- Home

- »

- Biotechnology

- »

-

Exosomes Market Size And Share, Industry Report, 2030GVR Report cover

![Exosomes Market Size, Share & Trends Report]()

Exosomes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents, Services), By Workflow (Isolation Methods, Downstream Analysis), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-298-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Exosomes Market Summary

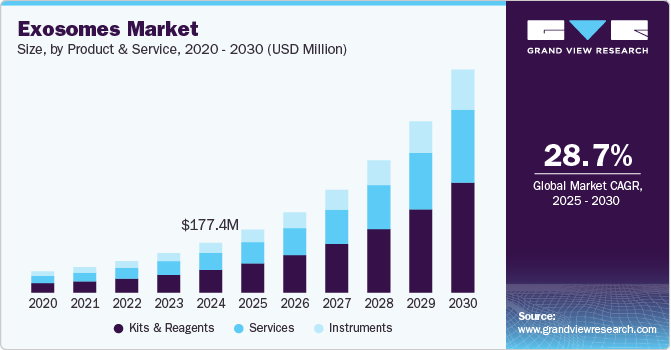

The global exosomes market size was estimated at USD 177.4 million in 2024 and is projected to reach USD 794.2 billion by 2030, growing at a CAGR of 28.73% from 2025 to 2030. Exosomes, also termed Extracellular Vesicles (EVs), are enclosed in a single outer membrane. They are secreted by various cell types and are present in bodily fluids like urine, plasma, saliva, breast milk, semen, Cerebral Spinal Fluid (CSF), bronchial fluid, amniotic fluid, and others. These vesicles transport proteins and genetic material, facilitating cellular communication.

Key Market Trends & Insights

- North America exosomes market accounted for the highest revenue share of 56.55% in 2024

- The exosomes market in the U.S. is expected to expand in the coming years.

- The Asia Pacific exosomes market is expected to witness rapid growth from 2025 to 2030.

- Based on product & service, the kits and reagents product segment captured the highest revenue share of 45.68% in 2024.

- In terms of application, the cancer segment held the largest revenue share of 32.76% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 177.4 billion

- 2030 Projected Market Size: USD 794.2 billion

- CAGR (2025-2030): 28.73%

- North America: Largest market in 2024

The industry is primarily driven by advancements in exosome isolation technologies and analytical methods, expanded applications of exosomes, increased support from governmental and non-governmental initiatives for exosome research, and rising rates of cancer. The COVID-19 pandemic disrupted clinical trials investigating exosomes' diagnostic and therapeutic potential in 2020, alongside nationwide lockdowns, supply chain interruptions, and redirected investments towards COVID-19-related products, all contributing to reduced research and development in exosome-related activities.

Despite these setbacks in 2020, the pandemic has presented new opportunities for developing COVID-19 vaccines and treatments using exosomes, which are expected to accelerate industry growth in the years ahead. For instance, in August 2022, researchers at North Carolina State University created an inhalable COVID-19 vaccine utilizing exosomes. Furthermore, exosomes hold potential for diagnosing and monitoring various diseases, including infectious diseases, neurodegenerative disorders, cancer, and cardiovascular diseases (CVDs).

In addition, the benefits of exosomes in drug delivery, such as their ability to permeate biological barriers, low immunogenicity and toxicity, etc. are expanding their therapeutic applications. This is expected to drive the exosomes industry forward in therapeutics, diagnostics, and vaccine development in the forecast period. The increasing incidence of cancer is creating a strong demand for innovative therapeutic solutions for its diagnosis and treatment. In the U.S., the American Cancer Society reported an estimated 1,9 million new cancer cases and 609 thousand cancer-related deaths by the end of 2022. Furthermore, advancements in exosome isolation technologies and analytical methods are forecasted to bolster industry growth in the coming years. These innovations are expected to enhance the adoption of exosomes in research and contribute to industry expansion.

Market Concentration & Characteristics

The industry exhibits significant innovation, propelled by biotechnology and regenerative medicine advances. These nanoscale vesicles are increasingly harnessed for targeted drug delivery, diagnostics, and therapeutic applications. Rapid research and development are expanding their potential across diverse medical fields leading to a moderate to high degree of innovation in the market.

Mergers and acquisitions in the industry are notable, driven by the development of cutting-edge technologies and expanding market prospects. Companies are consolidating to enhance research capabilities, broaden product pipelines, and accelerate commercialization. Such dynamic activities are accelerating the level of merger and acquisition initiatives in the industry.

