- Home

- »

- Homecare & Decor

- »

-

Europe Vacation Rental Market Size, Industry Report, 2030GVR Report cover

![Europe Vacation Rental Market Size, Share & Trends Report]()

Europe Vacation Rental Market Size, Share & Trends Analysis Report By Booking Mode (Online, Offline), By Accommodation Type (Home, Resort/Condominium), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-211-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Europe Vacation Rental Market Trends

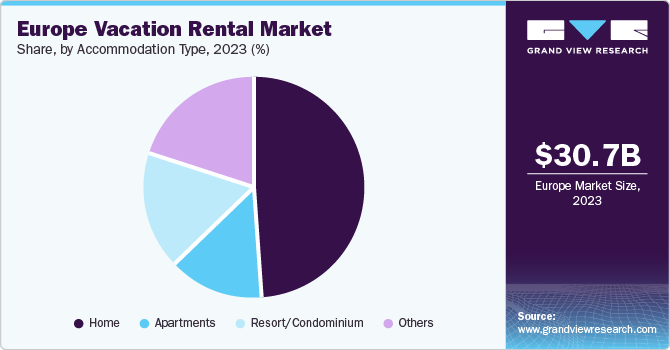

The Europe vacation rental market size was estimated at USD 30.70 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.0% from 2024 to 2030. The millennial generation's growing spending on travel, holidays, and lodging is propelling the market's expansion. Since vacation rental homes are more economical, provide more comfort and privacy than hotels, and are suitable for families with children and pets, they are preferred by travelers over hotels.

The Europe vacation rental market accounted for 34.4% share of the global vacation rental market revenue in 2023. Due to lockdowns and travel restrictions, the vacation rental business only began to shrink following the COVID-19 epidemic, which saw a sharp increase in recent years. Prior to the pandemic, there was an increase in travel and a growing desire among consumers to have more luxurious and homelike holidays, which fueled the expansion of the vacation rental sector. To discover the perfect destination based on their tastes, people were making lengthier vacation reservations, spending more money, and flying farther.

Thanks to increased transport connectivity and the quick uptake of high-speed internet, travelers can now reach even the most isolated locations in Europe. Over the course of the projection period, the want to discover new, intriguing, and exotic places throughout the region will be fueled by this, propelling the vacation rental market. The biggest markets in the area include those in Germany, France, the UK, Italy, and Spain. The largest concentration of vacation rentals in the area may be found in cities like London, Paris, Rome, Moscow, Madrid, Saint Petersburg, Barcelona, Lisbon, Milano, and Batumi. According to STR, there were 54% fewer new reservations in Europe in 2020 compared to 2019.

The number of reservations for vacation rentals has increased significantly in the UK, France, Germany, Netherlands, and Italy. Companies like Airbnb and Vrbo have modified their cancellation and refund policies in response to the massive number of cancellations that occurred during the COVID-19 outbreak. For example, starting on March 30, 2020, Airbnb will offer guests a choice between a regular host refund and travel credit for cancellations. Instead of receiving 0% of the total reservation cost, the host might receive 25% of the cancellation price by choosing the travel credit option. These rules will support the hosts' survival and entice guests to make additional reservations.

Renters who want high-rise accommodations with shared outdoor spaces can choose a rental condo; those who value privacy would be better off renting a private residence. Those seeking a peaceful beach getaway with a view of the ocean can reserve a house with a private beach and a pool. Those looking for adventure can choose a house near the ski-in and ski-out areas. There are vacation rentals available in both urban and rural areas. Compared to a hotel room or suite, a vacation rental offers greater solitude. It is not necessary; however guests are welcome to enjoy the dining spaces, hot tubs, laundry rooms, and pools. Renting a home can provide guests with their own bedroom, bathroom, and seating area.

Furthermore, guests can also unwind at a personal, dedicated space. Vacation homes are ideal for families because parents would consider it safer to have their children close by.

The comforts and amenities of home are available in vacation rental properties. Moreover, a lot of hotels are owned by big businesses that employ a lot of people, therefore they charge for almost everything. The majority of vacation rentals include everything a visitor might possibly require at no extra charge. Cookware, utensils, and dishes are available in the kitchen and eating spaces. Additionally, the rental may include books, DVDs, and board games for the guests.

