Explosion Proof Equipment Market Size, Share & Trends Analysis Report By Protection Method (Explosion Prevention, Explosion Containment), By Industry (Oil & Gas, Mining), By System, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-138-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Explosion Proof Equipment Market Trends

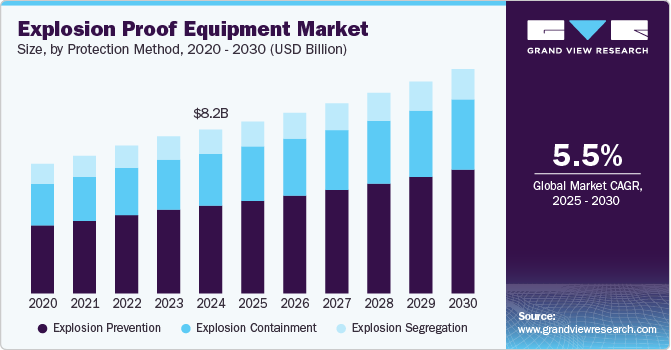

The global explosion proof equipment market size was valued at USD 8,232.3 million in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030. The rising demand for explosion-proof equipment is primarily driven by increasing safety regulations in industries such as oil and gas, chemicals, and mining. As these sectors face higher risks of explosive atmospheres, companies are prioritizing worker safety and equipment reliability. In addition, technological advancements are leading to more efficient and durable explosion-proof solutions. The growth of emerging markets and urbanization further fuels the need for such specialized equipment.

The explosion-proof equipment market is primarily driven by stringent safety regulations and standards imposed by governments and industry bodies to protect workers in hazardous environments. Industries such as oil and gas, chemicals, pharmaceuticals, and mining are particularly affected, as they frequently operate in settings with explosive atmospheres. As companies increasingly prioritize safety and risk management, the demand for reliable explosion-proof equipment has surged. Furthermore, technological advancements have enhanced the functionality and efficacy of these products, making them essential for compliance with safety standards while also improving operational efficiency.

Drivers, Opportunities & Restraints

The explosion-proof equipment industry is significantly driven by the growing demand for enhanced safety measures in hazardous work environments. As industries like oil and gas, mining, and chemicals face stringent regulatory requirements, companies are compelled to invest in equipment that minimizes the risk of explosions and ensures worker safety. This trend is further supported by technological advancements that improve the effectiveness and reliability of explosion-proof products, leading organizations to prioritize compliance and safety as integral parts of their operations.

A notable restraint in the explosion-proof equipment market is the high initial cost associated with procuring specialized equipment. The manufacturing and certification processes for explosion-proof products often demand significant investment, which may deter small and medium-sized enterprises from adopting these solutions. Additionally, the complexity of integrating such equipment into existing systems can pose challenges, leading to hesitancy among potential buyers. This cost barrier can hinder market growth, especially in regions with less stringent safety regulations.

The explosion-proof equipment industry presents ample opportunities due to the increasing industrialization and expansion of infrastructure in developing regions. As countries invest in modernization and new industrial projects, there is a rising need for safety-compliant equipment to mitigate risks in explosive environments. Furthermore, the integration of smart technologies and IoT into explosion-proof solutions offers additional potential for innovation, enhancing operational efficiency and safety monitoring. This intersection of growth in emerging markets and technological advancements can drive significant opportunities for manufacturers and suppliers in the explosion-proof equipment sector.

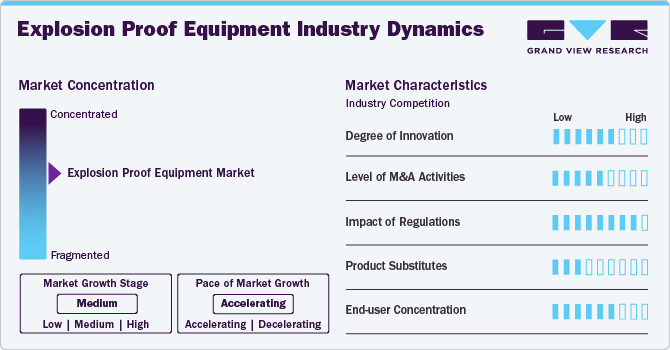

Market Concentration & Characteristics

The explosion-proof equipment industry is experiencing moderate growth, fueled by an increasing emphasis on safety and regulatory compliance across various industries. This sector is characterized by significant technological advancements, which enhance the effectiveness, reliability, and durability of explosion-proof products. Key market players are actively pursuing both organic and inorganic growth strategies, including the introduction of new products, expansion into new geographical markets, mergers and acquisitions, and strategic partnerships to solidify their foothold in the global landscape.

