- Home

- »

- Catalysts & Enzymes

- »

-

Europe Serine Proteases Market Size Report, 2022 - 2030GVR Report cover

![Europe Serine Proteases Market Size, Share & Trends Report]()

Europe Serine Proteases Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Soaps & Detergents, Protein Hydrolysate Production, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-958-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

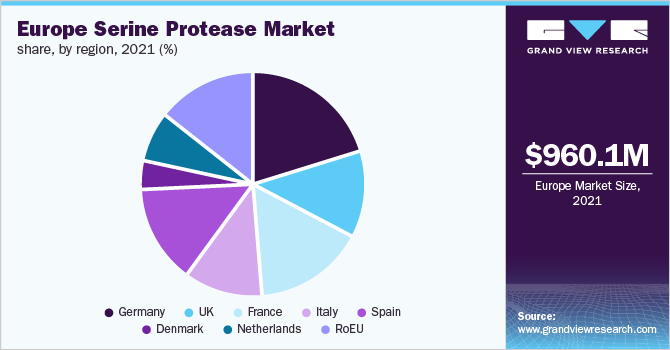

The Europe serine proteases market size was valued at USD 960.1 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2022 to 2030. The demand for the product is anticipated to be driven by the wide applicability of serine protease in various home care products as a cleansing agent. The laundry care industry has been witnessing a stable and moderate growth rate in the last few years, especially in Western Europe. This growth is driven by the availability of liquid tablet detergents and concentrated detergents. Amid the global pandemic of COVID-19, the demand for laundry care products witnessed a spike.

Amid the COVID-19 pandemic, while in some countries, production was completely or partially put to halt, while in other countries, due to the application of serine protease in-home care and cleansing utility, the demand for the product was on the rise. Additionally, its application in the pharmaceutical industry also had a positive impact on product demand. Despite the spread of COVID and the shutdown of various manufacturing and production facilities, the serine protease market in Europe witnessed a positive impact.

Serine proteases are mainly found in eukaryotes and prokaryotes microorganisms. Based on their structure, they are divided into two main types; subtilisins and trypsins. The trypsin organisms are widely present as it helps in regulating blood coagulation and fibrinolysis and has higher amino acid content. They are present in fungi, animals, and prokaryotic cells. However, the subtilisins organisms are specifically found in bacteria.

In addition, the usage of the product in the pharmaceutical industry has gained crucial importance since the COVID-19 pandemic. As the spending in the pharmaceutical industry rose, the demand for essential and non-essential products grew. Serine Protease, according to various research and experiments, have found to have crucial application in the COVID-19 treatment. As a result, the demand for the product grew in the formulation of medicines.

Serine proteases are resistant to changes in temperature and pH, as well as not as denatured by toxic metals and detergents. They are manufactured from different sources such as animals, plants, and microorganisms. At a large scale, microbes are used for product extraction having utilization in industrial applications. Serine proteases are used in various biological processes. It helps in various functions such as digesting food, fighting infections, and blood clot and helping sperm enter eggs. They also help bacteria to digest and help viruses infect cells.

Serine Protease is a microbial enzyme which means it has been derived from some micro-organisms. These native microbial enzymes are generally utilized as biocatalysts in the process of biocatalysis. Though these microbial enzymes are generally used as biocatalysts, under certain circumstances, they might be unsuitable in the bio-catalytic process and thus their usage might be restricted.

Application Insights

The soaps & detergents segment dominated the market with the highest revenue share of 54.62% in 2021. Its high share is attributable to the increasing utilization of detergents in industrial, and household applications. It is used to improve clothes performance as well as to enhance the washing capability of industrial detergents.

Serine Proteases are used to remove protein-based stains of body fluids, grass, food soils, and blood from clothes. Highly alkaline serine proteases are used in detergent formulations as protein-degrading components. They improve detergent performance and stability through extensive protein engineering.

In the pharmaceutical industry, these products are employed as agents for curing cystic fibrosis, psoriasis, retinal disorders, etc. These proteases also help in ensuring joint health and reducing gluten intolerance. An increase in the aging population and surging healthcare costs in Europe are anticipated to drive the demand for serine proteases in the pharmaceutical industry of the region.

