Europe Transfer Molded Pulp Packaging Market Size, Share & Trends Analysis Report By Application (Food Packaging, Food Service, Electronics), By Region (Western Europe, Eastern Europe, Scandinavia), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-155-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The Europe transfer molded pulp packaging market size was estimated at USD 679.3 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2030. The growth of the European molded fiber pulp packaging industry can be credited to factors such as the sustainability of transfer molded pulp, consumer preference for recyclable materials, rising disposable incomes, and demand for reusable and sustainable packaging. Furthermore, increasing production and consumption of eggs across Europe is driving demand for transfer molded egg cartons and trays, which in turn is stimulating demand for transfer molded pulp products.

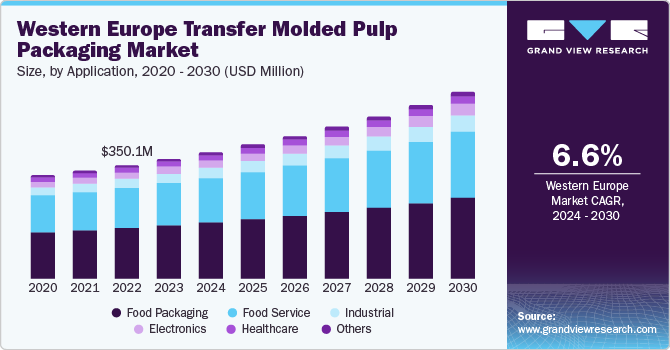

Western Europe leads in terms of number of automobile production plants, population, GDP, manufacturing sector value addition to GDP, and healthcare spending compared to the Eastern European and Scandinavian regions. In addition, according to USDOSTAT, the region also leads in terms of household spending on eating out which drives food service application growth. The leading position of the Western European region in terms of population, healthcare sector, and manufacturing sector makes it dominant in transfer molded pulp packaging products.

According to the Specialty Coffee Association (SCA), France is one of the prominent European nations with a strong presence in ready-to-eat sector. The country is comprised of numerous cafes that offer ready-to-eat food options. An increasing urban population and growing adoption of a busy lifestyle by French people are boosting demand for convenient food choices, leading to a decline in time allocated for home-cooked meals. According to the United Nations Population Division, in 2022, approximately 82% of France's total population resided in urban areas. Hence, this outlook can result in driving the demand for transfer molded fiber products, such as plates, cups, plates, rectangular containers, and bowls in food service applications during the forecast period.

According to the Food and Agriculture Organization (FAO), Austria's per capita egg consumption reached 14.3 kg in 2021, indicating a 0.070% increase from the previous year. In the global ranking, Austria secured 22nd position out of 164 countries in terms of egg consumption. This highlights a significant portion of the Austrian population incorporating eggs into their diets, leading to a consistent demand for cartoning solutions that offer both security and environmental sustainability. Transfer molded pulp products, including cartons and trays, play a crucial role in protecting eggs from damage during transportation and storage. Consequently, these products are driving market growth in the country during the forecast period.

The German Association of Automotive Industry (VDA) predicts that the production of electric passenger cars in Germany, the largest economy in Europe, is expected to increase by 50% in 2023, surpassing one million vehicles. This growth is attributed to rising demand from foreign markets and increased efforts by car manufacturers to expand their production of electric vehicles. Besides, as per the German Association of the Automotive Industry (VDA), in 2022, Germany produced a total of 885,000 electric cars, with 300,000 of them being plug-in hybrids.

Hence, electric vehicles (EVs) are equipped with advanced electronic systems for various functions, including battery management, motor control, navigation, entertainment, safety features, and connectivity. These electronic systems rely on electronic semiconductors to operate efficiently, thus increasing demand for semiconductors in the country. This outlook is projected to fuel demand for transfer molded pulp packaging as it provides cushioning properties and prevents small and fragile electronics parts, such as electronics semiconductors, from breakage and damage during transit and shipping.

Furthermore, in October 2023, England implemented a ban on certain single-use plastic items, prohibiting businesses from supplying items such as polystyrene cups and plastic cutlery. This measure is part of a broader objective to eliminate all "avoidable plastic waste" by the year 2042. This ban is expected to drive demand for sustainable packaging options such as transfer molded pulp packaging products across the UK.

Application Insights

Based on the application, the market is segmented into food packaging, food service, electronics, healthcare, industrial, etc., and the food packaging segment accounted for the largest revenue share of over 45.0% in 2023. The growing production and consumption of eggs across Europe are anticipated to drive demand for fiber-molded egg cartons and trays, which in turn is anticipated to support segment growth. Furthermore, increasing usage of transfer molded wine or champagne shippers to prevent wine bottles from breaking and damage during transit is further likely to spur segment growth.

