- Home

- »

- Medical Devices

- »

-

Europe Skin Boosters Market Size And Share, Report, 2030GVR Report cover

![Europe Skin Boosters Market Size, Share & Trends Report]()

Europe Skin Boosters Market Size, Share & Trends Analysis Report By Type (Mesotherapy, Micro-needle), By Gender (Male, Female), By End-use (Dermatology Clinics), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-198-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Europe Skin Boosters Market Size & Trends

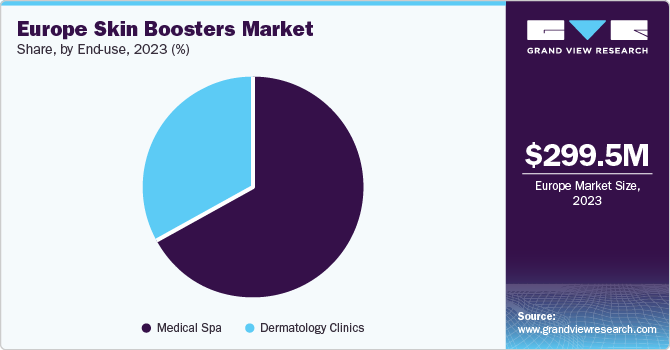

The Europe skin boosters market size was valued at USD 299.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. This growth can be attributed to the changing beauty standards and increasing preference for aesthetic surgeries. In addition, the rising influence of social media and increasing concerns over dermatological conditions are further expected to drive market growth. According to the survey results published by the American Society for Dermatologic Surgery in 2023, around 80% of respondents believed texture/discoloration, and 79% believed lines and wrinkles around and under the eye to be the most bothersome cosmetic concerns. These rising concerns are expected to drive consumers toward the best skin booster treatment options.

Such treatments involve using hyaluronic acid skin booster injections to help hydrate the skin and assist the functioning of fibroblasts responsible for producing collagen and elastin. This can help to improve the overall quality of the skin, which is driving their demand. The study published in the National Library of Medicine in April 2023 also suggested that using all types of HA formulations can significantly improve facial quality in terms of texture, hydration, fatigue, firmness, brightness, and elasticity.

In addition, the increasing awareness regarding dermatological conditions and the availability of boosters in Europe can further boost their demand. For instance, in August 2023, the Theěrapie Clinic announced the launch of its booster, Eye Revive, in Ireland and the UK. The booster is expected to help reduce the appearance of dark circles and improve texture.

Market Concentration & Characteristics

The growth stage of the market is high, and the pace of the market growth is accelerating. It can be characterized by a moderate degree of innovation owing to the increasing technological advancements, new product launches, and development activities by key players. For instance, in November 2023, Mibelle Biochemistry, a Switzerland-based manufacturer, developed RejuveNAD, a natural active ingredient that activates the enzyme NAMPT and stimulates the endogenous regeneration of NAD+. This helps in counteracting various hallmarks of aging, such as mitochondrial dysfunction, loss of proteostasis, epigenetic alteration, cellular senescence, and genomic instability.

The market is also characterized by a low to moderate level of merger and acquisition (M&A) activity by the leading players. This can be attributed to the increasing demand for technologically advanced dermatological treatments and the need to gain a competitive advantage against other players. In September 2022, Shiseido Company entered into an agreement to acquire GALLINÉE, which is a beauty brand based in London.

The European skin boosters market is also subject to increasing regulatory scrutiny. The regulations related to the cosmetic industry help build consumer trust and ensure the safety of aesthetic procedures. For instance, in April 2022, the UK government introduced the Health and Care Act 2022, which brought the licensing regime for cosmetic procedures to the country. The act prohibits a person from carrying out specified cosmetic procedures without a personal license. It is expected to ensure consistent procedure standards and help protect consumers from the potentially harmful effects of non-surgical cosmetic procedures.