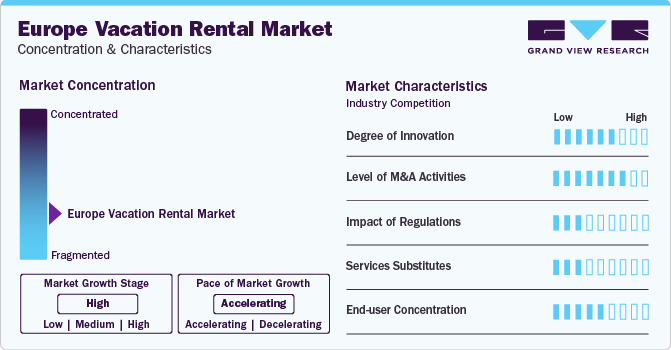

Market Concentration & Characteristics

Due to the presence of both few regional and many foreign companies, the vacation rental industry is inherently fragmented. The bulk of industry participants have also gained recognition and assisted in drawing in customers from all over the world by introducing features and solutions that make traveling simple and convenient. Both organized and unorganized businesses can be found in the vacation rental sector, with organized firms typically holding a sizable market share.

Due to their substantial client bases, well-known brands, and extensive distribution networks, the leading competitors in the vacation rental industry pose a serious threat to competitors. In an effort to stay competitive, businesses have been utilizing a range of growth tactics, including technology breakthroughs, new campaign launches, mergers and acquisitions, and regional expansion.

By broadening the players' consumer bases and boosting industry rivalry, these advancements and the adoption of creative tactics have had a favorable effect on the worldwide vacation rental market. A growing number of businesses have also started spending money on product development in an effort to outperform rivals.Accommodation Type Insights

On the basis of accommodation type, the industry has been further categorized into home, apartments, resort/condominium, and others. The home accommodation accounted a share of 48.9% in 2023. This is attributed to the high popularity of homes among travelers owing to space availability, safety, and access to amenities. Moreover, the low cost of accommodation in rural and travel destinations is acting as a major driver for the segment growth.

On the other hand, the resort/condominium segment is projected to register a CAGR of 3.7% from 2024 to 2030. The segment growth is majorly driven by millennials as they are more inclined toward spending on experiencing various amenities including barbeque pits, games, swimming pools, clubhouses, and tennis.

Booking Mode Insights

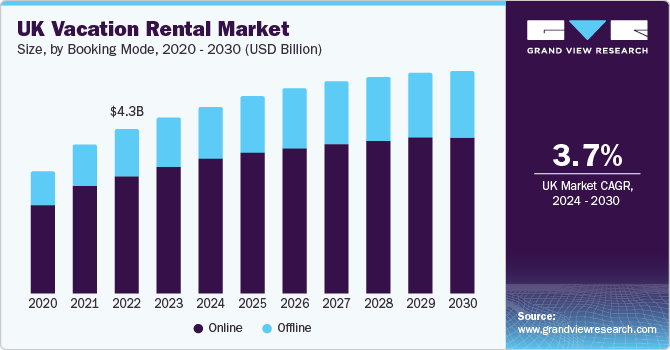

In terms of revenue, the offline booking mode segment accounted for a revenue share of 71.2% in 2023. This is attributed to the Baby Boomers and Gen X being the major consumer base preferring offline mode of booking. Augmenting penetration of the internet and smartphone among customers is projected to move consumer preference toward online booking mode.

The online booking mode segment is estimated to expand at a CAGR of 3.6% over the forecast period. The growth can be accounted to the inclination of consumers towards having thorough access to the offerings of accommodation, facilities, and other advantages. Convenience, value for money, and search for dependable travel experiences are prime factors boosting the growth of online booking. A rising number of startups and third-party travel booking companies are providing services through application and website only.

Country Insights

UK Vacation Rental Market Trends

The vacation rental market in the UK held 15.06% of the European revenue share in in 2023. The vacation rental industry has been growing significantly in the UK. As per the Airbnb Annual Citizen Report, the number of listings grew by 80% YOY in some regions of the country in 2019. London, Edinburgh, and Glasgow are the key cities in the country.

