eVTOL Aircraft Market Size, Share & Trends Analysis Report By Propulsion (Fully Electric, Hybrid), By Application (Cargo Transport, Passenger Transport), By Operation Mode (Piloted, Autonomous), By Range, By System, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

eVTOL Aircraft Market Size & Trends

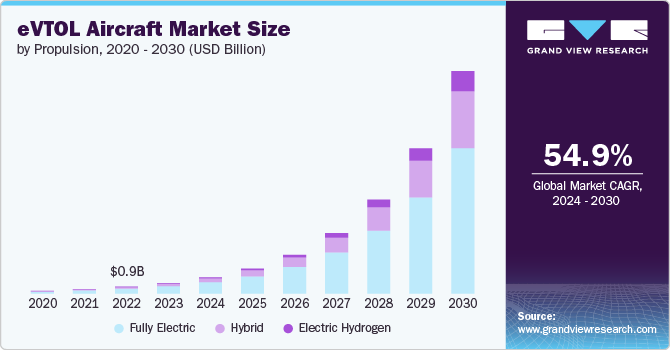

The global eVTOL aircraft market size was estimated at USD 1.35 billion in 2023 and is expected to grow at a CAGR of 54.9% from 2024 to 2030. The development and improvement in battery technologies are significant drivers for the eVTOL (electric Vertical Takeoff and Landing) aircraft market growth. As batteries become more powerful, lighter, and capable of faster charging times, eVTOLs can fly longer distances with shorter downtimes, making them more practical and appealing for urban air mobility and other applications. This technological leap enhances operational efficiency and expands the possible use cases for eVTOLs, from passenger drones to cargo delivery systems, thereby driving market growth.

Moreover, with global awareness and governmental policies shifting towards reducing carbon emissions and combating climate change, there's a growing demand for sustainable transport solutions. eVTOL aircraft represent a potential for eco-friendly urban air mobility by considerably reducing the reliance on ground transportation, which is often powered by fossil fuels. The push for more environment-friendly options is guiding financial investments and regulatory backing in favor of the electric aviation industry, which, in turn, is accelerating the expansion of the eVTOL aircraft market.

The integration of autonomous technologies into eVTOL designs is a significant driver for the market growth. Autonomy in aviation can increase safety by reducing human error, enhance efficiency through optimized route planning, and eventually reduce operational costs by potentially eliminating the need for pilots. The ongoing development of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, sensors, and flight control systems paves the way for fully autonomous eVTOL services in the future, contributing to market growth.

Additionally, the establishment of regulatory frameworks and support from aviation authorities is crucial for the growth of the eVTOL market. Regulatory bodies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) are working on developing guidelines and certifications specific to eVTOL operations. This regulatory clarity is essential for ensuring safety, standardization, and public trust in eVTOL aircraft. Government initiatives and policies that promote the adoption of innovative aviation technologies are also playing a significant role. As regulations become more defined and supportive, they will facilitate the wider adoption and commercial operation of eVTOL aircraft, driving market expansion in the coming years.

Furthermore, the global increase in urban population and the consequent rise in traffic congestion are increasing demand for eVTOL aircrafts. eVTOL aircraft offer a solution to bypass crowded urban streets, significantly reducing commute times and improving the quality of life for city residents. As cities continue to grow, the demand for efficient, time-saving transportation options like eVTOL aircraft is expected to rise, propelling the market forward.

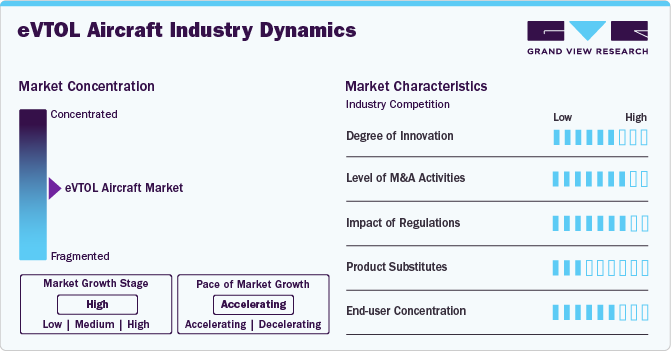

Market Concentration & Characteristics

The eVTOL aircraft market is marked by a high degree of innovation, driven by the need to offer efficient and sustainable alternatives to traditional urban transportation methods. This push is fueled by increasing urban congestion and the demand for quicker, cleaner commuting options.

Regulation plays a crucial role in shaping the eVTOL aircraft market. Stringent safety and operational standards offer regulated protocols for manufacturers around the globe. Supportive regulatory frameworks can accelerate market acceptance and expansion by ensuring safety and reliability.

