- Home

- »

- Automotive & Transportation

- »

-

Event Logistics Market Size, Share And Trends Report, 2030GVR Report cover

![Event Logistics Market Size, Share & Trends Report]()

Event Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Inventory Management, Distribution Systems And Freight Forwarding), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-460-4

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Event Logistics Market Summary

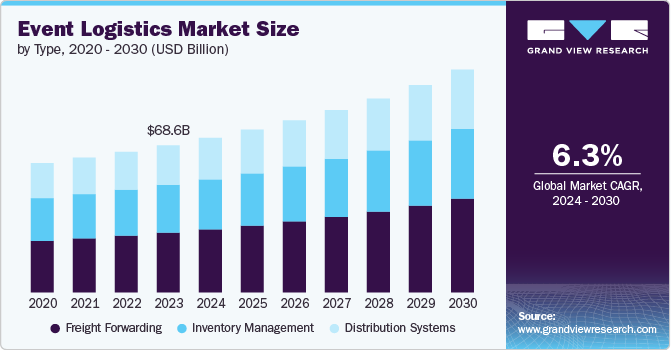

The global event logistics market size was estimated at USD 68.63 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The market growth can be attributed to the increasing globalization that has led to a surge in large-scale corporate events.

Key Market Trends & Insights

- North America dominated the event logistics market with the revenue share of 38.1% in 2023.

- By type, the freight forwarding segment led the market with the largest revenue share of 40.6% in 2023.

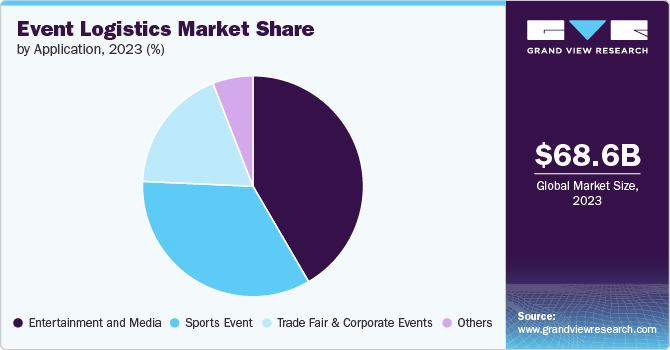

- By application, the entertainment and media segment led the market with the largest revenue share of 41.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 68.63 Billion

- 2030 Projected Market Size: USD 103.90 Billion

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

This trend is further amplified by the rise of experience-based marketing strategies, where companies create elaborate, immersive events that require intricate logistical planning. Simultaneously, the growing sports and entertainment sectors, with their massive global events and music festivals, are pushing the boundaries of event logistics capabilities.

Technological advancements are playing a crucial role in shaping the market's growth trajectory. The integration of AI, Internet of Things (IoT), and blockchain technologies is transforming event logistics operations, enabling real-time asset tracking, streamlining inventory management, and enhancing overall operational efficiency. These innovations are particularly vital as the industry faces increasing demands for sustainability. Event logistics providers are under pressure to adopt eco-friendly practices, from using electric vehicles to implementing waste reduction strategies, driving further innovation in the sector.

The market is also benefiting from the expansion of emerging economies and their investments in infrastructure. Countries in Asia and Africa are positioning themselves as new hubs for international events, creating fresh opportunities for event logistics providers to enter diverse geographical locations. This global expansion is coupled with a growing trend towards customization and personalization in event logistics. Organizers are demanding tailored solutions to meet specific event requirements, pushing providers to offer more specialized and flexible services.

The COVID-19 pandemic has had a profound impact on the market growth, initially causing disruptions but also spurring adaptations that are shaping its future. The rise of hybrid events, combining in-person and virtual elements, has created new logistical challenges and opportunities. As the world recovers from the pandemic, there's a surge in pent-up demand for in-person events, further driving market growth. However, the market also faces challenges such as economic uncertainties, geopolitical tensions affecting international events, and the ongoing threat of public health crises. These factors can lead to event cancellations or downsizing, potentially moderating the market's growth trajectory. In addition, the shift towards virtual events in some sectors could impact the demand for traditional event logistics services.

Type Insights

Based on type, the freight forwarding segment led the market with the largest revenue share of 40.6% in 2023 and is expected to maintain its dominance from 2024-2030. Freight forwarders play a crucial role in managing complex international logistics for large-scale events, handling customs clearance, and navigating global transportation networks. Their expertise in coordinating multimodal transport is particularly valuable for events requiring equipment and materials from various global sources. The segment's growth is further fueled by increasing cross-border events and trade shows, which necessitate specialized knowledge of international shipping regulations. In addition, freight forwarders are adapting to digital transformation, incorporating advanced tracking systems and AI-driven logistics solutions, enhancing their efficiency and appeal to event organizers seeking seamless, end-to-end logistics management.

