- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Europe Thermal Spray Coatings Market Size, Report, 2030GVR Report cover

![Europe Thermal Spray Coatings Market Size, Share & Trends Report]()

Europe Thermal Spray Coatings Market Size, Share & Trends Analysis Report By Material (Metal, Ceramics, Abradable), By Technology (Plasma Spray, HVOF), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-309-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

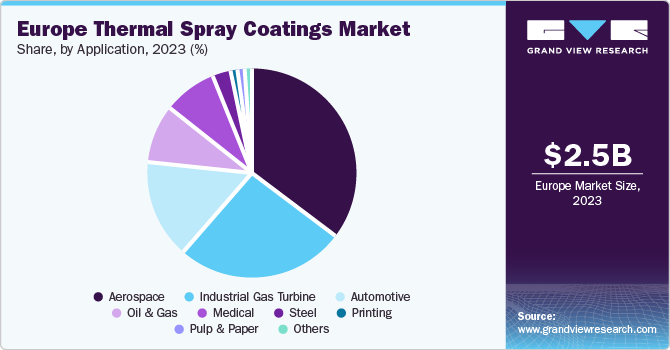

The Europe thermal spray coatings market size was estimated at USD 2.5 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increasing use of thermal spray coatings in medical devices and the ongoing development of more environmentally friendly alternatives to traditional coating methods are expected to contribute to the market’s growth.

The Europe thermal spray coatings market accounted for a share of 23.6% of the global thermal spray coatings market revenue in 2023. This expansion is fuelled by increasing demand from key industries, such as aerospace and automotive. Stringent regulations, like REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and CLP (Classification, Labelling and Packaging), ensure the safety of materials used in the coatings and during application. This can slightly increase costs for producers as they comply with testing and registration processes. However, regulations like those targeting Volatile Organic Content (VOC) can benefit the market. Since thermal spray coatings often have low VOCs compared to traditional methods, these regulations can encourage their adoption.

Material Insights

The ceramic coatings segment dominated the market and accounted for a revenue share of 34.3% in 2023. This is attributed to the unmatched properties of ceramic coatings, including excellent resistance to high temperatures, wear, and corrosion. These qualities make ceramic coatings highly sought-after for various industrial applications, such as power generation, aerospace, and automotive manufacturing. Moreover, ceramic coatings offer superior insulation properties, which enhance energy efficiency in certain applications.

The abradable coatings segment is expected to grow at a CAGR of 4.9% during the forecast period. This growth is primarily driven by rising demand for these coatings in turbine engines, particularly aero-gas and industrial gas turbines. Abradable coatings play a critical role in safeguarding turbine components from the wear and tear caused by continuous contact with rotating parts.

Technology Insights

The flamespray segment captured the largest revenue share of 47.2% in 2023. This well-established technology offers a budget-friendly solution for a wide range of applications. Its popularity stems from its versatility and affordability, making it a widely used method for applications, such as corrosion protection, wear resistance, and thermal insulation. Industries like automotive, aerospace, and energy rely on flame spray coatings for components like shafts, cylinders, and valves. This established market presence and cost-effectiveness contribute to its dominant position.

The plasma spray segment is projected to witness the fastest CAGR of 6.0% from 2024 to 2030 due to the ability of these sprays to produce superior-quality coatings. Plasma spray creates coatings with exceptional adhesion, strength, and wear resistance. These qualities make it ideal for applications in demanding environments, particularly in sectors like aerospace, energy, and automotive. As the need for high-performance components continues to grow, plasma spray is expected to be a key technology driving innovation in the market.

Application Insights

The aerospace industry dominated the market and accounted for a revenue share of 35.2% in 2023. This dominance can be attributed to the critical role that thermal spray coatings play in enhancing the performance of aerospace components. Thermal spray coatings improve wear, corrosion, and high-temperature resistance, all of which are essential properties for parts operating under extreme conditions experienced in flight. For instance, thermal spray coatings are used on landing gear, turbine blades, and airframes to protect them from wear and tear, corrosion from moisture and salt, and the scorching temperatures encountered during high-speed flight.

The medical device sector is expected to experience a CAGR of 4.9% from 2024 to 2030. The increasing demand for improved medical implants drives the segment growth. Thermal spray coatings can significantly enhance the durability and biocompatibility of implants, making them last longer and reducing the risk of rejection by the body. For instance, thermal spray coatings are used on artificial joints, bone screws, and dental implants to improve their wear resistance, corrosion resistance, and osseointegration, the process by which implants bond with bone tissue.