Regulations play a crucial role in shaping the industry. They ensure safety, quality, and efficacy of products, influencing research, development, and commercialization. However, lack of clear guidelines in this industry may hinder the development of exosome-based therapies and diagnostic tools.

Key players are adopting the strategy of increasing production capacity and expanding their market reach to improve the availability of their products & services in diverse geographic areas. In addition, companies are launching new platforms to strengthen their product & service portfolio. For example, in May 2020, Cell Guidance Systems launched its Exo-spin mini-HD column for exosomes isolation.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for exosome products & services. Furthermore, as scientific awareness of novel therapy types continues to grow globally and access to biotechnological tools improves in emerging markets, major market players are expected to enhance their regional expansion efforts.

Product & Service Insights

The kits and reagents product segment captured the highest revenue share of 45.68% in 2024. Leading companies are introducing innovative kits and reagents to expand the versatility of exosomes. For example, Clara Biotech introduced the ExoRelease starter kit for exosome isolation and purification in May 2022. These advanced products facilitate researchers in identifying new biomarkers and refining applications for exosome-based therapeutics and diagnostics. Consequently, these advancements are expected to fuel the growth of this segment in the future.

The services segment is anticipated to register a rapid growth rate from 2025 to 2030. Exosome isolation is often complex, non-specific, and labor-intensive, prompting end users to outsource tasks such as isolation, characterization, and therapeutic development to streamline processes and reduce turnaround times. Numerous industry participants provide exosome services, exemplified by AMSBIO, a U.S.-based company offering services such as exosome isolation and quantification, exosome miRNA isolation and sequencing, and exosome surface marker analysis and proteomics services. This diverse array of service offerings from various companies is projected to propel growth within this segment.

Workflow Insights

The downstream analysis segment held the largest revenue share in 2024. The downstream analysis includes detection, quantification, labeling, and modification or engineering of exosomes. These procedures may require sophisticated sample preparation, downstream data interpretation, and the use of analytical methods, such as RNA sequencing and mass spectrometry for proteomic analysis. Major players in the exosomes industry are offering various technologically advanced products for downstream analysis. For instance, System Biosciences, Exo-ELISA Ultra method quantifies exosomes in 4 hours by using micro samples. Hence, the increasing efficiency and utility of advanced downstream analysis techniques are contributing to segment growth.

The isolation methods segment is projected to grow at a lucrative CAGR over the forecast period. The optimal exosome isolation method is chosen based on the type and amount of starting material (e.g., urine, cell culture media, urine, plasma, etc.), intended therapeutic use, route of administration, availability of specialized equipment, as well as the desired end product. The common isolation methods include ultracentrifugation, immunocapture on beads, precipitation, and filtration, among others. Companies are offering smart isolation platforms for simpler workflow, faster turnaround time, high yield, and intact exosomes, which is fueling segment growth. For instance, System Biosciences offers the SmartSEC Platform, which is fast & easy to use and enables parallel processing of multiple samples.

Application Insights

The cancer segment held the largest revenue share of 32.76% in 2024. This can be attributed to the broad range of applications of exosomes in cancer diagnosis, prognosis, and treatment. Exosomes can be potentially used for the therapeutic delivery of RNAs, small molecules, and proteins to target cancer cells with high efficiency. Similarly, proteins, lipids, and nucleic acids carried by exosomes are being studied as prospective targets for cancer treatment as well as promising biomarkers for cancer detection and prognosis. The rising cancer prevalence and increasing need for early detection of the disease are expected to boost the segment in the near future.

The infectious diseases segment is anticipated to grow at a rapid CAGR from 2025 to 2030. Exosomes are known to be involved in the pathogenesis of numerous infectious diseases. The ability of extracellular vesicles to convey a variety of molecules to distant locations or over short distances, which enables the mediation of various biological functions, is a key characteristic of such vesicles. This delivery mechanism can be used for the development of therapeutic strategies, such as vaccination. All these factors are likely to aid revenue generation in this segment.