The distribution systems segment is expected to register at the fastest CAGR of 6.1% from 2024-2030. The market growth is primarily attributed to the increasing complexity and scale of global events. This growth is fueled by the rising demand for customized, just-in-time delivery solutions at event venues. The segment is also benefiting from advancements in warehouse automation and modular distribution systems, allowing for more flexible and efficient on-site logistics management. In addition, the trend towards sustainable event management is pushing distribution systems to adopt eco-friendly practices, such as optimized routing and reduced packaging waste.

Application Insights

Based on application, the entertainment and media segment led the market with the largest revenue share of 41.6% in 2023, which is mainly attributed to the sector's logistical complexity and scale. Large-scale productions such as concerts, film shoots, and festivals require precise coordination of equipment, stage setups, and audiovisual technology and often involve international transport of specialized goods. The time-sensitive nature of these events, with non-negotiable deadlines, increases the demand for reliable and efficient logistics partners. In addition, the rise of global media platforms and digital streaming services has intensified the need for logistics solutions to support content creation and distribution across multiple locations, further driving revenue in this segment.

The sports event segment is expected to register at the fastest CAGR of 6.8% from 2024-2030. The market growth is primarily attributed to the increasing frequency of large-scale international tournaments, regional sports leagues, and esports events. This growth is supported by the rising demand for specialized logistics solutions to handle equipment, team transport, and venue setup, along with the expanding global audience for live sports, which creates higher logistical needs for seamless event execution.

Regional Insights

North America dominated the event logistics market with the revenue share of 38.1% in 2023, due to several key factors. Increased corporate spending on events, conferences, and trade shows is fueling demand for specialized logistics services. The rise of experiential marketing and large-scale consumer events is also contributing to market growth. Technological advancements in event management software and logistics platforms are enhancing operational efficiency. In addition, the post-pandemic resurgence of in-person gatherings has created a backlog of events, further boosting the sector. However, the market faces challenges from economic uncertainties and the ongoing shift towards hybrid event models.

U.S. Event Logistics Market Trends

The event logistics market in U.S. accounted for the largest market share of North America in 2023, due to several key factors. The country's robust economy supports a high volume of corporate and consumer events across various industries. Major cities like New York, Las Vegas, and Orlando serve as global hubs for conventions and trade shows, attracting international participants. The U.S. boasts advanced infrastructure, including modern venues and efficient transportation networks, facilitating seamless event logistics. In addition, the presence of numerous multinational corporations and a culture of large-scale events, from music festivals to sports tournaments, contributes to the market's size and sophistication in the U.S.

Asia Pacific Event Logistics Market Trends

The event logistics market in Asia Pacific is projected to experience at a rapid CAGR of 6.8% from 2024 to 2030. This surge is driven by several factors. Economic development in countries like China and India is fueling increased corporate and consumer event activity. The region's expanding middle class is creating demand for more diverse and sophisticated events. Governments are investing in infrastructure and promoting international conventions to boost tourism and business. In addition, the rise of technology hubs in cities like Singapore and Seoul is attracting global conferences and trade shows. The post-pandemic economic recovery is also contributing to a resurgence in event planning and execution across the region.

Europe Event Logistics Market Trends

The event logistics market in Europe is primarily driven by the region's strong emphasis on cultural events and festivals. Many European cities host world-renowned events, attracting global audiences and necessitating complex logistics operations. The continent's well-developed transportation infrastructure facilitates efficient event planning and execution. The presence of numerous international organizations and corporations in cities like Brussels, Paris, and Frankfurt generates consistent demand for high-profile conferences and exhibitions. In addition, Europe's focus on sustainability is pushing event logistics providers to adopt eco-friendly practices, spurring innovation in the sector. The region's diverse languages and cultures also create a need for specialized, localized event logistics services.

Key Event Logistics Company Insights

Some of the key companies operating in the global market include FedEx, and Kuehne + Nagel, among others.

