- Home

- »

- Advanced Interior Materials

- »

-

Europe Thermal Paper Market Size, Industry Report, 2030GVR Report cover

![Europe Thermal Paper Market Size, Share & Trends Report]()

Europe Thermal Paper Market Size, Share & Trends Analysis Report By Application (POS, Tags & Label, Lottery & Gaming), By Width, By Technology, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-324-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Thermal Paper Market Size & Trends

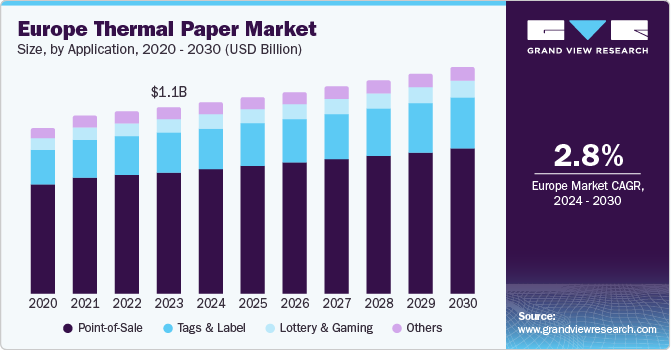

The Europe thermal paper market size was estimated at USD 1.1 billion in 2023 and is expected to grow at a CAGR of 2.8% from 2024 to 2030. This growth can be attributed to the increasing demand for thermal paper in various sectors, such as retail, banking, and transportation. The rise in point-of-sale (POS) transactions, coupled with the growing trend of self-service kiosks, has significantly boosted the demand for thermal paper. Furthermore, technological advancements in thermal paper manufacturing and the development of eco-friendly thermal paper are expected to propel market growth during the forecast period.

The Europe thermal paper market accounted for a share of 27.6% of the global thermal paper market revenue in 2023. European Union (EU) has implemented stringent regulations on the use of Bisphenol A (BPA), a chemical commonly used in the production of thermal paper. The EU-wide ban on BPA in thermal paper took effect in January 2020. BPA is expected to be replaced mainly by Bisphenol S (BPS). In addition, the European Commission imposed a definitive anti-dumping duty on imports of heavyweight thermal paper originating from the Republic of Korea. These regulations, along with the stringent requirements for labeling, traceability, and data retention set by regulatory agencies like the European Medicines Agency (EMA), have significantly influenced the industry dynamics.

Width Insights

The 80mm thermal paper segment dominated the market in 2023. Its popularity stems from its versatility and applicability across a broad spectrum of industries. Cash registers, receipt printers, parking tickets, and ATMs all heavily rely on 80mm thermal paper for their operations. The consistent demand from these sectors ensures the leading position of this width segment.

The 57mm thermal paper segment also held a prominent share in 2023. This segment finds favor due to its suitability for compact devices. Mobile POS systems and credit card terminals, prevalent in today's digital payment landscape, primarily utilize 57mm width thermal paper. As the use of these devices continues to grow, the demand for 57mm thermal paper is expected to remain steady.

Technology Insights

The direct transfer segment led the market in 2023. This technology is favored for its affordability and simplicity. This method utilizes heat-sensitive paper that darkens upon contact with a thermal print head. It's a cost-effective solution for applications with optional longevity, such as receipts or short-term labels.

Thermal transfer technology offers distinct advantages that are projected to drive its growth. This technology employs a ribbon containing wax or resin. This makes thermal transfer ideal for applications requiring longer-lasting prints, such as shipping labels or tags exposed to harsh conditions. However, the superior durability and print quality come at a cost, with thermal transfer printers and ribbons typically more expensive than their direct thermal counterparts.

Application Insights

The POS application segment held the largest revenue share of 65.2% in 2023 due to the widespread use of thermal paper in POS terminals for printing receipts in various sectors, such as retail, hospitality, and healthcare. The rise in cashless transactions and the increasing adoption of POS terminals in small- and medium-sized enterprises have further fueled the demand for thermal paper. Moreover, the growing trend of self-service kiosks and the implementation of fiscal laws mandating the issuance of receipts for every transaction have also contributed to the market growth.

The tags & label application segment is projected to witness the fastest CAGR of 3.5% from 2024 to 2030. This growth can be attributed to the increasing use of thermal paper for tags and labels in various industries, such as retail, logistics, and manufacturing. The surge in e-commerce activities and the need for efficient inventory management have led to a rise in the demand for thermal paper tags and labels. Furthermore, the development of eco-friendly thermal paper and the introduction of innovative products, such as linerless labels, are expected to drive segment growth in the coming years.