Country Insights

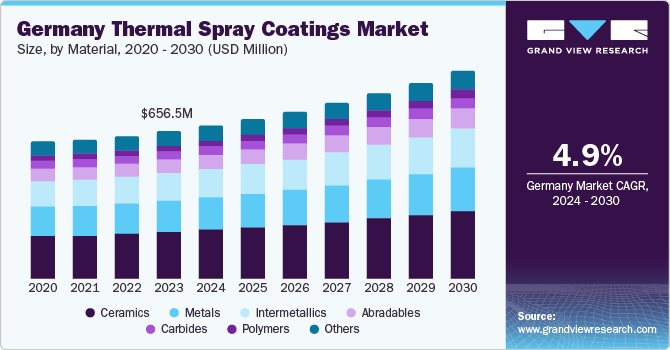

Germany Thermal Spray Coatings Market Trends

The Germany thermal spray coatings market held the largest revenue share of 26.6% in 2023. This strong position is attributed to several factors including Germany's robust industrial base that drives demand for thermal spray coatings across various sectors, including automotive, aerospace, and energy. Also, advancements in spraying technology have enabled efficient and high-quality coating applications. As a result, Germany is expected to witness the fastest CAGR from 2024 to 2030. The combination of existing market dominance and projected growth makes Germany a pivotal contributor to the Europe regional market.

Italy Thermal Spray Coatings Market Trends

The thermal spray coatings market in Italy is projected to grow at a CAGR of 4.2% from 2024 to 2030. This growth is driven by Italy's thriving automotive and aerospace industries, where thermal spray coatings play a vital role. As manufacturers seek to enhance component durability, corrosion resistance, and performance, the adoption of thermal spray coatings becomes increasingly crucial. Italy's focus on innovation and collaboration with research institutions further contributes to its positive trajectory in the thermal spray coatings market.

Key Europe Thermal Spray Coatings Company Insights

Some of the key players operating in the market include Bodycote, Linde Plc, Kennametal, and APS Materials.

-

Bodycote has a strong foothold in the European market. Its expertise lies in heat treatment, surface engineering, and thermal spray coatings

-

Kennametal Stellite, known for its specialized alloys and coatings, plays a significant role in the Europe thermal spray coatings landscape. The company’s materials are widely used in critical applications, including wear-resistant components for gas turbines, valves, and industrial machinery

Key Europe Thermal Spray Coatings Companies:

- APS Materials, Inc.

- ARC International

- Bodycote

- Kennametal Stellite

- CASTOLIN EUTECTIC

- Chromalloy Gas Turbine LLC

- Fujimi Corporation

- Kennametl Stellite

- Linde Plc

- Metallisation Ltd.

- OC Oerlikon Management AG

Recent Developments

-

In October 2023, Hardide Coatings collaborated with Gardner Aerospace to implement their CVD coating technology on vital Airbus A320 wing components. This selection serves as a replacement for the prior hard chrome plating (HCP) method. The move away from HCP aligns with Airbus's strategic compliance with REACH regulations, which will prohibit HCP production within the EU and UK as of September 2024

-

In November 2023, ASG AMF Engineering expanded its operations in Wirral, England. The company is allocating approximately USD 0.5 million towards advanced automated thermal spraying equipment and the enlargement of its UHV cleaning facility

-

In July 2023, Oerlikon Metco released thermal spray equipment featuring digitalization and their Metco IIoT platform. Metco IIoT is the inaugural Industry 4.0 solution for thermal spraying, paving the way for smart factory integration

Europe Thermal Spray Coatings Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.3 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Material, technology, application, country

Key companies profiled

APS Materials, Inc.; ARC International; Bodycote; Kennametal Stellite; CASTOLIN EUTECTIC; Chromalloy Gas Turbine LLC; Fujimi Corp.; Kennametl Stellite; Linde Plc; Metallisation Ltd.; OC Oerlikon Management AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Thermal Spray Coatings Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe thermal spray coatings market report based on material, technology, application and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Ceramics

-

Intermetallics

-

Polymers

-

Carbides

-

Abradables

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold Spray

-

Flame Spray

-

Plasma Spray

-

HVOF

-

Electric Arc Spray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace

-

Industrial Gas Turbine

-

Automotive

-

Medical

-

Printing

-

Oil & Gas

-

Steel

-

Pulp & Paper

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."