- Home

- »

- Clinical Diagnostics

- »

-

Exocrine Pancreatic Insufficiency Diagnostics Market Report, 2030GVR Report cover

![Exocrine Pancreatic Insufficiency Diagnostics Market Size, Share & Trends Report]()

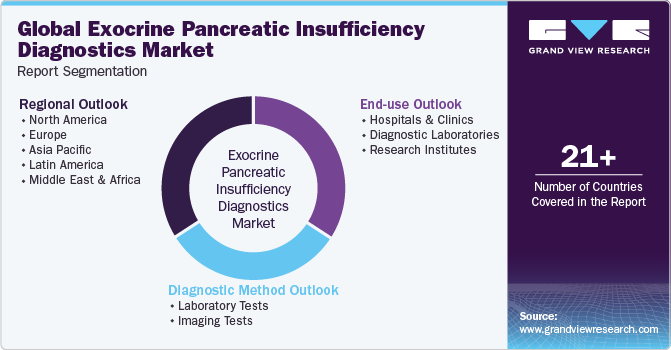

Exocrine Pancreatic Insufficiency Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Diagnostic Method (Laboratory, Imaging), By End-use (Hospitals & Clinics, Research Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-294-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

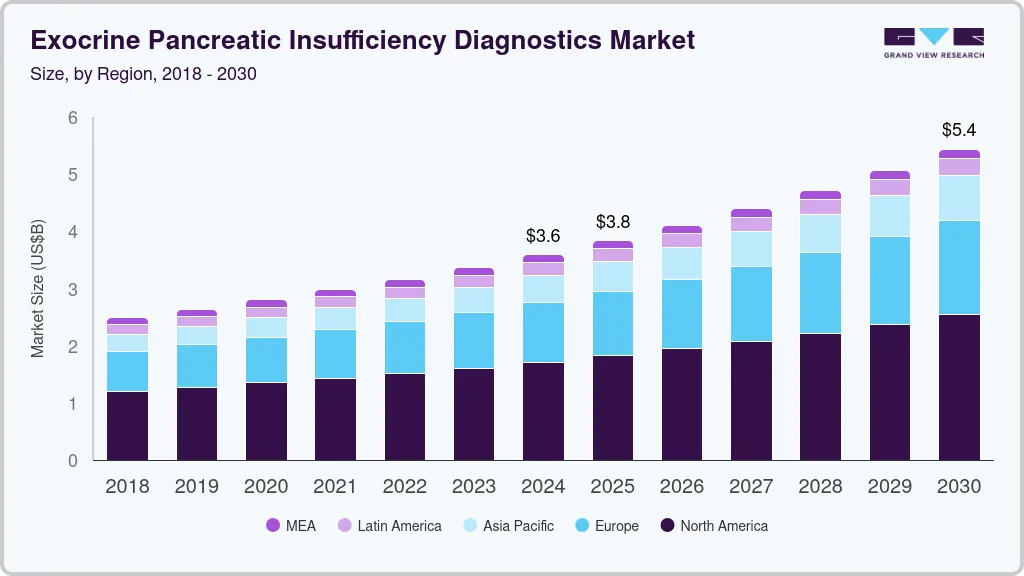

The global exocrine pancreatic insufficiency diagnostics market size was estimated at USD 3.59 billion in 2024 and is projected to reach USD 5.44 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The market growth is attributed to the increasing prevalence of exocrine pancreatic insufficiency (EPI), rising awareness about the condition, and advancements in diagnostic techniques. In addition, the growing elderly population, which is more susceptible to EPI, and the rising incidence of chronic pancreatitis and cystic fibrosis contribute to market growth.

Chronic pancreatitis, characterized by progressive inflammation in the pancreas, stands as the primary contributor to EPI. As the inflammation persists, it leads to pancreatic damage, culminating in EPI development. Statistics indicate that 60-90% of individuals living with chronic pancreatitis for approximately 10 to 12 years are affected by EPI. In the United States alone, exocrine pancreatic insufficiency emerges as the most prevalent pancreatic disorder, impacting 42-73 per 100,000 individuals.

