- Home

- »

- Advanced Interior Materials

- »

-

Europe Steel Wire Market Size, Share, Industry Report 2030GVR Report cover

![Europe Steel Wire Market Size, Share & Trends Report]()

Europe Steel Wire Market Size, Share & Trends Analysis Report By Application (Construction, Automotive, Energy, Waste Management, Agriculture), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-320-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Europe Steel Wire Market Size & Trends

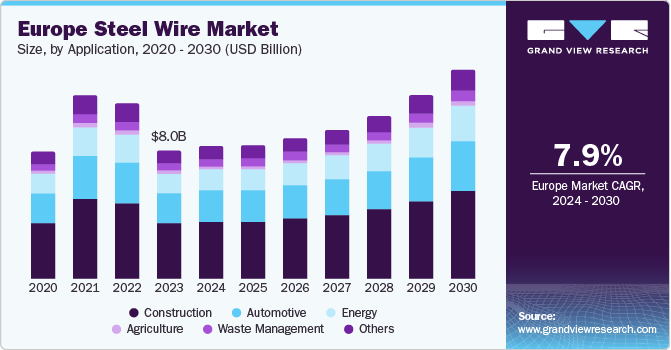

The Europe steel wire market size was estimated at USD 8.02 billion in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. Rising investments in construction activities are anticipated to augment market growth as downstream products of steel wires like ropes and strands find numerous uses in the construction industry, such as in supporting suspension bridges and as an added reinforcement in towers.

The surging waste generation in Europe is poised to propel the growth of the waste recycling services market in Europe during the forecast period. Thus, waste generation from manufacturing, construction, and energy sectors in Europe strengthens demand for recycling services and, consequently, contributes to growth of baling wires market in the region.

The demand for steel wire is likely to be affected by investment in the construction industry as it has vital applications in construction. As per the European Commission, over the next few years, investment in non-residential construction is anticipated to remain strong, reflecting government infrastructure spending. However, housing investment is expected to observe sluggishness on account of a fall in house prices and a rise in supply in the market.

Growing investment in the waste management industry is expected to benefit the market, as they are used for bailing plastics, paper, and metals. In February 2024, Hydro announced an investment of USD 194.9 million (~EUR 180 million) for an aluminum recycling plant in Spain. The project is expected to produce 120 kilotons of low-carbon aluminum. Construction of the project is likely to start in the second half of 2024.

Steel Wire Price Trends

Steel wire prices are significantly impacted by volatility in raw materials prices, which also hampers the growth of the European market. The rise in raw materials prices has led companies to halt their construction activities, thereby impacting demand for steel wires in the region. Steel commodities have experienced daily price swings since 2022 in most European countries, along with fluctuations in costs of raw materials such as iron ore, coal, steel scrap, and semi-finished steel products.

Market Concentration & Characteristics

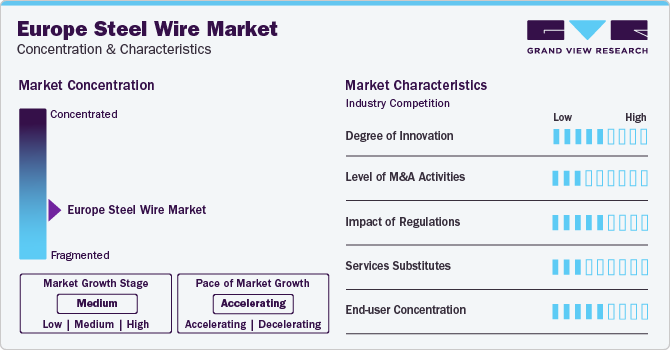

The steel wire market in Europe is growing moderately at an accelerated pace. It is relatively fragmented, characterized by the presence of both medium-and small-scale steel wire producers across various regions. There is a high level of competition within the industry as these entities cater to regional demand.

The market scenario exhibits a moderate level of innovation, primarily directed toward refining manufacturing processes to yield superior-quality steel wire products. In pursuit of this objective, companies are moving towards sustainable, high-strength steel wires, which has escalated their investment in technological advancements and R&D activities. This strategic allocation of resources aims to integrate advanced technological solutions to augment efficiency of manufacturing process.

The market observed a moderate level of merger and acquisition (M&A) activity with key industry players trying to consolidate their market share. Investors are targeting small-scale firms leveraging advanced technology, streamlining operations, and controlling significant regional market presence.

The market is also subject to moderate levels of regulatory scrutiny. Regulatory norms provide benefits and safety to production and worker safety in the facility. In recent times, metal waste is no longer deemed mere refuse, given its potential for recycling through appropriate disposal methods, contributing to the growth of baling wire sustainable practices.

Application Insights

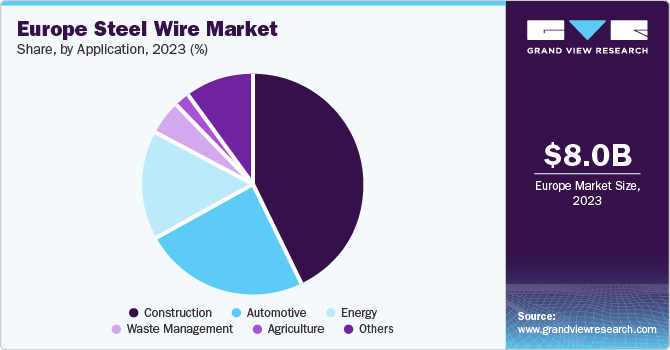

The construction application segment accounted for more than 42.0% share of global revenue in 2023. Steel wire provides support to concrete structures and different types of infrastructure. It also provides great flexibility without loss of resistance and strength, depending on percentage of carbon used in wire production process.