The industry has been gradually getting back on track after COVID-19 caused such a major disruption. Many UK consumers have canceled their summer holiday plans abroad due to the mandated quarantine and the risk associated with flying. But arrangements for domestic road vacations have been made, particularly to well-liked southern locations. In addition, the government's initiatives to encourage the hospitality sector, like "Eat Out to Help Out," which launched in August 2020, have lessened people's fears associated with eating at cafes and restaurants. As a result, well-known coastal towns such as Cornwall and Brighton are slowly recovering.

France Vacation Rental Market Trends

France vacation rental market is projected to grow at a CAGR of 4.1% during the forecast period. The demand for rental reservations has increased as more tourists are drawn to discover France. There are other explanations for the rise in visitor visitation, including popular tourist destinations like the Louvre museum and the Eiffel Tower. Paris is the fashion capital, and fashion enthusiasts travel there often, which is another important factor. Increased reservations for vacation rentals, hotels, and other accommodations follow from this.

Key Europe Vacation Rental Market Company Insights

There are both fresh entrants and a small number of established competitors in the market. A lot of major players are putting more emphasis on the expanding vacation rental market. Players in the market are diversifying the service offering to maintain market share.

Some of the key players operating in the market include, Airbnb Inc., 9flats.com Pte Ltd., and Booking Holdings Inc., among others.

Some emerging players in the market are NOVASOL A/S and 9flats.com Pte Ltd., among others

-

In May 2023, Airbnb, Inc. stated that its agents had checked and confirmed the accuracy of roughly 300,000 accessible elements in residences globally, in honor of Global Accessibility Awareness Day. These accessibility features comprised fixed grab bars, step-free entrances, or bath or shower chairs

-

In August 2022, Oravel Stays Private Limited purchased Bornholmske Feriehuse, an operator of vacation rentals to extend its presence in Europe. The procurement intended to rise Oyo's presence in Croatia, where it had roughly above 7,000 houses on its Traum Ferienwohnungen platform and near to 1,800 vacation homes on its Belvilla channel

Key Europe Vacation Rental Companies:

- Airbnb Inc.

- 9flats.com Pte Ltd.

- Booking Holdings Inc.

- Expedia Group Inc.

- Hotelplan Holding AG

- Vrbo

- NOVASOL A/S

- Wimdu

- TripAdvisor Inc.

- Wyndham Destinations Inc.

Recent Developments

-

In December 2020, Hotels.com, an Expedia Group, Inc. company, was labeled as the official traveling partner of the NBA. The contract will enable Hotel.com to communicate with NBA fans and travelers through cohesive marketing efforts, which will demonstrate that using Hotel.com is the most benefitting way to reserve accommodations.

-

In December 2020, Tripadvisor announced the unveiling of its new trip designing platform called Reco. The platform provides tailor-made itineraries to travelers, which features highlights of destinations in over 100 countries. Reco entails the expertise of over 300 trip designers.

Europe Vacation Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.65 billion

Revenue forecast in 2030

USD 38.87 billion

Growth rate

CAGR of 3.0% from 2024 to 2030

Base year for estimation

2023

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, booking mode

Regional scope

Europe

Country scope

Germany; UK; France; Spain; Italy

Key companies profiled

9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; Vrbo; NOVASOL AS; Wimdu.; TripAdvisor Inc.; Wyndham Destinations Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Vacation Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe vacation rental market report based on accommodation type, booking mode, and country:

-

Accommodation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home

-

Apartments

-

Resort/Condominium

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

- Offline

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Frequently Asked Questions About This Report

b. The Europe vacation rental market was estimated at USD 30.70 billion in 2023 and is expected to reach USD 32.65 billion in 2024.

b. The Europe vacation rental market is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 30.87 billion by 2030.

b. UK dominated the Europe vacation rental market with a share of around 15% in 2023. The rising expenditure on travel, vacations, and accommodation in this country is driving market growth.

b. Some of the key players operating in the Europe vacation rental market include 9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; Vrbo; NOVASOL AS; Wimdu.; TripAdvisor Inc.; Wyndham Destinations Inc.

b. The millennial generation's growing spending on travel, holidays, and lodging is propelling the market's expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."