- Home

- »

- Homecare & Decor

- »

-

Europe Vending Machine Market Size, Industry Report, 2030GVR Report cover

![Europe Vending Machine Market Size, Share & Trends Report]()

Europe Vending Machine Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Application (Commercial Places, Offices, Public Places, Others), By Payment Mode (Cash Cashless), By Country, And Segment Forecasts

- Report ID: GVR-4-68038-389-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Vending Machine Market Trends

The Europe vending machine market size was valued at USD 22.11 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. The rising demand for convenient snack and beverage options, driven by hectic lifestyles, is fueling the growth of the vending machine industry in European countries. The European Vending & Coffee Service Association (EVA) reports that many vending machines in the region dispense hot beverages, primarily coffee, while others offer a diverse range of products, including sandwiches, cold drinks, hot meals, and snacks. Consumers seeking hot beverages such as tea and coffee for immediate consumption further contribute to expanding the vending machine industry in the region.

Europe boasts a diverse demographic, with consumers exhibiting various food and beverage preferences. Rapid urbanization and fast-paced lifestyles have fueled the growth of the vending machine industry in densely populated cities, including London, Paris, Berlin, Frankfurt, Barcelona, Rome, and Athens. According to the European Vending and Coffee Association (EVA), Europe has a high vending machine penetration rate of one machine per 200 people. EVA further estimates that approximately 4.4 million European vending machines serve around 25.4 million items annually. Most of these vending machines dispense food and beverages; others offer products like cigarettes, medicines/drugs, and newspapers/magazines.

The influx of tourists is another key driver of the vending machine industry in Europe. With millions of tourists visiting the continent annually, vending machines offer a convenient and hassle-free way to access food and beverages without language barriers. Vending machine operators strategically place their machines at transit stations, major tourist attractions, and airports to capitalize on the steady stream of tourists.

80% of all European vending machines are in corporate offices and workplaces, primarily dispensing food and beverages such as coffee. Europe accounts for one-third of global coffee consumption and boasts the highest per capita coffee consumption rate of 5 kilograms per person annually. The trend of consuming freshly brewed coffee on the go and in workplaces is particularly strong in Northern and Eastern European countries, further supporting the high prevalence of coffee vending machines in the region. Moreover, fast-paced lifestyles leave little time for corporate employees to prepare meals, boosting the demand for snack and meal vending machines.

New-generation consumers increasingly prioritize healthier choices, even when purchasing from vending machines. To cater to this evolving demand, industry players like AGRiDEE, Selfly Store, and Foodji are stocking their vending machines with healthy food and beverage items. These healthy snack options often include fruits, seeds, nuts, multi-grain cookies, crackers, nutritional bars, baked chips and pretzels, and cereal and granola bars. Additionally, many operators are expanding their offerings to include freshly cooked foods, such as pizzas, hot soups, and French fries, traditionally found in restaurants. This trend is particularly evident in Europe.

Type Insights

Based on type, the traditional vending machine segment dominated the European vending machine market with a revenue share of 77.1% in 2024. While traditional vending machines, which often rely on simple technology, are preferred by older generations due to their ruggedness and resilience to vandalism and theft, they face limitations. These include using cash as the primary payment method, high energy consumption, and susceptibility to operational breakdowns. To address these shortcomings, vending machine manufacturers like Westomatic Vending Services Ltd., FAS International, and AZKOYEN are introducing a new generation of energy-efficient machines.

The smart vending machines segment is expected to experience a significant CAGR from 2025 to 2030. Smart vending machines, equipped with touchscreens, cashless payment options, and energy-efficient hardware, are gaining significant popularity among younger generations. These machines leverage advanced technologies such as smart sensors, IoT, artificial intelligence (AI), and cloud-based vending management systems (VMS) to offer various benefits to operators. Cloud-based VMS provides real-time data on cash accountability, warehouse management, alerts, pre-kitting, merchandising, optimization, and reporting. This technological integration drives rapid growth in the smart vending machine market across European countries.

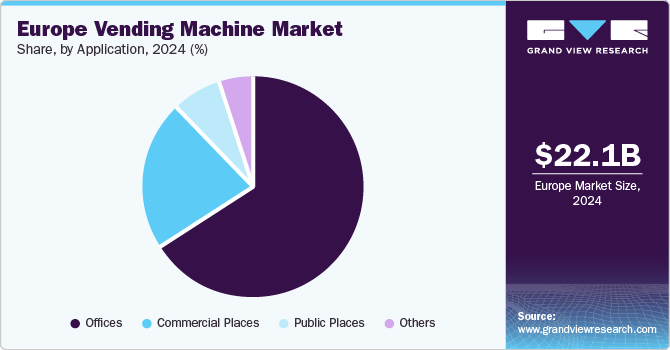

Application Insights

The office segment held the largest revenue share of the vending machine market in 2024. Office vending machines offer a low-maintenance and convenient solution for providing fresh food, snacks, and beverages, eliminating the need for dedicated canteen staff. By adding a vending machine, offices can enjoy immediate benefits such as increased convenience and reduced overhead costs. Additionally, these machines can boost staff morale by offering fresh food options and potentially improving productivity. Health-conscious employees seeking quick and healthy snack options further drive the demand for office vending machines.