The market is also being influenced by the rising number of mergers and acquisitions, which help companies increase market share, expand the customer base, and strengthen product portfolios.

The presence of product substitutes, such as conventional helicopters and emerging urban air mobility solutions, could either pose competitive challenges or compel eVTOL aircraft to innovate further, impacting their market share and growth trajectory.

The eVTOL aircraft market is heavily reliant on a concentrated group of end users, primarily consisting of city residents and businesses seeking efficient urban transportation solutions, which can influence market dynamics and demand.

Propulsion Insights

The propulsion segment dominated the market in 2023 with a market share of around 71%, due to advancements in battery technology, which are increasing energy density and reducing costs. The push for sustainable and environmentally friendly urban air mobility solutions is driving demand, supported by stringent emissions regulations. Investments from both private and public sectors are accelerating technological developments and infrastructure improvements, thereby driving the segment growth.

The electric hydrogen segment is expected to record the highest CAGR of over 66% from 2024 to 2030. The segment growth is due to its potential for zero-emission flights, aligning with global sustainability goals. Advancements in hydrogen fuel cell technology have improved efficiency and energy density, making it a viable alternative to traditional batteries. The increasing investments and collaborations among key aerospace companies are accelerating the development and deployment of hydrogen-powered eVTOLs. Regulatory support and growing public demand for cleaner transportation solutions further drive the segment growth.

Application Insights

The surveillance & monitoring segment held the highest revenue share in 2023, due to advancements in autonomous technology, which enhance precision and efficiency in various monitoring tasks. The increasing need for real-time data collection and surveillance in urban environments, driven by security and safety concerns, further propels this demand. Additionally, the integration of AI and machine learning enhances predictive capabilities, making eVTOLs indispensable in proactive monitoring. These factors collectively drive the adoption of eVTOLs for surveillance & monitoring applications, fueling market expansion.

The passenger transport segment is estimated to register the highest growth rate from 2024 to 2030. Urban air mobility initiatives are addressing traffic congestion and reducing travel time, making eVTOLs an attractive alternative for city commutes. Technological advancements in battery efficiency and autonomous flight systems are enhancing the feasibility and safety of eVTOLs. Additionally, increased investment from both private and public sectors, alongside supportive regulatory frameworks, is accelerating the development and deployment of passenger transport eVTOLs, thereby driving the segment growth.

Operation Mode Insights

The piloted segment held the highest revenue share in 2023, due to increasing urbanization and the subsequent demand for efficient intra-city transportation solutions. Technological advancements in avionics and control systems have enhanced safety and reliability, making piloted eVTOLs more viable. Additionally, regulatory bodies are progressively establishing frameworks to integrate piloted eVTOLs into existing airspaces. Investor confidence and substantial funding in this segment are further propelling its expansion.

The autonomous segment is estimated to register the highest growth rate from 2024 to 2030. The autonomous operation mode segment is experiencing rapid growth due to advancements in artificial intelligence and machine learning, which enhance the precision and safety of autonomous systems. Increased investments from both public and private sectors in smart city initiatives and urban air mobility are driving this growth. Additionally, regulatory support and pilot programs for autonomous flights are enhancing the segment growth.

Range Insights

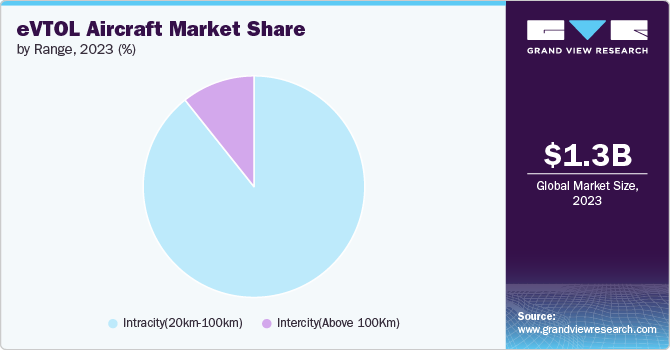

The intracity (20km-100km) & monitoring segment held the highest revenue share in 2023, due to increasing urban congestion and the demand for faster, more efficient transportation solutions. Advancements in battery technology and autonomous flight systems are enhancing the feasibility and safety of eVTOL operations. These factors collectively contribute to the rapid expansion of the intracity eVTOL segment, promising a transformative impact on urban mobility and fueling segment growth.

The intercity (above 100km) segment is estimated to register the highest growth rate from 2024 to 2030. The intercity segment of the eVTOL aircraft market is experiencing significant growth, driven by advancements in battery technology and autonomous flight systems that enhance range and safety. Increased urbanization and congestion in metropolitan areas are creating demand for faster, more efficient travel solutions over longer distances. Additionally, growing investments from both private and public sectors in infrastructure and regulatory frameworks are accelerating the segment growth.

