- Home

- »

- Electronic Devices

- »

-

Explosion Proof Lighting Market Size & Share Report, 2030GVR Report cover

![Explosion Proof Lighting Market Size, Share & Trends Report]()

Explosion Proof Lighting Market Size, Share & Trends Analysis Report By Type, By Light Source (LED, Fluorescent), By Zone, By End Use (Oil & Gas, Mining), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-466-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Explosion Proof Lighting Market Trends

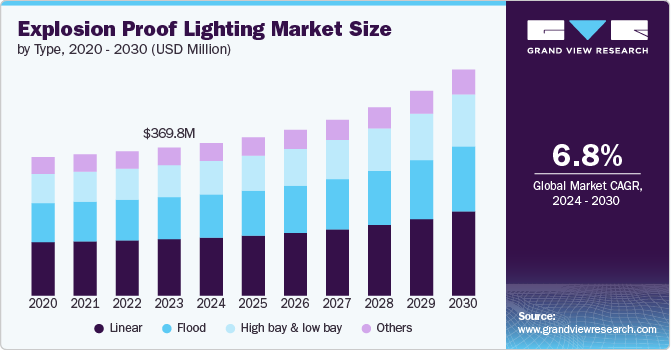

The global explosion proof lighting market size was estimated at USD 369.8 million in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. The increasing demand for safe and durable lighting in hazardous environments drives market growth. Industries such as oil and gas, mining, chemical processing, and manufacturing often involve volatile conditions where sparks or high temperatures can lead to dangerous explosions. Explosion proof lighting is engineered to prevent the ignition of surrounding gases or dust, which makes it crucial in these settings. This necessity for safety in high-risk workspaces is a significant driver of demand.

The technological advancements in LED technology fuel the market's growth. LEDs are becoming increasingly popular in explosion-proof lighting due to their energy efficiency, longer lifespan, and lower maintenance requirements. LED-based explosion-proof lights also offer better illumination and reliability than traditional lighting systems, making them ideal for industrial applications where continuous and dependable lighting is essential.

Moreover, the global expansion of industries such as oil and gas, pharmaceuticals, and petrochemicals into developing regions such as Asia Pacific and Latin America is also fueling the growth of the explosion-proof lighting market. As these industries grow, so does the need for infrastructure that meets high safety standards, further expanding the market for explosion-proof lighting systems.

In addition, the growing awareness of workplace safety and the increasing emphasis on maintaining safe operational conditions in hazardous locations encourage companies to invest in more reliable lighting solutions. This cultural shift towards proactive safety measures has increased demand for explosion-proof lighting for comprehensive safety systems.

However, the lack of awareness regarding the importance of explosion-proof lighting for safety in hazardous environments restrains the market's growth. Many businesses may not be fully informed about regulatory requirements or the consequences of non-compliance, leading to underinvestment in these systems. Additionally, there may be a shortage of skilled professionals capable of designing, installing, and maintaining explosion-proof lighting, further hindering market growth.

Type Insights

The linear segment led the market and accounted for 38.2% of the global revenue in 2023. The ability of linear lighting to provide wider and more uniform light distribution across large spaces drives the segment's growth. This makes it particularly suitable for hazardous areas such as manufacturing plants, refineries, and warehouses, where even illumination is crucial for ensuring visibility and safety. Linear lights can cover broader areas with fewer fixtures, reducing the overall number of installations needed.

The high bay & low bay segment is expected to grow at a significant CAGR from 2024 to 2030. The increasing demand in industrial applications fuels the segment's growth. High bay and low bay lighting are widely used in industrial settings such as warehouses, manufacturing plants, and refineries, needed for bright and uniform lighting in large spaces. Explosion-proof high bay and low bay lighting are essential in hazardous environments such as oil & gas facilities, chemical plants, and mining operations due to the presence of volatile gases, dust, or flammable substances.

Light Source Insights

The LED segment accounted for the largest revenue share in 2023. The segment's growth is driven by its energy efficiency compared to traditional lighting technologies such as incandescent, halogen, or fluorescent lamps. LEDs consume significantly less power while providing brighter, more consistent light output. This results in lower energy consumption, which translates to cost savings for industries such as oil and gas, chemicals, and mining, where lighting often operates continuously.

The fluorescent segment is expected to register significant growth from 2024 to 2030. Fluorescent lamps are known for their relatively low operational costs than traditional incandescent lighting. Despite the growing popularity of LED lighting, fluorescent lighting remains a cost-effective option for many industries, especially in hazardous environments where explosion-proof systems are required. Fluorescent lamps consume less energy than older lighting technologies while offering sufficient illumination for large spaces, making them an attractive choice for companies looking to balance performance and cost in environments where safety is paramount.

Zone Insights

The Zone 1 segment accounted for the largest revenue share in 2023. Zone 1 environments are classified as areas where explosive gases or vapors are likely to occur during normal operation. Industries such as oil & gas, chemical processing, and pharmaceuticals often operate in these hazardous locations, where safety is a top priority. Global safety standards such as ATEX in Europe and NEC in North America require the installation of explosion-proof lighting in Zone 1 areas to prevent the potential ignition of hazardous substances. Such stringent safety regulations for hazardous environments drive market’s growth.

The zone 0 segment is expected to grow significantly from 2024 to 2030. In Zone 0 environments, such as those found in certain sections of oil refineries, chemical plants, and petrochemical facilities, explosive gases or vapors are a constant concern. The risk of ignition is significant, making it essential to use explosion-proof lighting systems that can withstand and safely operate in these hazardous conditions. The high level of risk associated with Zone 0 areas drives the adoption of advanced explosion-proof lighting solutions to ensure safety and prevent potential accidents.