The regulatory environment plays a critical role in shaping the dynamics of the explosion-proof equipment industry. Regulations and standards governing safety practices dictate everything from design specifications to manufacturing processes. Recent updates to safety and compliance standards ensure that explosion-proof gear meets rigorous operational requirements, enhancing accountability and safety for users in potentially hazardous conditions. This legislative focus on compliance is anticipated to continue driving growth within the sector.

The demand for explosion-proof equipment among end users is propelled by a growing focus on safety, operational efficiency, and risk management in industries such as oil and gas, chemical processing, and construction. This specialized equipment is vital for ensuring that personnel can operate effectively in environments prone to explosive hazards. The use of innovative materials and advanced engineering in explosion-proof gear significantly enhances safety and reliability, providing essential support for those working in high-risk settings.

The threat of substitutes in the explosion-proof equipment industry is moderate. While alternatives such as standard industrial equipment may present some cost advantages, they often fail to meet the stringent safety and compliance requirements essential for operations in hazardous areas. Consequently, users typically prioritize high-quality, specialized explosion-proof equipment over generic options, sustaining a consistent demand for products specifically designed for risk-prone environments.

End user concentration within the explosion-proof equipment industry varies, with heavy reliance on sectors that operate in hazardous environments. Industries such as petrochemicals, pharmaceuticals, and mining exhibit a concentrated demand for explosion-proof solutions driven by strict safety regulations and the necessity for compliance. As awareness of safety standards continues to rise, the demand from these specific end user groups is expected to remain robust, further propelling the market's growth.

Protection Method Insights

The explosion prevention protection method segment held the largest share in 2024. Explosion-proof equipment provides a highly effective means of preventing explosions in hazardous environments by containing potential ignition sources within robust enclosures. This method is particularly advantageous in industries where high-power machinery is necessary, such as oil refineries, chemical processing plants, and mining operations.

The demand for the explosion containment prevention method segment is expected to grow at a significant CAGR from 2025 to 2030. This involves housing electrical or mechanical equipment inside explosion-proof enclosures made from strong materials such as cast aluminum or stainless steel. These enclosures are constructed to handle the pressure of an explosion without rupturing. When an explosion occurs inside, the enclosure prevents the ignition of external flammable atmospheres by cooling and dissipating the heat of escaping gases through flame paths or labyrinth seals.

Industry Insights

The oil & gas industry segment held the largest share in 2024. Explosion-proof equipment is designed with sealed enclosures and reinforced materials that contain any internal explosion, preventing it from spreading to the surrounding atmosphere. In offshore drilling, explosion-proof motor power pumps circulate drilling fluids, which are essential for maintaining well pressure. Similarly, explosion-proof lighting systems provide illumination in hazardous zones like refineries and storage facilities, where gas leaks are a constant threat.

The demand for the chemical & petrochemical industry segment is expected to grow at a significant CAGR from 2025 to 2030. The chemical & petrochemical industry handles highly volatile substances such as hydrocarbons, solvents, and toxic gases, creating significant explosion hazards. Explosion-proof equipment is essential in managing these risks in operations like refining, chemical synthesis, and polymer processing.