System Insights

The hardware segment accounted for the highest market share in 2023. The segment growth is driven by advancements in battery technology, propulsion systems, and lightweight materials. Enhanced energy density in batteries allows for longer flight times and greater efficiency, while innovations in electric propulsion systems improve reliability and reduce operational costs. The use of advanced composites and lightweight materials helps to increase payload capacity and overall performance, which is fueling the segment growth.

The software segment is anticipated to expand at the highest CAGR from 2024 to 2030. The segment growth is attributed to the advancements in automation, navigation, and communication technologies. Key drivers include the increasing demand for efficient air traffic management solutions, enhanced safety features through real-time data analytics, and the integration of AI for autonomous flight operations. Additionally, regulatory support for urban air mobility initiatives and significant investments in R&D are propelling the development and adoption of sophisticated software systems in eVTOL aircraft.

Regional Insights

The eVTOL aircraft market in North America accounted for the highest revenue share of nearly 42% in 2023, driven by the region's strong focus on technological innovation and a significant push towards reducing urban congestion through sustainable means. Investments from both the public and private sectors in developing the necessary infrastructure for urban air mobility highlight the region's commitment to introducing eVTOLs as a viable transportation alternative.

U.S. eVTOL Aircraft Market Trends

The eVTOL aircraft market in the U.S. is anticipated to grow at a CAGR of around 53% from 2024 to 2030. In the U.S., advancements in technology and supportive regulations are accelerating the eVTOL aircraft market as a revolutionary solution for urban mobility challenges.

Asia Pacific eVTOL Aircraft Market Trends

The eVTOL aircraft market in Asia Pacific is anticipated to grow at the highest CAGR of over 60% from 2024 to 2030. The rapid pace of urbanization, along with escalating traffic congestion in major cities, has placed a premium on efficient, alternative transportation solutions like eVTOLs. Governments in the region are actively supporting urban air mobility projects through favorable policies and incentives, keen to integrate eVTOL aircrafts into their transportation ecosystem.

The eVTOL aircraft market in India is estimated to record a significant growth rate from 2024 to 2030. In India, rapid urbanization and the need for sustainable transportation alternatives are driving the adoption of eVTOL aircraft.

China eVTOL aircraft market is expected to grow considerably from 2024 to 2030. China's commitment to reducing urban air pollution and its investment in innovative air mobility solutions are propelling the eVTOL aircraft market forward.

The eVTOL aircraft market in Japan is projected to witness a considerable growth rate from 2024 to 2030. Japan's focus on hosting futuristic Olympics, including the demonstration of flying cars, showcases its initiative to integrate eVTOL aircraft into daily transportation.

Europe eVTOL Aircraft Market Trends

eVTOL Aircraft market in Europe accounted for a notable revenue share in 2023. Europe's approach to the eVTOL aircraft market is supported by strong regulatory support, with safety and environmental sustainability at its central. The region’s well-established aerospace industry is making advances in eVTOL technology, backed by clear and supportive regulations from the European Union Aviation Safety Agency (EASA). European cities, known for their commitment to reducing urban traffic and promoting eco-friendly transportation alternatives, are ideal environments for the adoption of eVTOL aircrafts, positioning the market for substantial growth.

The eVTOL aircraft market in UK is projected to grow considerably from 2024 to 2030. The UK's strategy towards achieving net-zero emissions by 2050 includes the promotion of zero-emissions air transport, such as eVTOL aircrafts, to revolutionize urban travel.

Germany eVTOL aircraft market is expected to record significant growth from 2024 to 2030. Germany's robust automotive and engineering sectors are pivotal in pioneering eVTOL aircraft technology and infrastructure, setting the stage for market growth.

Middle East and Africa (MEA) eVTOL Aircraft Market Trends

The eVTOL aircraft market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of around 52% from 2024 to 2030, driven by strategic investments in technology and infrastructure aimed at revolutionizing urban mobility. The region's focus on enhancing its tourism sector and improving urban transport efficiency serves as a significant driver for the adoption of innovative solutions like eVTOL aircrafts.

eVTOL Aircraft market in Saudi Arabia accounted for a considerable revenue share in 2023. In Saudi Arabia, the Saudi Vision 2030 plan emphasizes economic diversification through smart city projects, integrating eVTOL aircrafts into the future of urban transportation.

Key eVTOL Aircraft Company Insights

Some of the key players operating in the market are Airbus S.E., Elbit Systems Ltd., and Guangzhou EHang Intelligent Technology Co. Ltd.

-

Guangzhou EHang Intelligent Technology Co. Ltd. develops and manufactures aerial systems and drones for commercial and recreational uses. The company provides various aerial devices and solutions, consumer drones. The company has a wide network of authorized dealers located across various countries in Asia Pacific and Europe.

