Exercise And Weight Loss Apps Market Size, Share & Trends Analysis Report By Platform (iOS, Android), By Device (Smartphones, Tablets, Wearable Devices), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-129-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

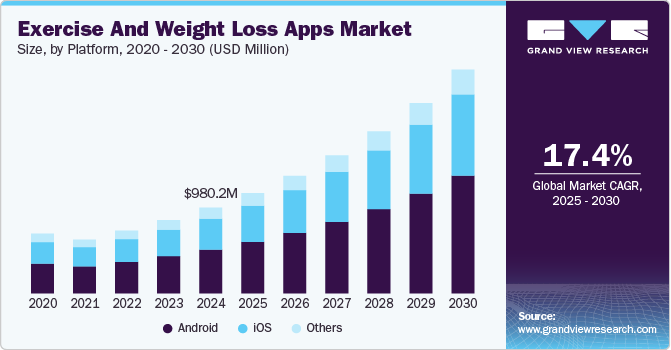

The global exercise and weight loss apps market size was estimated at USD 980.19 million in 2024 and is expected to grow at a CAGR of 17.4% from 2025 to 2030. The exercise and weight loss apps industry is experiencing significant growth, driven by the increasing prevalence of obesity and related health issues, and growing awareness of the importance of health. In 2022, the World Health Organization (WHO) reported that 37 million children under age 5 were overweight. In addition, over 390 million children and adolescents aged 5-19 faced weight issues, including 160 million with obesity.

The rise of sedentary lifestyles and the proliferation of unhealthy habits have contributed to a surge in weight-related issues, driving the growth of the exercise and weight loss apps industry. The U.S. is one of the leading countries in terms of the percentage of the adult population that is obese and overweight. According to SingleCare Administrators, about 40% of adults in the U.S. are obese, which is approximately 4 out of every 10 adults in 2024. Data from the CDC indicates that in 2022, 22 states had a prevalence of adult obesity at or above 35%, compared to 19 states in 2021. Moreover, according to the 2022 WHO report, approximately 16% of adults aged 18 and above worldwide were classified as obese. According to the World Obesity Atlas 2022, it is projected that by 2030, 1 billion individuals worldwide are expected to have obesity, with 1 in 5 women and 1 in 7 men being affected.

The market has witnessed significant technological advancements, leading to the development of more effective and engaging solutions. The integration of artificial intelligence (AI) and machine learning (ML) has enabled personalized coaching, tailored meal planning, and real-time tracking, making it easier for users to achieve their weight loss goals. The increasing adoption of app-based interventions further drives the growth of the weight loss apps market. For instance, in March 2024, MyNetDiary, a health and wellness app, introduced an advanced autopilot feature, an advancement in personal weight management, which utilizes an intelligent coaching algorithm that learns and adapts to an individual's unique metabolic needs and adjusts over time. These interventions leverage mobile technology to deliver targeted, scalable, and cost-effective weight loss programs, reaching a broader audience and improving health outcomes. As a result, the exercise and eight loss apps market is expected to grow over the forecast period.

The Internet of Things (IoT) has been one of healthcare's most adopted digital platforms. With efficient data backup through integrated analytics, strong mobile connectivity, and advanced wearable devices, IoT has evolved and reached a point where it is drastically transforming the healthcare sector by facilitating various activities, such as efficient user activity tracking. However, dieticians and nutritionist clinics strive to personalize the digital experience according to individual patient preferences, contributing to the increasing adoption of IoT worldwide. For example, GE Healthcare collaborated with Lifesum AB, an app used for weight management through diet planning, to provide Lifesum employees with the tools needed to stay healthier.

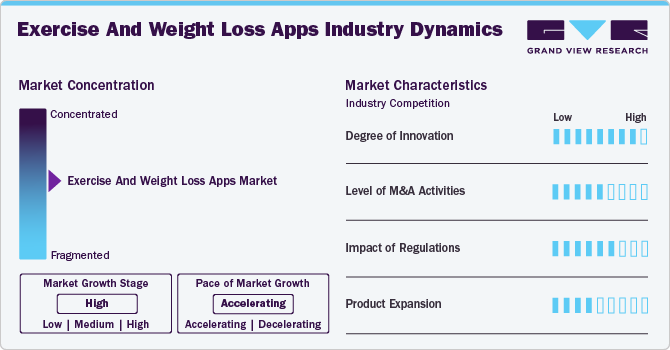

Market Concentration & Characteristics

The exercise and weight loss apps market has a high degree of innovation, due to increasing technological advancements, integrating AI/ML with exercise and weight loss apps, and more. For instance, in March 2024, Breakthrough M2, a provider of homeopathic supplement diets, is set to launch a new mobile app. This innovative app offers users a convenient and personalized way to manage their weight loss journeys, utilizing the company's expertise in homeopathic supplements and nutrition planning. New features, such as AI-powered coaching and personalized nutrition planning, are being introduced regularly.