-

FedEx is one of the global leaders in transportation, logistics, warehousing & order fulfillment, and courier delivery services. The company’s operations and activities are categorized under four reportable business segments, namely FedEx Freight, FedEx Express, FedEx Services, and FedEx Ground. FedEx Express utilizes a vast air cargo network to ensure fast and timely deliveries across the globe to more than 220 countries. FedEx Ground is a leading North American provider of small package ground delivery services catering to both residential and commercial customers, providing cost-effective and reliable options. FedEx Ground Economy focuses on consolidating and delivering large quantities of lightweight, less time-critical business-to-consumer shipments. FedEx Freight specializes in less-than-truckload (LTL) freight services, offering efficient transportation solutions for larger and heavier shipment packages. The FedEx Services segment encompasses various support services, including technology, sales, marketing, and customer service, enhancing the overall efficiency and customer experience. The company’s global network provides time-sensitive, air-ground express service through more than 650 airports worldwide, transporting an average volume of 5.3 million packages daily

-

Kuehne+Nagel, a Swiss-based company, provides a comprehensive array of logistics services encompassing air and sea freight, overland transportation, contract logistics, and supply chain solutions. The company's extensive network spans over 100 countries serving nearly 1,300 locations, providing clients with a global reach for their logistics needs. The company serves a wide array of industries and sectors, including but not limited to automotive, retail, healthcare, technology, and aerospace. The company operates through four reportable segments, namely Sea Logistics, Air Logistics, Road Logistics, and Contract Logistics. Within the Contract Logistics segment, Kuehne + Nagel offers services such as storage, handling, and distribution linked to customer contracts for warehouse and distribution activities. In addition, the company offers ancillary services, such as customs clearance, export and import documentation, door-to-door services, and arrangement of intricate logistics supply movement

XPO, Inc.and CEVA Logistics are some of the emerging market companies in the target market.

-

XPO Inc. is a global provider of transportation and logistics solutions and is one of the largest less-than-truckload freight providers in North America. The range of services offered by the company encompasses full truckload, less-than-truckload, intermodal brokerage, ground/air transportation, last-mile delivery logistics, and freight forwarding services. In addition, XPO provides contract logistics services, covering areas such as warehousing and distribution, packaging and labeling, e-commerce fulfillment, cold chain solutions, reverse logistics, factory support, inventory management, aftermarket support, and personalization services. XPO caters to a diverse clientele, including multinational, national, mid-size, and small enterprises involved in manufacturing, industrial, commercial, life sciences, food and beverages, consumer goods, retail, and government sectors. The company's operational footprint extends across North America, Asia, and Europe, serving approximately 48,000 customers in 554 locations. The company’s coast-to-coast network within North American countries such as the U.S., Mexico, Canada, and the Caribbean includes 13,000 drivers and 38,000+ tractors & trailers

Key Event Logistics Companies:

The following are the leading companies in the event logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Agility

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DB SCHENKER

- DHL Group

- FedEx

- Kuehne+Nagel

- Rhenus Group

- United Parcel Service Of America, Inc.

- XPO, Inc.

Recent Developments

-

In July 2024, FedEx is expanding its FedEx International Connect Plus (FICP) service to support e-commerce merchants in China, Hong Kong, and Japan by providing faster, cost-effective shipping to the U.S. and Europe. The service offers day-definite delivery, parcel tracking, and flexible pickup options, making it ideal for time-sensitive sectors like event logistics, where efficient international shipping is crucial for the timely delivery of materials and equipment across regions

-

In March 2024, DHL entered a multi-year partnership with the FIM Enel MotoE World Championship to promote sustainability and e-mobility in motorsports. Alongside this, DHL continues its role as the Official Logistics Partner for MotoGP, ensuring the transport of bikes and equipment globally. This partnership aligns with DHL's broader sustainability goals, contributing to their target of achieving Net-Zero emissions by 2050. The collaboration highlights DHL's expertise in logistics and commitment to sustainable innovation in high-profile global events like motorsports

Event Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.10 billion

Revenue forecast in 2030

USD 103.90 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Agility; C.H. Robinson Worldwide, Inc.; CEVA Logistics; DB SCHENKER; DHL Group; FedEx; Kuehne+Nagel; Rhenus Group; United Parcel Service of America, Inc.; XPO, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Event Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global event logistics market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Inventory Management

-

Distribution Systems

-

Freight Forwarding

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Entertainment and Media

-

Sports Event

-

Trade Fair & Corporate Events

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Event Logistics market size was estimated at USD 68.63 billion in 2023 and is expected to reach USD 72.10 billion in 2024.

b. The global Event Logistics market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 103.90 billion by 2030.

b. North America dominated the Event Logistics market with a share of over 38.1% in 2023. This is attributable to the increased corporate spending on events, conferences, and trade shows.

b. Some key players operating in the Event Logistics market include Agility, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB SCHENKER, DHL Group, FedEx, Kuehne+Nagel, Rhenus Group, United Parcel Service of America, Inc., and XPO, Inc.

b. Key factors driving market growth include the increasing frequency of large-scale events such as sports tournaments, music festivals, trade fairs, and corporate conferences fuels the demand for efficient logistics services to handle the movement of materials, equipment, and goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.