- Home

- »

- Medical Devices

- »

-

Extracorporeal CO2 Removal Devices Market Report, 2030GVR Report cover

![Extracorporeal CO2 Removal Devices Market Size, Share & Trends Report]()

Extracorporeal CO2 Removal Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Extracorporeal CO2 Machines, Disposables), By Application (ARDS, COPD), By Access (Venovenous, Arteriovenous), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-636-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

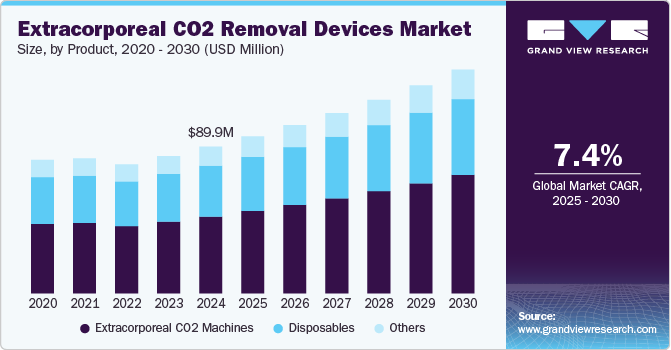

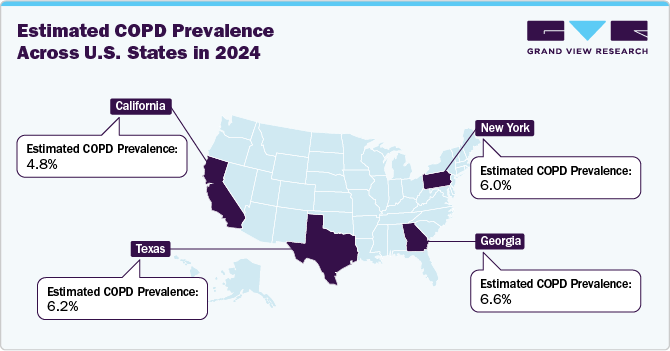

The global extracorporeal CO2 removal devices market size was estimated at USD 89.9 million in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. This can be attributed to the increasing prevalence of chronic obstructive pulmonary disease (COPD) and acute respiratory distress syndrome (ARDS), which significantly boosts demand for these devices, as they provide essential support in managing respiratory failure. For instance, the percentage of adults in the U.S. who have received a diagnosis of COPD, emphysema, or chronic bronchitis was 4.3% in 2023. Technological advancements have led to the development of more efficient and user-friendly devices, enhancing their adoption in clinical settings.

The market growth is also driven by its rising demand for advanced respiratory support technologies in managing patients with acute respiratory failure, COPD, and acute respiratory distress syndrome (ARDS). Moreover, their usage is witnessing demand especially in intensive care units (ICUs), where they help in reducing the burden of ventilator-induced lung injury by allowing lower tidal volumes during ventilation. Technological advancements have made extracorporeal CO2 removal (ECCO₂R) systems more compact, efficient, and easier to integrate with other extracorporeal life support systems such as ECMO (extracorporeal membrane oxygenation). Innovations in membrane oxygenator technology, pump systems, and catheter designs have enabled safer and more precise CO₂ clearance, improving patient outcomes.

Another key driver for the extracorporeal CO2 removal (ECCO₂R) devices market is the growing adoption of these devices in pre and post-operative management of patients undergoing lung transplantation and complex thoracic surgeries. Additionally, in chronic hypercapnic patients, ECCO₂R provides an alternative to non-invasive ventilation (NIV), especially when NIV is poorly tolerated or fails to provide sufficient CO₂ clearance. This has led to increased adoption of ECCO₂R devices in specialized pulmonary care units and among anesthesiologists and pulmonologists managing high-risk patients. The expanding clinical application of ECCO₂R in managing acute and chronic respiratory conditions is fueling the market growth. Moreover, clinical guidelines and best practice protocols integrating ECCO₂R into multimodal respiratory care strategies have increased their adoption in healthcare facilities.