In the diagnostics market for exocrine pancreatic insufficiency, factors such as the rising incidence of chronic pancreatitis and cystic fibrosis drive demand. EPI is highly prevalent among those with cystic fibrosis, with around 90% of patients also exhibiting symptoms of EPI. Cystic fibrosis, an inherited and progressive condition, is a primary cause of EPI in children. Its hallmark is chronic lung infections, gradually leading to respiratory complications. The prevalence of cystic fibrosis surpasses 30,000 individuals in the U.S. and approximately 70,000 worldwide.

Technological advancements enhancing diagnostic accuracy and accessibility further stimulate growth. In addition, increasing awareness about EPI among healthcare professionals and patients prompts early detection and treatment initiation. Favorable reimbursement policies and the development of novel diagnostic tools also contribute to market expansion. As the burden of chronic pancreatitis and cystic fibrosis persists, the demand for efficient EPI diagnostics is expected to escalate, propelling market growth in the foreseeable future.

Furthermore, the prevalence of diabetes is a significant driver for the growing demand for EPI diagnostics. Type 2 diabetes mellitus (T2DM), a chronic condition affecting millions worldwide, is projected to impact 643 million individuals by 2030. As of 2021, approximately 537 million adults, roughly 1 in 10 of the global adult population, were living with diabetes. This number is expected to surge to 783 million by 2045. The rising incidence of diabetes is attributed to factors like increasing rates of obesity, aging populations, and lifestyle changes predisposing individuals to T2DM. Consequently, the growing prevalence of T2DM contributes to the demand for EPI diagnostics, as diabetes is a risk factor for developing EPI. This dynamic landscape underscores the importance of advanced diagnostic tools and strategies to accurately detect and manage EPI in individuals with diabetes, thereby driving market growth.

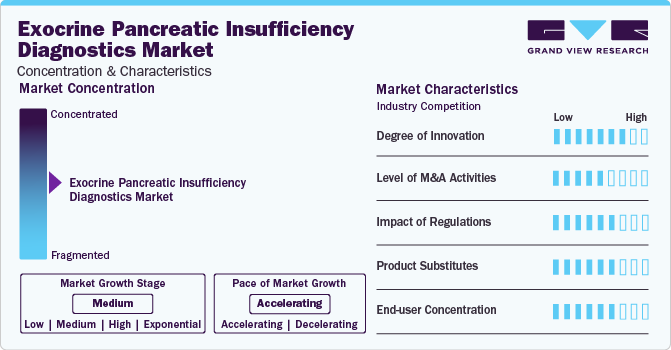

Market Concentration & Characteristics

The exocrine pancreatic insufficiency diagnostics market exhibits a moderate degree of innovation, with advancements in automation and assay technologies. For instance, the automation of fecal pancreatic elastase testing, exemplified by the fPELA turbo from BÜHLMANN, enables flexible and random access applications on most clinical chemistry platforms, streamlining patient identification and monitoring. The use of the same CALEX extraction device as the fCAL turbo assay adds convenience and efficiency by allowing both tests to be conducted from a single extract. This automation reduces hands-on time significantly, with a time to first result of just 10 minutes and subsequent results available every few seconds thereafter. These advancements are key market driving factors, as they improve the speed, accuracy, and efficiency of fecal elastase assays, meeting the growing demand for rapid diagnostic solutions in healthcare settings.

The market exhibits a moderate level of merger and acquisition (M&A) activities. The merger between GeneProof and ALPCO in April 2022 exemplifies this trend, creating a global market leader with comprehensive capabilities in diagnostic products. This activity reflects the market's dynamic nature, driven by the need for expanded product portfolios and technological advancements to meet the growing demand for accurate and efficient EPI diagnostics.

Regulations significantly impact the EPI diagnostics market by ensuring the safety, efficacy, and quality of diagnostic products. Compliance with regulatory requirements, such as FDA approval and CE marking, is essential for market entry. Stringent regulations drive innovation, standardization, and quality assurance, shaping dynamics and fostering trust among stakeholders.

The EPI diagnostics market faces limited product substitutes, as specific tests are required to diagnose and monitor EPI accurately. However, alternative methods, such as fecal fat quantification, can be used, though they are less specific and sensitive compared to elastase tests. These limitations highlight the importance of dedicated EPI diagnostic tools.