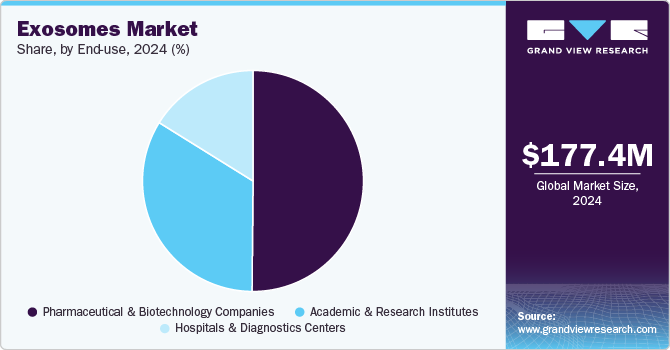

End-use Insights

The pharmaceutical & biotechnology companies segment captured the highest revenue share of 50.13% in 2024. The segment is experiencing growth driven by rising demand for extracellular vesicle-based therapeutics and vaccines. In addition, numerous pharmaceutical and biotechnology firms are forming partnerships and collaborations to enhance large-scale production capabilities. For example, in January 2023, Sartorius AG partnered with RoosterBio to advance downstream purification processes for exosome manufacturing. Similarly, in November 2022, Sartorius BIA Separations and Exopharm collaborated to enhance the production and commercialization of therapeutic exosomes on a large scale. These strategic alliances are expected to further bolster the segment's development.

The academic & research institutes segment is anticipated to grow at a significant CAGR from 2025 to 2030. This is due to the increasing focus of several research institutes on the use of exosomes for the discovery and development of novel therapeutics. For instance, researchers at Carnegie Mellon University are working on understanding the biological activities of exosome-based cell communication to use exosome-based delivery of growth factors for applications in regenerative medicine. Such research activities are projected to boost segment growth in the near future.

Regional Insights

North America exosomes market accounted for the highest revenue share of 56.55% in 2024 and is projected to grow at the fastest rate over the forecast period. This is due to the rising government funding for the detection of new biomarkers and the increasing incidence of chronic conditions, such as cardiovascular diseases and cancer. In addition, growing research & development activities for the development of novel drugs, diagnostic methods, and treatment options are anticipated to drive the exosomes industry in the region. Moreover, the presence of major key players, such as Bio-Techne Corp., Hologic Inc., and Danaher Corp., in the region is likely to fuel the growth.

U.S. Exosomes Market Trends

The exosomes market in the U.S. is expected to expand in the coming years, driven by rising government investments and a growing emphasis on targeted therapies and regenerative medicine. Increasing disease prevalence is also contributing to this growth. Additionally, heightened research in drug discovery and personalized medicine, alongside the presence of numerous biotechnology and biopharmaceutical firms, will likely boost market expansion.

Europe Exosomes Market Trends

The Europe exosomes market is projected to experience rapid growth with a strong CAGR during the forecast period. This growth is fueled by increasing public-private partnerships across the region. For instance, initiatives like the German Society for Extracellular Vesicles unite professionals, promoting collaborative research and supporting young academics in exosome studies. These efforts are poised to enhance the market's long-term growth potential.

The exosomes market in the UK is driven by advancements in biotechnology, increasing research investments, and a growing focus on personalized medicine. Government support and collaborations between academic institutions and biopharmaceutical companies are key factors propelling market growth. Additionally, rising applications in drug delivery and regenerative therapies further contribute to expanding opportunities in the field.

Germany exosomes market is anticipated to experience growth from 2025 to 2030, driven by robust biotechnological innovations, substantial research funding, and a strong emphasis on personalized healthcare solutions. Collaborations among universities, research institutions, and biopharmaceutical are playing a key role in driving market expansion.

The exosomes market in France is expected to grow over the forecast period due to significant advancements in biotechnology and increasing investments in research and development. There is a growing focus on leveraging exosomes for therapeutic applications and diagnostics. Government initiatives promoting innovation in healthcare technologies further stimulate market growth.

Asia Pacific Exosomes Market Trends

The Asia Pacific exosomes market is expected to witness rapid growth from 2025 to 2030. This can be attributed to the expanding biotechnological capabilities and rising healthcare expenditures in the region. Countries like China and Japan are undertaking substantial investments in research and development of exosome-based therapies and diagnostics, thereby driving the market.

The exosomes market in China is anticipated to grow over the forecast period. The country's large population and increasing incidence of chronic diseases are driving demand for advanced medical solutions, including exosome-based therapies and diagnostics, which is likely to positively affect the market.