Regulations play a significant role in shaping the exercise and weight loss apps industry by ensuring product safety, data privacy protection, and adherence to industry standards. Health Canada regulates fitness apps, including exercise and weight loss apps, providing overarching regulations and guidelines that affect health and fitness apps. These guidelines ensure that such apps do not pose risks to consumers and adhere to safety standards applicable to health products and services.

The market has seen a moderate level of mergers and acquisitions in recent years. Small to medium-sized startups have been acquiring or merging with larger players to expand their user base, improve their offerings, and increase their market share. This trend is expected to continue as the market grows and competition increases. For instance, in April 2025, Strava, the California-based fitness app tracking physical exercise, acquired the British running app Runna. This London-based personalized running app designs user plans based on their goals and fitness. It's gained traction in the UK and partnered with several nationwide running events.

The market for exercise and weight loss apps has seen a significant level of product expansion in recent years. Many apps have expanded their offerings to include new features, such as personalized coaching, social sharing, and integrations with wearable devices and smartwatches. For instance, in October 2023, Found, a medically-assisted weight loss program, unveiled the Found Assistant, a revolutionary AI-powered guide within the Found app. This innovative feature enables users to ask questions and receive instant, personalized answers on topics such as nutrition, exercise, health habits, and more.

The market is experiencing significant global expansion, driven by growing demand for digital health solutions. Many apps have expanded their reach to new regions, including Asia, Latin America, and Africa, where there is a growing appetite for fitness and wellness technology. For instance, in May 2024, WHOOP, a provider of wearable fitness technology, officially entered the Indian market, introducing new membership options for fitness enthusiasts across the country. This expansion is expected to continue, driven by the increasing adoption of mobile devices and the growing awareness of the importance of health and wellness worldwide.

Platform Insights

The Android segment held the largest market share of 50.90% in 2024 and is expected to witness the fastest CAGR growth over the forecast period. The global adoption of Android smartphones is expected to fuel the segment's growth. According to a Backlinko report, Android smartphones accounted for 56% of global quarterly smartphone sales in Q4 2023. In addition, continuous improvements to the Android operating system, such as enhanced health and fitness tracking features, API integrations, and advancements in machine learning, have significantly increased the functionality and accuracy of exercise and weight loss apps, further driving user engagement and adoption.

The iOS segment is expected to experience significant growth over the forecast period. The segment has witnessed remarkable growth, with several key players adopting various strategies to maintain their market position. Moreover, the high adoption of iOS devices is one of the major factors propelling growth and is expected to continue to boost the segment over the forecast period. For instance, according to the Demandsage report, as of 2023, there are 153 million iPhone users in the U.S. In addition, according to the Backlinko report, in 2023, Apple delivered 231.8 million iPhones across the globe.

Device Insights

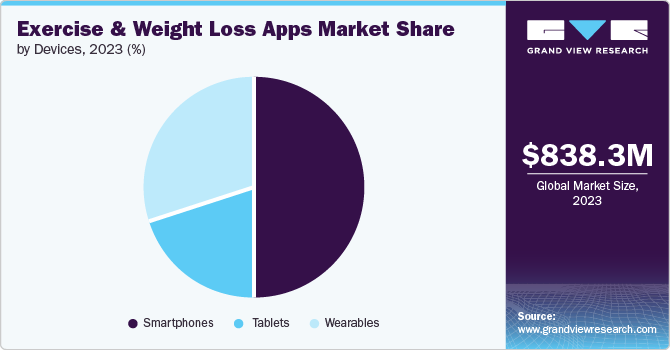

The smartphones segment dominated with the largest revenue share of 48.57% in 2024. The widespread adoption of smartphones due to exercise and weight loss apps has emerged as a cost-efficient alternative to costly gym memberships and fitness centers, serving as a primary factor for market expansion. For instance, according to the 2024 Kepios report, nearly all the world’s internet users, amounting to 96.3%, utilize a mobile phone to access the internet at least occasionally. Moreover, mobile phones currently represent about 57.8% of online time and contribute to 60% of the world’s web traffic. Thus, the increasing usage of the internet on smartphones is expected to propel segment growth over the forecast period. Moreover, renowned for their extensive storage, portability, and user-friendly interfaces, smartphones have emerged as the preferred choice for monitoring and activity-tracking services. Increasing affordability and declining hardware expenses are driving the demand for smartphones. Particularly, the rapid growth of mobile phones in low-income regions, driving the growth of the exercise and weight loss apps market, surpassing their adoption rates in high-income counterparts.

