Exascale Computing Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (On-premises, Cloud-based), By Customer Type ( Government & Defense, Healthcare & Biosciences), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-424-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Exascale Computing Market Size & Trends

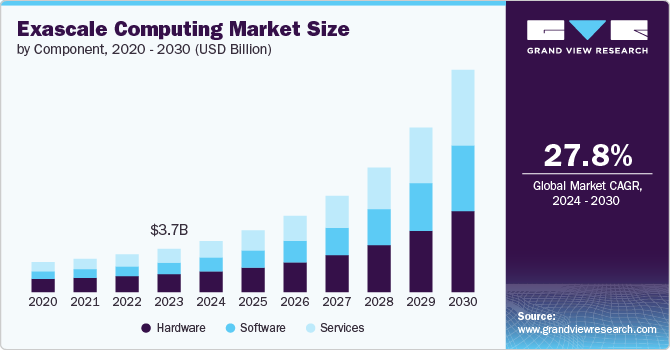

The global exascale computing market size was valued at USD 3.69 billion in 2023 and is projected to grow at a CAGR of 27.8% from 2024 to 2030. The market is being significantly influenced by rapid technological advancements in hardware and software. Innovations in semiconductor technology, such as the development of more efficient processors and memory architectures, are enabling the construction of exascale systems that are faster and more energy efficient. Furthermore, advancements in parallel processing and distributed computing are allowing for more effective utilization of resources, enhancing performance capabilities. The integration of artificial intelligence and machine learning into exascale systems is also becoming a trend, facilitating smarter data processing and analysis. Overall, these technological developments are crucial for meeting the growing demands for high-performance computing.

As the demand for exascale computing grows, there is an increasing focus on sustainability and energy efficiency. The high energy consumption associated with exascale systems has prompted stakeholders to seek solutions that minimize environmental impact. Innovations in cooling technologies and energy-efficient hardware are being prioritized to reduce the carbon footprint of these systems. Additionally, many organizations are adopting green computing practices, integrating renewable energy sources into their operations. This trend reflects a broader commitment within the industry to balance performance with environmental responsibility.

The rise of data-driven industries is a major driver of exascale computing adoption. Fields like genomics, climate science, and astrophysics require immense computational power to process and analyze large datasets. Exascale systems are enabling scientists to conduct simulations and analyses that were previously impossible due to computational limitations. These capabilities are leading to breakthroughs in areas like drug discovery, climate prediction, and understanding the universe. As data continues to grow exponentially, the demand for exascale computing to handle these workloads will only increase.

Component Insights

The hardware segment led the market and accounted for 41.4% of the global revenue in 2023. The demand for High-Bandwidth Memory (HBM) is increasing as it provides the necessary bandwidth and low latency needed for exascale computing. HBM is designed to handle massive data flows, which is essential for large-scale simulations and AI applications. The integration of HBM with processors is becoming more common, offering a significant performance boost over traditional memory systems. Additionally, innovations in memory stacking and packaging techniques are enhancing the capacity and efficiency of these memory solutions. This trend is vital as it directly impacts the ability of exascale systems to manage vast amounts of data.

With the rapid advancement of exascale technology, organizations are seeking consulting services to help them navigate the complexities of adopting and implementing these systems. Consulting firms provide strategic guidance on the design, development, and deployment of exascale solutions tailored to specific industry needs. Advisory services also focus on optimizing existing IT infrastructure to integrate seamlessly with exascale capabilities. This trend reflects the growing recognition that a deep understanding of both the technology and the business implications is essential for successful exascale adoption. As a result, demand for expert advisory services is expected to rise as more organizations transition to exascale computing.

Deployment Insights

The on-premises segment has the highest revenue share in 2023. The growing complexity of data-driven operations necessitates advanced computing capabilities that on-premises systems can provide. Organizations are facing challenges in processing vast amounts of data for analytics, simulations, and modeling, which require significant computational power. On-premises Exascale systems are designed to handle such intricate tasks, offering the scalability and performance needed for large-scale projects. This trend is particularly evident in sectors like scientific research, where the need for high-fidelity simulations is paramount. As operational demands continue to evolve, the reliance on robust on-premises solutions is expected to increase.

