Event Management Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud-based, On-premise), By Enterprise Size, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-365-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Event Management Software Market Trends

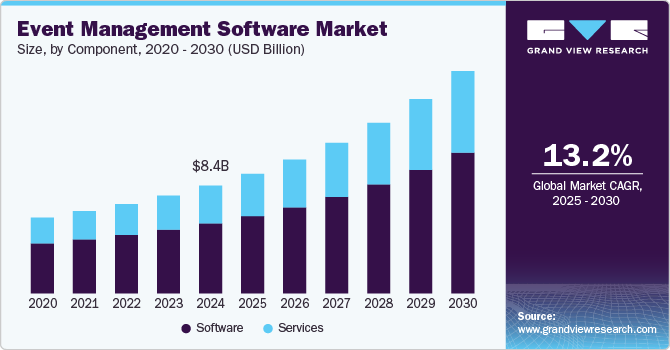

The global event management software market size was estimated at USD 8.40 billion in 2024 and is expected to grow at a CAGR of 13.2% from 2025 to 2030. With the proliferation of technology, event management software has strong data-handling attributes. It enables event managers to gather and evaluate data on participant population demographics, opinions, and behavior. The data gathered can assist event organizers in making informed choices, enhancing future events, and customizing the overall experience to the needs of participants is driving the event management software industry’s growth. Event management has grown in importance globally as the range of worldwide conferences, exhibits, and cultural events has increased. Cultural variations, communication hurdles, and foreign logistics are all managed by event organizers. They play an important role in planning events that cater to varied audiences and ensure cross-border activities run effectively.

The strong emphasis various event planners put on implementing automation and making data-driven decisions for business growth is poised to drive market growth over the forecast period. Event management software facilitates various tasks, including event planning, event marketing, analytics & reporting, and venue & ticket management. As such, market players are offering event management software tailored to the specific requirements of end users as part of their efforts to augment revenues and strengthen brand positioning. For instance, in June 2023, capital market access platform Q4, Inc. introduced the Event Management App to its Q4 Platform. The Event Management App enables streamlined event preparation, reporting, and management for various events, such as investor days and earning days, on the clients’ IR calendars.

Artificial intelligence (AI) and machine learning (ML) are revolutionizing many elements of event management. AI-powered chatbots and digital assistants can answer guest inquiries, offer event details, and provide customized suggestions. Automation technologies can help companies reduce time by automating email marketing, social media time management, and statistical entry tasks. Interactive event engagements are gradually being created using AR and VR technologies. AR can provide fun and interactive elements by adding digital content to the physical event venue. Attendees can utilize VR to discover virtual settings while participating in virtual presentations, outings, or games. These technologies provide events with a new dimension by allowing visitors to examine items, venues, or ideas in a more collaborative and realistic method.

The initial costs of using event management software usually include licensing expenses, customization, and coaching. These costs can be expensive for small firms with limited resources. Furthermore, ongoing upkeep and subscription charges may put an additional burden on the budget, particularly for ongoing activities or firms with an increased activity frequency.To facilitate online registration and ticket sales, event management software frequently interacts with payment gateways. Visitors are able to navigate to the event website or registration platform and choose their desired tickets or registration options.

The increased emphasis on sustainability and eco-friendly methods will impact the event management software industry. Green event management software will include features that reduce paper waste via digital applications, purchasing tickets, and interaction. Sustainability measurement and reporting capabilities will be embedded in event management software to assess and track environmental effects, which is expected to propel the market in the forecasted period.

Component Insights

The software segment accounted for the largest market share of over 64.0% in 2024. The segment growth is attributed to a wide range of tools and capabilities to manage numerous components of event planning. It consists of event selection, financial management, conference scheduling, logistical management, vendor management, and task monitoring. The rise of hybrid and virtual events has resulted in the creation of software solutions designed solely for handling these types of events. For instance, virtual exhibitor booths, chat functionality, live broadcasting, and content distribution are all accessible via virtual event platforms. Event organizers can utilize these platforms to create influencing and engaging digital journeys for visitors.

The services segment is expected to register the highest CAGR over the forecast period.Event management software services provide detailed knowledge and a specialized understanding of event planning, organization, and performance. Professional event planners have expertise in event logistics, current trends, standard procedures, and innovative methods. Their expertise and skills help to guarantee that events are well-planned, efficiently performed, and connected with the client's aims and objectives. Event management software services include promotional and marketing techniques to increase event participation and attract the target audience.

Deployment Insights

The cloud-based segment held the largest market share of over 63.0% in 2024 and is expected to maintain its dominance by 2030. Cloud-based event management software permits customers to use the platform with a broadband connection from any location. Event planners, administrators, and participants can use the program on various devices, including PCs, tablets, and smartphones. This flexibility facilitates real-time communication, notifications, and event management on an ongoing basis. Cloud-based event management software is built to provide high availability and consistent performance, reducing the chance of interruption during key event operations.