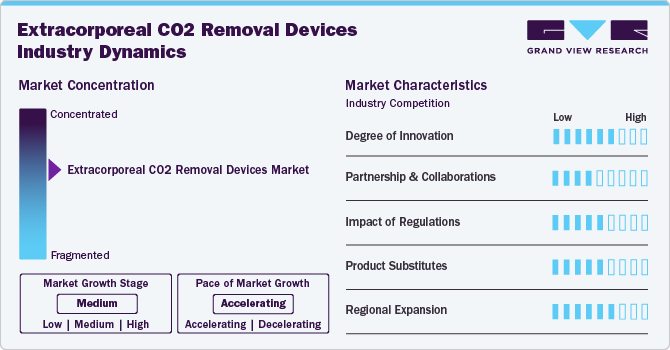

Market Concentration & Characteristics

The extracorporeal co2 removal devices industry witnesses significant industry concentration, with key players focusing on expansion and product differentiation. The market is characterized by advanced technologies aimed at efficiently removing carbon dioxide from the bloodstream, enhancing respiratory support in critically ill patients. Key drivers include rising prevalence of respiratory diseases, increasing demand for advanced respiratory support systems, technological advancements in medical devices, and growing awareness of extracorporeal therapies in critical care settings.

The extracorporeal co₂ removal devices industry demonstrates a moderately high degree of innovation, indicating ongoing technological advancements aimed at improving the safety, efficiency, and portability of these devices. Innovation is largely driven by the unmet clinical need in managing patients with ARDS, COPD, and other critical pulmonary conditions where conventional mechanical ventilation proves insufficient.

The level of partnerships and collaborations in the extracorporeal CO₂ removal devices market remains relatively low at present. However, the ECCO₂R market holds substantial potential for increased collaboration among MedTech firms, academic institutions, and healthcare providers. Similarly, joint research projects and public-private partnerships could emerge as key drivers of innovation and adoption.

Regulations play a crucial role in shaping the extracorporeal co₂ removal devices industry. As these devices interact directly with the bloodstream and are used in critical care settings, they fall under high-risk device categories in many regions and require stringent regulatory scrutiny. For instance, in the U.S., ECCO₂R devices need to undergo thorough FDA evaluation under the Class III designation, requiring extensive clinical evidence for approval. In the EU, these devices are regulated under the Medical Device Regulation (MDR), which has further increased the regulatory burden for manufacturers.

The threat of product substitutes in the extracorporeal co₂ removal devices industry is moderate. The primary alternatives include mechanical ventilation and extracorporeal membrane oxygenation (ECMO), both of which are well-established in critical care. However, ECCO₂R devices offer unique advantages in specific clinical scenarios, such as selective CO₂ removal with reduced risk of ventilator-induced lung injury (VILI), which are not easily matched by these substitutes.

Regional expansion of ECCO₂R technologies remains in its early stages but is beginning to gain momentum. Regions with developed regions such as North America and Europe have significantly higher adoption rates of these devices due to more established healthcare infrastructure, higher ICU penetration, and a concentration of clinical research institutions. However, the increasing burden of respiratory diseases, along with rising awareness about lung-supportive technologies, is further increasing the market growth opportunities. Additionally, governments and private sectors in emerging economies are beginning to invest more heavily in critical care infrastructure, creating new opportunities for ECCO₂R manufacturers.

Product Insights

The extracorporeal CO2 machines segment dominated the market in 2024 with 52.4% of the market share and is expected to witness fastest growth due to their advanced ability to efficiently remove excess carbon dioxide from a patient’s bloodstream, particularly in critical care settings. These machines utilize membrane-based technology, which provides a highly effective method for gas exchange, offering precise control over CO2 levels. This is crucial in patients with acute respiratory failure, where manual ventilation is insufficient. The ability to maintain stable blood gas levels and improve oxygenation while minimizing the risk of complications further increases their importance in the treatment of patients with severe respiratory distress or trauma, thereby increasing their demand.

The disposables segment is expected to witness the fastest growth over the forecast period owing to the increasing clinical emphasis on infection prevention and cross-contamination control. Components such as oxygenators, cannulas, and tubing sets are designed for single-use to eliminate the risk of patient-to-patient transmission of pathogens. Hospitals and intensive care units prefer disposable components as they reduce the burden of sterilization and turnaround time between procedures, thereby enhancing operational efficiency and aligning with strict infection control protocols.

