- Home

- »

- Biotechnology

- »

-

Europe Viral Vector And Plasmid DNA Manufacturing Market, Industry Report, 2030GVR Report cover

![Europe Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

Europe Viral Vector And Plasmid DNA Manufacturing Market Size, Share & Trends Analysis Report By Vector Type (AAV, Lentivirus), By Workflow, By Application, By End-use, By Disease, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-299-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The Europe viral vector and plasmid DNA manufacturing market size was estimated at USD 1.3 billion in 2023 and is anticipated to grow at a CAGR of 20.0% from 2024 to 2030. The market growth can be attributed to an increase in research funding and the presence of local key market players in this region. The number of biopharmaceutical companies is growing in Europe owing to increasing investments. For instance, in February 2022, the UK pledged around USD 192 million to the Coalition for Epidemic Preparedness Innovations to boost vaccine development.

Europe viral vector and plasmid DNA manufacturing market accounted for a 24.8% share of the global industry in 2023. The population in Europe is rapidly aging. According to the UN, individuals aged over 65 make up 19% of the population, representing approximately 183 million people. This population is at a higher risk of developing infectious diseases, as they are more likely to develop flu and be hospitalized. Thus, owing to these factors, the region is expected to witness significant growth opportunities during the forecast period.

The presence of several companies that produce vaccines is expected to boost the manufacturing of vectors in European countries. Exothera S.A., a Contract Development and Manufacturing Organizations (CDMO) company in Belgium, has significantly invested in expanding viral vector technologies. In March 2022, Exothera S.A. collaborated with IDT Biologika to establish a manufacturing facility for viral vector-based vaccines. Similarly, in October 2022, ABL and RDBiotech announced a partnership in cell and gene therapy manufacturing. This partnership combines ABL’s expertise in viral vector GMP and RD-Biotech’s proficiency in plasmid DNA GMP manufacturing, to enable customers to accelerate the development of innovative therapies and expedite time-to-market.

Vector Type Insights

Based on vector type, the adenovirus segment held a considerable share in 2023. Adenoviral Vectors (AdV) are increasingly used for various research applications in gene therapy as they can be produced at high titers and integrate large transgenes and transduce quiescent & dividing cells. For instance, scientists are engaged in R&D of adenovirus-mediated gene therapy to cure HIV infection. This adenoviral gene therapy could be an effective way to improve HIV management. AdV are extensively employed as vaccines as they can induce strong humoral and T cell responses. Several studies have been carried out to evaluate the efficiency of AdV across various applications such as vaccinology and gene editing. Studies based on AdV as a delivery tool for CRISPR/Cas9 have resulted in effective gene disruption in the host genome of various human cells.

The lentivirus segment is projected to grow at the fastest CAGR of 20.2% during the forecast period. With the increasing use of lentiviral vectors in ongoing research, the research community is focusing on advancements in these vectors. For instance, scientists are studying the potential of non-integrating lentiviral vectors (NILVs) as a tool to avoid insertional mutagenesis. NILVs can transduce both non-dividing and dividing cells. These vectors have potential applications in CAR-T cell therapy research. Furthermore, a recent study published in June 2022 stated that lentiviral vectors are being used to develop vaccines targeting dendritic cells and stimulating a powerful T-cell immune response. The same study stated that lentivirus vectors are being used to produce vaccines against SARS-CoV-2. It also offers protection and treatment against HIV. Numerous applications of this vector have contributed to segment growth

Workflow Insights

Based on workflow, the downstream processing segment dominated the market with the largest revenue share of 53.5% in 2023. Downstream processes involve several purification methods that consist of multiple steps. These processes are typically divided into three stages: capture, intermediate purification, and polishing. For intermediate purification and the final polishing step, chromatography and ultrafiltration techniques are utilized. In the industry, chromatography techniques using ion exchange and affinity methods are the most preferred. However, these methods have certain challenges. For instance, they require additional purification methods, resulting in a loss of yield.

The upstream processing segment is expected to grow at a CAGR of 19.1% over the forecast period.The first stage of processing, known as upstream processing, involves introducing cells to the virus, growing these cells, and then extracting the virus from them. Increasing innovation in product development, such as the ambr 15 microbioreactor system for high throughput upstream process development, is expected to enhance this specific area.