The on-premises segment is expected to grow at a CAGR of 10.9% over the forecast period. Organizations gain full control over their event data using on-premises software as it is stored within their private infrastructure. Since the data does not reside in an outside cloud environment, it has better personal information security and compliance control. Organizations with on-premises software have greater flexibility over modification and configuration possibilities. They can customize the platform to match its unique event management requirements, procedures, and integration needs with other internal applications.

Enterprise Size Insights

The large enterprise segment dominated the market and registered a market share of over 53.0% in 2024. Large enterprises aim to provide superior service to their guests, including clients, staff members, or industry experts. Corporate event management software aids resource allocation, planning, supplier contracts, logistical coordination, and real-time updates. Large enterprises often organize various events, ranging from meetings and conferences to trade exhibitions and product launches. Event management software facilitates identification, ticketing, attendance management, logistical coordination, and reporting.

The SMEs segment is expected to register the highest CAGR over the forecast period. The segment's expansion can be ascribed to the increasing number of small & medium enterprises (SMEs) in countries such as India, the U.S., and China. During events, SMEs often aim to portray an expert image and provide a pleasant brand experience. Event management software provides forms for registration, email designs, configurable event sites, and branding options to assist small businesses in presenting a professional and logical image to customers. This professional image boosts their credibility and can positively affect client perception.

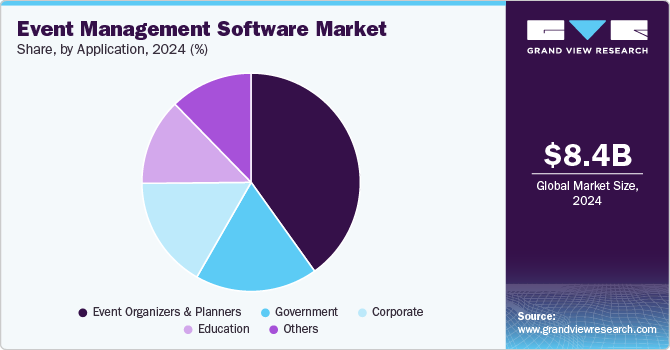

Application Insights

The event organizers & planners segment dominated the market and registered a revenue share of over 40.0% in 2024. Depending on its features, event organizers and planners frequently use event management software to organize, prepare, and execute events. They use the platform to manage the registration process, participant engagement, advertising, logistics collaboration, and analytics. Event organizers' and planners' desire for effective, user-friendly, and feature-rich software solutions drives development and creativity in the market.

The corporate segment is expected to grow at the highest CAGR from 2025 to 2030. Corporate events often demand high reliability, accuracy, and focus on small details. It enables organizations to simplify operations, automate jobs, and provide an ongoing and expert approach to handling events. Corporate enterprises prioritize data security and compliance with privacy legislation. Many corporate organizations are present at worldwide events across multiple locations. Highly confidential data, such as customer data, financial details, and intellectual property, is often displayed during corporate events. Data security is prioritized by event management software, ensuring conformity with privacy laws and business standards.

Regional Insights

The North America event management software market dominated the market with a share of over 45.0% in 2024. North America is known worldwide for technological developments and early adopters of new solutions. Event management software vendors in the region supply innovative and feature-rich software solutions by integrating cutting-edge technologies such as cloud hosting, Machine Learning (ML), Artificial Intelligence (AI), data analytics, and mobile applications. In North America, event management software is employed across various sectors, such as corporate, government, healthcare, education, non-profit, and entertainment. These sectors depend on event management software to boost event experiences, improve procedures, enhance consumer engagement, and meet event targets.

U.S. Event Management Software Market Trends

The event management software industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. market growth can be attributed to the rising initiatives taken by the government to improve the digitalization ecosystem. Adopting sophisticated event management solutions for applications such as real-time data reporting, collecting online payments, and organizing housing and travel preferences is expected to boost market growth. Industry players operating in the country are focused on improving their product portfolio by raising funds.

Europe Event Management Software Market Trends

The event management software market in Europe is expected to register a CAGR of 11.6% from 2025 to 2030. The growing number of events, such as stand-up comedy shows, tradeshows, musical concerts, and product launches, is a major factor driving market growth in Europe. Event management software is widely used in many international music festivals, such as the Sziget Festival, Tomorrowland, and Glastonbury Festival, bringing traction in the European market.

The UK event management software industry is expected to grow rapidly in the coming years. The market is booming owing to the rising use of event management tools in conferences, festivals, exhibitions & fairs, fundraising & social events, and promotion & product launches. Furthermore, private education centers and universities offer event management courses to help students pursue careers in this sector, creating robust market opportunities. Industry players emphasize improving their brand identity by launching event management platforms for nonprofit organizations and charitable trusts.