The EPI diagnostics market exhibits a moderate level of end-user concentration. Diagnostic tests for EPI are primarily utilized by healthcare facilities, including hospitals, clinics, and laboratories. While there are multiple end-users, the concentration is notable among these facilities due to the specialized nature of EPI diagnostics and the need for trained personnel to conduct and interpret the tests.

Diagnostic Method Insights

Laboratory tests led the market in 2023 with a share of 69.22% and is anticipated to grow at the fastest CAGR over the forecast period. Stool tests, such as the fecal elastase test, are crucial for diagnosing EPI, as they can detect insufficient pancreatic enzyme levels. Blood tests, including trypsinogen and chymotrypsin levels, can also indicate pancreatic insufficiency. Factors driving this segment include the increasing prevalence of conditions like chronic pancreatitis, which often leads to EPI, and the development of automated and more accurate testing methods. In addition, the growing awareness among healthcare professionals about the importance of early and accurate diagnosis of EPI is driving the demand for these laboratory tests.

Laboratory test is further segmented into indirect pancreatic function tests and other tests. The indirect pancreatic function tests is anticipated to grow at the fastest CAGR over the forecast period. They play a crucial role in the diagnosis of EPI by assessing the pancreas's ability to secrete enzymes. These tests measure the levels of specific substances, such as fecal elastase-1, in the stool or blood, which can indicate pancreatic dysfunction. The market for indirect pancreatic function tests is driven by the increasing prevalence of conditions like chronic pancreatitis and cystic fibrosis, which are major risk factors for EPI. In addition, advancements in testing technologies, such as the development of more sensitive and specific assays, contribute to the segment growth. The demand for accurate and efficient diagnostic tools for EPI is expected to further drive the market for indirect pancreatic function tests.

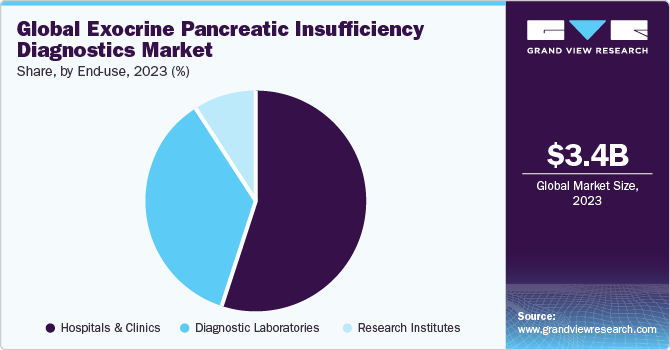

End-use Insights

Hospitals & clinics led the end-use segment with a share of 54.97% in 2023 and is expected to grow at the highest CAGR during the forecast period. Advancements in diagnostic technologies have significantly improved the accuracy and efficiency of EPI detection. From traditional methods like fecal elastase tests to more sophisticated imaging techniques such as MRI and CT scans, hospitals and clinics now have a plethora of options for diagnosing EPI, leading to increased patient referrals and revenue generation.

The rising prevalence of EPI due to factors like aging populations, lifestyle changes, and increasing awareness among healthcare professionals has led to a surge in demand for diagnostic services in hospitals and clinics. This trend is expected to continue as the incidence of EPI continues to rise globally. Moreover, the growing emphasis on early detection and intervention for EPI to prevent complications like malnutrition and digestive disorders has further fueled the demand for diagnostic tests in hospitals and clinics. Healthcare providers are increasingly recognizing the importance of timely diagnosis in improving patient outcomes, thereby driving segment growth.

