- Home

- »

- Medical Devices

- »

-

Exocrine Pancreatic Insufficiency Market Size Report, 2030GVR Report cover

![Exocrine Pancreatic Insufficiency Market Size, Share & Trends Report]()

Exocrine Pancreatic Insufficiency Market Size, Share & Trends Analysis Report By Therapy (Pancreatic Enzyme Replacement Therapy (PERT), Nutritional Therapy), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-193-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global exocrine pancreatic insufficiency market size was valued at USD 3.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Exocrine pancreatic insufficiency (EPI) is a medical condition characterized by the inability of the pancreas to produce and supply enough digestive enzymes to the small intestine, hampering the proper digestion of food. This condition can result from various factors, including chronic pancreatitis, cystic fibrosis, diabetes, and certain gastrointestinal surgeries. EPI can lead to symptoms like weight loss, diarrhea, abdominal pain, and malnutrition. The market for EPI focuses on developing diagnostic tools, therapies, and management strategies to improve the quality of life for individuals suffering from this condition. Advanced treatments and a growing understanding of EPI's underlying causes are driving innovation and growth within this market.

The exocrine pancreatic insufficiency (EPI) market is experiencing growth due to the increasing prevalence of chronic pancreatitis, a significant underlying cause of EPI. Chronic pancreatitis is a persistent inflammation of the pancreas, often caused by prolonged alcohol abuse, gallstones, or genetic factors. Prolonged, chronic pancreatitis can damage the pancreatic tissue, leading to a decline in the production of digestive enzymes. Pharmaceutical companies and medical device manufacturers are actively engaged in research and development to create innovative therapies and diagnostic tools to address the growing EPI cases associated with chronic pancreatitis. This focus on improving patient outcomes contributes to the overall growth of the EPI market.

Moreover, increasing incidences of diabetes further propels the market growth. For instance, in July 2022, according to an article published by the International Journal of Endocrinology, the overall occurrence of exocrine pancreatic insufficiency (EPI) was found to be 22% among individuals diagnosed with type 2 diabetes, and within this group, 8% experienced severe pancreatic insufficiency. Upon researching specific subgroups, it was observed that the prevalence of EPI in individuals with type 2 diabetes was influenced by geographic location. Additionally, those patients with elevated insulin needs, indicating a higher possibility of insulin deficiency, exhibited a greater prevalence of EPI.

Therapy Insights

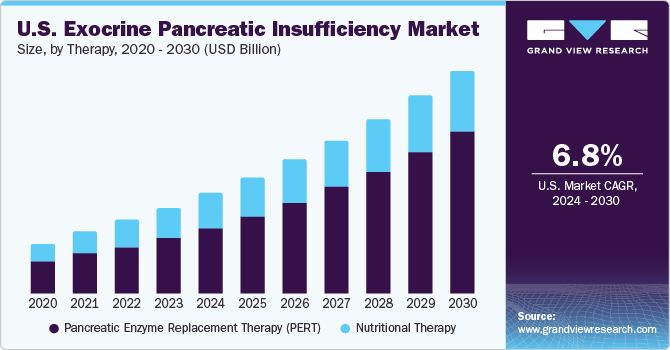

Based on therapy, the EPI market is segmented into Pancreatic Enzyme Replacement Therapy (PERT) and natural therapy. PERT dominated the market in 2023. PERT involves providing the body with the essential digestive enzymes that the pancreas can no longer produce adequately. PERT helps patients manage symptoms like abdominal pain, weight loss, and malnutrition, significantly enhancing their quality of life. The effectiveness and widespread use of PERT have positioned it as the primary therapy for EPI, driving its dominance in the market.

Nutritional therapy involves providing patients with enzyme replacement and supporting their diet to ensure proper absorption of essential nutrients. Enzyme replacement therapy, a core component of nutritional management, helps in compensating for deficient pancreatic enzymes, facilitating effective digestion and absorption of nutrients from food. This approach plays a crucial role in improving the overall nutritional status and quality of life for individuals with EPI.

Distribution Channel Insights

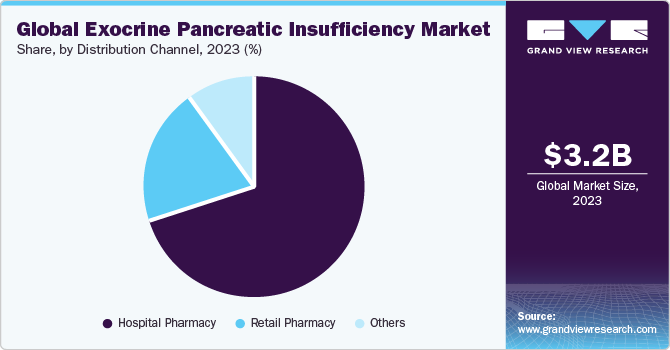

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and others. Hospital pharmacies dominated the market in 2023 due to the crucial role hospitals play in diagnosing and treating this condition. Hospitals are often the primary facilities where patients undergo comprehensive diagnostic tests and consultations with gastroenterologists or specialists. Additionally, hospitals provide a range of treatment options, including PERT and other medications, making them central hubs for EPI management. The convenience and accessibility of hospital pharmacies, coupled with their expertise in managing complex medical conditions like EPI, contribute to their dominance in distributing necessary medications and therapies for patients.

Regional Insights

North America dominated the market in 2023. The region's dominance is attributed to the presence of established manufacturers and a large patient pool, which is expected to further strengthen market growth. Additionally, North America has a higher prevalence of conditions linked to EPI, such as cystic fibrosis and chronic pancreatitis. The region has a well-established healthcare infrastructure, advanced diagnostic capabilities, and high levels of awareness about EPI, which contribute to early detection and effective management. Furthermore, major pharmaceutical companies and research institutions that focus on EPI and related disorders are present in North America, further boosting its position in the market. This region's proactive approach to healthcare and substantial investments in research and development underline its dominance in addressing EPI and driving advancements in its treatment.

Competitive Insights

Key players operating in the market include AbbVie, Nordmark Arzneimittel GmbH & Co., EagleBio, Cilian AG, Digestive Care, Inc., ChiRhoClin, Alcresta Therapeutics, Inc., Abbott, Laboratory Corporation of America, Bioserv Diagnostics, Metagenics LLC, Janssen, Organon Group of Companies, ScheBo Biotech AG, VIVUS LLC, and among several others. The EPI market is characterized by a competitive landscape with several key players competing for market share. These companies often focus on research and development initiatives to introduce advanced therapeutic solutions. Additionally, strategic partnerships, collaborations, mergers, and acquisitions are common strategies these entities employ to expand their product portfolios and global presence.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."