Serine proteases are also utilized in the food & beverages industry in Europe for cheese production and soft drink and fruit juice fortification. They also form a part of infant food formulations. These proteases are used to produce infant milk formulations and enable the development of a specific flavor for a specific protein type. Declining nutrition levels and increasing health awareness among consumers are anticipated to drive the demand for serine proteases in Europe over the forecast period.

Regional Insights

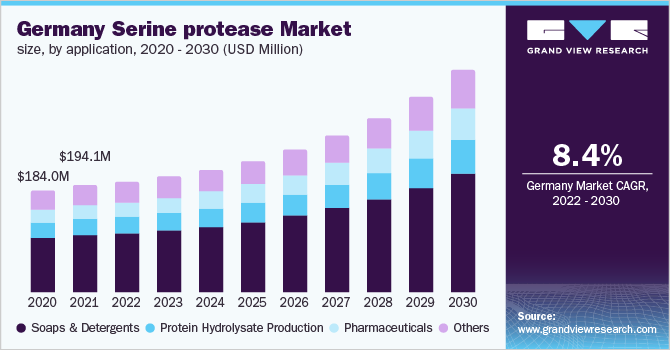

Germany dominated the Europe serine proteases market with the highest revenue share of 20.22% in 2021. This is attributed to the increase in awareness among the population in the country regarding health disorders, especially digestive disorders and food allergies. In addition, Germany is the largest producer of food products in Europe, and its food & beverages industry is expected to witness high growth during the forecast period owing to increasing population, rising consumer surplus, and surging consumer preference for healthy food products.

Increased consumption of detergents in households in France is expected to fuel the demand for serine proteases used for manufacturing them in the country. Other factors contributing to the growth of the market include the flourishing pharmaceutical industry in France. The growing penetration of systematized retail in both, rural and urban facilities in the country, is anticipated to drive the demand for food, beverages, and nutraceuticals containing serine proteases in France.

The increasing demand for ready-to-eat and processed food products and the rising number of health-conscious consumers in Spain is contributing to the growth of the food & beverages industry in the country. This, in turn, is expected to power up the demand for proteases in Spain. Serine proteases are used as ingredients to increase protein levels in food products. Additionally, as the country is an important economy in Europe, Spain-based manufacturers are engaged in research and development activities for the formulation of specialty products.

Key Companies & Market Share Insights

The rivalry in the Europe serine proteases market is highly dependent on the product portfolio, operational strategies, geographical presence, and more importantly the quality of the product. The product manufacturers are involved in continuous R&D to achieve product differentiation. For instance, companies like DSM, Biocatalysts, and Novozymes A/S have focused on integration throughout the value chain to ensure a consistent supply of raw materials and to maintain the consistent quality of the product.

Manufacturing companies are expected to focus on backward integration and also on establishing production facilities and distribution facilities to reduce transportation costs and make the products readily available to the end-users. Some prominent players in the Europe serine protease market include:

-

Biocatalysts

-

Novozymes A/S

-

DSM

-

Antozyme Biotech Pvt. Ltd.

-

Bioseutica

Europe Serine Proteases Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 990.3 million

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 8.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

Europe

Country scope

Germany; U.K.; France; Italy; Spain; Denmark Netherlands

Key companies profiled

Biocatalysts; Novozymes A/S; DSM; Antozyme Biotech Pvt. Ltd.; Bioseutica

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Serine Proteases Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe serine proteases market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Soaps & Detergents

-

Protein Hydrolysate Production

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

-

Frequently Asked Questions About This Report

b. The global Europe Serine Proteases market size was estimated at USD 960.1 million in 2021 and is expected to reach USD 990.3 million in 2022.

b. The global Europe Serine Proteases market is expected to grow at a compound annual growth rate of 8.3% from 2022 to 2030 to reach USD 1.97 billion by 2030.

b. Germany dominated the Europe Serine Proteases market with a share of 20.2% in 2021. This is attributable to high production and distribution of detergents from the German market

b. Some key players operating in the Europe Serine Proteases market include Novozymes, DSM, Biocatalysts, Antozyme Biotech Pvt. Ltd., and Bioseutica.

b. Key factors that are driving the Europe Serine Proteases market growth include high export of detergents in the region, rising demand from end-use industries such as food & beverages, and pharmaceuticals, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.