Building or standard wire mesh is used in walls and slabs for concrete reinforcement applications.This product is typically used for commercial and residential structures. Structural or engineered wire mesh is used in infrastructure and construction applications, such as soil reinforcement, barriers, bridges, and drainage boxes.

Waste management industry also uses a considerable amount of steel wire to create tightly compressed bales for recyclable materials such as plastics, metals, cardboard, and paper. Waste management companies can significantly reduce the volume of waste by using bailing wires, thereby making it easy for storage and transportation. Owing to growing interest of companies in waste management due to stringent government policies, waste management industry in Europe has witnessed rising investments in recent years and is expected to benefit from demand for the industry in the coming years as well.

Country Insights

Germany Steel Wire Market Trends

Germany steel wire market dominated the Europe region in 2023 with the largest revenue share of over 12.0%. This dominance in the market is attributed to its increasing investments in construction of high-rise buildings, which are expected to fuel demand for steel wire products in Germany during the forecast period.

UK Steel Wire Market Trends

The steel wire market in the UK is expected to be driven by strong growth in construction and refurbishment activities in key sectors, such as housing, offices, educational institutes, hotels & restaurants, resorts, transport buildings, and online retail warehousing. However, weakened commercial and industrial activities in the country, coupled with uncertainty in the industrial sector due to Brexit, may lead to moderate product demand over the forecast period.

France Steel Wire Market Trends

The France steel wire market is expected to be driven by household consumption on account of a decline in inflation. As per Banque de France, GDP growth in France is expected to remain sluggish in 2024, with an increase of 0.8% in 2024 from 2023. Moreover, recovery of private investment in line with improvement of financial conditions is expected to fuel economic growth over short term.

Italy Steel Wire Market Trends

The steel wire market in Italy is anticipated to grow at a healthy CAGR. The energy crisis in Italy resulted in household income erosion, thus affecting economic activity slowdown. This factor and tight monetary policy in the Eurozone led to a rapid rise in borrowing costs for businesses, households, and governments in 2023. However, ongoing tax reform in the country may result in reducing fiscal pressure and lead to a positive trend in GDP in 2024.

Key Europe Steel Wire Company Insights

Some of the key players operating in the market include Horle Wire-AB, IBERMETAIS, and Gabarró.

-

Bottaro Mario S.r.l. is a family-owned business that manufactures iron and steel wire for packaging and structural applications. The company mainly serves the recycling, agriculture, and construction industries. It sources wire rods from European mills. Its plants are fully automated, utilize clean energy, and have a sustainable production process.

-

Gabarró is a manufacturer of annealed drawn steel wire. Its plants are located in Barcelona, Spain, and Berlin, Germany. The company is ISO 5001 and ISO 9001:2015 certified. Its main market is Europe, and it also has the capacity to cater to the global market. Its key end use segments include automotive, household appliances, supermarket equipment, cable tray systems, and recycling of paper, cardboard, and plastics, among others.

-

Hörle Wire AB is a steel wire manufacturing and refining company. With extensive experience and efficient material logistics and production processes, the company serves as an economical and accessible partner to the European manufacturing industry. It boasts a diverse product range utilized in various applications including vehicles, buildings, furniture, store, kitchen interiors, power transmission, paper pulp production, and recycling industries.

Key Europe Steel Wire Companies:

- Accent Wire Tie

- Bottaro Mario S.r.l.

- Celsa Group

- Feralpi Group

- Hörle Wire AB

- IBERMETAIS

- Lambert Manufil

- MAZZOLENI TRAFILERIE BERGAMASCHE SPA

- Metallurgica Branchetti S.r.l.

- Metallurgica Locatelli S.p.A.

- Metalurgia S.A.

- WIRECO Poland sp. z.o.o

Recent Developments

-

In August 2023, UK-based BarnfatherWire announced that it invested nearly 2 million pounds (~USD 2.6 million) to upgrade its machinery and technology. The wire producer installed two new lines that can produce the largest diameter pattern laid coil in the UK.

-

In June 2022, the Netherlands-based Anders Invest acquired wire drawing manufacturer Van Meirvenne.

Europe Steel Wire Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.29 billion

Revenue forecast in 2030

USD 13.07 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

Europe

Country scope

UK; Germany; France; Russia; Italy; Spain; Portugal

Key companies profiled

Accent Wire Tie; Bottaro Mario S.r.l.; Celsa Group; Feralpi Group; Hörle Wire AB; IBERMETAIS; Lambert Manufil; MAZZOLENI TRAFILERIE BERGAMASCHE SPA; Metallurgica Branchetti S.r.l.; Metallurgica Locatelli S.p.A.; Metalurgia S.A.; WIRECO Poland sp. z.o.o

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Steel Wire Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe steel wire market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Automotive

-

Energy

-

Waste Management

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Italy

-

Spain

-

Portugal

-

-

Frequently Asked Questions About This Report

b. The Europe steel wire market size was estimated at USD 8.02 billion in 2023 and is expected to reach USD 8.29 billion in 2024.

b. The Europe steel wire market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 13.07 billion by 2030.

b. Based on application, construction dominated the Europe steel wire market with a share of over 42.0% in 2023, owing to significant growth across Europe owing to increased spending in the residential sector.

b. Some of the key players operating in the Europe steel wire market include Accent Wire Tie, Bottaro Mario S.r.l., Celsa Group, Feralpi Group, Hörle Wire AB, IBERMETAIS, Lambert Manufil, MAZZOLENI TRAFILERIE BERGAMASCHE SPA.

b. The key factors that are driving the Europe steel wire market include rising investments in construction activities are anticipated to augment market growth as downstream products of steel wires like ropes and strands find numerous uses in the construction industry such as in supporting suspension bridges and as an added reinforcement in towers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."