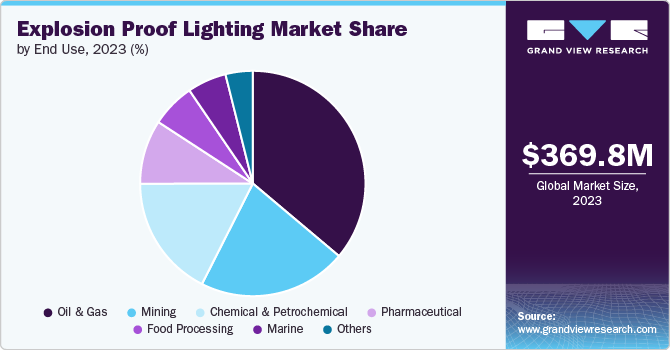

End Use Insights

The oil & gas segment accounted for a significant revenue share in 2023. The expansion and upgrade of infrastructure in the oil and gas industry fuels the adoption of explosion-proof lighting. The oil and gas sector continually expands and upgrades its infrastructure, including new drilling sites, refineries, and processing facilities. As new projects are developed and existing facilities are retrofitted or expanded, the demand for explosion-proof lighting systems increases.

The mining segment is expected to grow significantly from 2024 to 2030. The mining industry operates in environments where flammable dust and gases create a significant risk of explosions. This is particularly true in coal mines, where methane gas and coal dust are common. Explosion-proof lighting is essential in these hazardous areas to ensure safety and minimize the risk of ignition. The need to mitigate these risks drives the adoption of explosion-proof lighting systems designed to operate safely in such volatile conditions.

Regional Insights

North America explosion proof lighting market dominated the global market and accounted for 33.2% of the revenue share in 2023. Technological advancements in lighting technology, such as the development of high-efficiency LEDs and improved explosion-proof enclosures in the region, drive the market's growth.

The U.S. explosion proof lighting market is anticipated to grow significantly from 2024 to 2030. There is a growing emphasis on improving workplace safety and risk management in the U.S. Adopting explosion-proof lighting is part of broader safety measures to protect employees and prevent accidents in hazardous environments.

Europe Explosion Proof Lighting Market Trends

The Europe explosion proof lighting market is poised for significant growth from 2024 to 2030. The presence of stringent safety regulations and standards drives the market's growth. Europe has some of the strictest safety regulations and standards for explosion-proof equipment, driven by directives such as ATEX (Atmosphères Explosibles) and IECEx (International Electrotechnical Commission Explosive). These regulations mandate that equipment used in hazardous areas, including explosion-proof lighting, must meet rigorous safety and performance standards to prevent ignition of explosive atmospheres. The need to comply with these regulations drives the demand for high-quality explosion-proof lighting solutions across various European industries.

Asia Pacific Explosion Proof Lighting Market Trends

The Asia Pacific explosion proof lighting market is poised for significant growth from 2024 to 2030. The region is experiencing significant urbanization and industrialization, particularly in countries such as China, India, and Indonesia. As industries such as oil and gas, mining, and chemicals expand, the need for explosion-proof lighting in hazardous environments grows.

Key Explosion Proof Lighting Company Insights

Key players operating in the market include ABB; Adolf Schuch GmbH; Dialight; Eaton; and Emerson Electric Co. among others. The market is very competitive, with market players continuously seeking to gain an edge through advanced technological innovations and unique service offerings.

Key Explosion Proof Lighting Companies:

The following are the leading companies in the explosion proof lighting market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Adolf Schuch GmbH

- Dialight

- Eaton

- Emerson Electric Co.

- Hubbell Incorporated

- Larson Electronics LLC

- Phoenix Products LLC

- R. STAHL AG

- WorkSite Lighting

Recent Developments

In March 2023, ARCHON Industries, Inc. launched the EX20-1000 Explosion Proof Light, designed specifically for hazardous environments. This new lighting solution is compact yet powerful, providing ample illumination for viewing vessel contents through single-sight glass. The EX20-1000 features a robust design that prevents the introduction of sparks into explosive atmospheres, making it suitable for industries such as chemical processing, oil and gas, and pharmaceuticals.

Explosion Proof Lighting Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 381.2 million

Revenue forecast in 2030

USD 564.8 million

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, light source, zone, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ABB; Adolf Schuch GmbH; Dialight; Eaton; Emerson Electric Co.; Hubbell Incorporated; Larson Electronics LLC; Phoenix Products LLC; R. STAHL AG; and WorkSite Lighting

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Explosion Proof Lighting Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global explosion proof lighting market based on type, light source, zone, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear

-

Flood

-

High bay & low bay

-

Others

-

-

Light Source Outlook (Revenue, USD Million, 2018 - 2030)

-

LED light

-

Incandescent

-

Fluorescent

-

Others

-

-

Zone Outlook (Revenue, USD Million, 2018 - 2030)

-

Zone 0

-

Zone 1

-

Zone 2

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Mining

-

Chemical & Petrochemical

-

Pharmaceutical

-

Food Processing

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global explosion-proof lighting market size was estimated at USD 369.8 million in 2023 and is expected to reach USD 381.2 million in 2024.

b. The global explosion-proof lighting market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 564.8 billion by 2030.

b. North America dominated the explosion-proof lighting market with a share of 33.2% in 2023. Technological advancements in lighting technology, such as the development of high-efficiency LEDs and improved explosion-proof enclosures in the region, drive the market's growth.

b. Some key players operating in the explosion-proof lighting market include ABB; Adolf Schuch GmbH; Dialight; Eaton; Emerson Electric Co.; Hubbell Incorporated; Larson Electronics LLC; Phoenix Products LLC; R. STAHL AG; and WorkSite Lighting.

b. Key factors that are driving the market growth include the increasing demand for safe and durable lighting in hazardous environments and the growing awareness of workplace safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."