Transfer molded pulp packaging products, including plates, cup holders, plates, rectangular containers, and bowls, are used in food service applications as they can be customized to fit specific food items, ensuring a snug and secure fit. Rising consumption of packaged food products, ready-to-eat (RTE) meals, on-the-go snacks, and beverages is anticipated to drive segment growth over the forecast period. This positive outlook can be attributed to an increasing number of working professionals in European countries.

Transfer molded pulp packaging products, such as medical device trays, specimen trays, dental tray inserts, hospital bedpans & urinals, surgical instruments trays, and medical equipment cushioning, are used in healthcare applications due to their protective, biodegradable, and cost-effective nature. Besides, transfer molded pulp packaging products can act as a cost-effective, environment-friendly, and time-saving alternative to metal utensils as costs associated with reusing metal utensils are comparatively high. Hence, this advantage of transfer molded pulp packaging products is predicted to augment demand for fiber-molded products in the healthcare segment.

Regional Insights

Western Europe dominated the market and accounted for the largest revenue share of 54.0% in 2023. This positive landscape is due to an increase in production and subsequent consumption of eggs, as it fuels demand for transfer molded pulp packaging products such as egg cartons and trays in the region. In addition, rising consumption of wine is expected to escalate the demand for fiber-molded wine or champagne shippers across the region, thus stimulating transfer molded pulp packaging industry growth in Western Europe.

In Eastern Europe, expanding poultry sector and rising egg production are major factors fueling demand for transfer molded pulp packaging products. Furthermore, increased focus on building a circular economy, where materials are recycled and reused is positively impacting transfer molded pulp packaging market. Increasing home consumption and direct sale of eggs to consumers in Scandinavian countries are prominent factors responsible for escalated demand for transfer molded pulp packaging products in the region.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of multiple global and regional players. Key players mainly cater to demand from food, food service, beverages, healthcare, electronics, industrial, automotive, and personal care industries. They are undertaking different strategies such as product launches, mergers & acquisitions, and geographical expansion. In February 2023, ‘t Munckenei, a customer of Hartmann, introduced a new brand called Bio-Bel, which aims to become synonymous with Belgian organic eggs. As an agricultural innovator, 't Munckenei strives to set trends and lead the egg industry. This long-standing partnership between Hartmann and ‘t Munckenei is expected to generate increased demand for Hartmann's molded fiber egg packaging.

Key Europe Transfer Molded Pulp Packaging Companies:

- Brødrene Hartmann A/S

- Omni-Pac Group

- Huhtamaki

- Pulp-Tec Limited

- TART

- PAPACKS Sales GmbH

- KIEFEL GmbH

- James Cropper plc

- TRIDAS

- Goerner Formpack GmbH

- buhl-paperform GmbH

Europe Transfer Molded Pulp Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 716.9 million |

|

Revenue forecast in 2030 |

USD 1.04 billion |

|

Growth rate |

CAGR of 6.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Application, region |

|

Regional scope |

Western Europe; Eastern Europe; Scandinavian |

|

Country scope |

Germany; France; Netherlands; Belgium; Austria; Slovakia; Czech Republic; Poland; Hungary; Romania; Sweden; Denmark; Finland |

|

Key companies profiled |

Brødrene Hartmann A/S; Omni-Pac Group; Huhtamaki; Pulp-Tec Limited; TART, PAPACKS Sales GmbH; KIEFEL GmbH; James Cropper plc; TRIDAS; Goerner Formpack GmbH; buhl-paperform GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Europe Transfer Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe transfer molded pulp packaging market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Western Europe

-

Germany

-

France

-

Netherlands

-

Belgium

-

Austria

-

Slovakia

-

Czech Republic

-

Rest of Western Europe

-

-

Eastern Europe

-

Poland

-

Hungary

-

Romania

-

Rest of Eastern Europe

-

-

Scandinavian

-

Sweden

-

Denmark

-

Finland

-

Rest of Scandinavian

-

-

Frequently Asked Questions About This Report

b. The Europe transfer molded pulp packaging market was estimated at around USD 679.3 million in the year 2023 and is expected to reach around USD 716.9 million in 2024.

b. The Europe transfer molded pulp packaging is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach around USD 1.04 billion by 2030.

b. Food Packaging emerged as a dominating application with a value share of around 44.0% in the year 2023 owing to the expanding poultry sector in the European region. Besides, increasing consumers' preference for packaged food products, Ready-To-Eat (RTE) meals, on-the-go snacks, and beverages are driving the transfer molded pulp packaging market growth across Europe.

b. The key market player in the Europe transfer molded pulp packaging market includes Brødrene Hartmann A/S, Omni-Pac Group, Huhtamaki, Pulp-Tec Limited, TART, PAPACKS Sales GmbH, KIEFEL GmbH, James Cropper plc, TRIDAS, Goerner Formpack GmbH, and buhl-paperform GmbH.

b. Increasing consumer preference for recyclable materials, rising disposable incomes, and the demand for reusable and sustainable packaging solutions across Europe are expected to drive the demand for transfer molded pulp packaging products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."