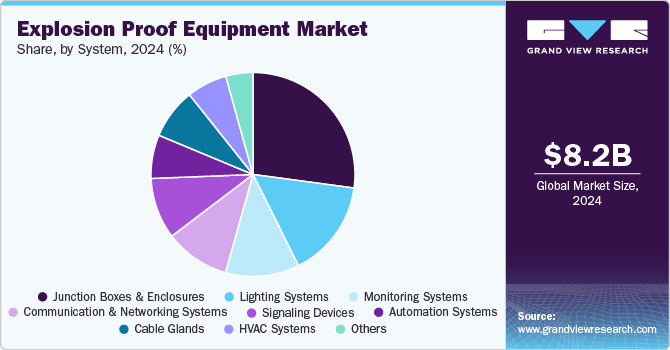

System Insights

The junction boxes & enclosures system segment held a 26.3% market share in 2024. Explosion-proof junction boxes and enclosures are crucial components in hazardous environments where explosive gases, vapors, or dust are present. They provide a secure housing for electrical connections, terminals, and other sensitive components, preventing sparks or heat from escaping and potentially igniting surrounding flammable substances. These devices are widely used in industries such as oil & gas, chemical processing, mining, and pharmaceuticals.

The demand for monitoring systems segment is expected to grow at a significant CAGR from 2025 to 2030. Monitoring systems are vital in various industries for ensuring safety, efficiency, and compliance with regulations. These systems enable real-time tracking of environmental conditions, equipment performance, and operational processes.

Regional Insights

North America explosion proof equipment industry led globally and accounted for 30.6% of the revenue share in 2024. The demand for explosion-proof equipment in North America is primarily driven by the diverse industrial base, including oil and gas, manufacturing, and chemical processing sectors. Strict workplace safety standards, along with the ongoing need for reliable protection against hazards in explosive environments, are spurring investment in explosion-proof solutions. Regulatory frameworks such as OSHA in the U.S. and WorkSafeBC in Canada mandate the use of such equipment in high-risk industries, contributing to a consistent market demand.

U.S. Explosion Proof Equipment Market Trends

The U.S. explosion proof equipment industry held an 85.0% share in the North America region. In the U.S., the increasing focus on safety in hazardous industries like oil and gas, mining, and chemical processing has fueled the need for explosion-proof equipment. The oil and gas sector, in particular, with its vast exploration and production operations, demands specialized equipment to meet safety regulations and reduce risks in volatile environments. The adoption of newer technologies, such as IoT and automation in industrial applications, also drives the growth of explosion-proof equipment.

Canada explosion proof equipment industry held a 9.0% share in the North America region. Canada's demand for explosion-proof equipment is closely tied to its resource-driven industries, particularly in oil sand extraction, mining, and chemical manufacturing. The country’s stringent safety regulations, including those outlined by the Canadian Centre for Occupational Health and Safety (CCOHS), compel businesses to adopt explosion-proof solutions to ensure worker safety and equipment reliability in hazardous conditions. Increased investment in sustainable energy sources also plays a role in boosting demand for such technologies.

Europe Explosion Proof Equipment Market Trends

The explosion-proof equipment industry in Europe is witnessing demand that is closely linked to the region's industrial diversification and adherence to stringent safety and environmental regulations. The need for such equipment is prominent in industries such as automotive, chemical processing, and energy, where stringent EU safety standards require businesses to implement advanced safety measures. The growing focus on renewable energy projects and infrastructure modernization is also influencing the adoption of explosion-proof solutions across the continent.

Germany explosion proof equipment industry held a 20.6% share in the Europe market. Germany, as a leading industrial hub in Europe, has a robust demand for explosion-proof equipment driven by its extensive manufacturing, chemical, and automotive industries. Compliance with both national and EU safety standards, as well as the rise of Industry 4.0 technologies, is pushing the need for explosion-proof equipment to safeguard against hazardous incidents. In addition, Germany’s growing focus on sustainable energy and advanced manufacturing processes further amplifies the market for such equipment.

France explosion proof equipment industry held a 12.5% share in the Europe region. In France, the demand for explosion-proof equipment is driven by sectors like aerospace, pharmaceuticals, and petrochemical industries, which require stringent safety protocols. France's commitment to industrial safety, particularly in high-risk areas such as chemical processing and nuclear energy, necessitates the widespread adoption of explosion-proof technologies. Moreover, the increasing implementation of safety measures within France’s mining and infrastructure sectors is further supporting the market's growth.

Asia Pacific Explosion Proof Equipment Market Trends

The Asia Pacific explosion proof equipment industry is driven by rapid industrialization and urbanization, particularly in countries like China and India, which has led to an increased demand for explosion-proof equipment. The region’s expanding infrastructure projects, energy sectors, and manufacturing industries are placing a greater emphasis on safety and risk mitigation, fostering a need for explosion-proof solutions. In addition, evolving safety regulations across key Asia Pacific countries are creating a more favorable environment for the adoption of these technologies.

