- Home

- »

- Communication Services

- »

-

Europe Unified Communications Market Size, Report, 2030GVR Report cover

![Europe Unified Communications Market Size, Share & Trends Report]()

Europe Unified Communications Market Size, Share & Trends Analysis Report By Deployment Mode (Hosted, On-premise), By Solution, By Organization Size, By Industry Vertical, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-309-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

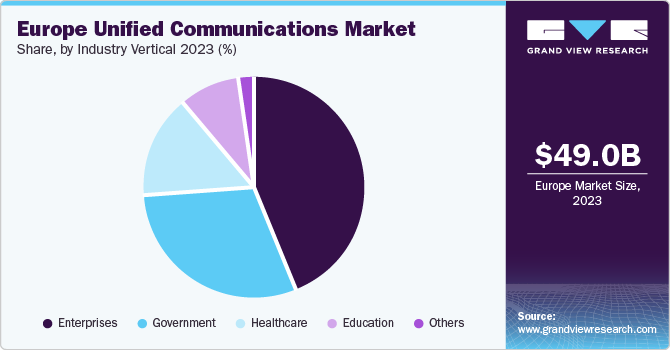

The Europe unified communications market size was estimated at USD 49.0 billion in 2023 and is projected to grow at a CAGR of 18.2% from 2024 to 2030. The increasing demand for streamlined business communication, coupled with the growing adoption of cloud-based solutions across various industries, is propelling the market growth. Furthermore, the rise in remote working trends has necessitated efficient and effective communication tools, thereby fueling the demand for unified communications solutions. Additionally, advancements in AI and machine learning technologies are expected to enhance the capabilities of unified communications systems. Government initiatives to promote digitalization and smart city projects across Europe are also contributing to the market growth.

The Europe unified communications market accounted for a 36.0% share of the global unified communications market in 2023. A key example of how regulations impact the market is the EU Electronic Communications Code, a comprehensive regulatory framework designed to enhance competition, stimulate innovation, and strengthen consumer rights within the European single market. This Code consolidates and updates EU telecommunications regulations, aiming to improve connectivity and ensure robust user protection across Europe. It fosters sustainable competition to benefit consumers by guaranteeing access to affordable communication services, including adequate broadband internet. Additionally, the Code promotes tariff transparency and the ability to compare contractual offers, which are essential for achieving Europe’s connectivity goals and ensuring optimal internet access for all EU citizens. Businesses in this market must stay informed about these regulations and ensure their solutions comply with the latest legal standards.

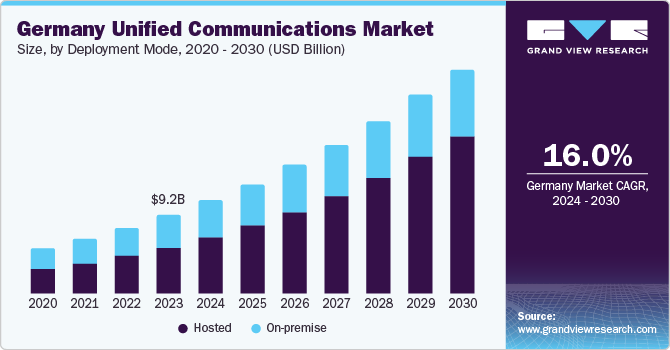

Deployment Mode Insights

Based on deployment mode, the hosted segment dominated the market, accounting for 56.1% revenue share in 2023. This segment is also projected to experience the fastest growth in the coming years. The dominance of the segment can be attributed to the increasing adoption of cloud-based solutions across various industries in Europe. Businesses are increasingly moving toward hosted unified communications solutions due to their cost-effectiveness, scalability, and flexibility. These solutions allow businesses to pay only for the services they use, reducing the total cost of ownership. Moreover, hosted solutions provide businesses with the ability to scale their communications needs up or down as required, providing a level of flexibility that is particularly beneficial for businesses experiencing rapid growth or seasonal fluctuations.

The on-premises segment is expected to witness the second-fastest CAGR of 13.1% from 2024 to 2030. Despite the shift toward cloud-based solutions, many businesses still prefer on-premises solutions due to their greater control over data and systems, as well as their ability to customize the solution to meet specific business needs. On-premises solutions are particularly popular among businesses with strict regulatory compliance requirements or those dealing with sensitive information, as they allow for greater control over data security. However, these solutions require a significant upfront investment and ongoing maintenance costs, which may limit their adoption among small and medium-sized businesses.

Solution Insights

Based on solution, the Internet Protocol (IP) telephony segment held the largest revenue share of 31.8% in 2023. The increasing shift toward digitalization, coupled with the need for cost-effective and efficient communication solutions, has led to a surge in the adoption of IP telephony. Businesses are leveraging IP telephony to reduce their communication costs, improve productivity, and enhance customer service. Despite the growing popularity of other unified communication solutions, IP Telephony continues to hold a significant share in the market due to its proven reliability and efficiency.

Collaboration platform and applications are projected to witness the fastest CAGR of 24.1% from 2024 to 2030. Collaboration platforms and applications enable teams to work together in real-time, regardless of their geographical location. These solutions include tools for instant messaging, video conferencing, file sharing, and project management. The recent shift toward remote work and the increasing need for team collaboration in a distributed work environment has significantly boosted the demand for these solutions. Furthermore, advancements in cloud computing and AI technologies have enhanced the capabilities of collaboration platforms and applications, making them more intuitive and user-friendly. As businesses continue to adapt to the new normal of remote work, the demand for collaboration platforms and applications is expected to grow rapidly.