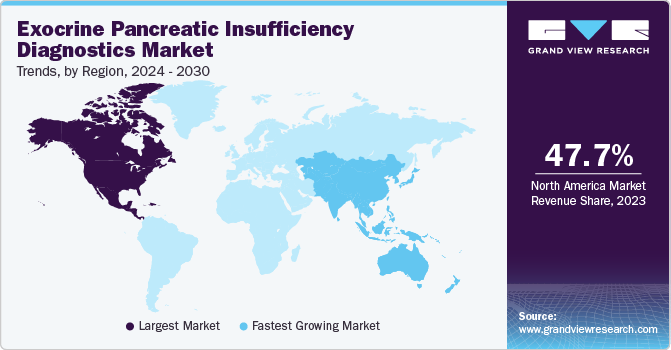

Regional Insights

The exocrine pancreatic insufficiency diagnostics market in North America is accounted for the largest revenue market share of 47.73% in 2023. The region's well-established healthcare infrastructure, including advanced hospitals, clinics, and diagnostic centers, facilitates widespread access to diagnostic services for EPI. This accessibility encourages more individuals to seek testing, thereby driving market demand. In addition, increasing awareness among both healthcare professionals and the general population about EPI and its symptoms has led to higher rates of diagnosis. Education campaigns, medical conferences, and patient advocacy groups have all contributed to this heightened awareness, resulting in more referrals for diagnostic testing in North America.

U.S. Exocrine Pancreatic Insufficiency Diagnostics Market Trends

The exocrine pancreatic insufficiency diagnostics market in the U.S. is driven by an increasing prevalence of target diseases such as chronic pancreatitis, diabetes, pancreatic cancer, IBD, and HIV/AIDS. As the incidence of these conditions continues to rise, there is a corresponding increase in the demand for diagnostic tests to accurately identify and manage EPI, thereby driving market growth in the U.S.

Europe Exocrine Pancreatic Insufficiency Diagnostics Market Trends

The exocrine pancreatic insufficiency diagnostics market is expanding due to factors such as advanced healthcare infrastructure, rising awareness, and aging demographics.

The UK exocrine pancreatic insufficiency diagnostics market is expected to grow over the forecast period due to the presence of well-established healthcare infrastructure, high disposable income, and rising awareness of early disease diagnosis.

The exocrine pancreatic insufficiency diagnostics market in France is expected to grow over the forecast period, attributed to technological advancements and increased awareness about the importance of early disease diagnosis.

Germany exocrine pancreatic insufficiency diagnostics market is expected to grow lucratively over the forecast period due to the rising number of initiatives being taken by the government to help spread awareness regarding diagnosis and innovative diagnostic solutions.

Asia Pacific Exocrine Pancreatic Insufficiency Diagnostics Market Trends

The exocrine pancreatic insufficiency diagnostics market in Asia Pacific is anticipated to witness fastest growth over the forecast period. Pancreatic exocrine insufficiency (PEI) affects nearly one-fourth of Indian patients with diabetes, highlighting the significant burden of pancreatic disorders in the region. Meanwhile, approximately 13.5% of the Japanese population is afflicted with either type 2 diabetes or impaired glucose tolerance. These statistics underscore the growing prevalence of pancreatic-related conditions in Asia Pacific. Consequently, the market in the region is poised for expansion, driven by the escalating demand for advanced diagnostic solutions to address these conditions effectively.

China exocrine pancreatic insufficiency diagnostics market is expected to grow over the forecast period due to the growing focus on improving healthcare R&D aided by the development of novel technologies.

The exocrine pancreatic insufficiency diagnostics market in Japan is witnessing several trends. Rising prevalence of pancreatic disorders, including among individuals with diabetes or impaired glucose tolerance, is driving increased demand for diagnostic services.

Latin America Exocrine Pancreatic Insufficiency Diagnostics Market Trends

The exocrine pancreatic insufficiency diagnostics market in Latin America was identified as a lucrative region in this industry. Technological advancements and increasing awareness regarding testing devices in the region are anticipated to fuel market growth.

Brazil exocrine pancreatic insufficiency diagnostics market is expected to grow over the forecast period due to the growing emphasis on early detection and intervention to improve patient outcomes, which is shaping the landscape of EPI diagnostics.

MEA Exocrine Pancreatic Insufficiency Diagnostics Market Trends

The exocrine pancreatic insufficiency diagnostics market in MEA was identified as a lucrative region in this industry. The market in this region is driven by the high prevalence of diabetes, aided by improvements in healthcare infrastructure.

Saudi Arabia exocrine pancreatic insufficiency diagnostics market is expected to grow over the forecast period owing to the need for better diagnostics and improvements in treatment options due to the rising prevalence of target diseases.