The wearable devices segment is anticipated to witness the fastest CAGR over the forecast period. The market has witnessed a remarkable surge in the adoption of wearable devices, and the statistics from a 2022 survey conducted in the U.S. provide crucial insights into this trend. With 64% of respondents utilizing smartwatches and fitness trackers primarily to monitor their daily step count, these wearables have emerged as powerful tools for promoting physical activity. In addition, 36% of individuals leveraged these gadgets as motivational aids, benefiting from reminders and achievement badges to enhance their exercise routines. 27% of survey participants relied on wearable devices for meticulous tracking of their weight loss progress. These statistics underscore the growing popularity and multifunctional roles of smartwatches and fitness trackers in empowering individuals to pursue and maintain their health and fitness goals, making wearables the fastest-growing segment.

Regional Insights

North America exercise and weight loss apps market accounted for the largest revenue share of 39.16% in 2024, driven by increasing consumer awareness of the importance of fitness and wellness. Key factors contributing to this growth include the rise of mobile technology, the desire for convenient & affordable fitness solutions, and the growing popularity of social media & online communities. Exercise and weight loss apps are anticipated to experience substantial growth, driven by video-based workouts and interconnected devices featuring diverse training platforms. For instance, according to a OnePoll survey, 74% of Americans turned to fitness apps during quarantine, with 60% finding home workouts enjoyable to the extent that they intend to cancel their costly gym memberships. In addition, these apps offer the added benefit of having a personal trainer accessible at home. The growth is also attributed to the increasing prevalence of conditions such as diabetes, obesity, and cardiovascular diseases in the region.

U.S. Exercise And Weight Loss Apps Market Trends

The exercise and weight loss apps industry in the U.S. held a significant share of the North America market in 2024, driven by increasing consumer adoption and the strategic developments of key players. For instance, in December 2024, WeightWatchers introduced its next-generation program, featuring innovative tools to make weight management more tailored and sustainable. This program offers insurance-covered access to registered dietitians for personalized nutritional advice, an AI-driven food scanner that utilizes photo recognition for instant Points tracking, and a recipe importer that applies AI to calculate Points for meals from any website. In addition, there is an expanded selection of over 150 new ZeroPoint foods that don’t require tracking, weighing, or measuring, along with in-depth macronutrient insights for a more holistic approach to nutrition.

Europe Exercise And Weight Loss Apps Market Trends

The Europe exercise and weight loss apps industry is witnessing growth, driven by the innovation of new features and the growing demand for personalized fitness solutions. Key players are introducing AI-powered coaching, social sharing features, and gamification elements to enhance user engagement and motivation. For instance, in March 2024, FIIT is revolutionizing the fitness landscape with the debut of its cutting-edge, all-encompassing hybrid fitness solution, the FIIT Platform. This innovative platform is designed to empower individuals and partners, offering a comprehensive suite of tools and technologies that facilitate the development of a lifelong fitness habit, regardless of location or ability. In addition, the integration of wearable devices and telemedicine platforms is further expanding the market's reach and potential.

The exercise and weight loss apps market in the UK is expected to grow significantly over the forecast period, driven by advancements in technology and increasing demand for personalized fitness solutions. The introduction of AI-powered coaching, augmented reality workouts, and wearables integration has enhanced the user experience, boosting engagement and motivation. For instance, in December 2023, Hearst UK unveiled the introduction of new mobile apps from Women's Health UK and Men's Health UK, as part of an upgraded membership program for both brands. This enhanced offering aims to provide subscribers with a more comprehensive & personalized fitness and wellness experience.

The Germany exercise and weight loss apps market is expected to grow significantly over the forecast period, driven by the launch of popular apps in the region. Germany is one of the largest healthcare markets in Europe, with a significant expenditure on health. Furthermore, startups with innovative business models are being established, boosting the market. For instance, in April 2022, WHOOP, a wearable technology brand, is set to introduce its innovative membership program to the German market. This growth is expected to continue, with more apps entering the market and increasing adoption among German consumers.

Asia Pacific Exercise And Weight Loss Apps Market Trends

The exercise and weight loss apps industry in Asia Pacific is expected to witness the fastest CAGR over the forecast period, owing to a rising obesity rate, increased healthcare spending, and a growing athlete population. Moreover, the increasing adoption of these apps during the COVID-19 pandemic in developing and underdeveloped countries is fueling market growth.

The exercise and weight loss apps market in China is expected to grow at a significant CAGR during the forecast period. The growing awareness of health and fitness issues and the increasing internet penetration in China are spurring the country’s market growth. For instance, according to the GSM Association, 1 billion 5G connections are expected by the end of 2024, rising to 1.6 billion by 2030. Moreover, according to data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion Internet users, an increase of 35.49 million since December 2021. Internet penetration has increased by 2.6%, reaching 75.6%. Moreover, the increasing use of smartphones is expected to drive the adoption of mobile platforms for various healthcare services.