The event management software market in Germany held a substantial market share in 2024. The country’s market growth can be attributed to the increasing digital transformation of society and the thriving entertainment sector. The countries’ consumer demographics are shifting rapidly with evolving lifestyles and digital preferences.

Asia Pacific Event Management Software Market Trends

The event management software market in the Asia Pacific is growing significantly at a CAGR of over 15.3% from 2025 to 2030. The region's enormous population, developing economy, and rising technological adoption contribute to the market's expansion. The market is expanding as regional firms discover the advantageous features of event management software. The region's thriving tourism industry and increased corporate events drive demand for event management software services that help accelerate event planning, execution, and guest management.

China event management software industry held a substantial market share in 2024. Significant digitization and the availability of a larger audience are driving market growth in China. Supportive initiatives taken by the government to improve the digital ecosystem are also expected to create lucrative opportunities for the market.

The event management software industry in Japan held a considerable market share in 2024. Market growth can be attributed to the shifting focus of various end-user companies on organizing events to improve their connection with customers. Moreover, the market is driven by rising research and development (R&D) investments in technological advancements in event management software and the increasing popularity of virtual events.

India event management software industry is growing rapidly due to the significant presence of market players and the rising number of international conventions in the country. Companies operating in the Indian event management market emphasize strengthening their product portfolio and increasing their market share. For instance, in February 2023, Country Holidays Travel India launched event management and banquets & destination wedding services. The new services will be available for Diwali events, birthday parties, dandiya night celebrations, New Year events, and summer & winter vacations, among others.

Key Event Management Software Company Insights

The key market players in the global market include Cvent, Inc., EventBrite, Whova, Certain, Inc., and Zoho Corporation Pvt Ltd, among others. Companies in the market are investing resources in research & development activities to support growth and enhance their internal business operations. Moreover, companies can engage in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively developing new products and enhancing existing products to acquire new customers and capture more market share.

Key Event Management Software Companies:

The following are the leading companies in the event management software market. These companies collectively hold the largest market share and dictate industry trends.

- Active Network LLC

- Arlo

- Stova

- Bitrix24

- Eventdex.com

- Hopin

- webMOBI

- Whova

- Certain, Inc.

- Cvent, Inc.

- EMS Software LLC

- EventBrite

- Rainfocus

- Ungerboeck

- Zoho Corporation Pvt Ltd

Recent Developments

-

In February 2025, Eventdex.com, a provider of event management software, launched an integrated event suite to enhance event experience, operational efficiency, and event planning. The suite combines three tools: Gala Event Seating Software, Custom Event Badge Printing Software, and Event Floor Plan Software.

-

In September 2024, Stova, an event management technology provider, launched an exhibitor management solution named Exhibitor Resource Center (ERC) for event professionals, sponsors, and exhibitors. ERC features include task management, sponsorship management, actionable insights, and seamless integration with other systems and tools.

-

In April 2023, Eventdex.com announced a strategic partnership with One World Rental, an event technology rental company offering laptops, iPads, and VR event equipment. This collaboration will strengthen Eventdex.com’s event management solution offerings, including software and hardware.

Event Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size in 2025 |

USD 9.32 billion |

|

Market Size forecast in 2030 |

USD 17.33 billion |

|

Growth rate |

CAGR of 13.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Active Network LLC; Arlo; Stova; Bitrix24; Eventdex.com; Hopin; webMOBI; Whova; Certain, Inc.; Cvent, Inc.; EMS Software LLC; EventBrite; Rainfocus; Ungerboeck; Zoho Corporation Pvt Ltd |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Event Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global event management software market report based on component, deployment, enterprise size, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Event Planning

-

Event Marketing

-

Venue & Ticket Management

-

Analytics and Reporting

-

Others

-

-

Services

-

Professional Services

-

Consulting

-

Deployment & Integration

-

Support & Maintenance

-

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise

-

Large Enterprise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Event Organizers & Planners

-

Corporate

-

Government

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global event management software market size was estimated at USD 8.40 billion in 2024 and is expected to reach USD 9.32 billion in 2025.

b. The global event management software market is expected to grow at a compound annual growth rate of 13.2% from 2025 to 2030 to reach USD 17.33 billion by 2030.

b. The software segment dominated the event management software market with a share of over 64.0% in 2024. This is attributable to the rise of hybrid and virtual events have resulted in the creation of software solutions designed solely for handling these types of events.

b. Some key players operating in the event management software market include Active Network LLC; Arlo; Stova; Bitrix24; Eventdex.com; Hopin; webMOBI; Whova; Certain, Inc.; Cvent, Inc.; EMS Software LLC; EventBrite; Rainfocus; Ungerboeck; and Zoho Corporation Pvt Ltd.

b. Key factors that are driving the event management software market growth include the growing need for software solutions that can streamline the management of events. Moreover, the proliferation of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing many elements of event management. AI-powered chatbots and digital assistants can answer guest inquiries, offer event details, and provide customized suggestions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."