Organization Size Insights

Based on organization size, large enterprises held the largest revenue share of 78.9% in 2023. Large enterprises often have complex communication needs due to their size, geographical spread, and diverse operations. Unified communications solutions provide these enterprises with a single platform that integrates various communication tools, thereby improving efficiency and productivity. Furthermore, large enterprises typically have the necessary resources to invest in advanced communication technologies, which contributes to their dominant share in the market. However, the high cost and complexity of managing these solutions can be a challenge for some large enterprises.

Small and Medium-sized Enterprises (SMEs) are expected to witness the fastest CAGR of 20.8% from 2024 to 2030. SMEs are increasingly adopting unified communications solutions to improve their business processes and compete with larger enterprises. These solutions offer SMEs the flexibility to scale their communication needs as they grow, without requiring a significant upfront investment. Moreover, the shift toward remote work and the increasing availability of cloud-based unified communications solutions have made these technologies more accessible to SMEs. Despite their smaller size, SMEs represent a significant growth opportunity for the industry due to their large number and rapid digital transformation.

Industry Vertical Insights

Based on industry vertical, the enterprises segment held the largest revenue share, accounting for 44.4% of the global market in 2023. Enterprises are increasingly adopting unified communications solutions to streamline their business processes and improve productivity. These solutions integrate various communication tools such as voice, video, messaging, and collaboration applications into a single platform, thereby reducing complexity and improving efficiency. The need for real-time communication, coupled with the increasing trend of remote work, has further boosted the demand for unified communications solutions in the enterprise sector.

The government segment is expected to witness the fastest CAGR of 21.7% from 2024 to 2030. Governments across Europe are increasingly leveraging digital technologies to improve their services and operations. Unified communications solutions play a crucial role in this digital transformation by enabling efficient communication and collaboration among various government departments and agencies. Furthermore, these solutions help governments to deliver better public services by improving accessibility and responsiveness. The increasing focus on e-governance, along with the need for secure and reliable communication systems, is expected to drive the growth of the unified communications market in the government sector.

Country Insights

Germany Unified Communications Market Trends

Germany unified communications market held the largest revenue share in Europe, accounting for 18.9% in 2023, and is also projected to experience the fastest growth over the forecast period. The dominance of Germany can be attributed to its strong economy, advanced infrastructure, and the presence of numerous large enterprises. German businesses are increasingly adopting unified communications solutions to improve their operational efficiency and productivity. Furthermore, the German government’s initiatives to promote digitalization and smart city projects have also contributed to the growth of the unified communications market in the country.

UK Unified Communications Market Trends

The unified communications market in UK is expected to witness the second fastest CAGR of 14.6% from 2024 to 2030. The growth of the UK market is driven by the increasing adoption of cloud-based solutions, the rise of remote working trends, and the need for efficient communication tools in businesses. The UK government’s initiatives to promote digital transformation and the implementation of advanced technologies like AI and machine learning in communication systems are also contributing to the market growth.

Key Europe Unified Communications Company Insights

Some of the key players operating in the Europe unified communications market include Bouygues Construction, CRH, Balfour Beatty PLC, and Holcim:

-

Microsoft Teams leverages Europe's growing cloud adoption to become a major player in the UC&C market, meeting data privacy regulations for a competitive edge.

-

Mitel has surpassed one million European users for its service provider cloud solutions, reinforcing its position as a global market leader in cloud-based business communications.

Key Europe Unified Communications Companies:

- Microsoft Corporation

- Mitel

- Ascom

- Cisco Systems, Inc.

- Panasonic

- Zoom Video Communications, Inc.

- RingCentral, Inc.

- 8×8, Inc.

- Avaya Holdings Corporation

Recent Developments

-

In June 2024, Deutsche Telekom and Mitel expanded their collaboration by entering into a joint B2B channel partnership. This initiative is anticipated to introduce "Unify X powered by Telekom," a bundled solution that integrates Mitel's cloud-based UCC platform with Deutsche Telekom's broadband offerings.

-

In October 2023, Mitel acquired Unify. The acquisition propels the company to the number two position globally in the enterprise UC market share. Additionally, it strengthens their regional leadership with a number one position in Europe.

-

In April 2024, Ascom and Istekki (Finland), a leading healthcare ICT provider, signed a 5-year framework agreement to deploy Ascom's nurse call systems in Finnish healthcare facilities. This collaboration aims to enhance workflow efficiency and patient care through improved communication and data-driven insights, addressing current nursing staff shortages.

Europe Unified Communications Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 158.3 billion

Growth rate

CAGR of 18.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Deployment mode, solution, organization size, industry vertical, country

Country scope

UK; Germany

Key companies profiled

Microsoft Corporation; Mitel; Ascom; Cisco Systems, Inc.; Panasonic; Zoom Video Communications, Inc.; RingCentral, Inc.; 8×8, Inc.; Avaya Holdings Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Unified Communications Market Report Segmentation

This report forecasts revenue growth at regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Europe unified communications market report based on deployment mode, solution, organization size, industry vertical, and country:

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-premise

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instant & Unified Messaging

-

Audio & Video Conferencing

-

IP Telephony

-

Collaboration Platform and Applications

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprises

-

Education

-

Government

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."