- Home

- »

- Homecare & Decor

- »

-

Extended Stay Hotel Market Size And Share Report, 2030GVR Report cover

![Extended Stay Hotel Market Size, Share & Trends Report]()

Extended Stay Hotel Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Economy, Mid-Range, Luxury/Upscale), By Tourist Type (Domestic, International), By Booking Mode (Direct Booking), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-412-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Extended Stay Hotel Market Summary

The global extended stay hotel market size was valued at USD 57.7 billion in 2024 and is projected to reach USD 98.8 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The global market is experiencing significant growth due to evolving consumer preferences and demographic shifts. As modern lifestyles become increasingly mobile, individuals and businesses seek flexible accommodation solutions that cater to longer stays.

Key Market Trends & Insights

- The extended stay hotel market in North America held a share of 34.47% of the global revenue in 2023.

- The extended stay hotel market in the U.S. is expected to grow at a CAGR of 9.5% from 2024 to 2030.

- By type, The luxury/upscale extended stay hotels held a market share of 75.92% in 2023.

- By tourist type, The demand for extended stay hotels among domestic consumers held a market share of 71.30% in 2023

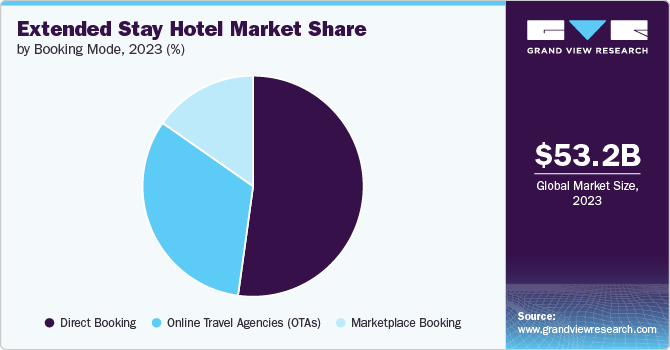

- By booking mode, The direct bookings of extended stay hotels accounted for a market share of 52.19% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 57.7 Billion

- 2030 Projected Market Size: USD 98.8 Billion

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2023

Extended stay hotels, offering amenities such as fully equipped kitchens, spacious living areas, and comprehensive service options, meet the growing demand for temporary housing that provides both comfort and convenience. This trend is driven by a surge in business travel, relocations, and long-term vacations, creating a robust demand for accommodations that can seamlessly transition from short-term to extended periods.

Recently, leading hotel groups such as Hilton Worldwide, Marriott International, Hyatt Hotels Corp., and BWH Hotel Group (parent of Best Western) have unveiled plans to launch new extended-stay brands. These new entries into the market will diversify consumer options, providing a broader selection of extended-stay accommodations tailored to various preferences and needs. The introduction of these brands is expected to enhance market competitiveness and drive overall growth, as increased brand variety offers consumers more choices and better alignment with their specific requirements for extended stays. This strategic expansion is likely to stimulate market demand and contribute to a dynamic and rapidly evolving industry.

The increasing global mobility and the trend towards relocation also contribute to the expansion of the market. As individuals and families relocate for job opportunities, educational pursuits, or personal reasons, they require temporary housing that offers a more stable and homely environment than traditional hotels. Extended stay hotels cater to this need by offering longer-term accommodation solutions with the comforts of home, including kitchen facilities and larger living spaces. This appeal is particularly strong in metropolitan areas and emerging markets where relocation trends are on the rise.

The pandemic and the adoption of hybrid work models have notably increased the demand for extended hotel stays, enhancing the attractiveness of cost-effective extended-stay hotels and establishing them as a prominent segment within the hospitality industry. These properties generally offer higher profit margins and lower development costs compared to full-service hotels, making them an appealing investment opportunity with the potential for substantial returns. As a result, financial institutions are increasingly inclined to fund extended-stay properties, especially those associated with established hotel brands, due to their reduced risk profile and superior return potential.

Leading hotel chains have acknowledged the growth potential in this market segment. According to the statistics published by CBRE in July 2023, over the past decade, globally recognized hotel brands have been expanding their extended-stay portfolios by over 50%, reflecting a CAGR of 7.1%, compared to the 3.2% CAGR of the broader U.S. hotel market. Furthermore, these brands have actively pursued the development and acquisition of new extended-stay concepts, with five new brands introduced since the fall of 2022.