There are a limited number of direct product substitutes for skin boosters. However, several other treatments can help in achieving similar outcomes. It can include laser treatment, fillers, microdermabrasion, and others. Such treatments can provide an alternative to boosters; however, these techniques can be invasive and may not provide permanent solutions to certain conditions. For instance, according to an article published by Apotheco in January 2021, microdermabrasion results can last up to 30 days.

End-user concentration is a significant factor in the Europe skin boosters market. These products can be used in dermatology clinics and medical spas for treatments. The increasing demand for such treatments is expected to create opportunities for the growth of end-use segments.

End-use Insights

The medical spa segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period. The increase in the prevalence of various dermatological conditions, the increasing number of cosmetic procedures in Europe, and the availability of medical spas are driving the growth of this segment. For instance, according to a study published in the National Library of Medicine in July 2022 based on participants from 27 European countries, approximately 43.35% of participants stated to have suffered from a skin condition in the previous year.

In addition, the rising disposable incomes and growth of medical tourism are also expected to drive the demand for this market in Europe. Spain, the UK, France, Germany, and Italy are considered top destinations for medical tourism in Europe. According to the MedicalTourism.com, Spain offers medical procedures at a cost that is 30% to 70% lower compared to the U.S.

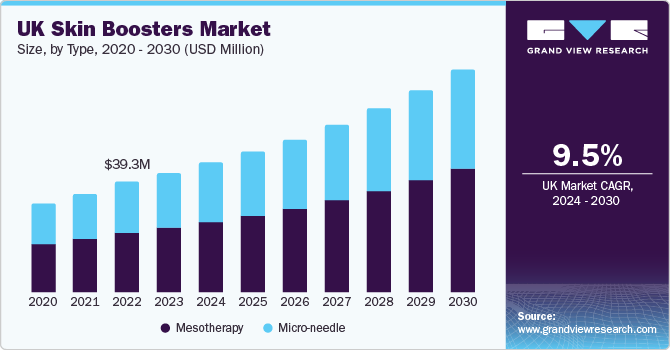

Type Insights

Mesotherapy accounted for the largest share of 54.3% in 2023 and is expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. The growth of this segment can be attributed to the increasing adoption of mesotherapy, the increase in the number of clinics offering such treatments, and growing concerns over dermatological conditions among the middle-aged population. According to the statistics presented by Eurostat in February 2023, by January 2022, the proportion of the population in the age group of 15 to 64 accounted for 63.9% of the total population in the region. This denotes the presence of a higher proportion of the working-age population concerned with their aesthetic appearance, which is likely to drive demand for this segment.

In addition, mesotherapy provides a non-invasive treatment option and can also provide customized treatment as per customer convenience. For instance, Skin Cosmetics London, a skin care service provider in the UK, provides mesotherapy with customized formulations depending on the needs and goals of a customer.

Gender Insights

The female segment accounted for the largest market revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing number of cosmetic treatments among women. Many women undertake cosmetic treatments to address common concerns such as wrinkles, pigmentation, and fine lines, which help them achieve a natural and refreshed appearance without undergoing more invasive procedures.

Country Insights

According to the 2022 International survey conducted by the International Society of Aesthetic Plastic Surgery, a total of 571,661 non-surgical cosmetic procedures were performed in Germany, whereas approximately 484,834 procedures were performed in Italy, out of which maximum, 43.9%, were procedures involving hyaluronic acid. The rising preference for non-surgical cosmetic procedures is further expected to drive growth in Europe.

Germany Skin Boosters Market Trends

Germany dominated the skin boosters market and accounted for a 25.6% share in 2023. This high share is attributable to the favorable government initiatives to ensure the safety and quality of these procedures and the presence of innovative technologies in the country. For instance, in December 2022, the Beauty Health Company launched a new booster, co-created with BABOR Skincare, that helps increase hydration levels to offer a smoother, lifted, and youthful-looking complexion using DOCTOR BABOR’s technology in Germany.