Application Insights

The bridge to lung transplant segment accounted for largest market share of 39.6% in 2024 due to the critical role these devices play in sustaining patients with end-stage lung diseases who are awaiting donor organs. Patients listed for lung transplantation often experience life-threatening hypercapnic respiratory failure that cannot be managed effectively with mechanical ventilation alone. Extracorporeal CO2 removal (ECCO₂R) offers a less invasive alternative to full extracorporeal membrane oxygenation, providing targeted carbon dioxide removal without compromising hemodynamics.

The acute respiratory distress syndrome (ARDS) segment is expected to witness the fastest growth over the forecast period. In patients with ARDS, mechanical ventilation is a primary treatment, but it carries risks of ventilator-induced lung injury (VILI), especially when attempting to manage elevated CO₂ levels. Extracorporeal CO₂ removal (ECCO₂R) devices are gaining demand in ARDS management as they enable ultraprotective ventilation strategies by removing excess carbon dioxide while allowing for lower ventilator settings. This role in lung-protective ventilation is making ECCO₂R devices increasingly preferable in ARDS treatment protocols, thereby fueling the segment growth.

Access Insights

The venovenous segment dominated the market in 2024 due to its ability to support gas exchange while minimizing hemodynamic compromise. Venovenous methods utilize a single or double-lumen catheter inserted into central veins, allowing for the removal of CO₂ without involving arterial circulation. This reduces risks such as vascular injury, bleeding, and limb ischemia. Clinicians favor venovenous access in critically ill patients because it maintains cardiovascular stability, especially in those with compromised cardiac function. Its compatibility with low-flow systems also enables safer CO₂ removal in non-intubated or spontaneously breathing patients, expanding its clinical utility.

The arteriovenous segment is expected to witness the fastest growth over the forecast period due to its ability to function without the need for an external pump, utilizing the patient’s own arterial blood pressure to drive circulation through the system. This reduces mechanical complexity, minimizes circuit-related complications, and improves biocompatibility by eliminating pump-induced hemolysis. This makes arteriovenous systems suitable for intermediate respiratory support, especially in intensive care settings where minimizing device-related complications is critical, thereby fueling the segment growth.

End-use Insights

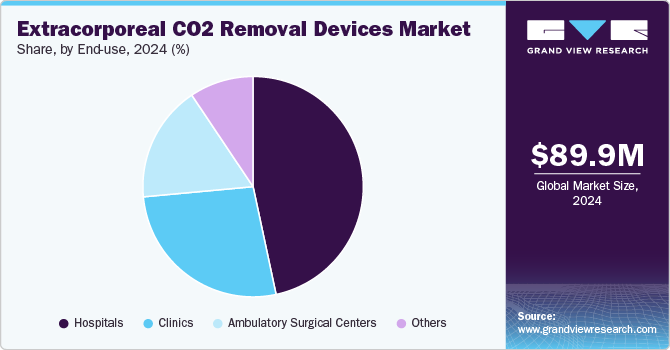

The hospital segment accounted for the largest revenue share of 46.7% in 2024 due to their ability to manage the complexity of critical care cases requiring such advanced respiratory support. Extracorporeal CO2 removal (ECCO₂R) devices are typically used for patients with acute respiratory failure or severe chronic obstructive pulmonary disease (COPD) exacerbations, conditions that require constant monitoring and multidisciplinary expertise. Additionally, hospitals can allow rapid diagnostics, continuous blood gas monitoring, and immediate intervention in the event of complications.

The ambulatory surgical centers segment is expected to witness growth over the forecast period due to their increasing adoption of advanced respiratory support technologies for managing high-risk patients undergoing complex procedures. Moreover, these centers are expanding their scope beyond minor surgeries to include procedures requiring advanced perioperative care. This integration enhances patient safety, reduces hospital transfers, and supports better clinical outcomes in outpatient care, thereby fueling the market growth over the forecast period.

Regional Insights

The extracorporeal CO₂ removal devices market in North America is driven by the increasing clinical adoption across specialized care settings. The region’s advanced healthcare infrastructure and high awareness among healthcare professionals are key factors supporting the integration of ECCO₂R technologies, in managing patients with acute respiratory failure and chronic obstructive pulmonary disease (COPD).