Country Insights

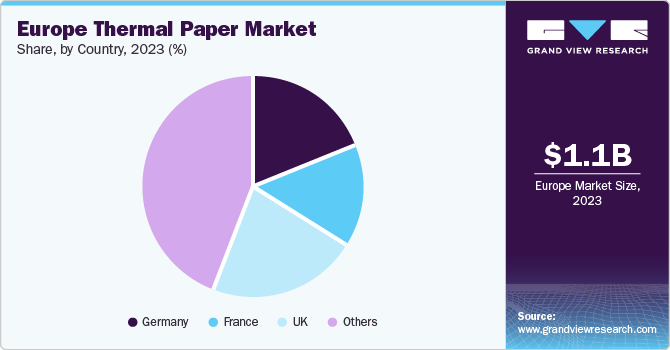

UK Thermal Paper Market Trends

The UK thermal paper market held the largest revenue share in Europe in 2023. This significant market share can be attributed to the widespread use of thermal paper in various sectors, such as retail, banking, and transportation, in the UK. The rise in cashless transactions and increasing adoption of POS terminals have further fuelled the demand for thermal paper. Moreover, the UK has seen a surge in e-commerce activities, leading to an increased demand for thermal paper tags and labels for efficient inventory management.

Germany Thermal Paper Market Trends

Thethermal paper market in Germany is projected to grow at a CAGR of 3.0% from 2024 to 2030. This growth can be attributed to the increasing use of thermal paper in various industries, such as retail, logistics, and manufacturing. The surge in e-commerce activities and the need for efficient inventory management have led to a rise in the demand for thermal paper tags and labels. Furthermore, Germany, being the largest market in Europe, has witnessed key developments shaping the main market segments, such as POS, labels, and tickets.

Key Europe Thermal Paper Company Insights

Some of the key players operating in the market include Oji Paper, Koehler Paper Group, Mitsubishi Paper Mills Limited, and Appvion Operations:

- Koehler Paper Group is known for its environmentally friendly thermal papers and holds a significant market share in the POS area

- Oji Paper (Mitsui Group), through its subsidiary Oji Imaging Media Co. Ltd., has been managing the thermal paper business and has decided to expand thermal paper production at KANZAN Spezialpapiere GmbH in Germany

Key Europe Thermal Paper Companies:

- Koehler Paper Group

- Oji Paper (Mitsui Group)

- Appvion Operations, Inc.

- Mitsubishi HiTec Paper

- Jujo Thermal Ltd.

- Siam Paper

- Nakagawa Manufacturing Inc.

Recent Developments

-

In September 2023, Lintec Europe introduced a new label stock solution at Labelexpo Europe 2023. This innovation enhances the recyclability of PET bottles and promotes the use of direct thermal paper as a sustainable substitute for synthetic paper products.

-

In April 2024, Mitsubishi Paper Mills Limited (MPM) introduced a novel eco-friendly linerless thermal label solution, "Water Thermal", featuring a remoistenable adhesive

-

In September 2023, Timber QCP GmbH acquired the Flensburg paper mill from Mitsubishi HiTec Paper Europe. The facility will transition to independent operations under the new moniker, Fjord Paper Flensburg GmbH. Notably, the mill specializes in the production of thermal paper and coated barrier papers catering to a diverse range of applications

Europe Thermal Paper Market Scope

Report Attribute

Details

Market size value in 2023

USD 1.1 billion

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Width, technology, application, country

Key companies profiled

Koehler Paper Group; Oji Paper (Mitsui Group); Appvion Operations, Inc.; Mitsubishi HiTec Paper; Jujo Thermal Ltd.; Siam Paper; Nakagawa Manufacturing Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Thermal Paper Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe thermal paper market report based on Width, technology, application, and country:

-

Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

57mm

-

80mm

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct Transfer

-

Thermal Transfer

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Germany

-

France

-

UK

-

Frequently Asked Questions About This Report

b. The Europe thermal paper market size was estimated at USD 1.1 billion in 2023 and is expected to reach USD 1.20 billion in 2024.

b. Europe thermal paper market is expected to grow at a compound annual growth rate of 2.8% from 2024 to 2030 to reach USD 1.4 billion by 2030.

b. POS dominated the thermal paper market with a share of 62.7% in 2023 due to the expansion of retail chain stores in countries, resulting in increased monetary transactions.

b. Some of the key players operating in the Europe thermal paper market include Jujo Thermal Limited, Rotolificio Bergamasco Srl, Koehler Group, and Ricoh Company, Ltd.

b. The key factors that are driving the Europe thermal paper market are increasing usage of POS terminals for monetary transactions due to the expansion of e-commerce and packaging industry in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."