The market is benefiting from advancements in technology and enhanced booking platforms. The integration of technology in the hospitality industry, including sophisticated booking systems and personalized guest services, has streamlined the process of securing extended stay accommodations. Enhanced online presence and the use of data analytics enable hotels to better understand and cater to the preferences of their guests, driving higher occupancy rates and increased market share. This technological shift supports the market's growth by making it easier for consumers to find and book extended stay options that meet their specific needs.

The economic benefits associated with extended stay hotels contribute to their growing popularity. Extended stay hotels often provide cost advantages over traditional hotels, with discounted rates for longer stays and inclusive amenities that reduce the need for additional spending. This value proposition is appealing to both business and leisure travelers, as it offers a cost-effective alternative to conventional lodging while maintaining high standards of comfort and convenience. As economic conditions fluctuate, the attractiveness of extended stay hotels as a practical and economical choice continues to drive their expansion across global markets.

Type Insights

The luxury/upscale extended stay hotels held a market share of 75.92% in 2023. The demand for luxury and upscale extended stays is growing globally due to an increase in affluent travelers and business executives seeking premium accommodations that offer high-end amenities and personalized services. As international business travel rebounds and high-net-worth individuals seek extended periods in luxurious environments, the appeal of properties offering exceptional comfort, exclusivity, and bespoke services has surged. This segment is driven by a desire for superior experiences and enhanced privacy, as well as a growing trend of blending business and leisure travel, where luxury extended stays provide a sophisticated home-away-from-home experience.

The demand for economy extended stay hotels is anticipated to grow with a CAGR of 10.9% from 2024 to 2030. The rise in demand for economy extended stays is largely attributed to the growing need for cost-effective accommodations among budget-conscious travelers, including long-term business professionals, relocating individuals, and temporary residents. As economic uncertainty and cost management become more significant considerations, travelers and companies alike are seeking affordable yet functional lodging solutions. This segment benefits from the increasing availability of budget-friendly extended stay options that offer essential amenities at competitive rates, catering to those who prioritize affordability and practicality over luxury.

Additionally, prominent service providers are introducing new offerings within the economy segment to address the increasing demand from cost-conscious consumers. For instance, in March 2022, Wyndham Hotels & Resorts, the leading global hotel franchising entity, announced key developments regarding its forthcoming economy extended-stay brand. The company disclosed new agreements to initiate 50 new construction projects in collaboration with its primary partners: Sandpiper Hospitality of Richmond, VA, and Gulf Coast Hotel Management of Dallas. Operating under the provisional name “Project ECHO”—an acronym for Economy Hotel Opportunity—this emerging brand aims to address market gaps within Wyndham’s extensive portfolio while strategically positioning the company within the high-growth economy extended-stay sector. This initiative, which has been under development since the summer of 2021, is designed to leverage the sector’s notable resilience and expansion, which has persisted through the pandemic and previous lodging cycles.

Such strategic initiatives by prominent extended stay hotel providers like Wyndham Hotels & Resorts are poised to significantly bolster global market growth. By entering the economy extended-stay segment, these companies are capitalizing on robust market demand for cost-effective lodging solutions that cater to budget-conscious travelers and business professionals.

Tourist Type Insights

The demand for extended stay hotels among domestic consumers held a market share of 71.30% in 2023. The growth of this segment is driven on account of a shift towards longer, more immersive travel experiences and a desire for greater comfort and flexibility. Domestic travelers are increasingly opting for extended stays to take advantage of work-from-home arrangements, extended vacations, or temporary relocations. This trend is driven by the need for cost-effective, home-like accommodations that offer the convenience of self-catering and more space compared to traditional hotel rooms. The rise in remote work and the pursuit of leisure combined with practicality are key factors fueling this growth.

The demand for extended stay hotels among international travelers/consumers is anticipated to grow at a CAGR of 10.5% from 2024 to 2030. The growing demand for extended stays among international tourists is driven by several factors, including the desire for cost-efficient travel and the pursuit of immersive cultural experiences. International travelers are increasingly choosing extended stays to manage travel budgets effectively while enjoying longer periods in their destinations. Additionally, extended stays offer a practical solution for adjusting to new environments, reducing travel fatigue, and integrating into local cultures more seamlessly. This trend is further supported by the expanding availability of affordable and flexible extended stay accommodations that cater to the needs of long-term visitors seeking comfort and convenience during their travels.