Application Insights

Based on the application, the vaccinology segment dominated the market with the largest revenue share of 21.9% in 2023. The growing demand for vaccines to cure infectious diseases such as Coronavirus and cancer is projected to boost market growth. Manufacturing of viral vector-based vaccines is easy and can be accomplished along with manufacturing of other traditional vaccines in large manufacturing units. The safety profiles of these vaccines can also be easily determined. Several viral vectors are being investigated owing to their associated advantages, which are being explored to assess their potential and accelerate the development of viral vector-based vaccines.

The cell therapy segment is expected to grow at a CAGR of 22.2% over the forecast period. Cell therapy-based treatments are becoming more popular due to the development of advanced transfer vectors. These vectors are safe and effective. In this process, patient samples are expanded, extracted, and then modified using gene therapy vectors. The modified cells are subsequently re-implanted into patients for therapeutic purposes.

End-use Insights

Based on end-use, the research institutes segment dominated the market with the largest revenue share of 57.8% in 2023. The segment growth is attributed to the increase in the demand for viral vectors and the increasing involvement of scientific communities in gene and cell therapy research. Research activities carried out for improvement in vector production by research entities are driving the segment.

The pharmaceutical and biotechnology companies’ segment is expected to grow at a CAGR of 20.5% over the forecast period. This can be attributed to continuous introduction of advanced therapies coupled with subsequent increase in the number of gene therapy-based research programs by pharmaceutical firms. The number of biotech companies that are employing vectors for therapeutic production continues to increase over time.

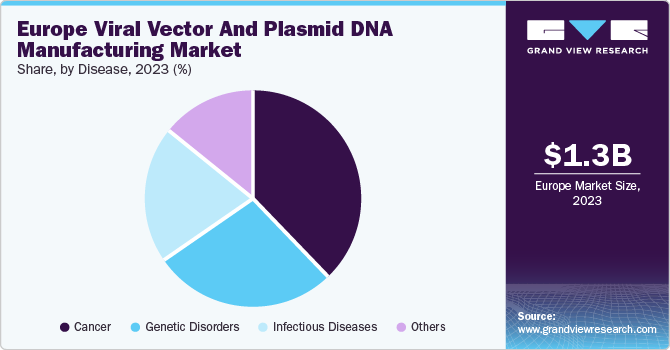

Disease Insights

Based on disease, the cancer segment dominated the market with the largest revenue share of 38.1% in 2023. An increasing number of cancer cases and a high number of plasmid DNA and viral vectors for the development of these gene therapies are anticipated to drive the segment’s growth. Furthermore, the adoption of a Western lifestyle, poor diet, and lack of physical activities are responsible for an increase in cancer cases.

The genetic disorders are expected to grow rapidly during the forecast period. Gene therapy was developed for the treatment of rare genetic disorders like hemophilia, Adenosine Deaminase-Severe Combined Immunodeficiency (ADA-SCID), and Lipoprotein Lipase Deficiency (LPLD) diseases, which are caused due to genetic inconsistencies or missing genes that express a particular trait. Genetic diseases are most commonly congenital; however, some diseases can be acquired by random mutations. The most common genetic diseases include sickle cell anemia and hemophilia, which are characterized by formation of blood clots and production of hemoglobin, affecting the oxygen-carrying capacity of the blood.