Japan exosomes market is expected to witness rapid growth over the forecast period due to a proactive regulatory environment that encourages innovation in biotechnology and regenerative medicine. Furthermore, Japan's leadership in precision medicine and its strong infrastructure for clinical trials are enhancing the country's position as a hub for advanced healthcare technologies, including exosomes.

The exosomes market in India is anticipated to grow over the forecast period. The country's diverse genetic pool offers unique opportunities for exosome research and development, particularly in tailoring therapies to different population segments. Collaborations between Indian biotech firms, academic institutions, and international partners are driving innovation and expanding the market's potential in addressing complex health challenges domestically and globally.

Middle East and Africa Exosomes Market Trends

The Middle East and Africa exosomes market is poised to grow in the near future due to the increasing interest in biotechnological advancements and healthcare innovation in this region. While still in its nascent stages, the region shows promise due to growing healthcare infrastructure and rising investments in medical research.

The exosomes market in Saudi Arabia is expected to grow over the forecast period due to ambitious healthcare reforms and substantial investments in biotechnology. The country's Vision 2030 initiative prioritizes innovation in healthcare, fostering a conducive environment for the development of advanced therapies like exosomes.

Kuwait exosomes market is anticipated to witness growth over the forecast period due to the country’s increasing investments in healthcare infrastructure and biotechnological research. The country's strategic initiatives to diversify its economy are fostering innovation in medical technologies, including exosome-based therapies and diagnostics, and are expected to support the market growth.

Key Exosomes Company Insights

Key industry players are implementing strategies to enhance their market influence and broaden product accessibility. These efforts include expanding operations and forming strategic partnerships, which are pivotal in driving market expansion.

Key Exosomes Companies:

The following are the leading companies in the exosomes market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Hologic Inc.

- Fujifilm Holdings Corporation

- Lonza

- Miltenyi Biotec

- Bio-Techne Corporation

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Abcam plc

- RoosterBio, Inc.

Recent Developments

-

In January 2024, EXO Biologics SA, a Belgian biotech firm focused on developing biopharmaceuticals with exosomes for rare diseases, launched ExoXpert, a contract development and manufacturing organization (CDMO) specializing in exosomes.

-

In October 2023, Cytiva and RoosterBio, Inc., collaborated to develop a scalable purification process for mass-producing exosomes. This partnership leveraged their respective strengths to overcome challenges in using exosomes for therapeutics and gene therapy delivery.

-

In January 2023, Sartorius and RoosterBio expanded their partnership to improve exosome production processes, addressing purification challenges and developing analytical techniques for quality control, aiming to enhance the yield, purity, and potency of therapies.

Exosomes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 224.6 million

Revenue forecast in 2030

USD 794.2 million

Growth rate

CAGR of 28.73% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & Service, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Singapore; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Danaher; Hologic Inc.; Fujifilm Holdings Corporation; Lonza; Miltenyi Biotec; Bio-Techne Corporation; QIAGEN; Thermo Fisher Scientific, Inc.; Abcam plc; RoosterBio, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exosomes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global exosomes market report based on product & service, workflow, application, end-use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Instruments

-

Services

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Isolation Methods

-

Ultracentrifugation

-

Immunocapture on beads

-

Precipitation

-

Filtration

-

Others

-

-

Downstream Analysis

-

Cell surface marker analysis using flow cytometry

-

Protein analysis using blotting & ELISA

-

RNA analysis with NGS & PCR

-

Proteomic analysis using mass spectroscopy

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Neurodegenerative diseases

-

Cardiovascular diseases

-

Infectious diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & biotechnology companies

-

Hospitals & diagnostics centers

-

Academic & research institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the exosomes market with a share of 56.55% in 2024. This is attributable to the presence of a substantial number of key players in the U.S. coupled with the well-established cell biology research domain in the region.

b. Some key players operating in the exosomes market include Danaher; Hologic Inc.; Fujifilm Holdings Corporation; Lonza; Miltenyi Biotec; Bio-Techne Corporation; QIAGEN; Thermo Fisher Scientific, Inc.; Abcam plc; and RoosterBio, Inc.

b. Key factors driving the market growth include innovations and new product development for exosome isolation and its analysis, rising cancer prevalence, and expanding clinical applications of exosomes.

b. The global exosomes market size was estimated at USD 177.4 million in 2024 and is expected to reach USD 224.6 million in 2025.

b. The global exosomes market is expected to grow at a compound annual growth rate (CAGR) of 28.73% from 2025 to 2030 to reach USD 794.2 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.