China explosion proof equipment market held a 35.7% share in the Asia Pacific region. China's demand for explosion-proof equipment is heavily influenced by its large-scale industrial activities, especially in sectors like oil and gas, chemicals, and mining. The government’s tightening of safety regulations and a growing emphasis on workplace safety are driving the adoption of explosion-proof equipment across hazardous environments. In addition, China’s ongoing push for industrial modernization and advancements in smart manufacturing technologies further stimulate the need for enhanced safety measures.

India explosion proof equipment market held a 13.8% share in the Asia Pacific market. In India, the explosion-proof equipment industry is expanding rapidly due to the country's growing industrial sectors, such as oil and gas, chemicals, and power generation. India’s ongoing infrastructure development projects, along with the increasing implementation of safety standards, are pushing demand for explosion-proof technologies. Moreover, the rise in domestic and international investments in India’s manufacturing sector is contributing to the market's growth as companies prioritize worker safety and regulatory compliance.

Latin America Explosion Proof Equipment Market Trends

Latin America explosion-proof equipment market is particularly strong in countries like Brazil, driven by the region's significant oil and gas reserves, mining industries, and chemical manufacturing. As safety standards in these industries become more stringent, there is a greater push toward adopting explosion-proof technologies to prevent workplace accidents. In addition, the growing focus on infrastructure and energy projects in Latin America is further driving the need for such specialized equipment.

Brazil explosion proof equipment market held a 38.3% share in the Latin America region. Brazil’s demand for explosion-proof equipment is largely fueled by its expansive oil and gas industry, which operates in high-risk environments where safety and regulatory compliance are crucial. The country’s mining and petrochemical industries also create a strong demand for these safety solutions. As Brazil continues to develop its industrial infrastructure and focuses on meeting international safety standards, the market for explosion-proof equipment continues to grow, particularly in hazardous and explosive environments.

Middle East & Africa Explosion Proof Equipment Market Trends

The Middle East and Africa explosion-proof equipment market is driven by the demand in large-scale oil and gas, petrochemical, and energy sectors, which require high levels of safety in volatile environments. The region's growing focus on maintaining industrial safety and adhering to global standards has led to the widespread adoption of explosion-proof technologies. In addition, the region’s ongoing infrastructure development and expansion of power generation projects further boost the demand for such equipment.

Saudi Arabia explosion proof equipment market held a 26.7% share in the Middle East & Africa region. Saudi Arabia's demand for explosion-proof equipment is particularly high in the oil and gas sector, where the country plays a leading role as one of the world’s largest oil producers. The country’s strict adherence to international safety standards in its oil exploration and production facilities is a major factor driving the need for explosion-proof equipment. The expansion of infrastructure and energy projects in Saudi Arabia, along with the growth of the petrochemical industry, continues to fuel market growth for these specialized safety solutions.

Key Explosion Proof Equipment Company Insights

Some of the key players operating in the market include Honeywell International Plc, ABB, Emerson Electric Co., and Siemens.

-

Honeywell International Inc. is a multinational company that operates in a wide range of industries, including building technologies, aerospace, performance materials, and safety and productivity solutions. The company designs and manufactures diverse solutions, such as advanced control systems for buildings, smart home technology, aerospace products, industrial automation systems, and materials for the healthcare and energy sectors.

-

ABB (Asea Brown Boveri) is a global leader in electrification, automation, and digitalization, providing innovative solutions across industries such as energy, transportation, manufacturing, and utilities. The company offers a wide range of products and services, including electrical equipment, robotics, industrial automation, and digital solutions aimed at improving efficiency, sustainability, and safety.

WorkSite Lighting and Extronics Ltd. are some of the emerging market participants in the explosion proof equipment industry.

-

WorkSite Lighting is a U.S.-based company specializing in the design and manufacturing of high-performance portable lighting solutions for industrial and commercial applications. Known for its rugged, durable, and energy-efficient products, WorkSite Lighting offers a wide range of lighting solutions, including LED work lights, floodlights, and portable lighting towers, which are specifically designed for use in construction sites, outdoor events, emergency response situations, and other demanding environments.