Key Exocrine Pancreatic Insufficiency Diagnostics Company Insights

Major market players are leveraging their established customer bases in the region to prioritize maintaining top-notch quality standards and securing significant market access. This approach proves beneficial for brands with established trust in the market. These entities are making substantial investments in advanced technology and infrastructure, enabling efficient processing and analysis of large sample volumes. Furthermore, firms are engaging in strategic collaborations with other companies and distributors to bolster their market presence.

Alpha Laboratories and Verisana Laboratories are some of the emerging companies in the exocrine pancreatic insufficiency diagnostics market. These companies focus on achieving funding support from government bodies and healthcare organizations, aided by novel product launches, to capitalize on untapped avenues.

Key Exocrine Pancreatic Insufficiency Diagnostics Companies:

The following are the leading companies in the exocrine pancreatic insufficiency diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- ChiRhoClin

- Certest Biotec

- ScheBo Biotech AG

- Immundiagnostik AG

- Laboratory Corporation of America Holdings

- Boster Biological Technology

- ALPCO Diagnostics

- Quest Diagnostics Incorporated

- DiaSorin S.p.A.

- ARUP Laboratories

- Alpha Laboratories

- Verisana Laboratories

Recent Developments

-

In September 2022, ChiRhoClin launched a redesigned website to support various medical professions. This new website helps the company facilitate collaboration across various healthcare communities, including gastrointestinal, radiological, pancreatic, and pediatric.

-

In June 2021, CERTEST BIOTEC announced to participate and showcase its product with the latest developments at the 71st Annual Scientific Meeting and Exhibition of Clinical Laboratories of the AACC held from August 4 to 8 in California.

-

In November 2019, CERTEST BIOTEC launched a new series of four catalogs that showcase the complete portfolio of Certest IVD products for humans. This catalog includes VIASURE Real-Time PCR Detection Kits, Certest Turbilatex (Pancreatic Elastase Turbilatex), Certest Rapid Test, and Certest bioSCIENCE.

Exocrine Pancreatic Insufficiency Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.83 billion

Revenue forecast in 2030

USD 5.44 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diagnostic method, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Thailand; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

ChiRhoClin; Certest Biotec; ScheBo Biotech AG; Immundiagnostik AG; Laboratory Corporation of America Holdings; Boster Biological Technology; ALPCO Diagnostics; Quest Diagnostics Incorporated; DiaSorin S.p.A.; ARUP Laboratories; Alpha Laboratories; Verisana Laboratories.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exocrine Pancreatic Insufficiency Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global exocrine pancreatic insufficiency diagnostics market report based on diagnostic method, end-use, and region:

-

Diagnostic Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Tests

-

Indirect Pancreatic Function Tests

-

Stool Tests

-

Blood Tests

-

-

Other Tests

-

-

Imaging Tests

-

CT scans

-

MRI

-

Endoscopic Ultrasound for pancreatic function tests

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global exocrine pancreatic insufficiency diagnostics market size was estimated at USD 3.36 billion in 2023 and is expected to reach USD 3.59 billion in 2024.

b. The global exocrine pancreatic insufficiency diagnostics market is expected to grow at a compound annual growth rate of 7.16% from 2024 to 2030 to reach USD 5.44 billion by 2030.

b. The laboratory tests segment dominated the global market in 2023 and captured the maximum share of the overall revenue. Factors driving this segment include the increasing prevalence of conditions like chronic pancreatitis, which often lead to EPI, and the development of automated and more accurate testing methods. Additionally, the growing awareness among healthcare professionals about the importance of early and accurate diagnosis of EPI is driving the demand for these laboratory tests.

b. Some key players operating in the exocrine pancreatic insufficiency diagnostics market include ChiRhoClin, Certest Biotec, ScheBo Biotech AG, Immundiagnostik AG, Laboratory Corporation of America Holdings, Boster Biological Technology, ALPCO Diagnostics, Quest Diagnostics Incorporated, DiaSorin S.p.A., ARUP Laboratories, Alpha Laboratories and Verisana Laboratories.

b. The growth of the market is attributed to the increasing prevalence of EPI, rising awareness about the condition, and advancements in diagnostic techniques. Additionally, the growing elderly population, which is more susceptible to EPI, and the rising incidence of chronic pancreatitis and cystic fibrosis contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.