Italy Skin Boosters Market Trends

The skin boosters market in Italy is anticipated to witness significant growth in the skin boosters market, which is driven by an increase in demand for non-invasive cosmetic solutions. The increasing preference for non-surgical treatments has led to the adoption of boosters, which involve injecting hydrating substances like hyaluronic acid.

Key Europe Skin Boosters Company Insights

Some of the key players operating in the market include AbbVie, GALDERMA, Merz Pharma, and CROMA-PHARMA GmbH

-

AbbVie is a global biopharmaceutical company engaged in developing and delivering innovative solutions to address diverse health challenges. In May 2020, the company acquired Allergan PLC to further diversify its business. It offers a range of products related to aesthetics, with its pipeline focusing on soft tissue fillers, non-invasive body contouring, neurotoxins, plastic surgery, and topical skincare.

-

Galderma is a pharmaceutical company specializing in dermatology. It has a diverse portfolio aimed at providing consumers with innovative, science-based treatments to help maintain healthy skin. Some of the top customer care brands of the company include Cetaphil and Alastin.

Bloomage Biotech Co., Ltd., IBSA Institut Biochimique SA., and Teoxane are some of the other participants in the Europe skin boosters market.

-

Bloomage Biotech Co., Ltd. is a biotechnology company, specialized in the production of hyaluronic acid through microbial fermentation and is recognized for its Skin Care 5 Line. The company aims to provide solutions for various skincare needs, focusing on research and quality ingredients to offer science-driven solutions.

-

Teoxane is a Swiss company operating in the aesthetic industry, engaged in the design and manufacturing of hyaluronic acid (HA)-based dermo cosmetics products, including fillers and beauty products. REDENSITY 1 is one of its important products.

Key Europe Skin Boosters Companies:

- AbbVie

- GALDERMA

- CROMA-PHARMA GmbH

- Merz Pharma

- Bloomage Biotech Co., Ltd

- IBSA Institut Biochimique SA

- Teoxane

Recent Developments

-

In February 2024, Merz Pharma received approval from the European Union for RADIESSE, an aesthetic injectable aiming to improve moderate and severe wrinkles in the decollete area.

-

In March 2023, CROMA-PHARMA GmbH, a manufacturer of hyaluronic acid (HA) syringes launched PhilArt, a series of injectable skin boosters to further broaden its product portfolio.

-

In January 2023, Galderma opened a Global Capability Center in Spain that aims to expand its operations and centralize its commercial functions in a cost-efficient manner.

Europe Skin Boosters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 323.8 million

Revenue forecast in 2030

USD 549.5 million

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, gender, end-use, country

Regional scope

Europe

Country scope

Germany; U.K.; France; Italy; Spain; Norway; Sweden; Denmark; Poland

Key companies profiled

AbbVie; GALDERMA; Merz Pharma; CROMA-PHARMA GmbH; Bloomage Biotech Co., Ltd.; IBSA Institut Biochimique SA.; Teoxane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Skin Boosters Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe skin boosters market report based on type, gender, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mesotherapy

-

Micro-needle

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dermatology Clinics

-

Medical spa

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

Poland

-

-

Frequently Asked Questions About This Report

b. The Europe skin boosters market size was estimated at USD 299.5 million in 2023 and is expected to reach USD 323.8 million in 2024.

b. The Europe skin boosters market is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030 to reach USD 549.5 million by 2030.

b. The mesotherapy segment dominated the market with the largest market share of 54.3% in 2023. This high share is attributable to the increasing adoption of mesotherapy and growing concerns over dermatological conditions among the middle-aged population.

b. Some of the key players operating in the Europe skin boosters market include AbbVie, GALDERMA, Merz Pharma, CROMA-PHARMA GmbH, Bloomage Biotech Co., Ltd., IBSA Institut Biochimique SA., and Teoxane, among others.

b. Key factors driving the market growth include the changing beauty standards, the rising influence of social media, and increasing preference for aesthetic surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."