Country Insights

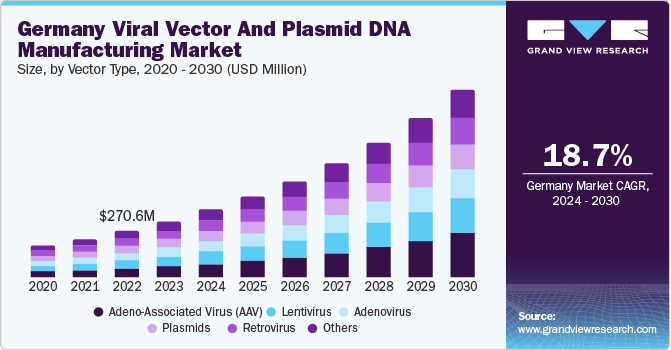

Germany viral vector and plasmid DNA manufacturing market accounted for a revenue share of 24.9% in 2023. Germany is one of the leading gene therapy clinical trials countries in Europe. A substantial number of companies have their facilities set up here, which is anticipated to support the rapid commercialization of drugs. Germany is the first country where the recently approved gene therapy treatment has been utilized. It is expected to witness significant growth in the number of trials and approval of drugs in the coming years, owing to an increase in the number of companies being set up and the support provided by governments in finding feasible treatment options for genetic disorders & various cancers.

The viral vector and plasmid DNA manufacturing market in Italy is expected to grow at a CAGR of 19.4% over the forecast period due to tremendous advances in biomanufacturing and industrial research. The country hosts several biotechnology & biopharmaceutical hotspots and is home to several key players in the viral vectors and plasmid DNA manufacturing domain. For instance, Milan is the hub of the biotechnology sector in Italy, housing approximately 35% of all biotech companies.

Key Europe Viral Vector And Plasmid DNA Manufacturing Company Insights

Merck KGaA, Lonza, and BioMarin are among the key players operating in the market.

-

Merck KGaA provides a wide range of pharmaceutical and chemical products catering to various industries. It operates through three business sectors: healthcare, life sciences, and performance materials. It offers life sciences products and services for drug discovery & development, along with research & laboratory applications.

-

Lonza is a worldwide supplier of biopharmaceuticals and offers products in bioresearch, consumer care, agro-ingredients, pharmaceutical & biotechnology, water treatment, industrial solutions, and wood protection.

Key Europe Viral Vector And Plasmid DNA Manufacturing Companies:

- Merck KGaA

- Lonza

- BioMarin

- Batavia Biosciences

- BioNTech IMFS

- Miltenyi Biotec

- Charles River Laboratories (Cobra Biologics)

- FUJIFILM Holdings Corporation

- Thermo Fisher Scientific, Inc..

Recent Developments

-

In July 2022, Charles River Laboratories announced the launch of the Plasmid DNA Center of Excellence in the UK. This expansion follows Charles River's acquisition of Cognate BioServices and Cobra Biologics, two leading contract development and production companies specializing in plasmid DNA, viral vectors, and cell therapy (CDMOs).

Europe Viral Vector And Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.8 billion

Growth rate

CAGR of 20.0% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vector type, workflow, application, end-use, disease

Regional scope

Europe

Country scope

Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway

Key companies profiled

Merck KGaA; Lonza; BioMarin; Batavia Biosciences; BioNTech IMFS; Miltenyi Biotec; Charles River Laboratories (Cobra Biologics); FUJIFILM Holdings Corporation; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Viral Vector And Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Europe viral vector and plasmid DNA manufacturing market report based on vector type, workflow, application, end-use, disease, and country:

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adenovirus

-

Retrovirus

-

Adeno-Associated Virus (AAV)

-

Lentivirus

-

Plasmids

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream Manufacturing

-

Vector Amplification & Expansion

-

Vector Recovery/Harvesting

-

-

Downstream Manufacturing

-

Purification

-

Fill Finish

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antisense & RNAi Therapy

-

Gene Therapy

-

Cell Therapy

-

Vaccinology

-

Research Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Research Institutes

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The Europe viral vector and plasmid DNA manufacturing market size was estimated at USD 1.3 billion in 2023 and is expected to reach USD 1.60 billion in 2024.

b. The Europe viral vector and plasmid DNA manufacturing market are expected to witness a compound annual growth rate of 20.0% from 2024 to 2030 to reach USD 4.8 billion by 2030.

b. AAV is expected to witness a compound annual growth rate of 20.15% owing to the development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency.

b. Merck, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Cobra Biologics, Catalent Inc., Wuxi Biologics, Takara Bio Inc., and Waisman Biomanufacturing are some key companies operating in the viral vector and plasmid DNA manufacturing market.

b. Some of the factors boosting the market growth include robust pipeline for gene therapies and viral vector vaccines, and technological advancements in manufacturing vectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."