In the first quarter of 2024, international tourist arrivals nearly matched pre-pandemic levels, reaching 97% of those figures. Data from UN Tourism reveals that over 285 million tourists traveled abroad from January to March, reflecting a 20% increase compared to the same period in 2023. This substantial rise underscores the sector’s strong rebound from the pandemic. This resurgence in international travel is expected to drive increased adoption of extended stays, as tourists seek more flexible and comfortable accommodation options for longer visits, enhancing their travel experience and managing extended itineraries more effectively.

Booking Mode Insights

The direct bookings of extended stay hotels accounted for a market share of 52.19% in 2023. Hotels experience enhanced profitability through direct bookings as they circumvent commission fees associated with third-party platforms, enabling them to offer more competitive pricing and exclusive promotions. This direct engagement fosters stronger customer relationships, allowing hotels to tailor experiences and enhance loyalty through targeted offers and loyalty programs. Additionally, direct booking channels facilitate improved guest service and customization, which are crucial for extended stays that demand personalized arrangements. The adoption of advanced booking technologies and CRM systems has further streamlined the direct booking process, increasing convenExtended Stay Share by Booking Mode, 2023 (%)ience for guests and contributing to higher direct reservation volumes.

Extended stay hotel bookings through marketplaces are projected to grow at a CAGR of 10.8% over the forecast period of 2024 to 2030. Marketplaces offer a wide range of property types and experiences that appeal to travelers seeking unique or non-traditional stays, often featuring more homelike environments and varied amenities compared to traditional hotel settings. The platform-based model of marketplaces enhances visibility for extended stay properties, facilitating easier comparison and access for potential guests. Additionally, the convenience and user-friendly interfaces of these platforms streamline the booking process, attracting both cost-conscious travelers and those seeking personalized accommodations. The integration of customer reviews and ratings on marketplace platforms further builds trust and confidence, driving higher booking volumes in this segment.

Regional Insights

The extended stay hotel market in North America held a share of 34.47% of the global revenue in 2023. In North America, the surge in demand for extended-stay hotels is driven by a combination of increased business travel, a growing remote workforce, and the rise of project-based work. Companies favor extended-stay options for employees on long-term assignments due to cost-efficiency and the convenience of home-like amenities. Additionally, the trend towards longer-term relocations and temporary housing needs among professionals further fuels this growth.

U.S. Extended Stay Hotel Market Trends

The extended stay hotel market in the U.S. is expected to grow at a CAGR of 9.5% from 2024 to 2030. In the U.S., the extended-stay segment is expanding due to a growing preference for flexible accommodation options that cater to both business and leisure travelers seeking home-like comfort for extended periods. Factors contributing to this trend include an increase in corporate relocations, project-based work, and a shift towards remote working arrangements. From 2013 to 2023, the number of extended-stay hotel brands in the U.S. grew from 18 to 31, with a CAGR of 4.1% during 2013-2018 and accelerating to 7.1% from 2018-2023. The diverse domestic and international travel preferences also support the demand for such accommodations in the U.S.

Asia Pacific Extended Stay Hotel Market Trends

Asia Pacific emerged and accounted for a revenue share of around 16.89% in the year 2023. In Asia Pacific, the growing demand for extended-stay hotels is propelled by rapid urbanization, increasing international business investments, and a burgeoning middle class with higher disposable incomes. The region's diverse economic landscape, including burgeoning technology hubs and industrial projects, creates a need for flexible accommodation solutions. Additionally, the rise in multinational corporations and expatriate communities supports the expansion of extended-stay options.

Europe Extended Stay Hotel Market Trends

The European market is projected to grow at a CAGR of 9.9% from 2024 to 2030. Europe’s extended-stay hotel market is experiencing growth due to rising international business activities, increased cross-border travel, and a robust influx of expatriates and corporate relocations. The demand is also bolstered by the region's strong focus on tourism, which includes long-term stays for extended vacations and temporary assignments. The integration of extended-stay hotels into urban areas with comprehensive amenities enhances their appeal to both business travelers and tourists.