The commercial places segment is expected to experience the fastest CAGR during the forecast period. Vending machines offer convenient access to products in commercial settings such as supermarkets, hypermarkets, convenience stores, restaurants, and cafes. Placing vending machines in malls and shopping centers enables consumers to grab food and beverages on the go, contributing to the growth of vending machine applications in these commercial spaces.

Payment Mode Insights

The cash payment segment led the market in 2024 and is estimated to grow at a CAGR of 4.2% from 2025 to 2030, as cash is still the predominant payment method in most European countries. While cash remains a prevalent payment method in many European countries, particularly among older generations who may feel more comfortable with cash transactions, its usage is gradually declining. The European Central Bank reports that 60% of EU consumers still value the option to pay with cash. Additionally, the high number of traditional vending machines that do not accept cashless payments contributes to the continued dominance of cash-based transactions in the European vending machine market.

The cashless segment is expected to experience the fastest market growth during the forecast period. The increasing adoption of cashless payments in vending machines presents significant opportunities for operators to expand their customer base, particularly among younger generations like Millennials and Gen Z. As consumer payment preferences shift towards cashless options, with 55% of EU consumers favoring card or other digital payment methods, the demand for cashless vending machines is expected to grow. The declining use of cash in daily transactions is further accelerating this trend. Vending machine operators can cater to modern consumer preferences and drive future growth by offering flexible payment options like bank cards and mobile payments.

Country Insights

Italy Vending Machine Market Trends

Italy vending machine industry dominated the European vending machines market with a revenue share of 16.8% in 2024. Italy is a leading country in terms of vending machine installations. According to Confida, coffee is the country's top-selling product from vending machines. As many Italian cafes and espresso bars charge over USD 1 for a single shot of espresso, vending machines offer a more affordable option for consumers. Moreover, the rising demand for high-quality, freshly ground coffee from vending machines is further fueling market growth. The increasing deployment of vending machines in commercial areas, catering to both locals and tourists, contributes significantly to the country's large market share.

Spain Vending Machine Market Trends

Spain is projected to experience the fastest growth in the regional market over the forecast period. The increasing preference for vending machines, especially for fresh food options, is a key driver of the vending machine industry. Spanish consumers are becoming increasingly health-conscious and seek healthier alternatives from vending machines, particularly during work breaks. This trend has led to the rapid growth of the healthy vending segment in Spain. With the growing popularity among both local consumers and international tourists, the Spanish vending machine market is poised for significant growth.

Key Europe Vending Machine Company Insights

The market is characterized by the presence of various well-established and several small- and medium-sized players.S ome of the key companies operating in the Europe vending machine market are Selecta TMP AG; Delikia Fresh; Alliance Vending Services; IVS Iberica; Costa; NVCS Ltd.; Express Vending; Nayax Ltd.; Worldline; ventopay GmbH; On Track Innovations Ltd.; and CCV Group B.V. and others. Most of the companies are adopting the strategy of incorporating advanced technology such as AI & cloud-based vending management systems. Additionally, introducing new vending machines with smart features and cashless payment is a key point of focus for the majority of vending machine companies in Europe.

-

Delikia Fresh is a prominent vending machine company headquartered in Spain. Delikia offers a variety of freshly prepared food products, including sandwiches, snacks, desserts, and coffee, through vending machines tailored to different environments, including hospitals and offices.

-

IVS Iberica is situated in Spain and is a leader in vending operations across Europe. IVS group is Europe's second largest vending operator, with almost 300,000 and Office Coffee Service (OCS) in different locations across Europe.

Key Europe Vending Machine Companies:

- Selecta TMP AG

- Delikia Fresh

- Alliance Vending Services

- IVS Iberica

- Costa

- NVCS Ltd.

- Express Vending

- Nayax Ltd.

- Worldline

- ventopay GmbH

- On Track Innovations Ltd.

- CCV Group B.V.

Recent Developments

-

In October 2023, Enrique Tomás, the world’s largest ham chain, implemented a new digital signage platform in its new vending machine model launched at Barcelona Airport. The first phase of the development includes opening 30 vending points across different strategic points throughout Barcelona airport. These machines will offer a wide variety of the brand’s products 24 hours a day.

-

In June 2023, Decorum Vending, a leading vending services company in the U.K., partnered with Dutch horticulture specialist Mobilane to install a LivePanel system in the vending machine at the Bournemouth train station in the U.K.

Europe Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.50 billion

Revenue forecast in 2030

USD 29.57 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, payment mode, region

Country scope

UK, Germany, France, Italy, Spain

Key companies profiled

Selecta TMP AG; Delikia Fresh; Alliance Vending Services; IVS Iberica; Costa; NVCS Ltd.; Express Vending; Nayax Ltd.; Worldline; ventopay GmbH; On Track Innovations Ltd.; CCV Group B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Vending Machine Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the European vending machine market report based on type, application, payment mode, and country.

-

Type (Revenue, USD Billion, 2018 - 2030)

-

Smart Vending Machine

-

Traditional Vending Machine

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial Places

-

Offices

-

Public Places

-

Others

-

-

Payment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cash Payment

-

Cashless Payment

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.