U.S. Extracorporeal CO2 Removal Devices Market Trends

The extracorporeal CO₂ removal devices market in the U.S. is witnessing significant growth, driven by the increasing prevalence of chronic respiratory diseases and the growing demand for less invasive alternatives to mechanical ventilation. Moreover, the increasing investments in R&D on respiratory diseases further contribute to market growth, driven by rising demand for advanced medical devices. For instance, in 2023, the American Lung Association established its Research Institute, pledging to enhance its annual investment in lung disease research to USD 25 million, aiming to advance scientific understanding and treatment of lung conditions. The presence of advanced intensive care infrastructure and favorable regulatory pathways for innovative respiratory support devices also contribute to the market growth.

Europe Extracorporeal CO2 Removal Devices Market Trends

The extracorporeal CO₂ removal devices market in Europe is witnessing steady growth, driven by the increasing adoption of advanced respiratory support technologies in intensive care units across countries in the region. A key factor fueling this growth is the rising incidence of acute respiratory failure and COPD, which has led to increased demand for minimally invasive alternatives to mechanical ventilation.

The extracorporeal CO₂ removal devices market in the UK is driven by rising clinical adoption in managing acute respiratory failure and chronic obstructive pulmonary disease (COPD) patients who are unresponsive to conventional therapies. The UK’s National Health Service (NHS) has increasingly supported the integration of advanced respiratory technologies in intensive care units, particularly as part of efforts to reduce the need for invasive mechanical ventilation. The presence of a robust regulatory framework through the Medicines and Healthcare products Regulatory Agency (MHRA) has enabled a more streamlined pathway for device approvals, contributing to faster adoption across specialized centers in the country.

The extracorporeal CO₂ removal devices market in Germany is driven by the country’s advanced critical care infrastructure and growing awareness among intensivists regarding lung-protective ventilation strategies. Additionally, reimbursement pathways for advanced extracorporeal therapies in Germany are more clearly defined compared to many other European countries, encouraging healthcare facilities to integrate such systems into routine care, thereby increasing their adoption.

Asia Pacific Extracorporeal CO2 Removal Devices Market Trends

The extracorporeal CO₂ removal devices market in Asia Pacific is witnessing significant growth due to the increasing burden of acute respiratory failure and COPD across countries such as China, Japan, South Korea, and India. Moreover, rapid urbanization and industrial pollution have contributed to a rise in chronic respiratory diseases, further increasing the demand for advanced respiratory support systems in intensive care settings. Furthermore, healthcare infrastructure in emerging economies is evolving, with governments investing in critical care facilities and tertiary hospitals adopting advanced technologies, including ECCO₂R systems, thereby fueling the market growth.

The is driven primarily by the country’s aging population and the rising prevalence of chronic respiratory conditions such as COPD. Japanese healthcare providers are increasingly adopting advanced respiratory support technologies to manage respiratory conditions in elderly patients who are often not suitable candidates for extracorporeal CO₂ removal devices industry in Japan invasive ventilation. Japan’s well-established healthcare infrastructure and extracorporeal CO₂ removal devices market in China its active approach to adopting innovative medical technologies have further increased the adoption of ECCO₂R systems in the country’s healthcare facilities.

The is witnessing significant growth, driven by increasing clinical awareness and adoption of advanced respiratory support technologies. Moreover, initiatives to modernize healthcare infrastructure and extracorporeal CO₂ removal devices industry in India expand critical care capacity are positively influencing the market.

The is primarily driven by the rising burden of respiratory disorders such as chronic obstructive pulmonary disease (COPD) and acute respiratory distress syndrome (ARDS). Moreover, the growth is further supported by expanding healthcare infrastructure in the country, allowing adoption of these devices in healthcare facilities.

Latin America Extracorporeal CO2 Removal Devices Market Trends

The extracorporeal CO₂ removal devices market in Latin America is driven by the increasing awareness and adoption of advanced respiratory support technologies in intensive care settings. Countries such as Brazil, and Argentina are witnessing a significant rise in the use of ECCO₂R devices, particularly in hospitals where clinicians are seeking alternative therapies for managing acute respiratory distress syndrome (ARDS) and COPD. The region’s growing burden of chronic respiratory diseases, coupled with a rising geriatric population, is pushing healthcare providers to invest in minimally invasive, lung-protective solutions, further fueling market growth.

The extracorporeal CO₂ removal devices industry in Brazil is driven by the Brazil's high prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD) and acute respiratory distress syndrome (ARDS), which has led to increased demand for advanced respiratory support technologies. The country's healthcare infrastructure is evolving, with hospitals and surgical centers adopting ECCO₂R devices to enhance patient care. Moreover, the increasing awareness among healthcare professionals about the benefits of ECCO₂R therapy contributes to its growing adoption.