The adoption of cloud-based solutions is rapidly transforming the exascale computing market, enabling organizations to leverage scalable resources without the need for extensive on-premises infrastructure. Cloud computing allows for efficient management of parallelization and distribution of data across multiple computing nodes, enhancing processing speed and efficiency. This shift is particularly beneficial for organizations that require high computational power but lack the resources to maintain large-scale on-premises systems. As a result, businesses are increasingly turning to cloud solutions to meet their HPC needs, contributing to the growth of the cloud segment. The trend is expected to continue, with cloud computing becoming a primary mode of operation for many organizations.

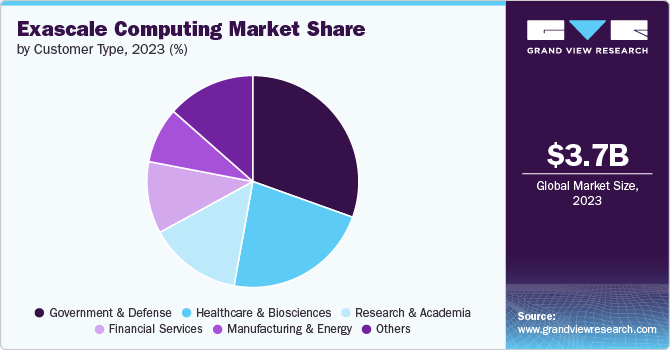

Customer Type Insights

The government & defense segment held the highest market share in 2023. Exascale computing represents a major leap in High-Performance Computing (HPC) capabilities, allowing for calculations at unprecedented speeds. This advancement is crucial for defense applications that require real-time data processing and analysis, such as simulations for military operations and strategic planning. The integration of Artificial Intelligence (AI) with exascale computing is becoming increasingly prevalent, enhancing the ability to analyze vast datasets and improve decision-making processes in defense and government operations. AI-powered applications are expected to drive significant advancements in predictive analytics and operational efficiency. As exascale systems continue to evolve, we can expect to see even more sophisticated and innovative applications emerge in the government and defense sectors.

The integration of exascale computing in medical imaging is revolutionizing diagnostic processes by enhancing image resolution and analysis speed. Advanced algorithms powered by exascale systems can process large volumes of imaging data, leading to more accurate diagnoses and better patient outcomes. For instance, exascale computing can improve the quality of MRI and CT scans, allowing for earlier detection of diseases such as cancer. Additionally, the ability to analyze complex imaging data in real-time supports more informed clinical decision-making. As imaging technologies continue to evolve, exascale computing will play a pivotal role in advancing medical imaging capabilities.

Regional Insights

North America exascale computing market dominated the global industry and accounted for a 34.1% share in 2023. With the increasing complexity of exascale systems, cybersecurity is a major concern in North America. Efforts are being made to develop robust security measures to protect these systems from potential threats. Advanced encryption, threat detection, and access control technologies are being implemented. Ensuring the security and integrity of exascale computing systems is critical for maintaining trust and reliability. North American organizations are prioritizing cybersecurity to safeguard their high-performance computing infrastructure.

U.S. Exascale Computing Market Trends

The exascale computing market in the U.S. is growing as it is a strategic priority for U.S. national security. The technology is being used to enhance capabilities in areas such as defense simulations, cryptographic analysis, and intelligence gathering. The ability to perform complex calculations and process large datasets is critical for national security applications. The U.S. government’s focus on exascale computing reflects its importance in maintaining technological superiority and addressing security challenges. This trend highlights the role of exascale computing in defense and security sectors.

Europe Exascale Computing Market Trends

The exascale computing market in Europe is expected to grow as the region is prioritizing the development of energy-efficient exascale systems to minimize environmental impact. Innovations in low-power components and advanced cooling technologies are key areas of focus. The region aims to lead in sustainable high-performance computing practices.

Asia Pacific Exascale Computing Market Trends

The exascale computing market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The adoption of exascale computing in various industrial sectors is growing in Asia Pacific. Industries such as finance, manufacturing, and healthcare are exploring the potential of exascale systems to enhance their operations. The ability to process large volumes of data and perform complex simulations is driving innovation and efficiency in these sectors. Companies are leveraging exascale computing to gain a competitive edge and address industry-specific challenges. This trend reflects the region’s commitment to integrating advanced computing technologies into industrial applications.