-

Airbus S.E. is renowned for its pioneering advancements in aviation, defense, and space technology. The European conglomerate excels in designing and manufacturing state-of-the-art commercial aircraft, helicopters, military transports, satellites, and space launch vehicles. With a focus on innovation and sustainability, Airbus is committed to connecting and protecting people across the globe, while actively participating in efforts to shape the future of air travel to be more efficient and environmentally friendly.

BETA Technologies, Inc., LIFT Aircraft Inc., among others are some of the emerging market participants in the eVTOL aircraft market.

-

BETA Technologies, Inc., a prominent innovator in the eVTOL (electric Vertical Takeoff and Landing) aircraft and charging infrastructure sector, aspiring to transform urban and regional mobility. Their flagship eVTOL, the ALIA, is designed with the vision of efficient, sustainable, and rapid air transport for cargo and passengers. BETA is dedicated to reducing the aviation industry's carbon footprint, focusing on creating eco-friendly solutions that offer a balance between technological advancement and environmental stewardship.

-

LIFT Aircraft Inc. is at the forefront of urban air mobility, developing cutting-edge electric vertical takeoff and landing (eVTOL) aircraft designed for personal flight. With their flagship model, HEXA, LIFT Aircraft aims to democratize aviation by making flying accessible to more people, not just professional pilots, through simplified controls and advanced safety features.

Key eVTOL Aircraft Companies:

The following are the leading companies in the eVTOL aircraft market. These companies collectively hold the largest market share and dictate industry trends.

- Airbus S.E.

- Elbit Systems Ltd.

- Bell Textron Inc.

- Workhorse Group, Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Embraer S.A.

- BETA Technologies, Inc.

- LIFT Aircraft Inc.

- Israel Aerospace Industries Ltd.

- Volocopter GmbH

Recent Developments

-

In April 2024, BETA Technologies, Inc. announced that it had successfully conducted the initial piloted transition flights with a prototype of its Alia 250 eVTOL aircraft. The achievement of a successful transition flight marked a significant milestone in the development of eVTOL aircraft, showcasing the essential capability to seamlessly transition between vertical lift-off and horizontal cruising.

-

In April 2024, Guangzhou EHang Intelligent Technology Co. Ltd. announced that its EH216-S, an unmanned electric vertical takeoff and landing (eVTOL) aircraft, achieved a milestone by completing its inaugural autonomous flight at the DRIFTx event in Abu Dhabi on April 25, 2024. This event marked the aircraft's debut flight in the region.

-

In March 2024, Airbus S.E. unveiled its latest prototype in electric vertical take-off and landing (eVTOL) aircraft, known as the CityAirbus NextGen. With a wingspan of 40 feet (approximately 12 meters), this advanced model is designed to accommodate a pilot and three passengers.

eVTOL Aircraft Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.07 billion |

|

Revenue forecast in 2030 |

USD 28.61 billion |

|

Growth rate |

CAGR of 54.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Propulsion, application, operation mode, range, system, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Airbus S.E.; Elbit Systems Ltd.; Bell Textron Inc.; Workhorse Group, Inc.; Guangzhou EHang Intelligent Technology Co. Ltd.; Embraer S.A.; BETA Technologies, Inc.; LIFT Aircraft Inc.; Israel Aerospace Industries Ltd.; Volocopter GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global eVTOL Aircraft Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global eVTOL aircraft market report based on propulsion, application, operation mode, range, system, and region.

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Fully Electric

-

Hybrid

-

Electric Hydrogen

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cargo Transport

-

Passenger Transport

-

Mapping & Surveying

-

Special Mission

-

Surveillance & Monitoring

-

Others

-

-

Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Piloted

-

Autonomous

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Intracity (20km-100km)

-

Intercity (Above 100Km)

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Aerostructure

-

Avionics

-

Electric Motor

-

Batteries and Fuel Cells

-

Others

-

-

Software

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global eVTOL aircraft market size was estimated at USD 1.35 billion in 2023 and is expected to reach USD 2.07 billion in 2024.

b. The global eVTOL aircraft market is expected to grow at a compound annual growth rate of 54.9% from 2024 to 2030 to reach USD 28.61 billion by 2030.

b. The North America region accounted for the largest share of over 41% in the eVTOL aircraft market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the avionics market include Airbus S.E., Elbit Systems Ltd., Bell Textron Inc., Workhorse Group, Inc., Guangzhou EHang Intelligent Technology Co. Ltd., Embraer S.A., BETA Technologies, Inc., LIFT Aircraft Inc., Israel Aerospace Industries Ltd., Volocopter GmbH.

b. Key factors that are driving the eVTOL aircraft market growth include the development and improvement in battery technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."