Key Extended Stay Hotel Company Insights

The competitive landscape of the extended stay hotel market is characterized by a dynamic interplay of established hospitality brands and emerging players vying for market share. Key players include major hotel chains and specialized extended stay operators that offer a range of accommodation options tailored to long-term guests, such as fully furnished suites and comprehensive amenities. Competitive differentiation is driven by factors such as service quality, property location, pricing strategies, and the availability of value-added services like flexible booking terms and enhanced in-room amenities.

Additionally, the market is witnessing increased competition from alternative accommodation providers, including serviced apartments and vacation rental platforms, which offer unique value propositions to attract extended stay travelers. The focus on innovation, customer experience, and strategic partnerships is critical for gaining a competitive edge in this evolving market segment.

Key Extended Stay Hotel Companies:

The following are the leading companies in the extended stay hotel market. These companies collectively hold the largest market share and dictate industry trends.

- Extended Stay America

- Marriott International, Inc.

- Hilton Worldwide Holdings Inc.

- The Ascott Limited

- Hyatt Hotels Corporation

- InterContinental Hotels Group

- Accor S.A.

- Sleep Intown IX, L.P.

- Choice Hotels International, Inc.

- Wyndham Hotels & Resorts

Recent Developments

-

In April 2024, Wyndham Hotels & Resorts expanded into the upscale extended stay segment by establishing a strategic partnership with industry innovator WaterWalk. This agreement introduced 11 hotels and over 1,500 rooms to the Wyndham portfolio, rebranding them under the newly created WaterWalk Extended Stay by Wyndham brand, marking the 25th addition to Wyndham’s collection. Situated in key markets such as Tucson, Jacksonville, and Wichita, the new offerings complemented Wyndham’s existing economy and midscale extended stay brands, catering to guests seeking a local yet elevated stay with the comforts of home.

-

In January 2024, Hilton Worldwide Holdings Inc. announced the launch of LivSmart Studios by Hilton, its new extended-stay hotel brand designed in a studio apartment style. Targeted at long-term guests who continued traveling even during the pandemic, LivSmart Studios garnered significant interest from owners and developers within just six months of its introduction. LivSmart Studios by Hilton became the latest addition to Hilton's portfolio of 22 esteemed brands. This lower midscale, extended-stay solution offered a reliable and consistent foundation for long-term stays, enabling guests to optimize their experience every day.

-

In June 2023, during the 2023 NYU International Hospitality Industry Investment Conference, Marriott International, Inc. outlined its strategy to further expand into the affordable midscale lodging segment. This expansion followed the company's recent introduction of City Express by Marriott in Latin America. Reflecting its commitment to providing regionally relevant lodging solutions for various stay purposes, Marriott announced its intention to launch a new, yet-to-be-named brand, currently referred to as Project MidX Studios. The brand was designed to offer affordable, modern comfort for guests seeking extended stay accommodations in the U.S. and Canada.

Extended Stay Hotel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.06 billion

Revenue forecast in 2030

USD 98.8 billion

Growth Rate

CAGR of 9.5% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, tourist type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Extended Stay America; Marriott International, Inc.; Hilton Worldwide Holdings Inc.; The Ascott Limited; Hyatt Hotels Corporation; InterContinental Hotels Group; Accor S.A.; Sleep Intown IX, L.P.; Choice Hotels International, Inc.; Wyndham Hotels & Resorts

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Extended Stay Hotel Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global extended stay hotel market on the basis of type, tourist type, booking mode, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Economy

-

Mid-Range

-

Luxury/Upscale

-

-

Tourist Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agencies (OTAs)

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global extended stay market was estimated at USD 53.24 billion in 2023 and is expected to reach USD 57.71 billion in 2024.

b. The global extended stay market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 98.80 billion by 2030.

b. North America dominated the extended stay market with a share of over 51.43% in 2023. In North America, the surge in demand for extended-stay hotels is driven by increased business travel, a growing remote workforce, and the rise of project-based work.

b. Some of the key players operating in the extended stay market include Extended Stay America; Marriott International, Inc.; Hilton Worldwide Holdings Inc.; The Ascott Limited; Hyatt Hotels Corporation; InterContinental Hotels Group; Accor S.A.; Sleep Intown IX, L.P.; Choice Hotels International, Inc.; and Wyndham Hotels & Resorts.

b. Key factors driving the extended stay market growth are consumers seeking flexible accommodation solutions that cater to longer stays, increased demand for amenities such as fully equipped kitchens, spacious living areas, and comprehensive service options, and growth of the global real estate market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.