Latin America Exercise And Weight Loss Apps Market Trends

The exercise and weight loss apps industry in Latin America is experiencing significant growth, driven by increasing awareness of health and wellness. Advancements in technology, such as augmented reality (AR) and voice assistants, are enhancing the user experience. For instance, in April 2024, Tech Roundup introduced Accessercise, a fitness app in Brazil, catering to the diverse needs of users.

MEA Exercise And Weight Loss Apps Market Trends

The exercise and weight loss apps industry in MEA is experiencing significant growth over the forecast period, due to the rising concern of obesity in the region. With lifestyle changes and dietary habits shifting, the demand for weight management solutions has increased significantly. A recent study published by the National Institutes of Health in March 2023 reported a significant finding from a comprehensive survey conducted across all regions of Saudi Arabia. The survey revealed that obesity prevalence in the country stands at 24.7%.

The exercise and weight loss apps market in Saudi Arabia is anticipated to expand in the forecast period, driven by growing healthcare concerns and a rising awareness of the importance of physical fitness. The country's high obesity rate has led to a surge in demand for fitness solutions. Apps offering personalized workout plans, nutrition guidance, and tracking features are gaining popularity among Saudis, as they seek to improve their overall health and wellbeing.

Key Exercise And Weight Loss Apps Company Insights

Key participants in the global market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions:

Key Exercise And Weight Loss Apps Companies:

The following are the leading companies in the exercise and weight loss apps Market. These companies collectively hold the largest market share and dictate industry trends.

- MyFitnessPal Inc.

- FitnessKeeper

- My Diet Coach

- Fitbit, Inc.

- Noom

- PlateJoy

- Sworkit

- WW International Inc. (WeightWatchers)

- Yazio

- Lose it

- DailyBurn

Recent Developments

-

In February 2024, Samsung Electronics initiated a strategic partnership with FlexIt, a company focused on enhancing the accessibility and convenience of exercise. This collaboration introduced FlexIt's trainer-oriented fitness content to users of Samsung Smart TVs via the newly established lifestyle hub, Samsung Daily+, hosted on the Samsung Tizen OS

-

In January 2024, Peloton, a premier provider of connected fitness solutions, entered into an exclusive partnership with TikTok, a dominant platform for short-form mobile videos, to integrate Peloton's superior workout content with TikTok's audience. This collaboration aimed to innovate fitness content by blending culture and creativity, targeting new content creators & enthusiasts.

-

In August 2023, Amo, an information technology company, launched HARNA, a fitness app that revolutionizes the way women approach exercise. By synchronizing workouts with the menstrual cycle, HARNA enables women to incorporate physical activity into their daily routines with ease. This innovative app utilizes a cycle-based approach to optimize workout effectiveness, taking into account the distinct phases of the menstrual cycle to maximize results.

Exercise And Weight Loss Apps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.15 billion |

|

Revenue forecast in 2030 |

USD 2.56 billion |

|

Growth rate |

CAGR of 17.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Platform, device, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

MyFitnessPal Inc.; FitnessKeeper; My Diet Coach; Fitbit, Inc.; Noom; PlateJoy; Google; Sworkit; WW International Inc. (WeightWatchers); Yazio; Lose it; DailyBurn |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Exercise And Weight Loss Apps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the exercise and weight loss apps market report based on platform, device, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

iOS

-

Android

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Wearables

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global exercise and weight loss apps market size was estimated at USD 980.19 million in 2024 and is expected to reach USD 1.15 billion in 2025.

b. The global exercise and weight loss apps market is expected to grow at a compound annual growth rate of 17.40% from 2025 to 2030 to reach USD 2.56 billion by 2030.

b. The Android segment in platform held the largest share of 50.90% in 2024 and is expected to experience the fastest CAGR, due to its widespread accessibility across diverse price ranges, an open ecosystem fostering app diversity, a substantial global market share, compatibility with a variety of devices including wearables, continuous app development, and a strong presence in emerging markets

b. Some of the key players in the market are MyFitnessPal Inc., FitnessKeeper, My Diet Coach, Fitbit, Inc., Noom, PlateJoy, Google, Sworkit, Weight Watchers, Yazio, Lose it, and Dailyburn.

b. The market has been experiencing growth due to a rising prevalence of obesity and associated health conditions, alongside growing health awareness. Additionally, incorporating advanced technologies such as artificial intelligence and machine learning is anticipated to contribute to market expansion. The weight loss apps market is rapidly expanding, offering applications on various operating systems, including iOS, Android, and others. These apps cater to various aspects such as lifestyle monitoring, diet tracking, weight management, exercise monitoring, and more.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."