Key Exascale Computing Company Insights

The market is highly competitive, with a concentrated landscape dominated by key players such as Hewlett Packard Enterprise Company, International Business Machines Corporation, Intel Corporation, and NVIDIA Corporation. These industry leaders are aggressively expanding their customer base through strategic initiatives including mergers & acquisition, collaborations, partnerships, and product launches to maintain market dominance. For instance, in May 2024, Intel Corporation partnered with Hewlett Packard Enterprise Company on the Aurora exascale supercomputer, providing 21,248 Intel Xeon CPU Max Series processors and 63,744 Intel Data Center GPU Max units. Aurora, recognized as the largest AI-capable system globally, achieved 10.6 exaflops on the HPL Mixed Precision Benchmark, marking a significant milestone in exascale computing. This system is designed to support advanced scientific research, including brain mapping and drug discovery, leveraging generative AI models. The collaboration between HPE, Intel, the U.S. Department of Energy, and Argonne National Laboratory exemplifies the importance of public-private partnerships in driving scientific progress and innovation.

Key Exascale Computing Companies:

The following are the leading companies in the exascale computing market. These companies collectively hold the largest market share and dictate industry trends.

- Hewlett Packard Enterprise Company

- International Business Machines Corporation

- Intel Corporation

- NVIDIA Corporation

- Cray Inc.

- Fujitsu Limited

- Advanced Micro Devices, Inc.

- Lenovo Group Limited

- Atos SE

- NEC Corporation

Recent Developments

-

In November 2023, DDN, a global leader in AI and multi-cloud data management solutions, partnered with Sandia National Laboratories to enhance the support and optimization of its DDN Infinia ecosystem for high-performance computing (HPC) workloads. This collaboration aims to advance data provisioning and quality of service (quality of service) to meet Sandia's complex data and parallel computing needs. This ensures that the DDN Infinia platform is well-equipped to handle current and future demands within the Department of Energy and government lab ecosystems. As part of Sandia's Vanguard program, the partnership focuses on integrating advanced data management capabilities to address the challenges posed by the rapid growth of unstructured data and the need for adaptable computing solutions across diverse environments.

-

In October 2023, EuroHPC JU and the German-French supercomputer consortium ParTec-Eviden signed an agreement to build JUPITER, Europe's first exascale supercomputer in Germany. This state-of-the-art system is designed to surpass one exaflop/s, facilitating advanced simulations and AI applications across a wide range of scientific and industrial sectors. JUPITER is expected to become operational in 2024, marking a significant boost to Europe's high-performance computing capabilities. The project is backed by substantial funding from the European Union and German federal ministries.

Exascale Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.35 billion |

|

Revenue forecast in 2030 |

USD 18.92 billion |

|

Growth rate |

CAGR of 27.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, customer type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia (KSA), South Africa |

|

Key companies profiled |

Hewlett Packard Enterprise Company, International Business Machines Corporation, Intel Corporation, NVIDIA Corporation, Cray Inc., Fujitsu Limited, Advanced Micro Devices, Inc., Lenovo Group Limited, Atos SE, NEC Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Exascale Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global exascale computing market report based on component, deployment, customer type, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Government & Defense

-

Healthcare & Biosciences

-

Financial Services

-

Research & Academia

-

Manufacturing & Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global exascale computing market size was estimated at USD 3.69 billion in 2023 and is expected to reach USD 4.35 billion in 2024.

b. The global exascale computing market is expected to grow at a compound annual growth rate of 27.8% from 2024 to 2030, reaching USD 18.92 billion by 2030.

b. North America dominated the exascale computing market with a share of 34.1% in 2023. With the increasing complexity of exascale systems, cybersecurity is a major concern in North America. Efforts are being made to develop robust security measures to protect these systems from potential threats. Advanced encryption, threat detection, and access control technologies are being implemented.

b. Some key players operating in the exascale computing market include Hewlett Packard Enterprise Company, International Business Machines Corporation, Intel Corporation, NVIDIA Corporation, Cray Inc., Fujitsu Limited, Advanced Micro Devices, Inc., Lenovo Group Limited, Atos SE, and NEC Corporation.

b. Key factors driving the market growth include advancements in AI and machine learning, increasing demand for computational power, and investments in data centers and infrastructure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."