-

Extronics Ltd. is a UK-based company specializing in designing and manufacturing industrial equipment and solutions for hazardous and explosive environments. Founded in 1982, Extronics provides a wide range of products, including explosion-proof electrical equipment, wireless solutions, and custom designed systems, primarily for industries such as oil and gas, chemical processing, pharmaceuticals, and manufacturing. The company’s product offerings include intrinsically safe and flameproof electrical devices, wireless networking equipment, asset tracking systems, and personal protective equipment, all designed to improve safety, efficiency, and productivity in hazardous environments.

Key Explosion Proof Equipment Companies:

The following are the leading companies in the explosion proof equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Adalet

- Siemens

- Honeywell International Plc.

- Rockwell Automation Inc.

- ABB

- Eaton Corporation

- Emerson Electric Co.

- Warom Technology Inc.

- WorkSite Lighting

- Extronics Ltd.

- Alloy Industry Co. Ltd

- Tomar Electronics Inc

- Potter Electric Signal Co. LLC

- Federal Signal Corporation

- Pepperl+Fuchs SE

Recent Developments

-

In June 2024, Honeywell International Plc. acquired the Enraf Holding B.V. agreement valued at approximately USD 260 million. The company consists of six groups, including a division called Enraf Fluid Technology, which is a custom-engineered explosion-proof precision blending and additive metering equipment manufacturer.

-

In March 2024, Emerson Electric Co. launched a new Acoustic Particle Monitor, Rosemount SAM42, for measuring entrained sand in the oil & gas wells output. The new products feature explosion proof protection along with onboard data processing.

Explosion Proof Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8,639.8 million |

|

Revenue forecast in 2030 |

USD 11.28 billion |

|

Growth rate |

CAGR of 5.5% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Protection method, industry, system, region |

|

Region scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies profiled |

Adalet; Siemens; Honeywell International Plc.; Rockwell Automation Inc.; ABB; Eaton Corporation; Emerson Electric Co.; Waram Technology Inc.; WorkSite Lighting; Extronics Ltd.; Allay Industry Co. Ltd.; Tomar Electronics Inc.; Potter Electric Signal Co. LLC; Federal Signal Corporation; Pepperl+Fuchs SE |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Explosion Proof Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global explosion proof equipment market report based on protection method, industry, system, and region:

-

Protection Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Explosion Prevention

-

Explosion Containment

-

Explosion Segregation

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical & Petrochemical

-

Mining

-

Energy & Power

-

Manufacturing

-

Food Processing

-

Pharmaceutical

-

Others

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Junction Boxes & Enclosures

-

Lighting Systems

-

Monitoring Systems

-

Explosion-Proof Cameras

-

Explosion-Proof Sensors

-

Others

-

-

Communication & Networking Systems

-

Access Points & Routers

-

Tablets & Smartphones

-

Networking Equipment

-

Explosion-Proof Servers

-

Others

-

-

Signaling Devices

-

Automation Systems

-

Cable Glands

-

HVAC Systems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Israel

-

UAE

-

-

Frequently Asked Questions About This Report

b. The explosion proof equipment market size was estimated at USD 8,232.3 million in 2024 and is expected to reach USD 8,639.8 million in 2025

b. The explosion proof equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 11.28 billion by 2030

b. The junction boxes & enclosures system segment held 26.3% market share in 2024. Explosion-proof junction boxes and enclosures are crucial components in hazardous environments where explosive gases, vapors, or dust are present.

b. Some of the key players operating in the explosion proof equipment market include Adalet, Siemens, Honeywell International Plc., Rockwell Automation Inc., ABB, Eaton Corporation, Emerson Electric Co., Waram Technology Inc., WorkSite Lighting, Extronics Ltd., Allay Industry Co. Ltd., Tomar Electronics Inc., Potter Electric Signal Co. LLC, Federal Signal Corporation, Pepperl+Fuchs SE.

b. The key factors that are driving the explosion proof equipment market are compliance with the strict safety regulations imposed by government regulating bodies, Increasing industrialization in developing countries, and the growing importance of risk & contingency management strategies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."