Middle East and Africa Extracorporeal CO2 Removal Devices Market Trends

The extracorporeal CO₂ removal devices market in the Middle East and Africa (MEA) is witnessing significant growth driven by the increasing burden of chronic respiratory conditions and the rising demand for advanced critical care technologies. In the Middle East, countries such as the UAE and Saudi Arabia are investing heavily in upgrading their intensive care infrastructure, particularly in tertiary and quaternary care centers, to manage acute respiratory failure and COPD-related complications more effectively.

The extracorporeal CO₂ removal devices market in Saudi Arabia is driven by the country's increasing focus on enhancing healthcare infrastructure and addressing respiratory health challenges. Additionally, the country's rising focus on medical research and training is developing a skilled workforce capable of operating complex medical devices, thereby allowing the integration of ECCO₂R technologies into clinical practice.

Key Extracorporeal CO2 Removal Devices Company Insights

The competitive scenario in the extracorporeal CO2 removal devices industry is significantly competitive, with key players such as Medtronic; Getinge AB; and Xenios AG holding significant positions. The major companies undertake various organic as well as inorganic strategies such as product introduction, collaborations, and regional expansion for serving the unmet needs of their customers.

Key Extracorporeal CO2 Removal Devices Companies:

The following are the leading companies in the extracorporeal CO2 removal devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Getinge AB

- Xenios AG

- Medica S.P.A.

- Aferetica srl

- ALung Technologies, Inc.

- ESTOR S.P.A.

- Baxter

- X-COR Therapeutics

Recent Developments

-

February 2024, GSK completed the acquisition of Aiolos Bio, enhancing its portfolio in immunology. This strategic move aims to advance GSK's capabilities in developing therapies for respiratory and inflammatory conditions, aligning with its focus on innovative treatments and expanding its presence in the biopharmaceutical sector.

-

In July 2023, Inogen acquired Physio-Assist to enhance its respiratory product portfolio. This strategic move aims to broaden Inogen's offerings in the respiratory care market, leveraging Physio-Assist's innovative technologies and expertise to better serve patients with respiratory conditions.

-

In October 2023, Praxis received FDA clearance for its EndoCore EBUS-TBNA biopsy device, designed to enhance the accuracy and efficiency of lung biopsies. This innovative device aims to improve patient outcomes by allowing better tissue sampling during endobronchial ultrasound procedures.

-

In May 2022, LivaNova PLC acquired ALung Technologies, known for its Hemolung Respiratory Assist System, which received FDA approval for treating severe respiratory conditions.

Extracorporeal CO2 Removal Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.2 million

Revenue forecast in 2030

USD 137.2 million

Growth Rate

CAGR of 7.4% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, access, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Medtronic; Getinge AB; Xenios AG; ALung Technologies, Inc.; ESTOR S.P.A.; Medica S.P.A.; Aferetica srl; Baxter; X-COR Therapeutics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extracorporeal CO2 Removal Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the extracorporeal CO2 removal devices market report on the basis of product, application, access, end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Extracorporeal CO2 Machines

-

Disposables

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute respiratory distress syndrome (ARDS)

-

Chronic obstructive pulmonary disease (COPD)

-

Bridge to lung transplant

-

Others

-

-

Access Outlook (Revenue, USD Million, 2018 - 2030)

-

Venovenous

-

Arteriovenous

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global extracorporeal CO2 removal devices market size was estimated at USD 89.9 million in 2024 and is expected to reach USD 96.2 million in 2025.

b. The global extracorporeal CO2 removal devices market is expected to grow at a compound annual growth rate of 7.36% from 2025 to 2030 to reach USD 137.2 million by 2030.

b. The extracorporeal CO2 machines segment dominated the global extracorporeal CO2 removal devices market and accounted for the largest revenue share of 52.4% in 2024.

b. Some key players operating in the extracorporeal CO2 removal devices market include Medtronic, Xenos AG, Alung Technologies, Getinge AB, ESTOR S.P.A, Medica Spa, Aferectica Srl., Baxter; and X-COR Therapeutics.

b. Key factors that are driving the extracorporeal CO2 removal devices market growth include increasing prevalence of COPD and asthma, technological advancements, rising number of product launches, and product approval.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.