic and Terumo, however they face competition from emerging domestic manufacturers aiming to capitalize on the growing demand and potentially offer cost-effective alternatives. Similar to China, affordability is a key consideration for hospitals in India. Companies need to be mindful of pricing strategies to cater to this price-sensitive market.

MEA Extracorporeal Membrane Oxygenation Cannula Market Trends

The MEA ECMO cannula market is expected to experience moderate growth, driven by factors such as rising awareness of ECMO therapy and an increase in critical care facilities. Due to the specialized nature of ECMO cannulas, the number of major players in the MEA region are limited as compared to global markets.

The Saudi Arabia extracorporeal membrane oxygenation cannula market presents a unique opportunity within the Middle East region. Saudi Arabia's Vision 2030 healthcare transformation plan is driving investments in advanced medical technologies, potentially boosting the ECMO cannula market.

The Extracorporeal membrane oxygenation cannula market growth in kuwait is restricted as the domestic production of ECMO cannulas is likely to be limited, making the market reliant on established international players such as Medtronic and Terumo. Kuwaiti hospitals might prioritize high-quality, proven cannula designs from established brands due to the critical nature of ECMO therapies.

Key Extracorporeal Membrane Oxygenation Cannula Company Insights

The ECMO cannula market is a dynamic and competitive space. Leading players such as Medtronic, LivaNova, and Getinge are major players, constantly innovating and expanding their reach. These companies are aggressively pursuing organic and inorganic growth strategies. This includes developing new cannula technologies, forming strategic partnerships, and exploring acquisitions or mergers to solidify their market positions and address evolving customer needs.

Key Extracorporeal Membrane Oxygenation Cannula Companies:

The following are the leading companies in the extracorporeal membrane oxygenation cannula market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- LivaNova PLC

- Edwards Lifesciences Corporation

- Getinge

- Andocor

- Changzhou KangXin Medical Instruments Co., Ltd

- Free Life Medical GmbH

- Fresenius Medical Care AG

- Abbott

Recent Developments

-

In January 2024, LivaNova PLC announced the wind-down of the Advanced Circulatory Support (ACS) business to improve its strategic emphasis on its Neuromodulation and Cardiopulmonary (CP) business. Livanova will retain all ACS cannulae products through the CP business unit product portfolio

-

In April 2023, Abbott obtained two new authorizations from the U.S. FDA for its leading life support system, CentriMag Blood Pump. With this clearance, the CentriMag Blood Pump can be used longer in adults during ECMO procedures. Furthermore, the company also obtained FDA authorization for its CentriMag Preconnected Pack for urgent cardiopulmonary support lasting less than 6 hours

-

In July 2022, Getinge announced an expansion in the medical device field action of Heart Lung Support (HLS) Set Advanced products due to a possible breach in sterile packaging. These products are utilized for extracorporeal cardiovascular and/or respiratory support

Extracorporeal Membrane Oxygenation Cannula Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.40 million

Revenue forecast in 2030

USD 43.82 million

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, patient type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; LivaNova PLC; Edwards Lifesciences Corporation; Getinge; Andocor; Changzhou KangXin Medical Instruments Co., Ltd; Free Life Medical GmbH; Fresenius Medical Care AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extracorporeal Membrane Oxygenation Cannula Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global extracorporeal membrane oxygenation cannula market report based on type, patient type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Veno-Arterial

-

Veno-Venous

-

Arterio-Venous

-

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neonates

-

Pediatric

-

Adult

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Cardiac

-

ECPR

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global extracorporeal membrane oxygenation cannula market size was estimated at USD 32.16 million in 2023 and is expected to reach USD 33.40 million in 2024.

b. The global extracorporeal membrane oxygenation cannula market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 43.82 million by 2030.

b. North America dominated the ECMO cannula market with a share of 39.3% in 2023. This is due to government support for quality healthcare, and increasing prevalence of diseases such as chronic obstructive pulmonary disease (COPD).

b. Some key players operating in the ECMO cannula market include Medtronic, LivaNova PLC, Changzhou KangXin Medical Instruments Co., Ltd, Abbott, Clarifai, Inc., Ayasdi AI LLC, H2O.ai, HyperVerge, Inc.

b. Key factors that are driving the ECMO cannula market growth include the rising prevalence of cardiopulmonary and respiratory diseases, increasing adoption of ECMO machines in hospitals, technological advancement in ECMO machines, and growing awareness towards the application of ECMO.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.